The legendary investment advisor, John Train, once said, “For the investor who knows what he is doing, volatility creates opportunity.”

Ultimately, as traders, we’re interested in how much prices fluctuate over a given period. As a technical concept, the best way of measuring the depth of these movements is by using a volatility indicator; this is where the Average Daily Range (ADR) comes into play.

This tool is identical to the Average True Range, bar modified settings on different trading platforms. Although the ADR isn’t meant to produce signals like most indicators, its significance in technical analysis cannot be overlooked.

What is the Average Daily Range?

The ADR is a volatility indicator measuring how many pips on average a pair has moved over a predetermined period from the high to the low.

While the tool’s name suggests it’s only for the daily movements, the indicator works across all time frames and reflects different readings on each based over however many specified days.

For instance, if you viewed the ADR at 30 days on the 4HR time frame with a reading of 50, it means that the pair has moved 50 pips on average over the last four hours. The final result would account for the pip range of the highs and lows of each candle on that time frame over the last 30 days.

Visually, the ADR usually looks like an oscillator with a moving average based on the preset period (as in the previous image). So, you may be wondering what’s the importance of understanding pip ranges as a forex trader. It all boils down to appreciating volatility.

The significance of volatility

Volatility in currencies refers to how much a pair has moved over a particular period in pips. As expected, every market in forex is quite distinct in volatility. Major or USD-based pairs generally have mid-range volatility, while minor or cross pairs, along with exotic markets, can cover a much greater distance over a shorter span.

All too often, traders employ a blanket approach and treat every market the same when, in reality, each pair is distinct in how fast or slow it moves. For instance, you generally wouldn’t fare well using tighter stops on GBP-based markets like GBPUSD and GBPCAD since these instruments are some of the most volatile.

As a result, you should expect the price to cover far more pips quickly than if you were trading a pair like EURCHF, which is inherently less volatile. Similarly, a trader cannot expect a 200 pip move on EURUSD within a day when this market has historically taken weeks to reach this range.

As we can see, understanding the ADR is quite helpful in setting appropriate stop loss and take profit levels. Another interesting method is how traders can use this indicator to forecast the strength of a support or resistance zone.

Let’s explore more of these concepts in the next section.

The three main ways forex traders can benefit from the ADR

Let’s cover the three benefits you can derive from using this indicator.

1. Appropriately setting your stops

One challenge many traders face, especially beginners, is setting their stop losses too tightly, resulting in losing positions and sometimes missed profiting opportunities. Conversely, it’s also a problem when your stops are too wide, meaning your potential reward is reduced considerably.

Ultimately, traders need to appreciate the dynamic changes to market volatility. This is where the ADR helps one find a balance and enforce strategic, maths-based decisions on setting stops.

So, the first step is applying the ADR to the time frame from which you’ve identified a trading opportunity. For instance, if you’re trading on the daily chart with EURUSD and the ADR is 60 pips, this means you’ll want your stop loss to be at least this wide.

If you made your stop tighter, you’d likely be kicked out of the position. Traders can even use this indicator to decide the worthwhileness of a position based on the depth of volatility.

For example, if you’re historically used to trading with a 50 pip stop on a particular pair and the reading is noticeably higher, that trade might not be worth taking as a larger stop means reduced profits.

Therefore, it might mean passing up on the opportunity until the volatility comes back to normal and looking for new setups on that pair.

2. Projecting profit targets

Firstly, a trader would need to define how many pips they’re aiming for in a position, whether they use a set profit-taking level or use discretion by taking profits from a support/resistance level, based on time, etc.

Going back to the previous EURUSD example, let’s assume the trader aimed for 150 pips as profit. If the current ADR on the time frame reference showed a reading of 200 pips, this would suggest the pair is likely to move above the projected 150, increasing the profit potential.

Conversely, if a trader’s profit potential is marginally higher than the ADR based on the time frame reference, it can help one to observe a more realistic area to take profits.

