Waka Waka EA is a Forex trading tool that is said to have worked on real accounts for years. Apparently, the system was designed to take advantage of inefficiencies in the market. So, according to the developer, it is not a simple “hit and miss” system that only survives by utilizing grid. Rather, it applies real market mechanics to its advantage to generate profits.

Waka Waka EA: to trust or not to trust?

Our evaluation of the Waka Waka EA has revealed that it is a system that cannot be trusted. This verdict is based on the following reasons:

- The system uses a risky strategy

- It has a low profitability rate

- The robot has a high drawdown

- It lacks vendor transparency

You will come across our findings in some of the following sections.

Features

The vendor is selling this EA at $499. This is a discounted offer and only 6 copies out of 10 are currently available at this cost. The next offer is $549 and the developer says that the price will remain at this level to decrease the number of people who use the system.

From its description, it is evident that the robot applies the grid strategy. This means that the system enters and exits trades at set intervals from the current market price. However, it is important to note that this approach carries significant risks. If the price fails to run in a sustained direction, then losses will be inevitable.

The vendor has described the features of the EA as follows:

- Only one chart is needed to trade all symbols

- Supports many currency pairs- AUDCAD, AUDNZD, NZDCAD

- No adjustment of GMT is required

- Should run on a VPS constantly

- Easy to use

- The recommended time frame is M15

- Runs on the MT4 platform

- Is not sensitive to spread and slippage but the usage of a good ECN broker is recommended

Backtest results

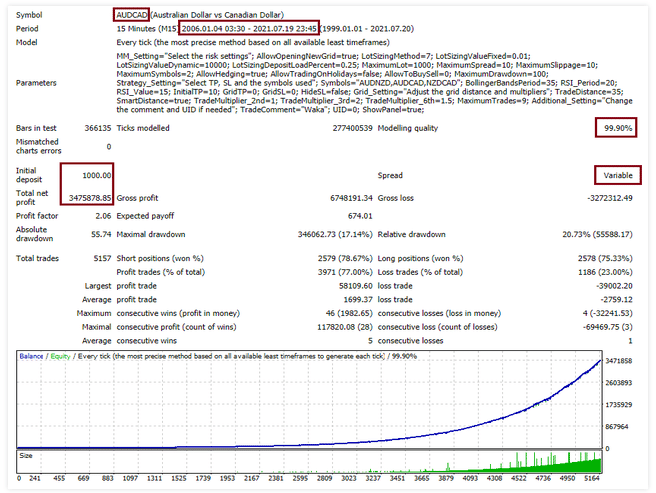

This backtest statement shows that the EA used the AUDCAD currency pair on the 15 minute time frame. It was tested between January 2006 and July 2021. During this 15-year period, it executed 5157 trades. Short positions win rate was 78.67% while the long positions win rate was 75.33%.

The average loss trade (-$2759.12) was nearly two times higher than the average profit trade ($1699.37). This indicates that the system had a hard time making profits as most of its trades ended up in losses.

The account was initially deposited at $1,000 and a total net profit of $3,475,878.85 was generated. The profit value was very high and is not feasible in reality. The profit factor was 2.06 and the maximal drawdown was 17.14%.

