IndEX EA has a mediocre and not updated presentation. The system makes profits on the strengths and weaknesses of YEN, USD, GBP, EURO, and Gold currencies.

IndEX EA: To Trust or Not to Trust?

We wouldn’t like to trust our real accounts to this advisor. The main reason is that it’s an unprofitable trading solution. The system has been struggling to survive for a long period since the beginning.

Features

We have only three blocks with the information. It’s not enough for being sure that the system is good to go:

- IndEX EA works automatically on the terminal.

- The robot opens an order only when it’s possible to reach a 150-pip profit.

- The system can be attached to a single chart.

- It works with the next pairs GBP/JPY, EUR/JPY, USD/JPY, EUR/USD, GBP/USD, EUR/GBP, and XAU/USD.

- The advisor can obtain from 200 to 400 pips monthly.

- We don’t know how a 150-pip goal can match the monthly profits.

- The trading frequency is 3-4 orders weekly.

- 95% of the accuracy rate is fake.

The EA works with “a weighted Index value that calculates relative strangeness for every symbol. The strategy works for GBP/JPY, EUR/JPY, USD/JPY, EUR/USD, GBP/USD, EUR/GBP, and XAU/USD.” The EA trades pairs when one of the index components strengthens, and the other weakens.” It’s unclear for people who don’t know Forex.

- “The robot opens orders during the volatility of GBP/JPY and Gold based on the next symbols: USD/JPY and XAU/GBP.” It performs trades on H1.

- The advisor trades with volatility on the USD/JPY pair, trading on the daily time frame. It requires much margin to keep orders on the market – much more than on the H1 time frame.

- It can trade trends on EUR/JPY.

- The last applied strategy is swing trading on the EUR/USD, GBP/USD, and EUR/GBP symbols applied.

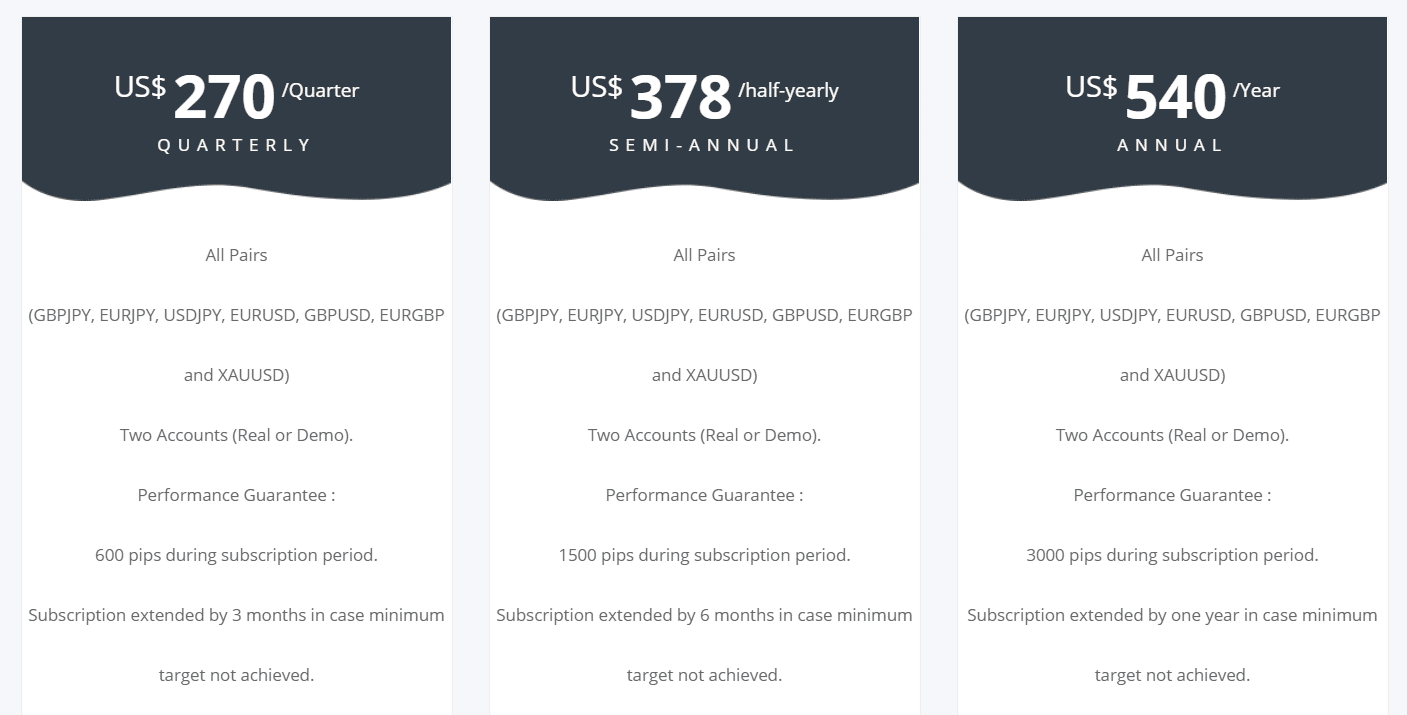

We have three packages on the board. They vary by range. The three-month rental option costs $270. We can expect to get 600 pips. The six-month rent costs $378, and it’s featured by 1500 pips. The annual subscription costs $540 and allows gaining 3000 pips. The packages include:

- Trading on EUR/GBP, EUR/JPY, EUR/USD, GBP/JPY, GBP/USD, USD/JPY, and Gold symbols.

