Topstep, are they a prop firm forex traders should consider? As one of the oldest in the industry, Topstep is a recognized name in the funding of thousands of traders globally who’ve managed to pass their strict program.

With many catchy and clever taglines like ‘Crude Oil Without The Snake Oil’ and ‘Don’t Let Your Past Get In The Way Of Your Futures,’ TopStep has become a recognized brand in the forex and futures prop firm industry since 2010.

According to their website (at the time of writing), the company claims to have funded at least 6б000 accounts in 2020 alone, boasts a global community of traders from 97 countries, and maintains a 4.6 ‘TrustScore’ rating on Trustpilot.

While these numbers are impressive, how good are they product-wise? This article will be an in-depth review of this firm, what they have to offer, the pros and cons, and whether they are a worthwhile consideration overall.

What is Topstep?

TopStep (previously Topstep Trader) Top describes itself as financial technology and prop firm for forex and futures traders.

Patak Trading Partners LLC is the parent organization of TopStep, founded by its namesake Michael Patak, a former Dow futures floor trader in Chicago. ‘The Windy City’ is also where the headquarters of TopStep are and have been since 2010.

Almost as an unintentional metaphor, the name ‘Topstep’ was in reference to the perception that the best traders in a trading pit stand on the top step where they have the best view. Their marketing efforts also give another point of interpretation in that only the best or ‘top’ traders should consider their program.

What does Topstep have to offer?

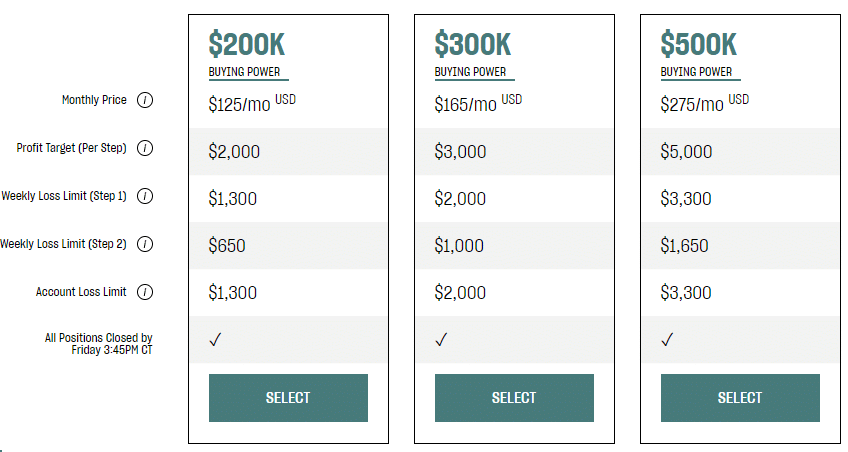

There are two phases to being funded on TopStep; the Trading Combine® Step One and Step Two. Traders pay a monthly subscription (detailed below) for any of the three accounts (100:1 is the leverage).

This fee remains recurrent provided one has not yet met the profit target and has not broken any of the rules. This program caters primarily towards day traders (the Swing Trading Combine® is for swing traders and is outlined following this section).

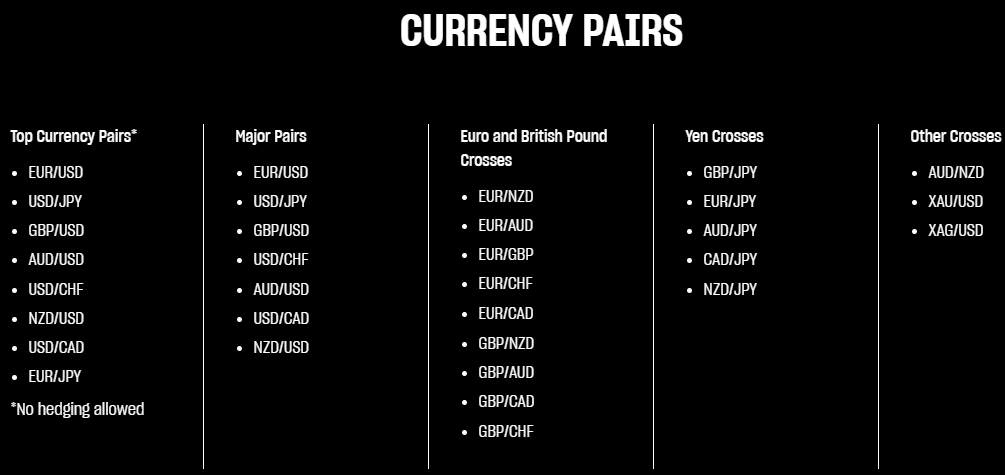

The permitted products in forex include all combinations of the eight major currencies (AUD, CAD, CHF, EUR, GBP, JPY, NZD, USD), gold (XAU/USD), and silver (XAG/USD).

