Hippo Trader works on EURUSD at the M1 chart. The robot is available for both MetaTrader 4 and 5 platforms and comes with various settings that can be adjusted according to the trader’s choice. The developer offers a free copy of their other algorithm if you purchase the Hippor Trader. Let us discuss and analyze all the pros and cons of the articles to have a better understanding of the performance of the algorithm.

Hippo Trader: to trust or not to trust?

Hippo Trader uses martingale and grid strategies, due to which the robot is completely untrustworthy. The developer is not transparent on the strategy, which raises further concerns.

Features

The robot has the following features:

- It is compliant with FIFO brokers with appropriate settings

- It has been subjected to backtests for 15 years

- The EA comes with backtesting and live account results

- It uses a relative vigor index oscillator for identifying trend

To get the robot up and running, you need to follow the following steps:

- Purchase the algorithm from the MQL 5 marketplace

- Login to the MQL 5 community and download the expert in the MT 4 or MT 5

- Refresh the experts’ tab

- Enable the auto trading button and place the algorithm on charts

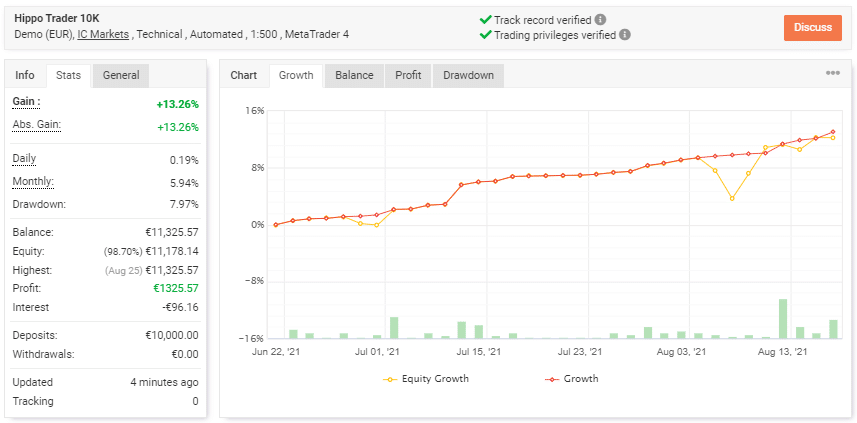

The developer states the robot employs a relative vigor index oscillator for identifying a trend. It enters the market based on the volatility ATR filter. Through the trading history on Myfxbook, we can see that the algorithm utilizes pure martingale and grid strategies for trading. This adds significant risk to the account. The developer doesn’t share this on the page, which raises some eyebrows on the authenticity of the system.

Price

The expert advisor can be bought for an asking price of $299. There is no money-back guarantee. It is also possible to rent it for 1 and three months for $199 and $269 respectively.

Trading results

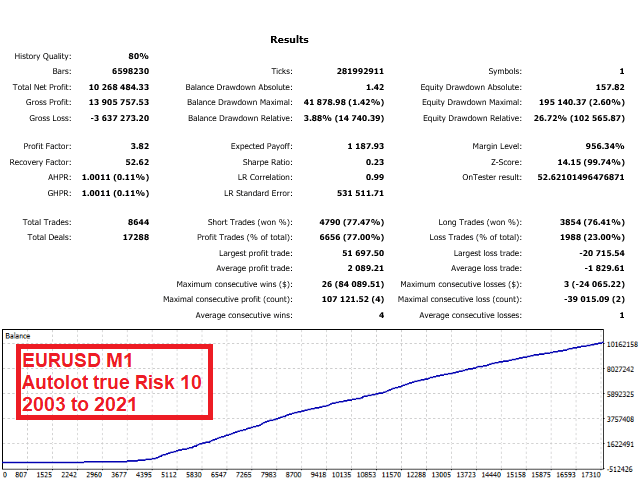

Backtesting results are available for EURUSD auto lot true. The relative drawdown was around 26.46%. The winning rate was 36.72%, with a profit factor of about 3.82. The robot tanked an average profit of $10268484.33 during this period. There were 8644 trades in total, with 17288 deals. The best trade was $51697.50, while the worst one was -$20715.54.

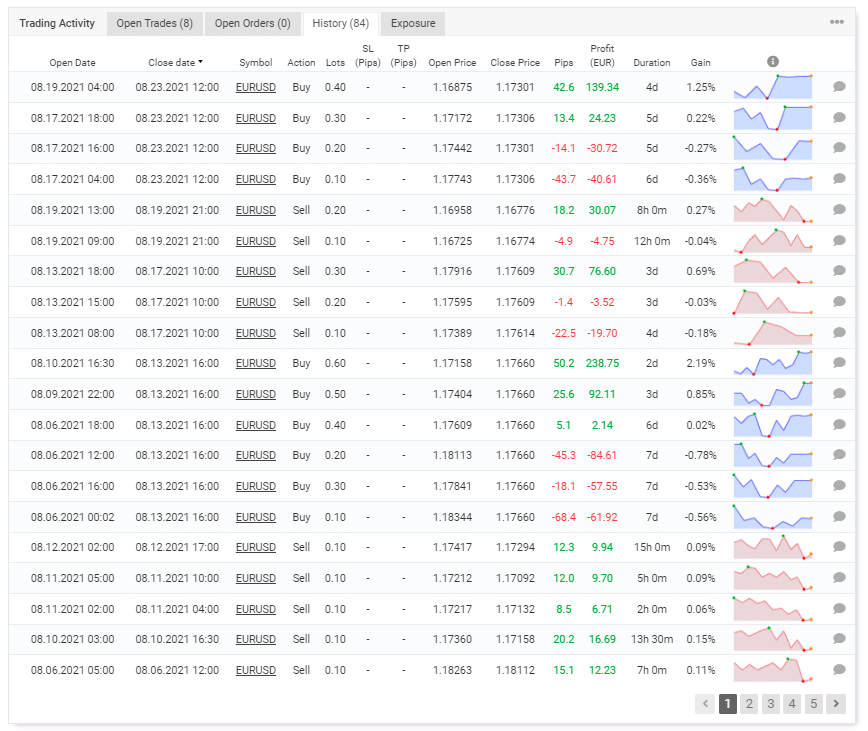

Verified trading records on Myfxbook show performance from June 22, 2021, till the current date. The system has an average monthly gain of 5.94%, with a drawdown of 7.97%. There are frequent drops in equity which shows the implementation of grid and martingale. The winning rate stands at 73%, with a profit factor of 3.67. The best trade is 68.9 pips, while the worst is -68.4 pips. There were a total of 85 trades.

Low drawdown

The current drawdown for the robot is low, but the value will increase when the EA loses a couple of trades. This is generally the case with algorithms that implement martingale and grid strategies.

Vendor transparency

Michela Ruoss is the author of the EA who resides in Italy. He has a total rating of 4.7 for 257 feedbacks. The developer has twelve products published on the MQL 5 marketplace and has 91 subscribers for his services. He has experience of two years.