Have you been wondering about which the better forex prop firm is, FTMO and the 5%ers? This review details an excellent comparison over the features, strengths, and weaknesses of each, and ultimately which type of traders would be suited for either based on these findings.

FTMO and The 5%ers, both established during similar times (2015 for FTMO and 2016 for The 5%ers), are two of the most well-known forex prop firms or funding programs currently. The FTMO head office is in the Czech Republic, while that of The 5%ers is in Israel.

This article will broadly cover the cost, account, and trading conditions comparison, drawdown, and profit targets, and a brief conclusion about specific aspects that each firm excels in over the other.

Costs comparison

As both funding programs require a fee, it’s only natural to observe the costs.

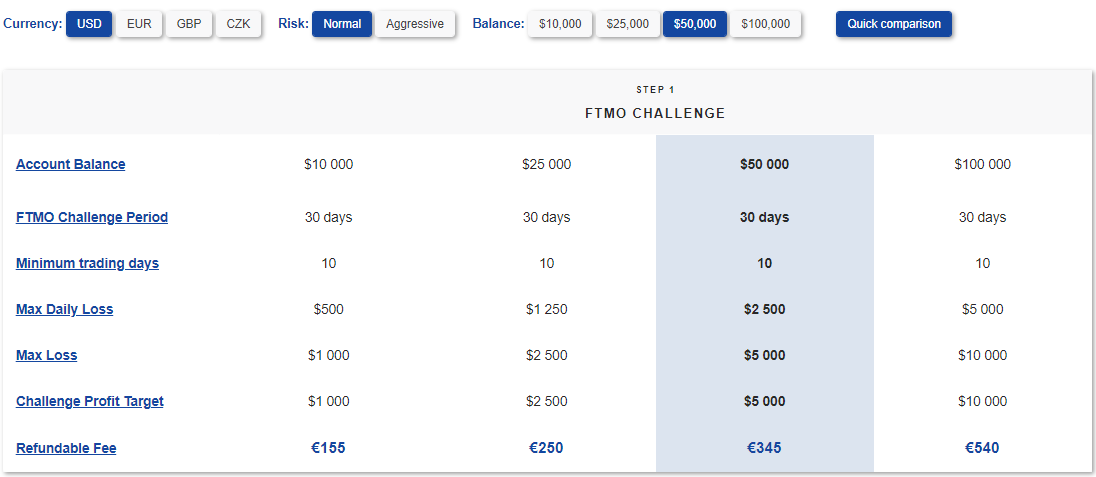

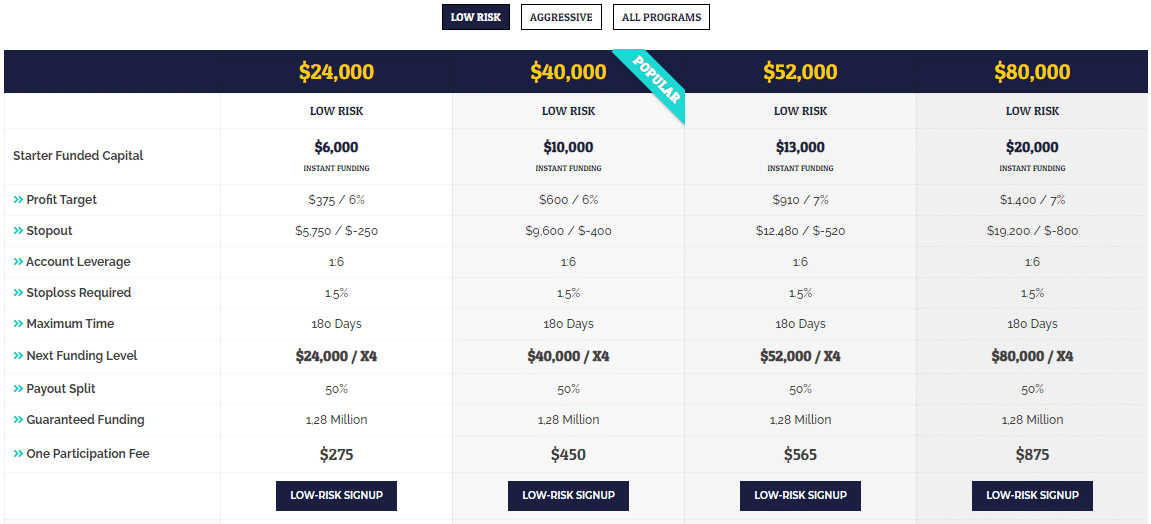

The 5%ers’ lowest funded account is $24,000, while the second-lowest for FTMO is $25,000. The fee for both is $275 and roughly $303, respectively (converting €250 with the current EUR/USD exchange rate). So from a cost perspective, we can see that for more or less the same account size (give or take away $1,000), The 5%ers are slightly cheaper.

