FXRapidEA offers two different algorithms that work on multiple currency pairs. The company tries to prove the performance of the EA by providing us with verified results and backtests. The robot uses a trend trading methodology and does not stay in the market for a long period. We will discuss all the possible outcomes of using the robot in our review below.

FXRapidEA: to trust or not to trust?

Hippo Trader uses martingale and grid strategies, due to which the robot is completely untrustworthy. The developer is not transparent on the strategy, which raises further concerns.

Features

The robot has the following features:

- It is compatible with all brokers

- The robot has a drawdown control system for trading

- It trades rapidly and does not stay in the market for long

- It works on four currency pairs and requires $460 to start trading

To get the robot up and running, you the following steps:

- Purchase the algorithm from the developer

- Place it in the MT4 platform

- Enable auto trading and attach it to the charts

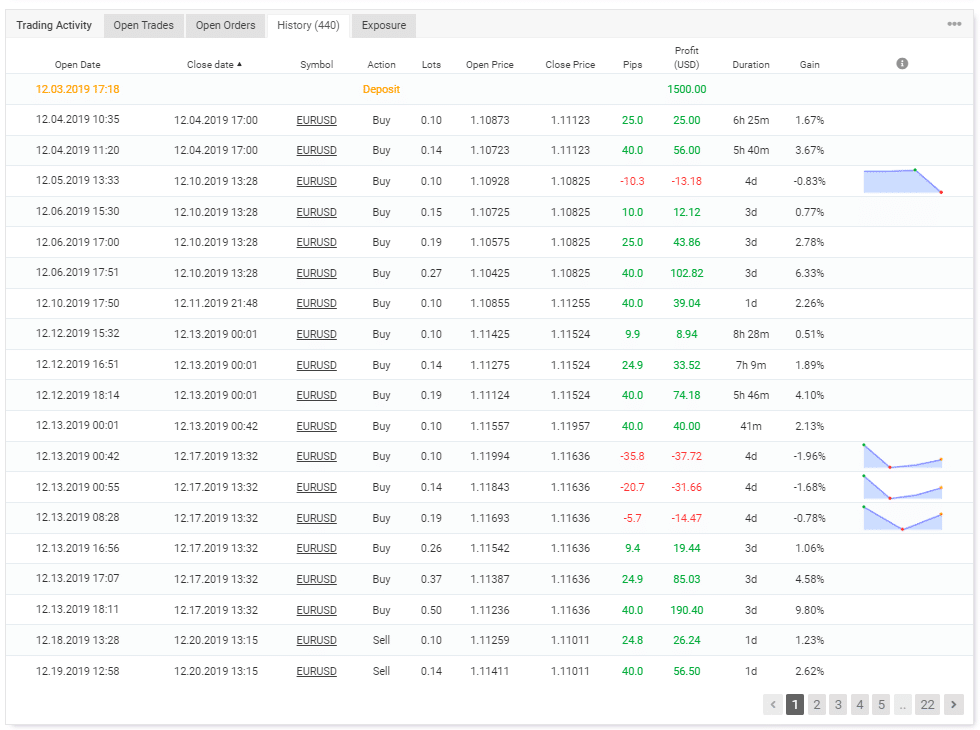

The developer states the robot uses a trend trading methodology. It opens trades in the direction of the momentum and will keep on doing so during a pullback. In case the trend reverses, it will close out all the positions. On average, the positions are kept open for 1-2 days. From the trading history on Myfxbook, we can see that in addition to the grid, it also employs martingale strategies that the developer does not disclose. The average holding duration is two days.

Price

FXRapidEA DUE can be bought for $269 that comes with a lifetime license for an account. Traders can also buy the QUATTRO for $349.

Trading results

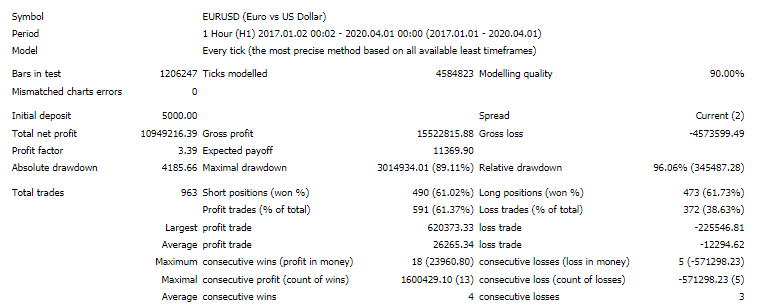

Backtesting results are available for multiple currecies. For EURUSD 100% risk the relative drawdown was around 96.46%. The winning rate was 61.37%, with a profit factor of about 3.39. The robot tanked an average profit of $10949216.39 during this period. There were 963 trades in total. The best trade was $620373.33, while the worst one was -$225546.81.

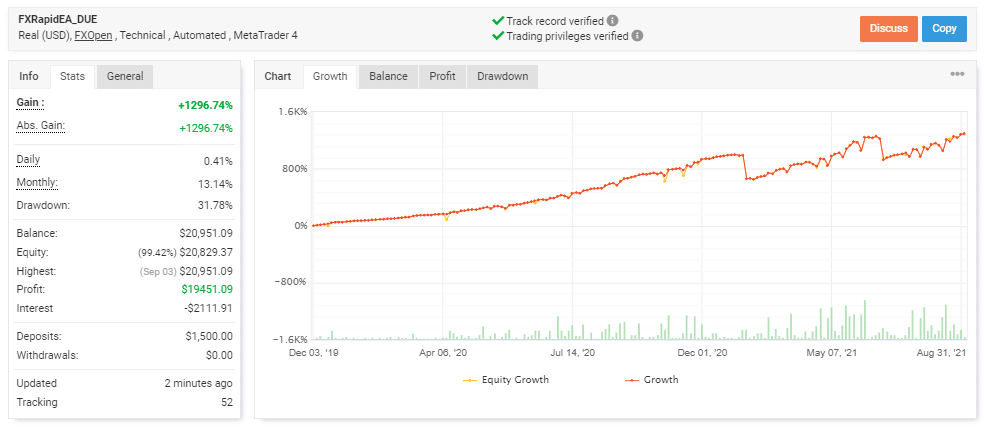

Verified trading records on Myfxbook show performance from December 03, 2019, till the current date. The system made an average monthly gain of 13.14%, with a drawdown of 31.78%. A few drops in the balance curve contribute to a nearly 50% loss in the account value. The winning rate stood at 60%, with a profit factor of 1.68. The best trade was 40 pips, while the worst was -343.8 pips. There were a total of 439 trades, with 221.29 lots traded. The robot made a total gain of 1296.74% on the account. The starting capital was $1500.

High drawdown

The current drawdown for the algorithm is pretty high, showing that the algorithm losses nearly half of the capital. This can further extend to a margin call if the market trends heavily in one direction. The grid and martingale strategy can easily liquidate the portfolio.

Vendor transparency

The company is not transparent in its portfolio. We do not know how much of trading experience the developer has. They do not share any contact information, and the only way to contact them is through a form on the website.