- The subscription will be extended if we don’t reach our goals.

- There are two licenses for real and demo accounts provided.

- We have no refund policy provided.

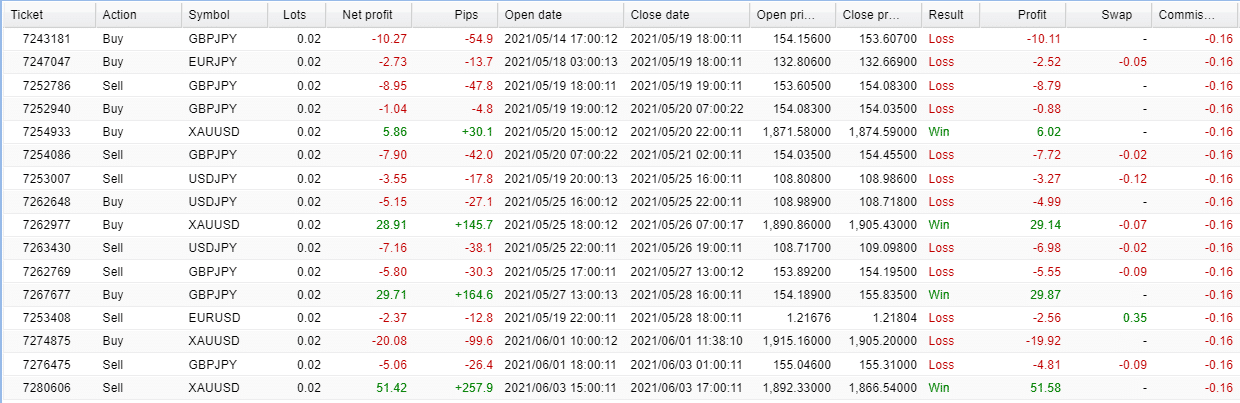

Verified Trading Results

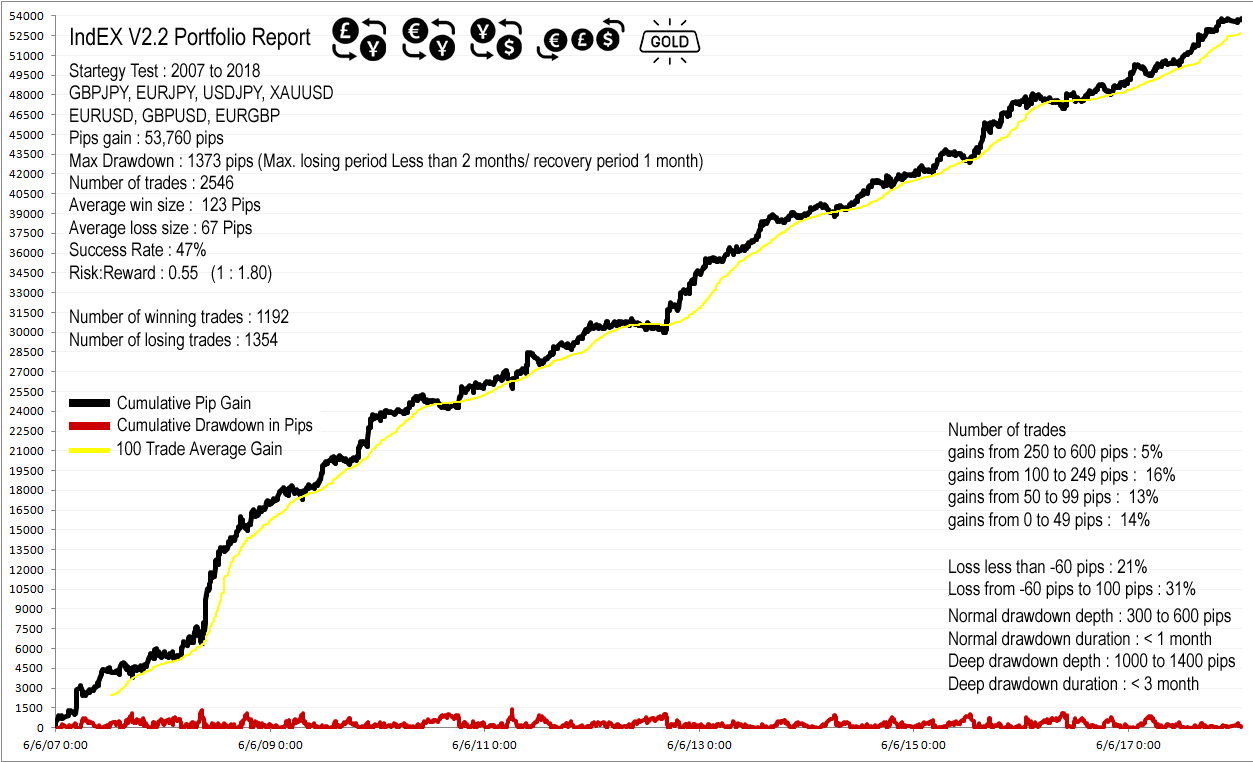

We have a report that unites all strategies and currency pairs. The data period was chosen from 2007 to 2018. The advisor has gained 53,760 pips. The maximum drawdown was 1373 pips only. An average win was 123 pips. It’s twice more than an average loss of 67 pips.

