The forex market is home to a multitude of currencies. However, activities in the $6 trillion revolve around a small group of pairs dubbed the majors. The majors are mostly made up of legal tenders of countries with a big influence on the global scene given their economies’ size. The US dollar and sterling stand out for good reasons.

History

The British pound holds the title of the oldest legal tender. However, it only became the official coinage in 1707. In addition to being the UK’s official legal tender, several territories still use it. Similarly, it is the official tender of some British territories.

While the pound is one of the fiats cherished by people in the $6 trillion marketplaces, it is a no match to some majors. It still trails the US dollar, the euro, and the Japanese fiat for daily turnover. The most traded pair involving the pound is the cable.

On the other hand, the dollar came into being in 1785 when there was lots of confusion regarding the medium of exchange. Its introduction helped avert reliance and use of other unreliable coins that were prone to manipulation.

At first, the greenback existed purely in coins before the banknote’s introduction in 1861. Its value at the start was pegged on the relative prices of crucial industrial metals such as gold and copper. Backed by the world’s biggest economy, it has shrugged the metals peg and risen to become the most used and preferred currency on the international scene.

Likewise, it is a popular Fiat, accounting for about 88% of the total daily trading volume in the $6 trillion markets. It accrues its edge on never being devalued or hyper-inflated, as is the case with others. Besides, it stands out as it is not prone to manipulation by the government, as is the case with some.

True value

The actual pound and dollar value fluctuate freely in response to supply and demand forces. However, for two decades, the greenback has been a no match to the sterling on the valuation front. Even though the UK’s currency has depreciated from 1.70 against the buck, as of 2010, it still commands a hefty valuation of about 1.37 against its peer.

More dollars in circulation is one reason it has continued to lag the sterling on the valuation front. Also, the UK boasts of one of the lowest inflation levels, which essentially makes its purchasing power much stronger.

However, the pound has continued to weaken in recent years amid a persistent UK economic slowdown. The UK economy has been under immense pressure amid trade uncertainty triggered by its decision to pull out of an important trading block.

Currency value vs. economic strength

It is important to note that whenever a currency is stronger than another, it necessarily does not signal economic strength. Currency strength comes down to several things. For instance, the yen has often been considered one of the strongest fiats despite lagging most majors.

Therefore, the UK economy cannot be said to match the US’s economy on the simple argument of the strength of its legal tender. The relative strength of any currency comes down to some things. Therefore, the best way to judge a fiat’s relative strength against another is to consider how it has performed over the years.

While the sterling has always been valuable, it no longer accrues the edge it did in yesteryears. Supply, demand, inflation deficiencies, and other economic factors have continued to weigh heavily on it. Ultimately it has depreciated significantly hurt in recent years by the Brexit debacle.

Brexit debacle

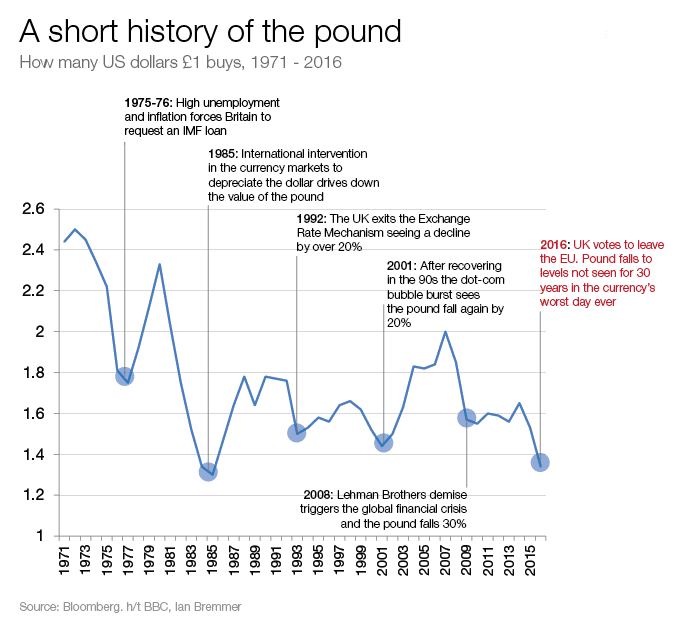

UK citizens voting to exit the European Union in 2016 rattled the market and the pound’s value. It lost as much as 8% against the buck on a single day. It has since struggled to bounce back, trading below the 1.40 level against its peers.

While the GBP/USD rate was at highs of 1.70 as of 2010, it touched record lows of 1.20 in the aftermath of Brexit as investors continued to shun the sterling. Even though the pound remains stronger than the greenback on the exchange rate front, investors continue to shun it amid fears of continued depreciation.