However, there is another consideration to factor in, and that is the drawdown. The drawdown isn’t just for risk management, but it reflects the actual amount a trader has to trade. So even if the account is larger, there is only a small maximum portion that should be at risk, which is what traders need to divide their positions with.

Drawdown percentages

The 5%ers drawdown is 4%, significantly lower than FTMO’s 10%. With their lowest-funded account of $24,000, the actual capital traders can use is $960. On the other hand, with a 10% drawdown on a $25,000 account, the resulting figure is $2,500, significantly more than $960.

Therefore, on a like-for-like basis, while FTMO is slightly pricier, their drawdown limit is a little more flexible, allowing traders to use much more capital than with The 5%ers.

Are the fees refundable?

Generally, both firms do not offer refunds for any traders who haven’t met all their trading objectives, except for one exception. For each company, if a trader’s equity is net positive after the trading duration, they claim to provide a new account free of charge.

FTMO states they refund the fees only after the first profit split when a trader is officially trading their live account. While The 5%ers do not explicitly state the same refund type, any profits made during the evaluation stage will be 50-50, and these may or may not exceed the participation fee.

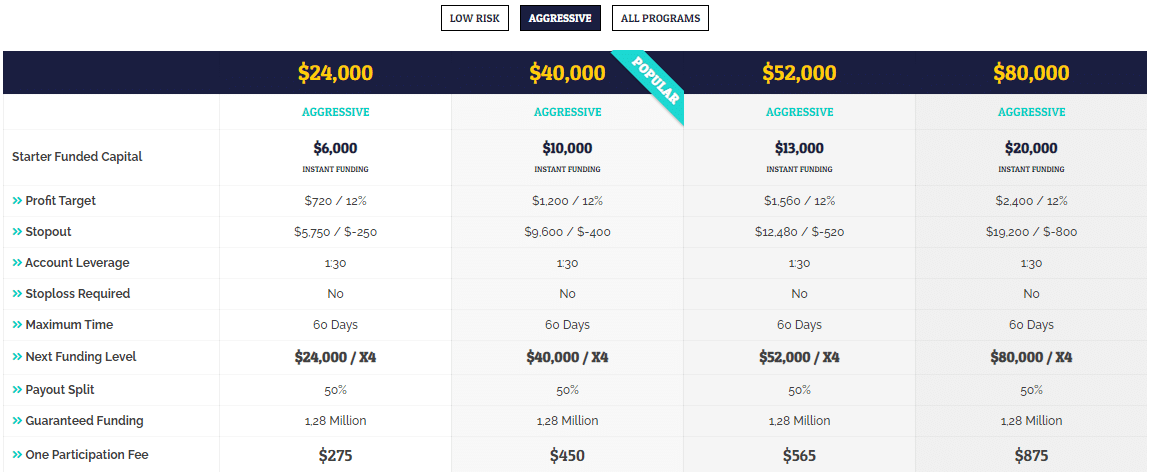

Differences between the normal and aggressive packages

Interestingly, both firms offer normal and aggressive packages. The aggressive accounts have more lenient objectives, although the targets are larger. The advantage with The 5%ers is there is no extra cost in choosing this option.

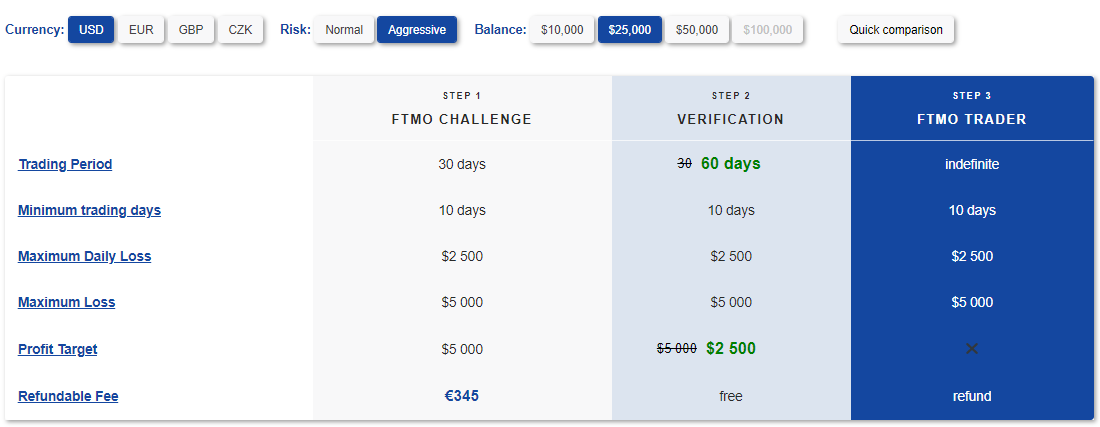

However, despite a bigger drawdown and profit target percentages (20% each), with FTMO, one would pay significantly more on a $25,000 account (€345, which equates to around $420 instead of $300 factoring in the current EUR/USD exchange rate).

