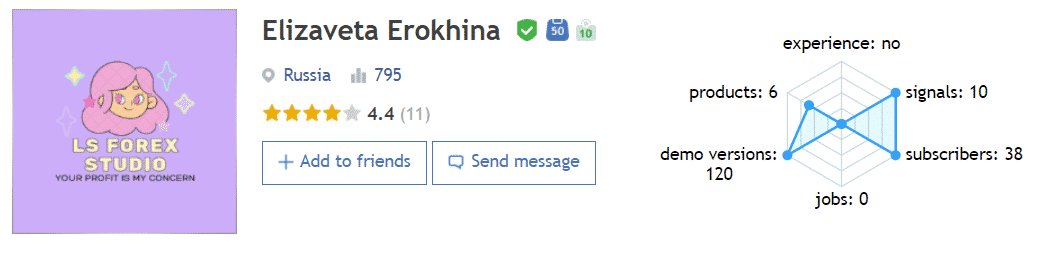

Tiburon EA is a system that is a part of the MQL5 community. The publishing date was the first of September, 2021. The developer is Elizaveta Erokhina from Russia. We are here to figure out what’s up with the system.

Tiburon EA: to trust or not to trust?

We don’t think so. The system should demonstrate good trading statistics for half a year or so to prove that it can work stable.

Features

The robot has a short presentation but there are still some useful details explained.

- The robot was designed to execute orders on a terminal automatically.

- It works with only a EURUSD pair.

- The system feels comfortable trading on H1.

- The testing period of data was chosen – 2011-2021.

- It uses the “following indicators: RSI (Relative Strength Indicator), Stochastic Oscillator and his own customized indicator which makes the EA even more efficient.”

- It analyzes “overbought and oversold areas, while Stochastic and the indicator identify the possibility of price change at definite levels.”

- The win rate should be high.

- The price is $400 for now, but it keeps rising.

- The next one will be $100 higher – $500.

- The account balance should have more than $3000.

- The broker has to be low-spread.

- It has a feature that allows using dynamic take profit.

- The system doesn’t need us to have previous trading experience.

- We can work with any broker that we want.

- The number of order parameters can be customized.

- The system lets us decide what hours we don’t want to trade.

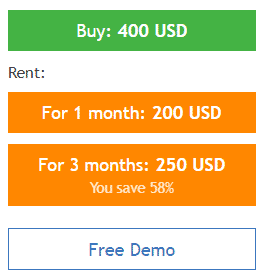

Price

A copy of the system is available for $400. It’s not an affordable offer. The one-month rent costs $200 when three-month rent costs $250. We are not allowed to have a refund policy if something goes wrong. The system can be downloaded for demo usage. We can execute backtests and check settings.

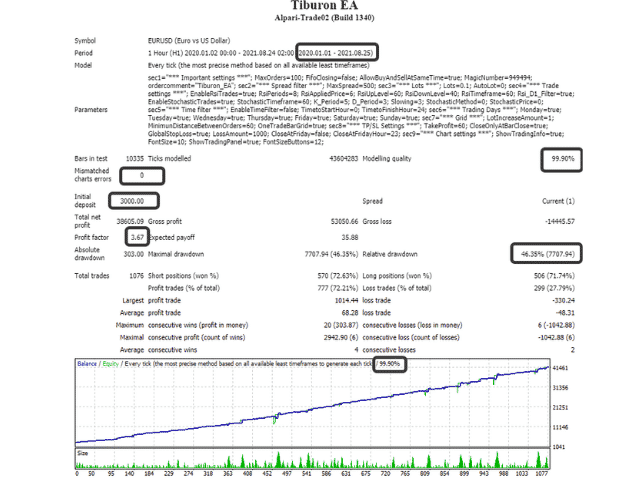

Trading results

We have a backtest report provided based on the EURUSD pair on the H1 time frame. The data period was 20 months long. The modeling quality was 99.90%. The spread was low – 1 pip. An initial deposit was $3000. As a result, the total net profit has amounted to $38,605. The profit factor was 3.67. There were 1076 orders traded. The accuracy was 71%-72%.