3. Assessing potential support/resistance zones

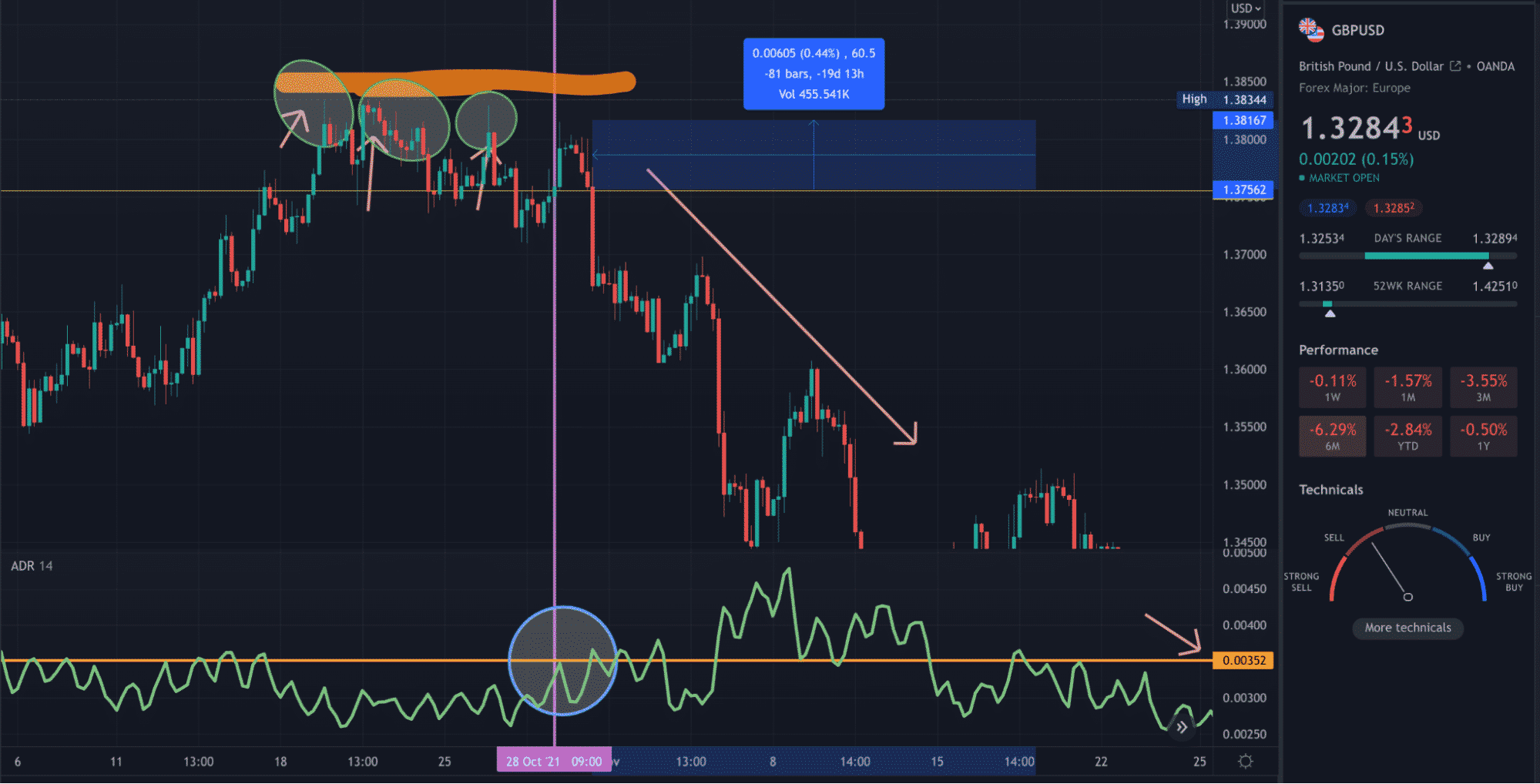

The idea is if a pair reaches or exceeds its range when near a support or resistance level, that area is likely to hold since the market would theoretically have no further to go. Let’s illustrate this example on the GBPUSD 4HR chart below.

We can see a resistance area (marked in orange highlighted) formed from 19/10/2021 with multiple touches over about a week. On the fourth occasion (the thick purple vertical line), the ADR reading was 35 pips.

The candle after the purple line moved 60.5 pips, noticeably higher than the previous range. This may have suggested the market had lost steam to the upside based on how many times it tested the level and exceeded the range. Consequently, prices began trending aggressively lower over the next few weeks.

Final word

Volatility in forex is appreciating the ebb and flow of price. When the markets move more fluidly, this presents opportunities for bigger profits due to extended price distances.

When things are quieter, we can expect slow, often sideways movements with no real oomph behind them. However, a new significant move may be on the horizon at these times. Moreover, understanding volatility matters greatly in reasonable setting stops and take profit levels, a big part of money management.