Trading conditions comparison

For a better measurement, traders should also analyze the trading conditions that each company enforces in their programs.

- Program structure: The 5%ers program is more straightforward as it effectively involves only one stage. FTMO has two main phases, and while they aren’t complex, traders need to be aware of the different objectives for each.

- Profit target: We should consider the profit target during the qualification stage and not the official one after passing as there is more free reign here. The normal package of The 5%ers has a 6% profit target, while on the aggressive option, it’s 12%. With FTMO, the profit targets on their normal and aggressive packages are 10% and 20%, respectively.

- Time completion: The challenge period is an important metric when weighing up both firms and is an area where we can see a clear distinction. In the first phase of the FTMO’s funding program, the maximum challenge period is 30 days, which is not ample time for the vast majority to complete their objectives.

In contrast, the normal and aggressive packages for The 5%ers have a maximum trading period of 180 and 60 days, respectively, a much fairer and flexible timespan than its counterpart.

FTMO clearly favors intraday traders who trade more frequently, while The 5%ers favor them as well as those trading long-term, who naturally take a slower approach.

- Holding positions overnight and over the weekend; trading news events: The 5%ers’ program allows for having trades overnight and over the weekend and news trading without any restrictions.

While the FTMO imposes no limitations on overnight and over-the-weekend orders, they state to restrict this on the actual live account, which is, again, detrimental for long-term traders who often hold their positions for long periods. Furthermore, there are boundaries on how one can trade the news.

- Platforms and number of offered instruments: FTMO are the clear winner with their impressive choice as they offer MT4, MT5, and cTrader as their trading platforms, along with a mixture of forex, stocks, indices, commodity, and cryptocurrency instruments. Unfortunately, The 5%ers only provide the MT4 platform with 28 currency pairs.

- Profit split: The 5%ers offer a 50% profit split. Again, the FTMO is the better option as the profit share for traders is 70%.

Conclusion: which firm wins?

This head-to-head assessment highlights many similarities between FTMO and The 5%ers. Before listing general summaries, perhaps the most crucial distinction between the two is that FTMO’s objectives undoubtedly favor intraday traders (short time completion, not allowing positions overnight or weekend on official live accounts).

Meanwhile, The 5%ers suit both intraday and swing trading as it has a longer time limit and no restrictions at any time on news trading and holding positions overnight and the weekend. Thus, The 5%ers does have the upper hand here but does fall short in a few areas against its competitor.

- On the ‘Normal’ option, purely on a cost basis, The 5%ers are slightly cheaper than FTMO. The 5%ers also have the same prices on their aggressive option, while it is more expensive with the latter.

- Even though FTMO is only slightly pricier than The 5%ers, it has a much more flexible drawdown (10% for the normal and 20% for the aggressive packages).

- FTMO has a better profit split (70-30) than The 5%ers’ 50-50.

- The profit targets for two of The 5%ers’ packages are 6% and 12%. With FTMO, the figures are 10% and 20%, meaning that The 5%ers are the winners here as the percentages are lower.

- The time completion for The 5%ers evaluation is either 60 or 180 days, a far cry from FTMO’s 30 days on their initial stage. Again, The 5%ers are more flexible and cater to more traders.

- FTMO has the upper hand in the markets and platforms they offer instead of just 28 forex pairs on MT4 like The 5%ers.

1 comment

I don’t fully agree with this review. While facts were simply stated, I don’t believe you can easily give the5ers the upper-hand when talking about profit targets. Yes, as of now its a 7% profit target to FTMO’s 10% PT. But, the drawdown is more severe given a 4% SL for the5ers while FTMO is at 10%. It would take more trades to win to gain the 7% than 10% if risking a safe % of account.

I do agree that these are the 2 best pro firms and I’m currently having a hard time deciding between which to start. I truly don’t believe there’s a wrong answer, but I’d love to hit the ground running hard. It’s either do the5ers and grind through the small lot sizes to try and gain that 7% and be making money right away. Or I can go with FTMO and not be as restricted and probably fly through the challenges way quicker given a looser drawdown. Looking at the endgame, the5ers takes the cake for me even with a 50/50 profit split compared to FTMO’s 70/30. You can reach up to a 1.28mil dollar account and your own pace if you can constantly reach the 10% goal to double your account. FTMO has the option of maxing out to 200,000 but that’s after 16 months (every 4 months with FTMO if you gain 10% accumulative they will raise your account 25%).

I may be talking to myself, but I just wanted to fill people in if they had a similar case like me who doesn’t know what to choose. I think I’ll still go with the5ers though and try to grind that 7%, but FTMO just seems too easy to pass up.