Trading results

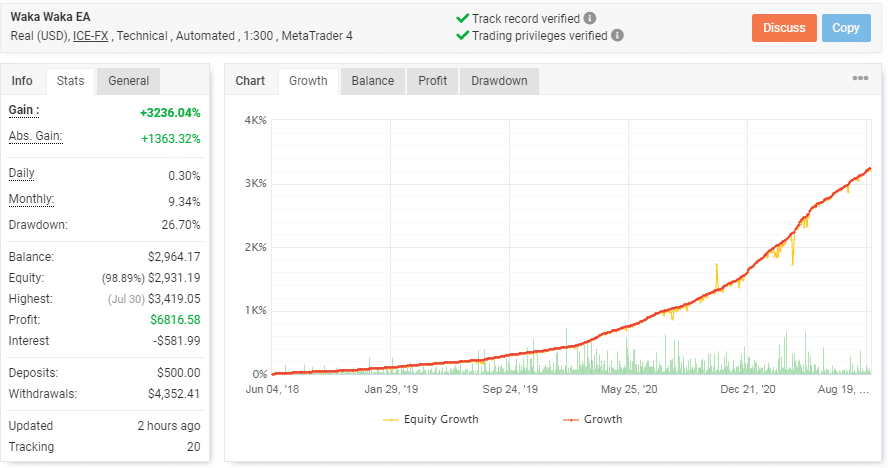

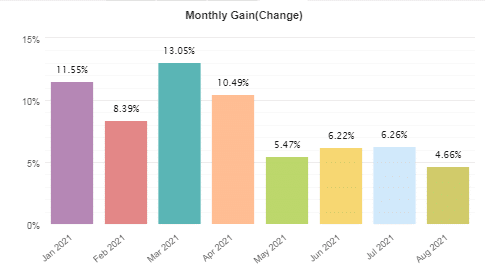

This is a real USD account operating under ICE-FX brokerage using a leverage of 1:300. Since its inception in June 2018 till now, it has accrued a gain of 3236.04%. The initial deposit was $500 and a profit of $6816.58 has been made to date. The account balance is presently $2,964.17 after a total of $4,352.41 was withdrawn. The daily and monthly profits are 0.30% and 9.34% respectively.

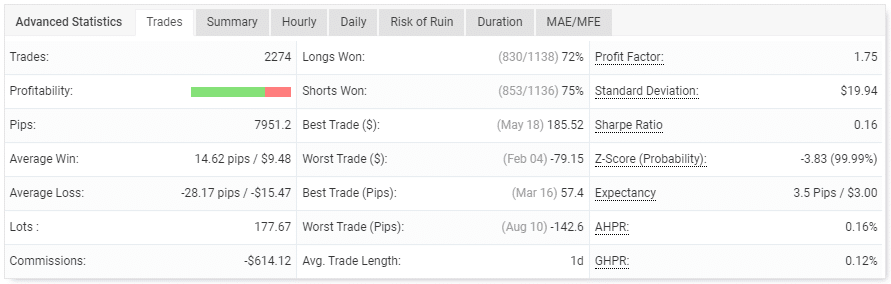

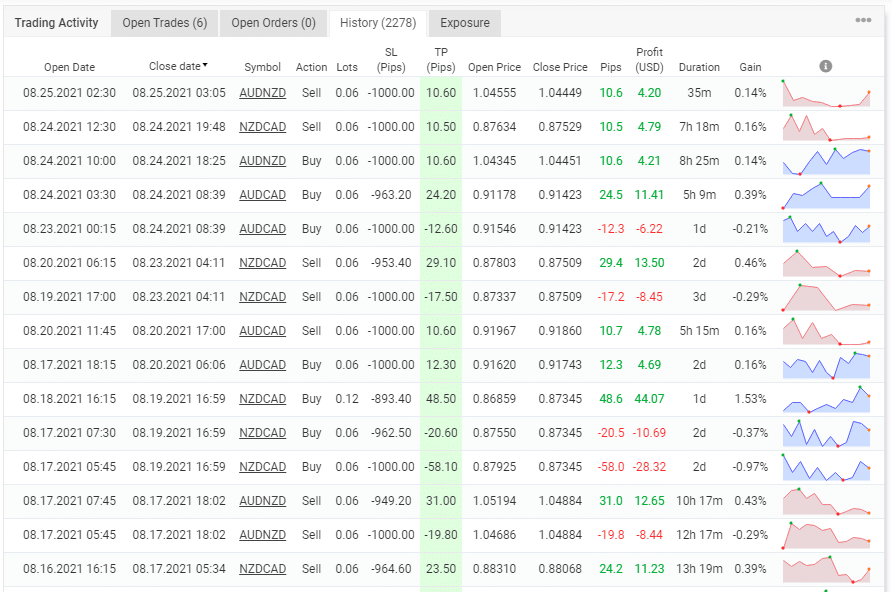

These results reveal to us that the EA carried out 2274 with 177.67 lots. The winning rates of 72% for long positions and 75% for short ones were lower than the results shown on the backtest statement. Here, we see a situation where the robot faces some real challenges when it comes to making profits.

