The concept of the metaverse is one that was coined by a science fiction novelist named Neal Stephenson in 1992. He dreamed up a virtual world where humans could interact with each other using avatars in a 3D clone of the real world. Many years later, the biggest social media giant, Facebook, changed its name to Meta to show its commitment to the metaverse movement. Nowadays, it seems like everyone and their mother are talking about this virtual world. Several other tech giants are also showing their commitment to this move. But what exactly does this metaverse entail?

About the metaverse

In essence, the metaverse is a digital iteration of the world as we know it. It is a virtual space where users can work or play using avatars that represent them. Each member has a unique avatar created using facial recognition. This digital representation can then explore sci-fi worlds within this space or more practical realities like shopping centers, malls, concerts, and even homes. For instance, rapper Snoop Dogg recently made headlines when he built a mansion in the Sandbox Metaverse.

To access this virtual reality, you’ll need a computer, hand-held device, or VR equipment. Once you’re in it, you can enjoy the multiple games and other content on offer. You can also purchase or rent virtual land plots and build your own games, businesses or host your content and charge others to experience it. What’s more, unlike in traditional gaming, where any income you generated was practically worthless outside the game, any tokens you earn in the metaverse have a real-world monetary value. This economy is powered by decentralized finance (DeFi), and the modes of exchange used are crypto and non-fungible tokens.

How to trade metaverse tokens

We’ve established that metaverse tokens are digital currencies that are used to facilitate transactions within this digital world. In total, the number is in the hundreds, if not thousands. Some of the top coins include SAND of the Sandbox metaverse, MANA of Decentraland, and ENJ of the Enjin ecosystem. Let’s look at viable strategies for trading these coins.

Short term trading strategies

Since the metaverse is still in its nascent stages, most of its tokens have not accumulated much value yet. Much like any other penny crypto or penny stock, they are often characterized by high volatility levels. This makes them suitable for short-term trading techniques such as scalping and day trading.

A suitable strategy to day-trade such coins would involve a combination of the MACD and EMA indicators. The former we’ll use with default settings, while for the EMA, we’ll utilize 20 periods. The MACD will be providing our entry signals while the EMA gives signal confirmation. The ideal timeframe is the 15-minute chart.

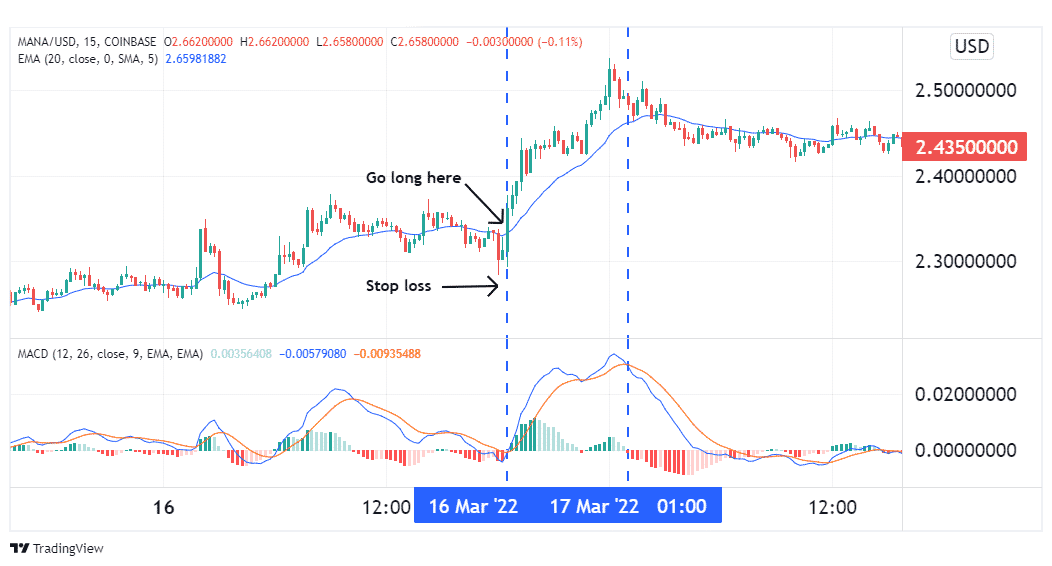

A bullish scenario will be marked by the MACD manifesting a bullish crossover and its histogram venturing into the positive region. As confirmation, prices must be trending above the 20-period EMA line. This is demonstrated in the chart below.