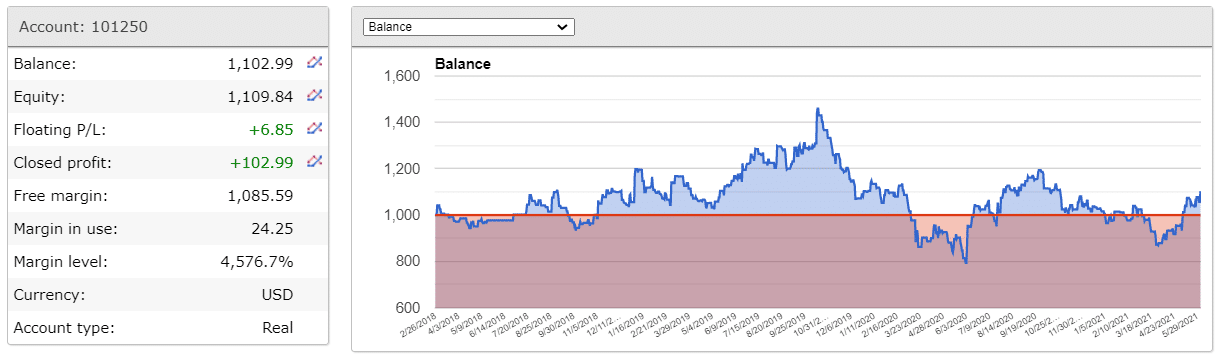

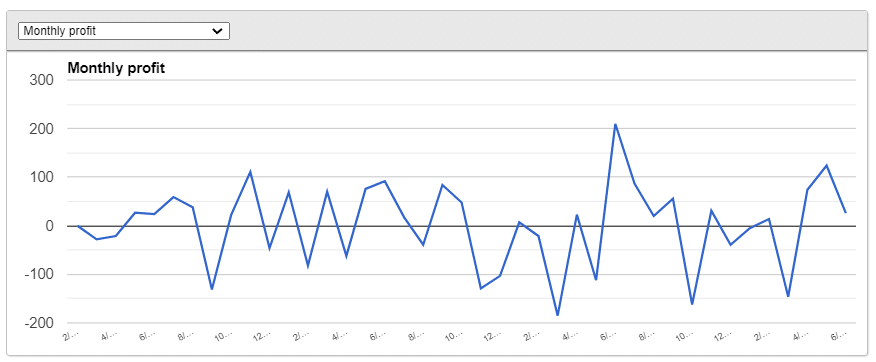

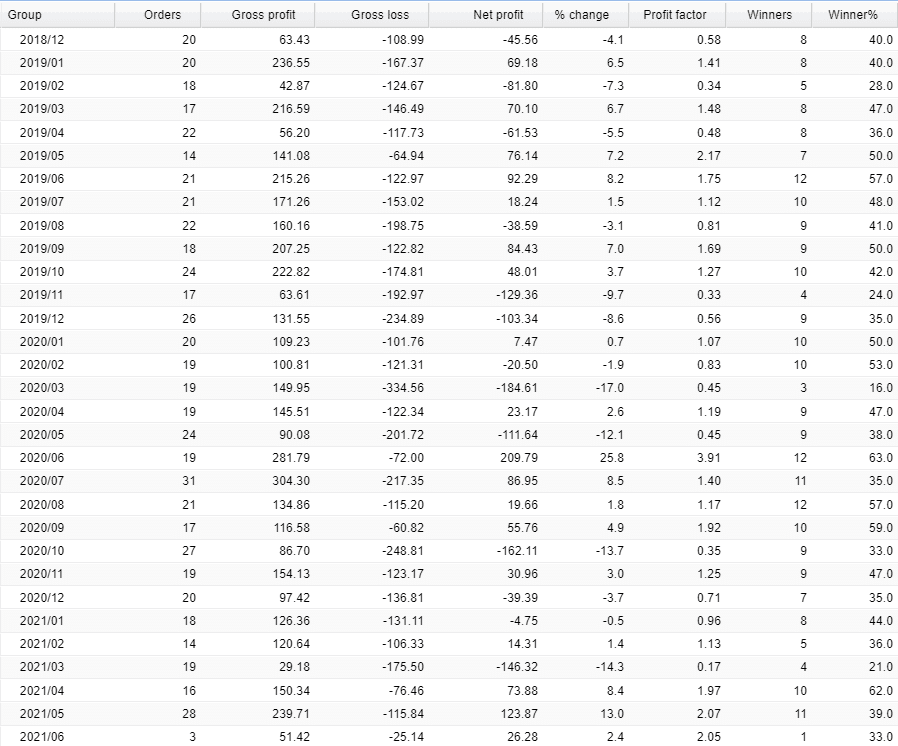

We have a real USD account on fxblue. It was deployed on February 26, 2018. The closed profit is $102.99. The balance is $1,102.99.

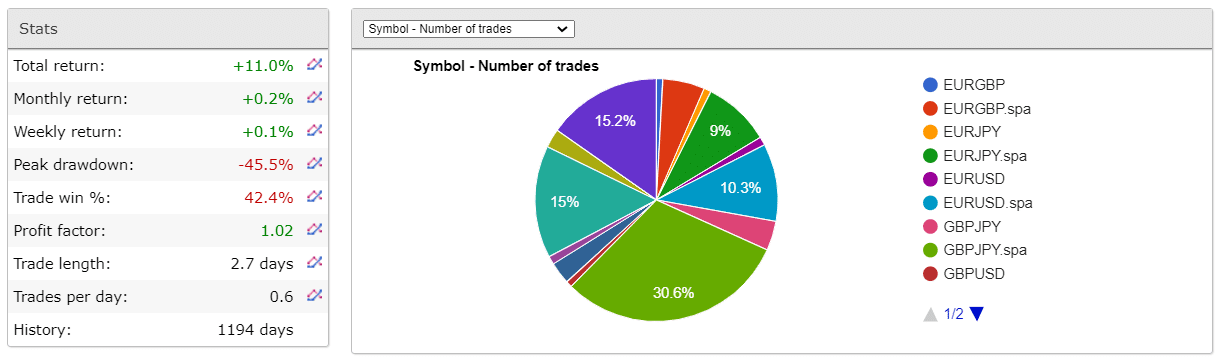

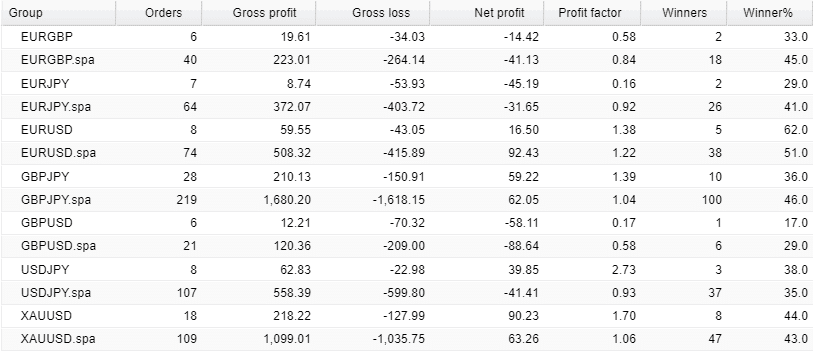

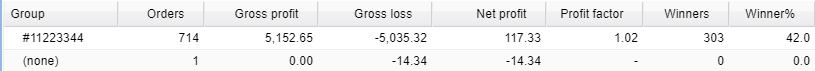

The advisor works with EUR/GBP, EUR/JPY, EUR/USD, GBP/JPY, GBP/USD, USD/JPY, and Gold pairs. The total net profit is 11%. The average monthly return is negative – 0.2%. The maximum drawdown was 45.5%. The accuracy rate is 42.4%. The average trade frequency is 0.6 trades daily. Numbers aren’t good for a professional advisor.

The system couldn’t manage to be a profitable trading solution.

GBPJPY is the most frequently traded currency pair. Many symbols have negative net profits.

The Sell direction isn’t profitable at all.

There’s a single strategy behind the system.

Tuesday, Wednesday, and Thursday are the most active days.

The system trades during all trading sessions.

The system started losing so many trades.

Vendor Transparency

The company has no transparency at all because we don’t know anything about the developers and the company behind it.

People Feedback

The presentation includes some feedback published. These testimonials are faceless and could be posted when the site was created.

Other Notes

There are additional services promoted. We couldn’t imagine any person who needs them.