Climbing Scalper is compatible with all currency pairs, including EURUSD, AUDUSD, EURCAD, GBPUSD, USDCAD, etc. According to the developers, the algorithm employs many sophisticated approaches to determine the most precise entry and exit locations, resulting in a high win rate. It also comes with a spread filter and slippage to avoid opening trades on the market that are overly unpredictable. To provide our readers with further information, we shall discuss the EA’s benefits, drawbacks, and customer feedback.

Climbing Scalper: to trust or not to trust?

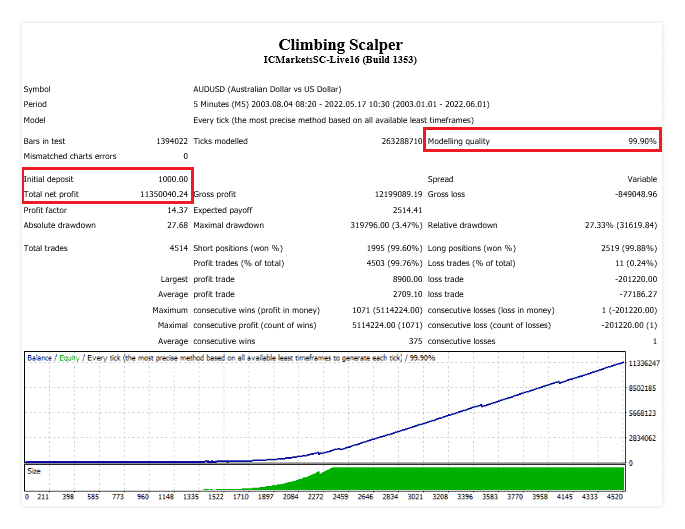

Backtesting is available in an image form which raises questions about its trustworthiness. There is no evidence of live results, making it hard for treaders to verify the robot’s live performance and drawdown. The author’s attitude is unsatisfactory as per user reviews, raising concerns about the robot’s performance.

Features

Following are the features of the expert advisor:

- It uses SL on every execution

- The algorithm trades on the MT 4/5 platform

- It is compatible with multiple symbols

- Spread and slippage filters are available

- Both renting and purchasing options are present

The developer states that the robot trades during quiet market periods at night. It does not use grid or martingale strategies and has a fixed stop loss/take profit for each trade. Unfortunately, there are no live records that could help us analyze its methodology for ourselves.

How it works

Traders can drag the EA to their charts in the MT 4 platform by placing the ex4 file into the expert’s folder. The system uses coded information to enter and exit trades.

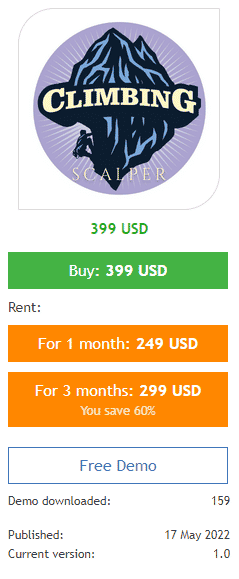

Pricing and refund

The algorithm is available on the MQL5 marketplace for sale. The single purchase costs $399 plus tax and is now discounted. Traders can rent it for $249 for one month, whereas the 90 days validity costs $299. The bot comes with a free demo.

There is no information concerning the product’s refund policy on the website.

Trading results

The bot comes with dissatisfactory backtesting results in picture format. According to the images, the system traded on the AUDUSD symbol at the M5 timeframe. The trading period began in August 2003 and was completed in May 2022. In that period, the software yielded a total net profit of $11,350,040.24. The EA had an initial deposit of $1,000 and participated in 4514 trades with a winning rate of 99.76 percent.

We can’t track the current win rate or drawdown because the algorithm doesn’t come with live data. We searched many performance tracking websites, including Myfxbook and FXStat, but could not locate any recent statistics.

Low drawdown

As there are no live records available for the bot, we will review the drawdown of its backtest results. The history shows the account had an absolute drawdown of 26.78%, indicating that the EA can lose a quarter of its balance while trading.

Vendor transparency

Liudmyla Bochkarova is the author of Climbing Scalper and other forex robots like Gold Plus, Gold Future, etc. She has a rating of 4.5 based on 11 reviews on the MQL5 website. The vendor’s portfolio is not transparent, as no certificates/real records are provided to substantiate their market experience. There is also no indication of the seller’s presence on social media sites like Facebook, LinkedIn, and others.

Customer reviews

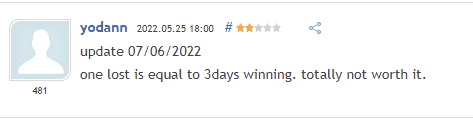

The algorithm has a rating of 4.57 based on eight feedback on the MQL5 website. One of the traders commented that three days of winning equals one day of losing, and the bot is not simply worth it.

Another user states that the developer replies fast and provides good communication.