From the image above, the entry signal was marked by the blue MACD line crossing over the red signal line – a bullish cross. Prices also broke above the 20 EMA, confirming our buy signal. A suitable stop loss should be placed just below the most recent swing low. The profit target can be determined by a suitable risk to reward ratio, or one could wait for the bearish MACD crossover to manifest. The latter occurred on 17th March.

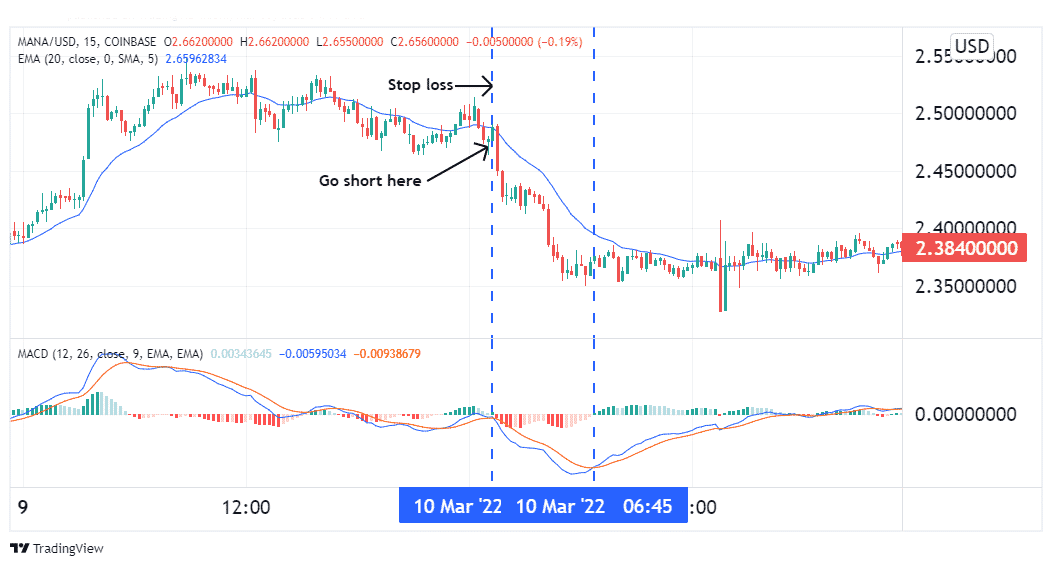

For short trades, the signal to look out for is a bearish MACD crossover. For confirmation, prices should break past the 20 EMA to trade below it. A suitable stop loss should be placed just above the most recent swing high. Take profit level can be determined by a risk to reward ratio of 1:3, or you could wait till a bullish MACD crossover manifests. This strategy is displayed in the illustration above.

