Forex trading is the process of buying and selling currencies with the goal of generating a profit. It is one of the biggest markets in the world, with daily transactions of over $5 trillion. In this article, we will look at what a micro account is in forex and how you can grow it over time.

Types of accounts in forex trading

There are three main types of accounts in forex trading: micro, mini, and standard accounts or lots. A micro account, also known as a micro-lot, is a small account that typically represents about 1,000 currency units.

These accounts are mostly used by beginner traders who don’t have access to a large pool of money. Experienced traders can also use the micro account to test new strategies. In some cases, these accounts are seen as a good bridge between a demo account and a bigger forex account.

A mini account, on the other hand, is made up of 10 micro-lots, which is equivalent to 10,000 currency units. Finally, a standard account has 10 mini lots, which is the same as 100,000 currency units. These accounts are designed for large traders with a substantial amount of money at their disposal.

Fundamental and technical analysis

To a large extent, trading with a micro account is similar to how you trade other types of accounts. The main difference is that you will need to be more careful to prevent your account from losing money. For one, it is often easier to have a margin call when you are using a micro account than when you are using a standard account.

Therefore, there are three main types of analysis that you need to do when trading using a micro account. First, before you open a trade, ensure that you have done some fundamental analysis. It does not need to be highly detailed since you are a day trader and not an investor.

In this, you should first look at the overall market themes for the day. Some of these market themes could be on interest rates, bond yields, and even geopolitics. They could also be on economic data.

In most cases, currency pairs will show some volatility when there is important data such as employment, inflation, and consumer confidence.

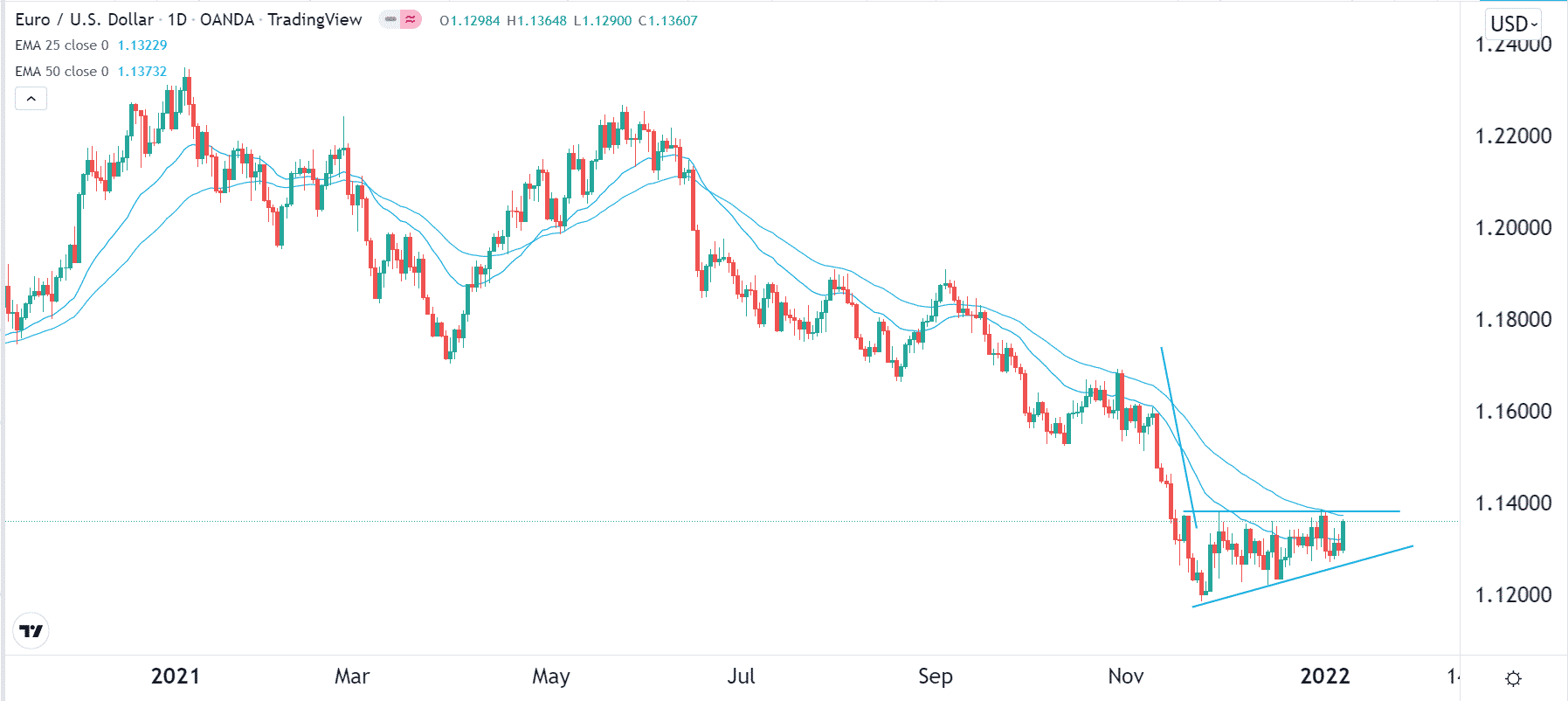

Second, you should conduct a technical analysis on your preferred currency pairs. In technical analysis, you will use indicators like the Moving Average, Donchian Channels, fractals, and market facilitation index (MFI) to predict the direction of the currency pair.

You will also analyze candlestick patterns. Some setups you could look at are triangle, bullish and bearish flags, and rectangles. Also, you could look at candlestick patterns like bullish and bearish pennants and flags.

The chart above shows the EURUSD with the 25-day and 50-day Exponential Moving Averages (EMA). A closer look shows that it has formed a bearish pennant pattern, meaning that it will likely have a bearish breakout.

