Vasiliy Strukov produces EA Gold Stuff which is present for the general community on the MQL 5 platform. The robot uses a gold stuff indicator that uses a trend strategy and employs a take profit and stop loss in trading. There are multiple settings with the algorithm that can be tweaked according to the trader’s liking. We will see if access to various input options can help the trader in making profits.

EA Gold Stuff: to trust or not to trust?

Due to the implementation of martingale strategies, using the algorithm on our live accounts is hazardous. It can cause a margin call on our account, which can affect the psychology of a trader and their trading gains.

Features

The robot has the following features:

- Traders can tweak stop loss and take profit.

- The martingale settings can be tweaked at the liking of a trader.

- It is possible to limit the maximum lot size.

- There is a drawdown reduction system.

To get the service up and running, you the following steps:

- Open a trading account with a broker

- Purchase the EA from MQL 5

- Login at the MT 4 platform and refresh your experts’ tab

- Attach it to the charts to start trading

The robot uses a built-in indicator to trade the market. According to the author, it trades in the direction of the trend. There is no further information on the topic, so we head over to the live records on MQL 5 to learn more about the algorithm’s strategy. From there, we can see the use of grid and martingale strategies which are quite risky. The average holding time of the robot is one day which points out that the robot uses a day trading gameplan in most cases. Traders can also tweak the stop loss and take profit and use drawdown measures to tweak the algorithm.

Price

The EA is available for an asking price of $199, and there are no renting options. There is no money-back guarantee according to the rules of the MQL 5 marketplace.

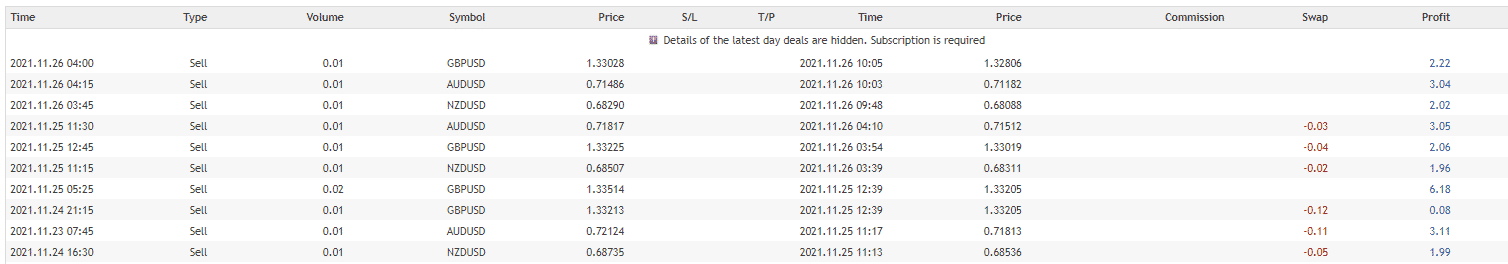

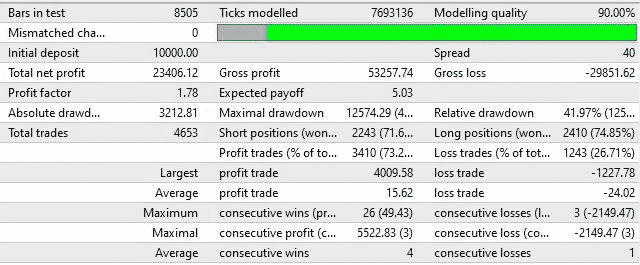

Trading results

Backtesting results are available for unknown currency pairs where the relative drawdown was around 41.97%. The winning rate was 73.2%, with a profit factor of about 1.78. The test was done on an unknown time frame with a starting balance of $10000. The robot has tanked an average profit of $23406.12 for this period. There were 4653 trades in total. The best trade was $4009.58, while the worst one was -$15.62.

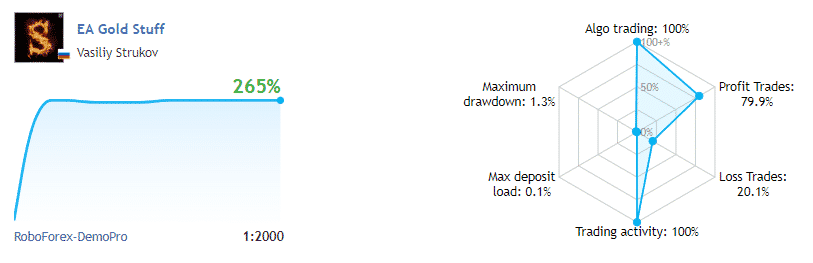

Verified trading records are available on MQL 5. The performance is available from November 04, 2021 till the current date. The system made an average monthly gain of around 14%, with a drawdown of 19%.

The winning rate stood at 265.23%, with a profit factor of 41.88. The best trade was $7620, while the worst was -$648.78 in a total of 179 trades. The developer trades on a demo account which is a poor practice as it does not respect live trading conditions.

Low drawdown

The current drawdown of the system is low, but the records are on a demo account which does not provide the real output. The value can increase in the future due to the implementation of grid and martingale.

Vendor transparency

Vasiliy Strukov is the author of the product who resides in Russia. He has a total rating of 5 for 544 reviews. The developer has 16 products published on the MQL 5 marketplace and has 0 subscribers. The MQL 5 website dictates that he has a trading experience of 2 years.