Long term trading strategies

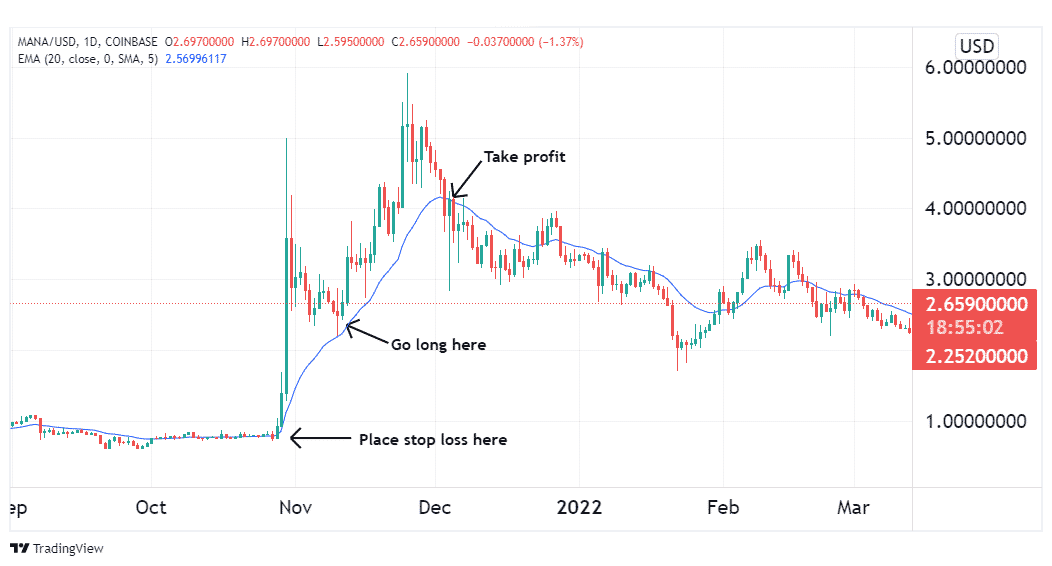

In crypto, most of the profit is made by holding on to tokens for long periods of time, sometimes spanning years. This is colloquially referred to as “hodling” in crypto circles. In the same fashion, one can make substantial profits by holding on to metaverse tokens. To trade this setup, we’ll utilize the 50 EMA indicator, which should indicate the prevailing market trend. The ideal timeframe for this strategy is the daily chart.

For a bullish setup, prices should be trading above the 50 EMA. Owing to the high volatility of these coins we mentioned earlier, pullbacks are bound to happen. Therefore, once we identify the trend, we shall wait for a retracement to retest the EMA line turned support. Once it bounces back from this line, that will provide our entry. A stop loss should be placed below the prior swing low. The profit target can be set at a 1:3 risk to reward ratio, or we could wait until prices break below the EMA line.

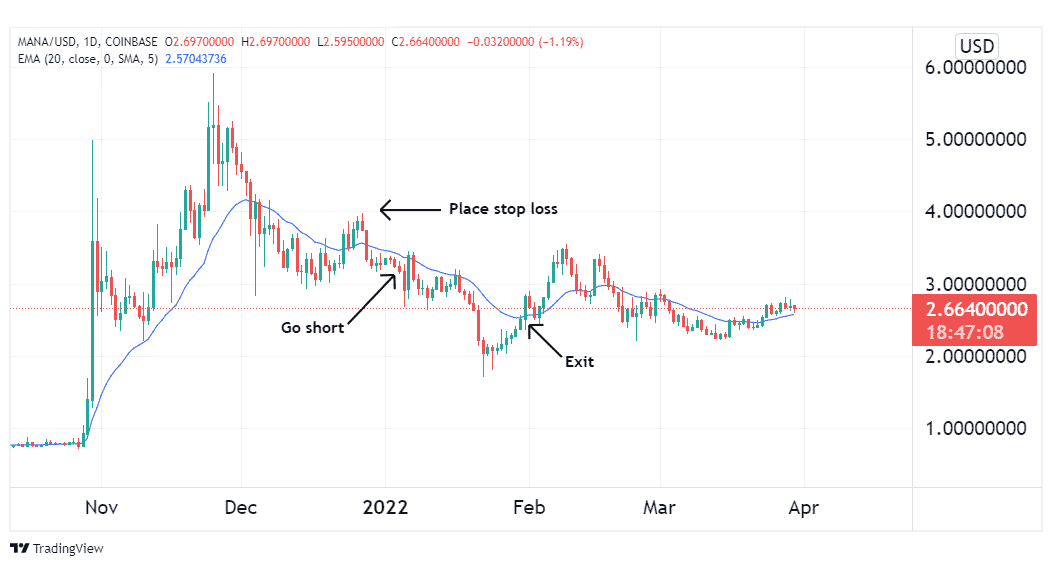

For a bearish setup, we shall be looking for the converse. Prices should break past the EMA line to trade below it. The entry signal will be marked by a price pullback retesting this line, which acts as resistance. Once the pullback bounces back, place a short trade and set your stop loss at the prior swing high. Just like for the bullish setup, the profit target should ideally be calculated using a 1:3 risk to reward ratio.

Alternatively, you could wait for prices to break past resistance and close your trade. This is demonstrated in the image above.

Conclusion

The metaverse is a digital 3D world with its own ecosystem and a functional economy. To facilitate transactions in this virtual space, two tokens are used – cryptocurrencies and NFTs. With several big tech firms foraying into this space, these tokens are well set up to post impressive rallies in the near future.