The Kingdom leaving the EU is not the only event that has rattled the pound’s strength. It was worth five times the buck in the early 1900s at the British Empire’s peak. The breakup of the empire in the aftermath of World War I and World War II took a significant toll on the legal tender.

In addition, it has continued to depreciate on traders selling it in response to the UK economy slowdown. For the better part of the 20th century, it depreciated significantly as the US emerged as an economic and political superpower.

Yen resurgence

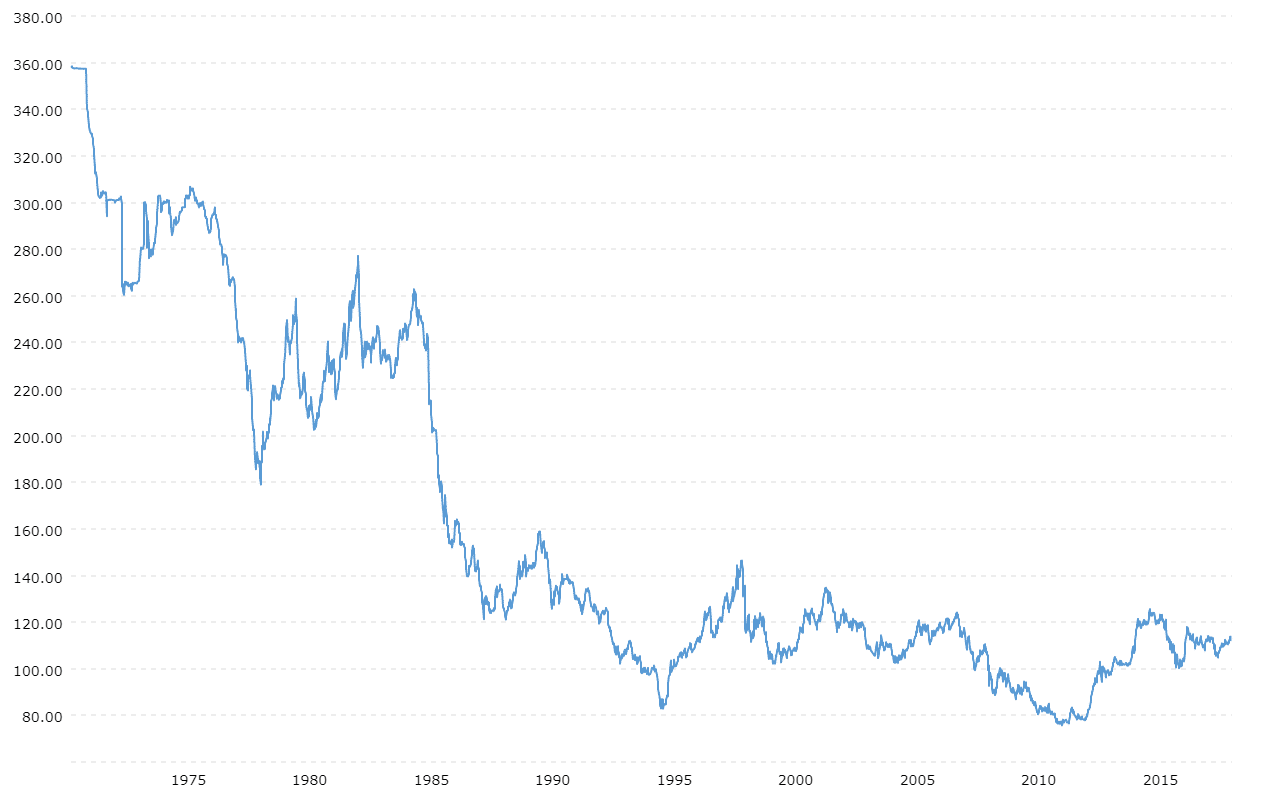

While the UK’s currency has depreciated significantly, the yen has continued to appreciate. In the 1970s, one US dollar was worth 300 yen. The value has since dropped by a third to current levels.

In the recent past, USD’s weakness against its peer has been significantly influenced by the ever-rising trade deficit with Japan. While the US dollar is still worth more, the Japanese currency is still a force to reckon with, given the trade deficits at play.

Exchange rate manipulation

While currency value fluctuates in response to supply and demand forces, national governments can also influence the floating value. For instance, the Chinese government maintains tight control over the yuan rate against the dollar. It constantly adjusts it to ensure its exports remain competitive and affordable. Creation of new currencies to try and adjust inflation levels often results in prices resetting.

Bottom line

The pound and the dollar are the old guards of the $6 trillion currency market. While the two attract substantial interest, the buck remains the most popular given the trading volumes it commands. However, the sterling is the most valuable of the two given its low and much lower UK inflation.