Pipster FX is a relatively new signal provider, promising “profitable signals you need”. Their website presentation includes some aggressive claims, like the one telling they have had “100 % Profitable Months” with a guarantee of “300 Pips”. They claim that if they do not “make minimum +300 PIPs in a week or +500 Pips in 3 weeks” they will extend your membership until they reach the guaranteed pips. Taking into account their claims, we have decided to write a detailed Pipster FX review and let you know whether it is true or not.

Is Pipster FX a Good Choice?

No. This signal provider is not as good as its developers claim. Our verdict is based on:

- No strategy insight

- No verified trading results provided on their official website

- The average loss is significantly higher than the average win

- High drawdown

- Dwindling performance in 2020

- Lack of vendor transparency

Pipster FX Features

The website looks professionally designed. However, the vendor provides very little information about their signal provider. A lot of important information is missed or left to our imagination. It is not a good sign, especially when it comes to signal services. The vendors say that they can provide you with 300 pips a week or 500 pips in 3 weeks. Transparency is the main feature of good, reliable service provides, and it is lacking here.

The developers of this signal provider add that they use a system that functions on how the market moves. They say they provide “5-7 high probable and low-risk trade set up” daily. Their minimum target is “20 Pips for short-term and 100 pips for the long-term trades”. Pipster FX trades EURUSD, AUDUSD, GBPUSD, NZDUSD, and USDCAD currency pairs.

No Strategy Insight

Pipster FX trading strategy is based on market flow analysis, market-moving mechanisms, and inter-market analysis. Their approach is based on providing 5-7 low-risk trade setups daily. The vendors say that their “minimum target is 20 Pips for short-term and 100 pips for the long-term trades”. We do not see any detailed review of their trading strategy, except a few vague buzzwords that we have reiterated before.

No Trading Results

Pipster FX does not show any screenshots of verified trading results on their website. Taking into account their aggressive promises and claims, it makes it difficult to believe in trustworthy and efficiency of any of their guarantees.

If they did achieve their expectations of 300 pips a week, it would be a big sense for them to share their achievements with the public. Moreover, it would help them to sell their service.

This is a red flag for this signal provider and a large problem, which should be resolved quickly if the vendors want to compete in this highly competitive Forex market.

Trading Performance Data

We have found a real and verified trading account at myfxbook. Now we are going to analyze it and decide whether Pipster FX performs as good as its developers claim.

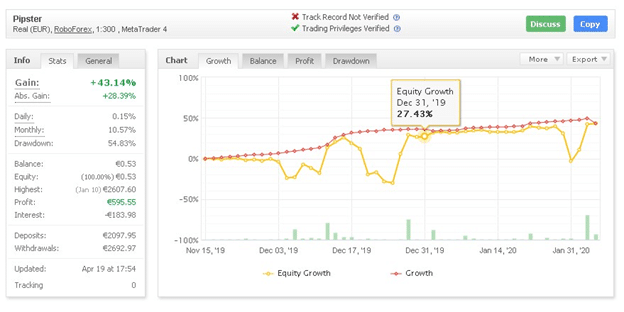

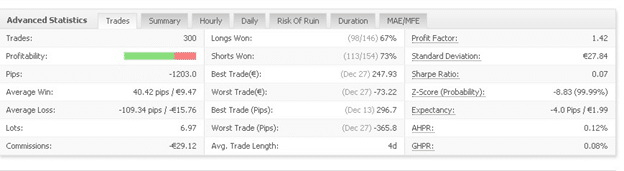

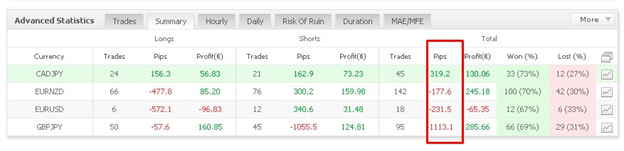

This is a Real Pipster account, which started trading on Nov 15, 2019. It is working on the MetaTrader 4 platform and trades with the CADJPY, EURNZD, EURUSD and GBPJPY currency pairs. Its absolute gain is +28.39%, while the total gain is +43.14%. The Pipster’s account daily profit is 0.15%, monthly – 10.57%. The trader deposited €2097.95 and has earned €595.55 from November 15, 2019, till April 19, 2020. The system placed 300 trades with the best trade of 296.7 and the worst trade of -73.22. The average trade length is 4 days. The account lost 89 out of 300 trades, which represents 30%. Its profit factor is 1.42 with the average win of 40.42 pips and a higher average loss -109.34 pips.

The developers promised 300 Pips in a week or +500 Pips in 3 weeks. However, the trading statistics of this account shows the other results:

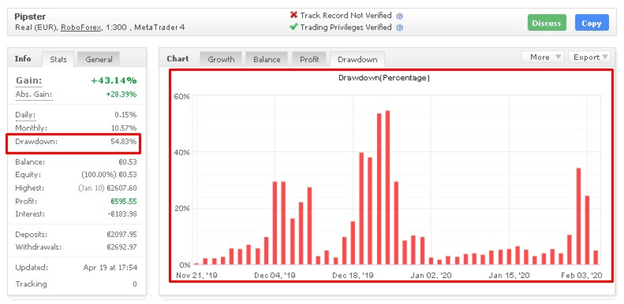

High Drawdown

Our team has noticed negative changes in terms of drawdown with the Pipster FX signal provider. Let’s review its statistics from November 21, 2019 to December 24, 2019. Its drawdown has constantly been growing from 0,5% up to 54.83%:

The screenshot above shows unpredictable vicissitudes in terms of drawdown performance. It is not good for any trading account because it can lead to serious losses and increase the risk of ruin.

Dwindling Performance in 2020

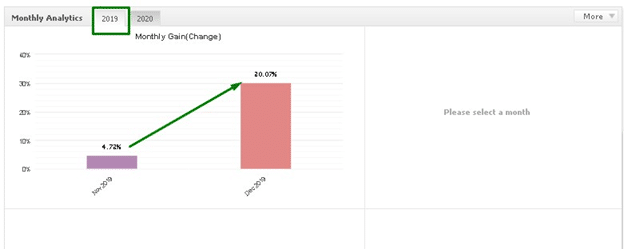

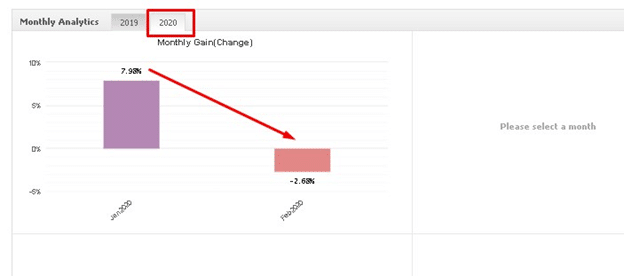

A study of the Myfxbook monthly performance data for Pipster FX shows that the performance of 2020 is not as good as the one of 2019:

As you may see from the snapshot above, profits have dwindled considerably in 2020. Since March 2020, the account has shown no trading activity, except two deposits on March 1, 2020, which have brought a total profit of €0,53:

Vendor Transparency

The Pipster FX website was launched in 2018, July. We know nothing about the developers, their trading history, or their location. We only know that Mrs. NeykovaFX heads their pro trader panel. In their FAQ page, they mention a large group of analysts “who study the charts to produce signals”. It is claimed by the Pipster FX page that these analysts have more than 10 years’ experience. It sounds great. However, it is strange, why their names are not mentioned at the Pipster FX website. For transparency sake, this information should be provided to the community.