The pips made are 7951.2. The average loss of -28.17 pips compared to the average win of 14.62 pips further highlights the dire condition of the account due to its inability to generate good returns. The profit factor which is 1.75 also sheds light on the low profitability rate of the account.

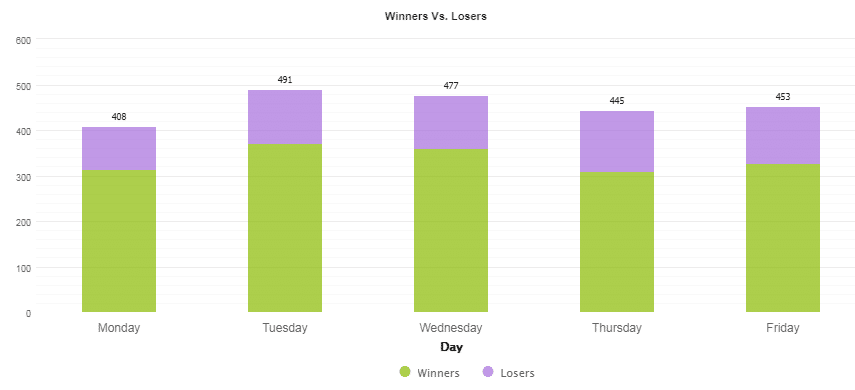

Tuesday is the most traded day with 491 trades.

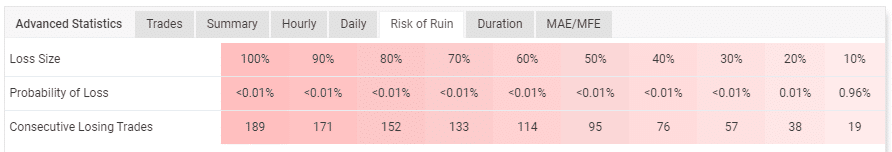

The risk of losing the account is moderate.

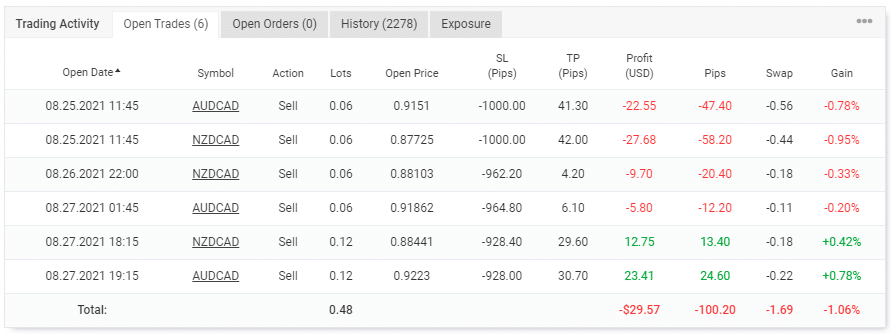

The various currency pairs have been making losses. They have made profits on 2 occasions only.

The EA has been making consistent gains. Therefore, it is possible to predict how it will perform in the future.

The system used large stop losses of up to 1000. Take profits were also applied. The gains made were nothing to write home about. The grid strategy was on board.

High drawdown

The drawdown (26.70%) generated by the system is big and higher than the one we see in the backtest report. The risks the EA presents to the account are seemingly more real in the live market. The grid strategy is obviously not working well.

Vendor transparency

Valeriia Mishchenko is the author of this product. She is from Russia and has also developed the Night Hunter Pro EA for both the MT4 and MT5 platforms. Sadly, we do not know anything else about this developer. It is fishy that she has kept her background info secret. Perhaps she is not qualified enough to develop trading tools for Forex and doesn’t want her credentials to be questioned by the public.

Customer reviews

The mql5 website highlights a total of 4 customer reviews that relate to this EA. All of them are positive but none has disclosed much about the performance of the robot. Therefore, the testimonials are pretty much useless. Unfortunately, we could not find more reviews on other trusted websites like Trustpilot and Forex Peace Army.