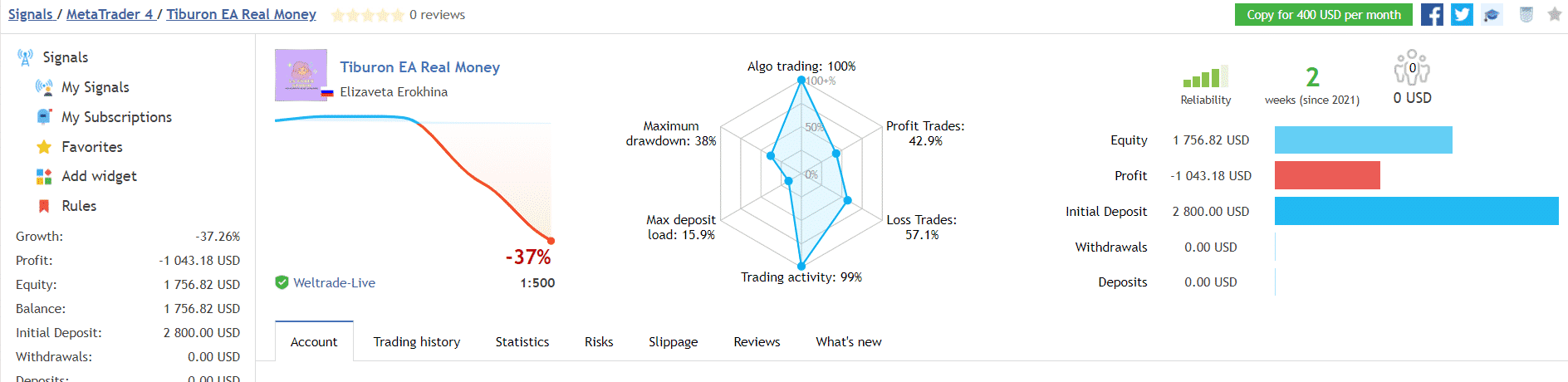

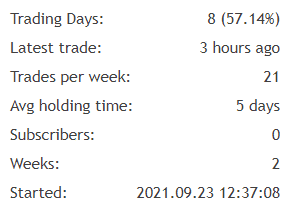

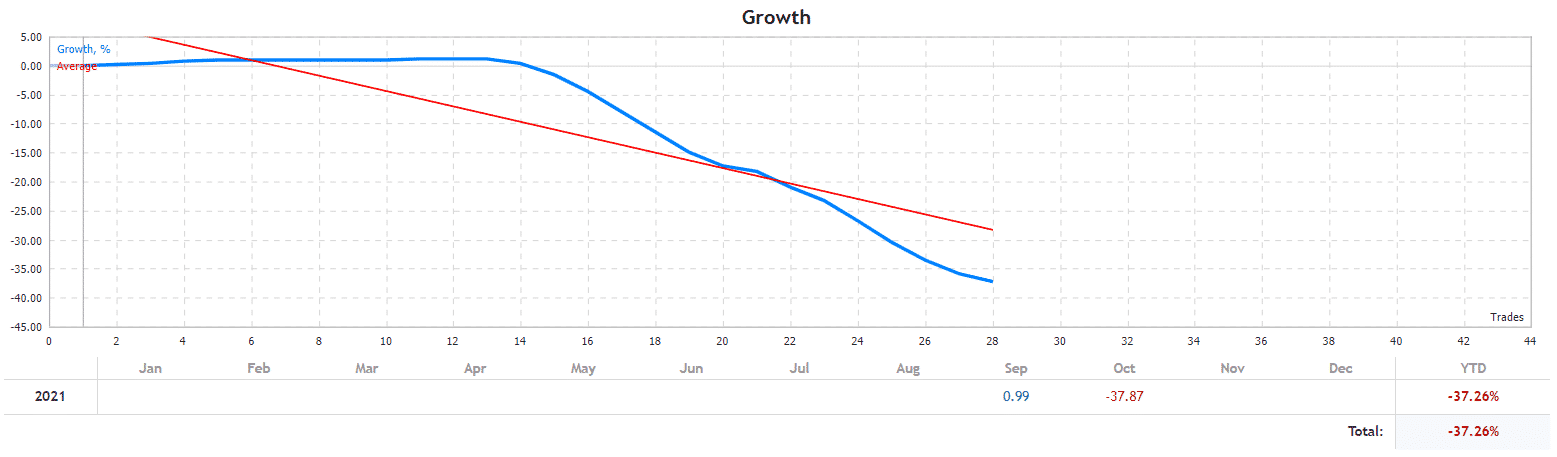

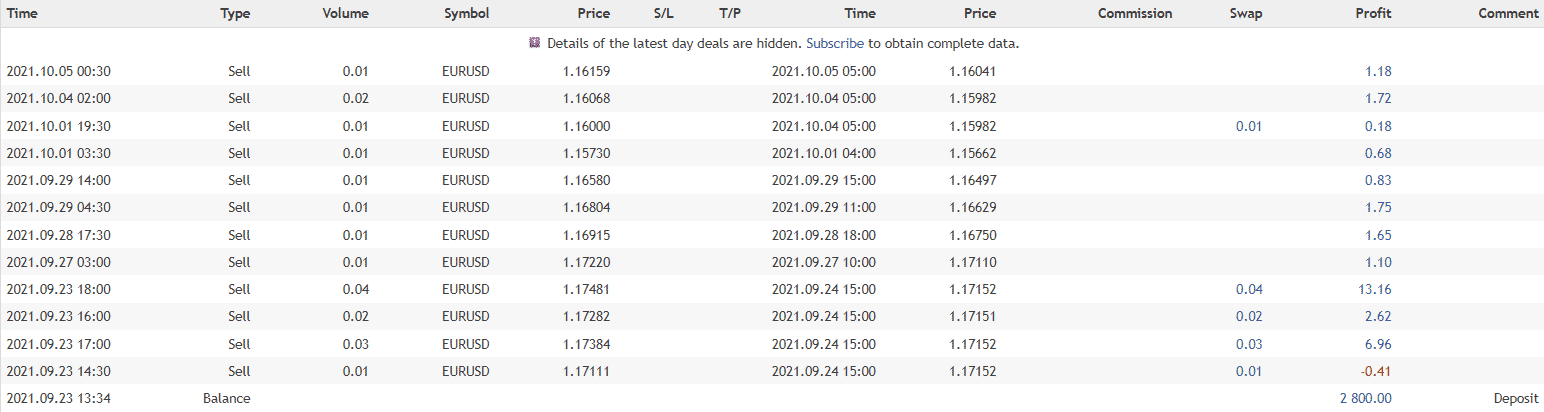

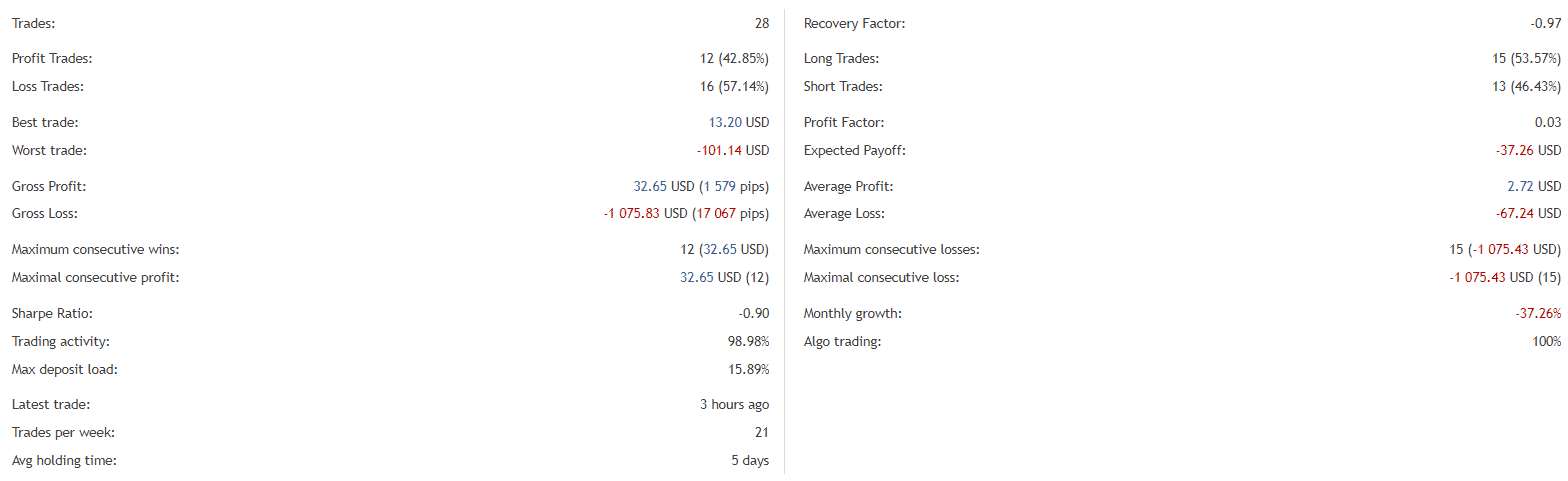

We have racked these screenshots several hours before the account was removed. The system has blown $2,800 from a real account on a Weltrade broker. The maximum drawdown was 38%. The win rate was a scam one – 42.9%. The maximum deposit load was average – 15.9%. The system has been working for two weeks. The total growth was -37.26%.

An average trade frequency was 21 deals. The average trade length was huge – 5 days.

The robot went down from the start immediately.

The system traded with lots of 0.07 when an average lot was 0.01. It was a scam to increase profitability.

There were 28 orders executed. We have intel about the best and the worst trade. The best trade was $13.20 when the worst trade was insane worst -$101.14. The profit factor was 0.03 only. The average monthly growth was -37.26%.

Vendor transparency

Elizaveta Erokhina has a 795 rate as a developer. It’s nothing. There are six products in the portfolio added. We have 10 signals with 38 subscribers. Her products have a 4.4 rate based on 11 reviews.

People feedback

We have no idea who this happy person is if we have a blown account on the plate. Most likely, that feedback is fake.