Exchange-traded funds are some of the most sought-after financial products in the capital markets, given their ability to offer broadened exposure at reduced risks. While they are mostly associated with stocks, they also find their way into the forex market.

Simply put, they are financial instruments that provide investors with exposure to more than one currency pair at a go. They are essential instruments that pool together currency pairs or a basket of currencies. The passively managed instruments trade on exchanges just like stocks allowing people to profit from price differences.

Highly experienced money managers set up these products on behalf of clients and manage them using tools like swaps and futures. Given that they also trade in exchanges makes it possible for people to speculate on their prices. The fact that they have low leverage-related risk makes them stand out.

Currencies ETFs are designed to offer people an affordable way of trading currencies without settling on an individual pair. While some come backed by foreign currency bank deposits, some are not. Nevertheless, most people turn to them as a way of funding currency market exposure to avert risks associated with gaining exposure to just one pair.

Types of currency ETFs

The most popular are known to track some of the biggest currency pairs. This is partly because such pairs are highly liquid and boast an added layer of stability. Currently, there are about 12 ETFs of currencies traded on the US markets with total assets under management of $1.96 billion.

The largest is the Invesco D.B. US Dollar Index Bullish Fund UUP, with about $550 million in assets under management. The ETF is long the US dollar while short the currencies of the G10 economies. The second-largest is the Invesco CurrencyShares Euro Trust, with about $270 million in assets. The ETF is long the euro but short the US dollar.

The best performing currency ETF was the WisdomTree Chinese Yuan Strategy Fund which gained about 6% last year. The ETF is long the Chinese yuan and shorts the US dollar.

Selecting currency ETF

While selecting a currency ETF, it is important to first ascertain the exposure that one wants to get. These products are usually long for a given currency while short for others. Therefore, it is important to know which currency is likely to outperform a basket of other currencies before initiating a trade.

Additionally, you should be able to determine whether you want to go long with a single currency or a basket. Most of the funds in the market are usually short the dollar, which allows people to make money when the greenback depreciates against a basket of other pairs.

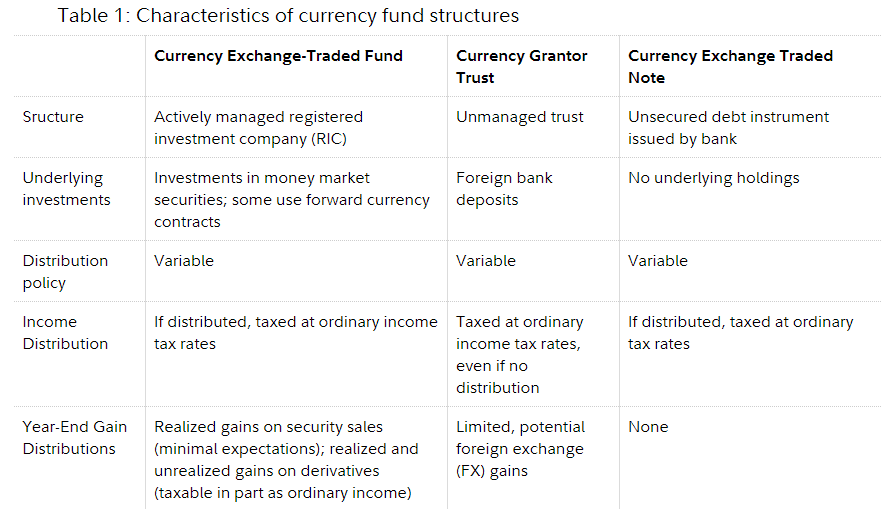

Understanding how the fund is structured is also an important aspect to also consider prior to investing. Most of them are broadly structured into grantor trusts, open-ended funds commodity pools, or exchange-traded notes. It is important to understand them, given that they come with unique strategies, risks, and tax implications.

Grantor ETFs, for instance, come with exposure to spot exchange rates as they hold foreign currency in bank accounts. On the other hand, open-ended funds hold assets in T-bills and offer currency exposure through forward currency contracts.

Commodity funds are well suited for investors looking to gain exposure through commodity pools. They also hold futures contracts.

While selecting a currency ETF, it is important to pay close watch to interest rates, economic events, political decisions, and international trade factors that might affect the currencies in the ETF. These factors influence a great deal how exchange rates move, thus crucial to the performance of such instruments.

Additionally, it is also important to pay close watch to the common uses of the currency fund and the management behind the fund. Most ETFs are usually set up for speculative betting of certain currencies and the spot exchange.

Why currency ETFs

Currency ETFs offer an ideal way of speculating price movements in the international markets by shorting one pair over a basket of others. They stand out partly because they offer a low-cost, low leverage way of gaining exposure to the trillion-dollar marketplace.

Most people turn to currency ETFs as they offer an ideal way of diversifying an investment portfolio. In addition to trading stocks, commodities, or bonds, such ETFs allow one to diversify the stream of income as well as offset any loss from other investments. The fact that they come with more than one currency pair ensures risks are kept at a bare minimum as one loss in one pair is equally offset by another pair.

Additionally, they prove to be ideal tools for taking advantage of differences in currency pair prices in more than one market in what is often referred to as arbitrage trades. Such financial tools also prove to be ideal tools for hedging against macroeconomic events, given their investment is a basket of currencies.

The different pairs in such ETFs come with varying degrees of risk-reward opportunities. Therefore, add a significant layer of stability to an investment portfolio compared to investing in just one pair. Consequently, they are ideal tools for clamping down on individual risks in the currency market.

The risks

Just like any other investment product, currency ETFs also come with their fair share of risks that investors should be aware of. Their performance is mostly influenced by a number of factors that are related to exchange rate fluctuations.

For starters, sluggish economic releases and sudden monetary policy changes by central banks tend to trigger increased levels of volatility in the forex market. The result is usually fluctuations in exchange rates which could take a toll on an ETF.

Macroeconomic events that impact multiple currency pairs also tend to pose the biggest risk to currency ETF as it becomes extremely difficult to offset the risks.