Gold trading in Forex can give splendid returns if you know the right entries and exits. The use of specialized strategies further improves the chances of big returns. Scalping is one of the strategies that help limit the losses by using tight leverage and also by its non-directional approach. Lucky Gold Scalper is an expert advisor that uses the advantage offered by scalping for trading the gold market. It uses price action volatility for identifying the right signals. In this review, we have comprehensively evaluated this scalping system. Find out what our experts have to say about the system’s reliability.

Lucky Gold Scalper: To Trust or Not to Trust?

Nguyen Hang Hai Ha, a Vietnamese designer and stock trader with over 9 years of experience in Forex is behind this Forex robot. He has developed 16 products and 3 signals. First published in March 2021, the current version of the system is 3.9. We have comprehensively covered the various aspects of this system to find out whether this system is reliable or not. To enable a thorough assessment of this expert advisor we look at the features of the system first.

Features

As per the info provided by the developer on the MQL5 site, this trading robot has a design that solely targets the gold market. The trading approach of the system is based on the volatility of the price action. On identifying the signals with high winning probability, this Forex robot spots the positions that have floating losses and tries to improve gains by closing at positions that bring on minimum loss.

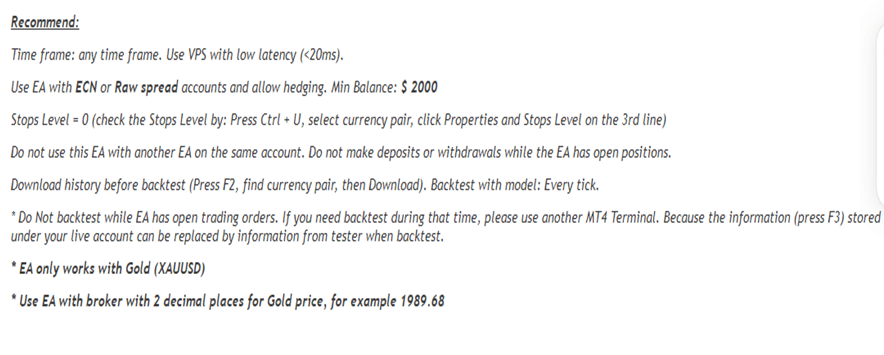

XAUUSD is the main currency pair that this Forex robot works on. The developer recommends using the default settings for newbies, and to use an initial deposit of $2000. But the recommended minimum deposit is $3000. Any time frame is suitable for this system and the developer recommends using the ECN broker or accounts with raw spread.

Now that we have gone through the important features highlighted on the site, here are the main aspects that influence our decision on the reliability of the system:

- No trading results

- Expensive price

- User Reviews

Let us analyze each of the above four influencing aspects here.

No Verified Trading Results

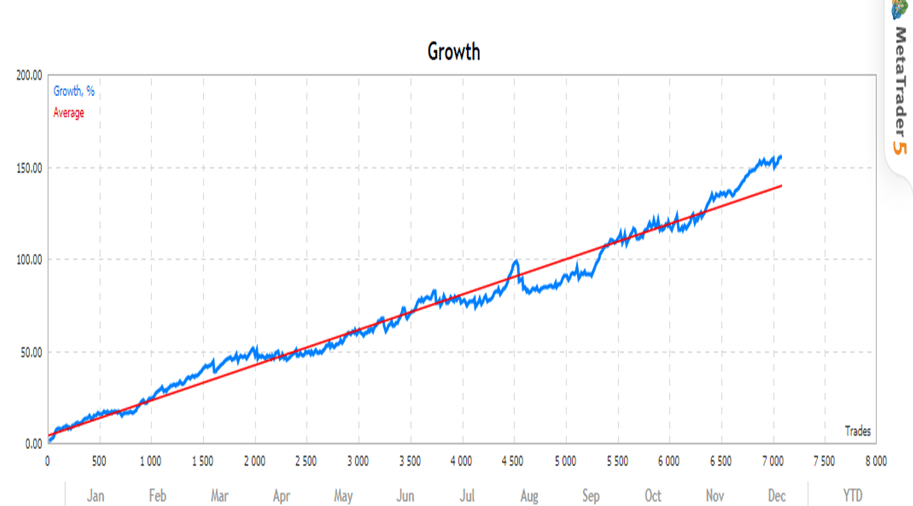

We could not find verified trading results for this system. A real account trading with the leverage of 1:500 is shown by the developer. Here is a screenshot of the results:

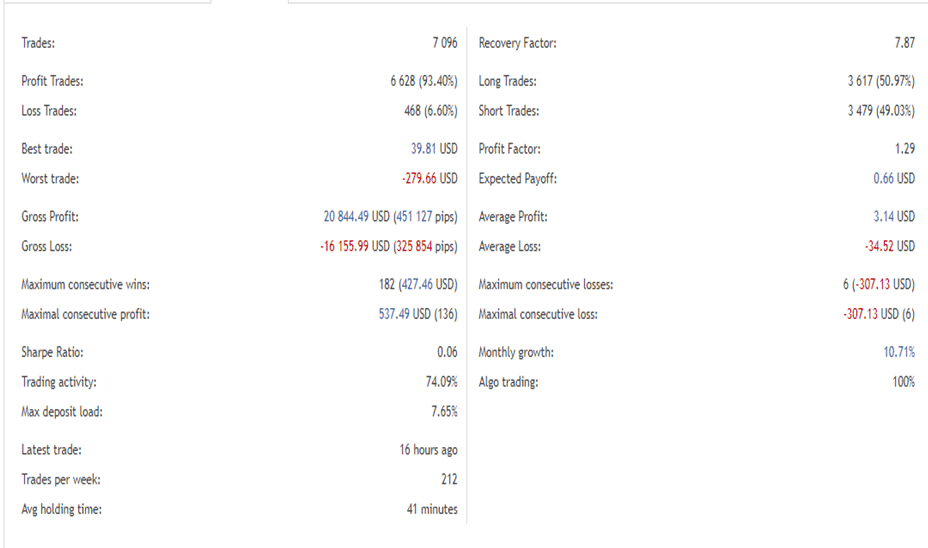

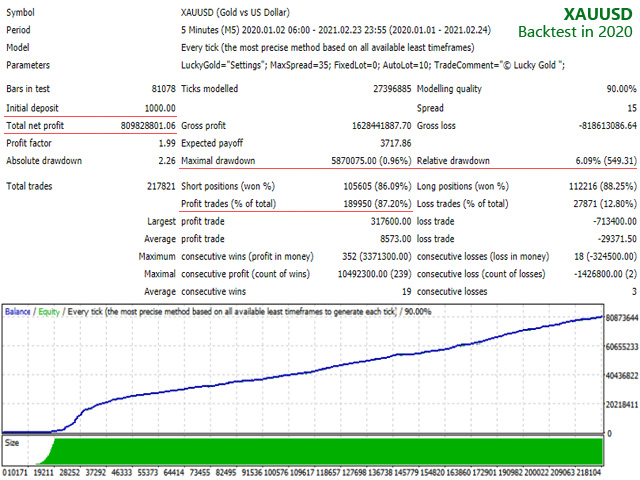

Trading results verified on sites such as myfxbook and FXBlue are reliable and authentic. The results reveal important statistics related to the trading account such as the total profit, the drawdown, profit factor, and more. These aspects are vital to assess the performance of the system. The lack of verified results makes it difficult for us to do a proper evaluation. Backtesting results are shown on the MQL5 site. Find the screenshot of the backtesting results below:

From the strategy tester report above, we could see the modeling quality is just 90%. We find this is not sufficient to know about details such as the spread, commissions, slippage, etc. For an initial deposit of $1000, the system has elicited a profit factor of 1.99 with a maximum drawdown of 0.95%. The testing done for 12 months uses a timeframe of 5 minutes. While the backtesting indicates a good performance for the system, without live verified trading results we are unable to gain a proper perspective of the strategy and performance.

Expensive price

A one-time payment of $399 is charged for this system. We could see a discounted price of $357 provided for a short span as per the info on the MQL5 site. Rental packages are also available for this system. The cost for three months is $197, $257 for 6 months, and $297 for one year. A free demo version is also present which has been downloaded 699 times according to the details shown on the site.

User Reviews

A few reviews are posted on the MQL5 site. While some of the reviews indicate the EA shows good performance, a few are critical about the stop loss and sell order settings of the system. We prefer reviews from reliable third-party sites such as Forexpeacearmy, Trustpilot, etc. as the reviews here are verified and unbiased mostly. Without authentic reviews, it is difficult to assess the performance, support, and other crucial features of the system.