“The Lost Decades” is a phrase that brings Japan’s economy to mind. The phrase entered mainstream use in the 2010s when economists evaluated the dismal economic performance in Japan that started in early 1990. Some commentators venture that the Plaza Accord could have led to the recession.

Whether or not the Plaza Accord caused the Japanese economy to enter a recession is not the topic of our discussion here. Instead, we will be looking at the agreement itself. This article will answer questions such as why the Plaza Agreement happened and its impact on the forex market.

The plaza accord: definition and explanation

Finance ministers from the Group of Five (G5) largest economies in the world met at the Plaza Hotel in downtown Manhattan. The day was September 22, 1985. Top on the agenda was the overvalued US dollar and solutions to weaken it. At the end of the meeting, the five finance ministers agreed to intervene in the foreign exchange market to devalue the dollar. The agreement marked the birth of the Plaza Accord.

The Plaza Hotel meeting marked the formalization of the international policy coordination that underlies today’s G7 and G20 factions. However, the most significant outcome of the meeting is the events that came in its wake. But before we delve into the aftermath of the Plaza Accord, it is worth understanding the events that necessitated its existence.

The build up to the plaza accord

The march towards the Plaza Accord began on August 15, 1971. This is when President Richard Nixon unchained the US dollar from gold, otherwise called the Nixon Shock. The end of the gold-backed monetary policy ushered in a period of macroeconomic excesses. After all, central banks had the liberty to print as much as they wanted to fund the profligacy.

The costs of a free-floating exchange rate system that governments and national central banks had to bear with were currency appreciation or depreciation. A high supply of a given currency in the forex market weighed down its value and vice versa. Besides enabling macroeconomic excesses, the new exchange rate system gave a free hand to central banks and governments to manipulate exchange rates. The Plaza Accord is a manifestation of this manipulation.

1981 marked the beginning of Reaganomics – the economic policies of President Ronald Reagan. Four central policies underlined Reaganomics – increased government spending, relaxation of regulation of the private sector, tax cuts, and an expansionary monetary policy.

In the first four years of Reagan’s administration (1981 – 1985), the greenback gained against all major currencies – 100% against the Deutschmark, 34.2% against the Japanese yen, and 150% against the French franc.

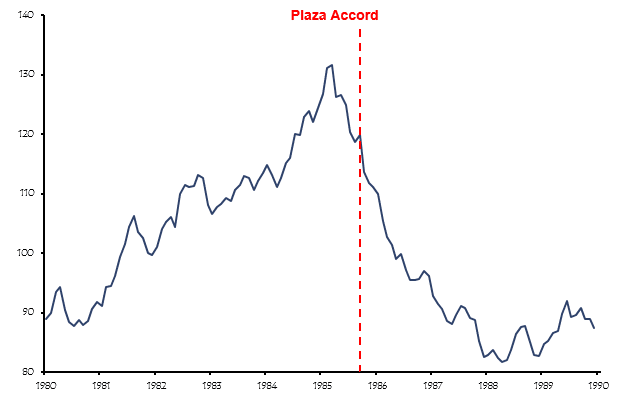

For context, the US dollar index (trade-weighted) appreciated its highest peak in March 1985, six months before the Plaza Accord. The US dollar index consists of currencies of the country’s most important trading partners. They include Japan, Germany, France, the United Kingdom, and Switzerland.

Figure 1: Real trade-weighted US Dollar Index, 03/1973=100, 01/1980–12/1989

The incredible growth of the index indicated one unmistakable phenomenon that the US current account balance was deteriorating. At the same time, the net trade of rival economies was improving. See the figure below:

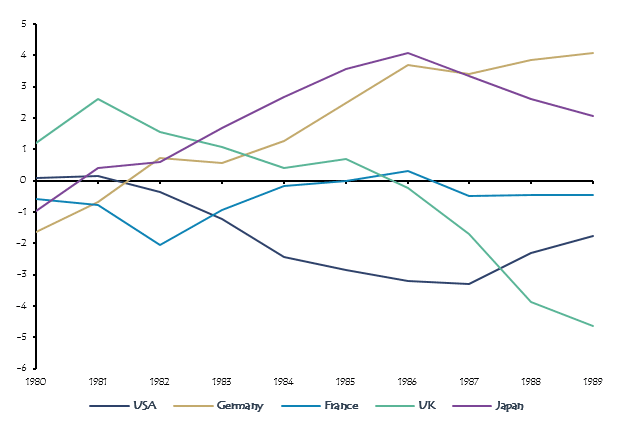

Figure 2: Current account balance Germany, Japan, US, France, UK, in the percentage of GDP, 1980–1989

While the trade deficit in the US ballooned, Japan and Germany were enjoying a diametrically opposite scenario. Japan and Germany’s current account deficits changed from 1.0% and 1.7% in 1980 to a surplus of 3.6% and 2.5% in 1985, respectively.

Enter the plaza accord

Members of the G5 in 1985 were Germany, the US, France, Japan, and the UK. On a material day, James Baker III, the US Treasury Secretary, persuaded his four colleagues to agree to a planned weakening of the dollar. The suggested solution was a direct intervention in the market – this refers to artificially reducing the supply of the greenback in the market.

The second part of the agreement was that Japan and Germany would expand their budget deficits to freshen domestic demand. Ultimately, the US wanted to gain the upper hand in the export market, and it got it.

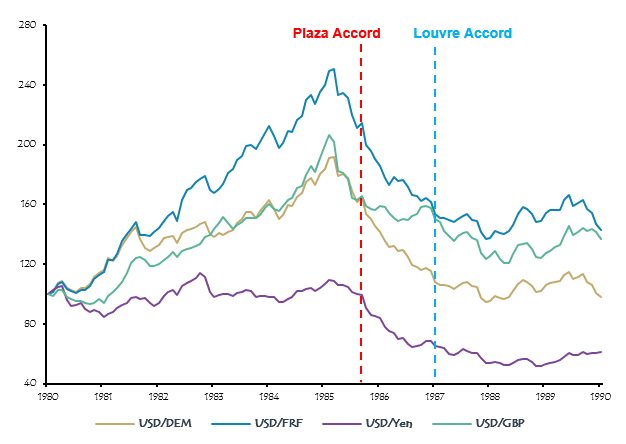

The Accord targeted the devaluation of the USD in the range of 10-12% within a year after ratification. But the effects of the agreement were more immediate than anticipated. All the currencies of the four members of the G5 were appreciated within a week. The Japanese yen grew by the most considerable amount of 11.8%. See the figure below:

Figure 3: USD exchange rate vs. GBP, JPY, FRF, DEM.

Japan’s lost decades

Of all the currencies, the Japanese yen climbed the most against the greenback. The immediate impact of the appreciation was the stalling of the Japanese economy. Japan’s economy was in recession less than a year after the Plaza Accord. In response, the Bank of Japan initiated an unorthodox macroeconomic solution called quantitative easing.

The policy entailed a reduction of interest rates by 300 basis points and a large fiscal package. Immediately after the policy went active, the Japanese economy was booming.

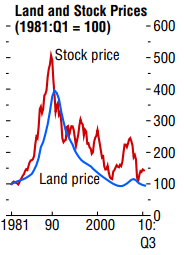

Figure 4: land and stock prices in japan since 1981

Figure 4 shows how land and stock prices entered a tailspin starting in January 1990. Until 2010, Japan was still in the throes of the recession, and experts were not expecting a meaningful recovery in the short term.

Most remarkable was the growth of the prices of urban land and stocks; they tripled between 1985 and 1989. However, the boom was short-lived as it burst in January 1990.

Final thoughts

Two years after the Plaza Accord, the central bank governors of the now G6 bloc met again in Paris. On the agenda was the need to stabilize the forex market given the continued decline of the greenback. The meeting adjourned after the consensus “to cooperate closely to foster stability of exchange rates around current levels” – or what is now the Louvre Accord.