Risk management strategies in a micro account

The most important concept when trading a small micro account is how you manage risks. A simple mistake can lead to your account being wiped out. Indeed, this is one of the reasons why many new traders lose money and give up. Here are some of the top risk management strategies when trading with a micro account. They also apply in the mini and standard accounts.

Trade type

Broadly, there are two types of opening trades in the forex market. You can open a market order, where the trade is initiated right away. Alternatively, you can open a pending order, which will be implemented only when the currency pair reaches the specified levels.

A buy stop is where a buy trade is implemented at a level above the market price. For example, if the EURUSD is trading at 1.1400, you could set a buy-stop at 1.1420. In this case, the buy order will be opened when the price rises to that level. You could also set a sell-stop at 1.1380, which will be implemented if the trade moves to that level.

A buy limit, on the other hand, happens when a bullish trade is implemented slightly below the current price. In this case, you could place a buy limit at 1.1380. A sell-limit can be placed at 1.4020.

Pending orders are usually better than market orders. For example, they help to mitigate the challenge of slippage, where a trade is implemented below or above where it was placed at.

Stop-loss and take-profit

Another risk management strategy when trading micro accounts is that of using a stop-loss and a take-profit. A stop-loss will halt your trade when it reaches a certain loss threshold, while a take-profit will be triggered when it reaches a pre-set profit level.

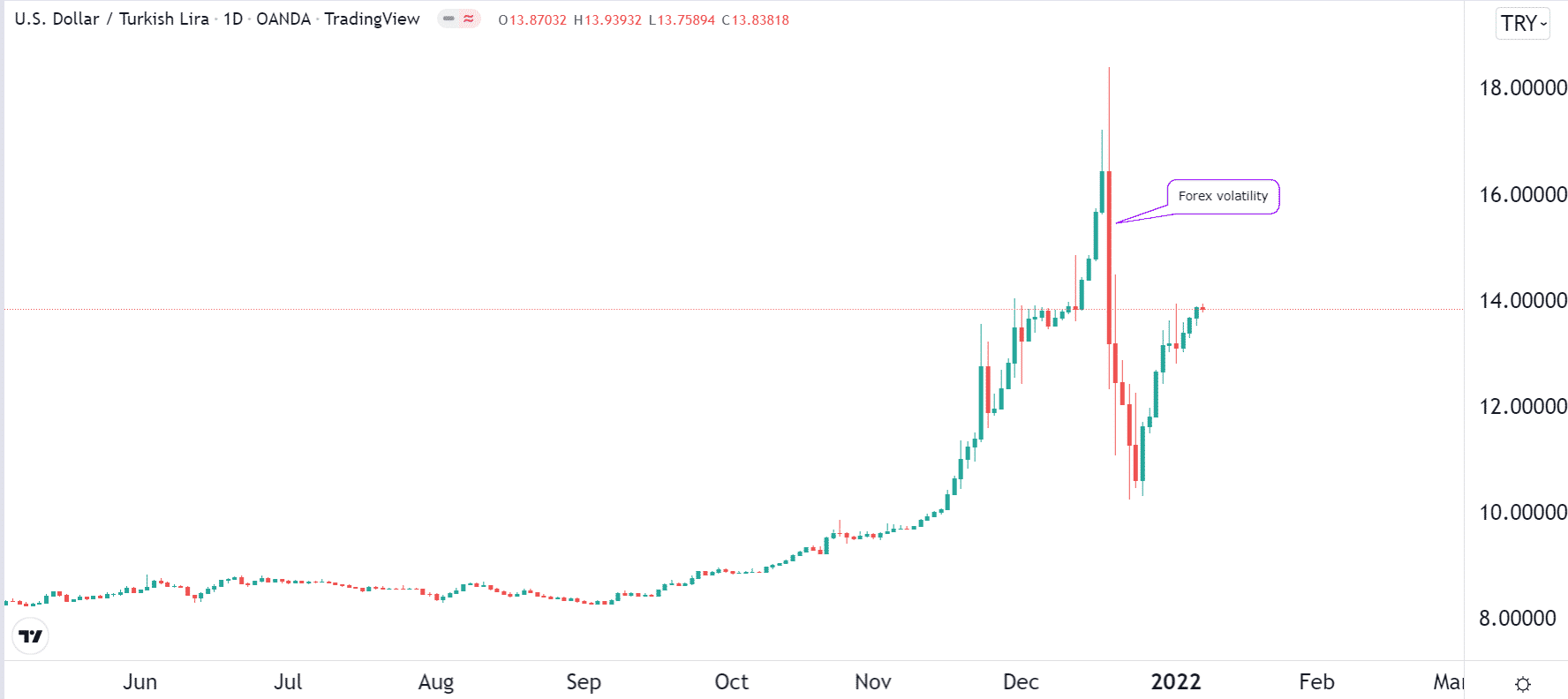

These stops are important because they will protect your account in case of major volatility in the currency pair you are trading. For example, if you were bullish on the USDTRY pair when it fell by over 40%, the stop-loss would have helped you to limit the loss.

Leverage

Leverage refers to a special type of loan that your broker extends to you. It is a good feature that helps you trade with more money than what you have. However, big leverage can lead to supersized losses. In fact, with leverage, it is possible to lose more money than what you invested.

Fortunately, many brokers today offer negative balance protection. Many others, especially in Europe and Australia, have reduced their maximum leverage. When trading with a micro account, you should start with small leverage and then increase it as you validate your strategy.

The bottom line

Most people start their trading journeys with micro or a mini account. In this article, we have looked at what these accounts are, how to trade them, and some of the top risk management strategies to consider.