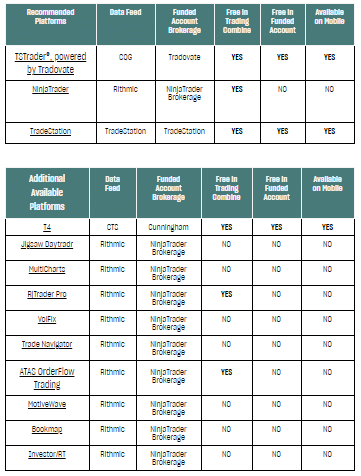

TSTrader, NinjaTrader, TradeStation, Jigsaw Daytrader, MultiCharts, R Trader Pro, VolFix, Trade Navigator, ATAS OrderFlow Trading, MotiveWave, Bookmap, and Investor/RT are the platforms where traders can speculate on these instruments.

Trading Combine® Step One objectives

- Minimum of 5 trading days

- Traders can only trade during the times stipulated by TopStep (most of these are not to hold positions overnight and over the weekend).

- 1% profit target.

- Weekly loss and account limit (the latter of which is effectively the drawdown) is about 0.67% of the account size. The account limit is a trailing drawdown, meaning it moves proportionally to the growth in equity but remains fixed if the balance goes lower than the original amount.

For example, if we look at the $200k account, if a trader made $1,000 in one week, their account loss limit now rises the same amount (to $2,300 instead of $1,300). If the equity fell back $1,000 the following week, the drawdown remains $2,300 and not $1,300.

- Maximum position sizes vary depending on the pair and are available on their website.

If a trader breaches any of these rules, their accounts become ineligible, meaning they have to start again from scratch or quit the program. Alternatively, TopStep employs a ‘reset’ that comes at an extra cost of $99. This function means a trader can pick up from where they were before violating an objective, accounting for their performance up to that point.

Trading Combine® Step Two objectives

The Trading Combine® Step 2 ensures traders didn’t just get lucky in the first step. Here, most of the objectives remain unchanged, and one trades the exact same account from the beginning again. The only differences are:

- Minimum of 10 trading days.

- Weekly and account loss limit/max drawdown is even lower.

- Traders aren’t allowed to hold positions in particular high-impact news releases, which are pre-determined by the firm according to the economic calendar.

- At the end of each day, TopStep implements a scaling plan where they reduce or increase your buying power based on incremental steps that traders can view on their website.

Because the Trading Combine® is for intraday traders, there is an option for swing traders known as the ‘Swing Trading Combine®, although it is drastically limited in many areas like the balance and the permitted tradeable products.

You can only trade MES, MNQ, M2K, and MYM products on the Chicago Mercantile Exchange, which comprises mainly stocks and indices. However, unlike in the ‘Trading Combine,’ one can hold positions overnight, over the weekend, and during news releases.

Pros

The points below summarise the good and bad.

- The firm has been around for longer than a decade.

- TopStep caters to both forex and futures traders.

- Aside from the accounts, TopStep offers comprehensive coaching (personal, AI, group), educational resources, and community events.

- Unlike other prop firms, there is no maximum time limit for the program, provided that a trader does not violate any of the main rules. The objectives are clear and easy to understand.

- Just over ten trading platforms are available to traders (although MetaTrader 4 isn’t).

- Low profit target.

Cons

- Although the buying power seems astronomical, the 0.67% drawdown is quite low for an account of this size.

- No hedging is allowed.

- As TopStep’s primary program (the Trading Combine®) is for day traders, positions cannot be open beyond the Friday market close (15 H 45 CT). Although there is the Swing Trading Combine® that is strictly for swing traders, it is severely limited and doesn’t offer as many benefits as the Trading Combine®.

- The monthly subscription model is generally not the preferred option for traders looking to join a prop firm. As there is no maximum time limit, it is difficult for one to know the maximum they’d be paying, unlike other companies employing a one-time fee structure.

- Like with all firms, the upfront monetary risk may be a deterrent as failure results in wasted fees.

Conclusion

One advantage of TopStep is credibility and recognition, having existed since 2010. This quality is a big plus if a trader’s priority is trust. Another advantage of TopStep is there is no time limit for reaching the profit target, provided one does not break any other rules.

This program clearly suits intraday traders. Depending on how long they take to reach the profit, it may be cheaper or more expensive in terms of cost. The monthly subscription model is tricky in that sense as no one knows how long it would take them to reach the profit mark.

The swing trading alternative is incredibly limited. Thus, swing traders should not consider this firm. Along with the monthly fee issue, the tiny drawdown limit, and not catering for swing traders, these may be the most pertinent drawbacks, bar a few other little ones. Overall, confident day traders who have adequately assessed the affordability should consider joining TopStep.