USDCHF is one of the most traded currency pairs globally and is also known as the ‘dollar swissy’ or the ‘Swissie.’ Switzerland has the 18th largest economy globally in terms of GDP, and it is ranked 2nd in terms of GDP per capita making it one of the most prosperous countries in the world.

It has also consistently remained in top ranks in the Global Innovation Index and Global Competitiveness Report. So, despite being landlocked and relatively small in size, Switzerland punches far above its weight in economic terms.

This makes its currency, the Swiss franc (CHF), also one of the most powerful currencies in the world. The average trading volume for USDCHF is estimated to be around $400 billion per day. In terms of timing, USDCHF sees high volumes during the Frankfurt and New York market hours.

After the US market close, the volume sees a sharp drop. So, if one wants good price discovery or wants to execute a large trade, they should ideally be done before the US market closes. USDCHF is quoted as the number of Swiss francs offered for 1 US dollar.

Interest rate and central bank dynamics

Coming to the price dynamics, as is the case with most developed market currency pairs, the interest rate differential between the two countries plays a major role in how the currency trades. So, it becomes important to track the actions of the central banks of both the US and Switzerland in order to predict the price movements in USDCHF.

The central bank of Switzerland is known as the Swiss National Bank (SNB). The SNB meets less frequently relative to the rest of the central banks of the developed economies. It conducts a thorough monetary assessment every quarter in March, June, September, and December. The results of these assessments are published in the same months. These results are accompanied by an inflation forecast for the medium term and a monetary policy decision on the rates.

Additionally, in June and December, the bank also holds a press conference in order to list out the reasons for the decisions taken thus far. It also includes a speech from the SNB chairman, Thomas Jordan presently. The key point here being if the SNB decides to increase the interest rate, Swiss investments become more attractive to the investors.

As a result, more capital flows happen into the currency leading to the strengthening of CHF against the USD. So, USDCHF will see a move lower should SNB give any indication of increasing rates against market expectations.

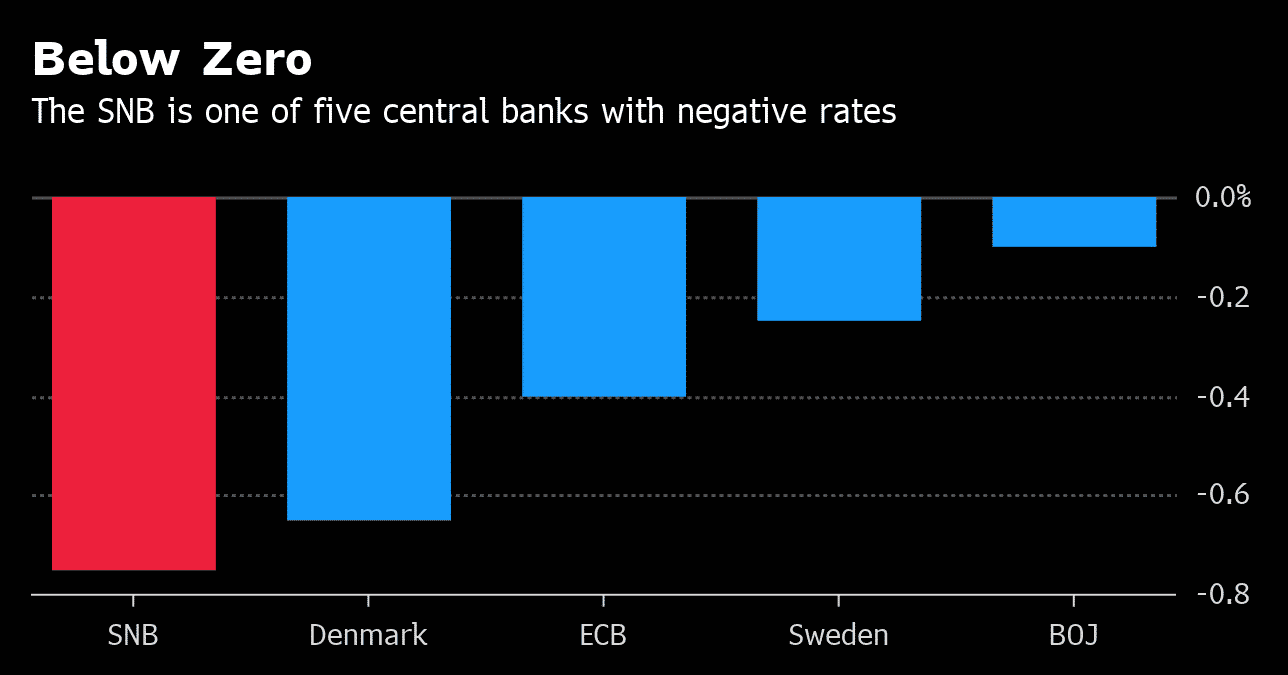

Before the pandemic, SNB was the most aggressive amongst the European central banks to cut rates and delve into the negative territory. As can be seen below, it has the lowest benchmark rate even in the negative interest rate regime.

When we look at the USD, there are two major drivers – the Federal Reserve, which is the monetary authority of the US, and the Federal Government. The Federal Reserve, through its fortnightly meetings, impacts the USD more frequently. It decides on the money supply and the interest rates for the US dollar.

The higher the money supply, the weaker the US dollar, and, similarly, the lower the interest rates, the weaker the US dollar. The present chairman of the Federal Reserve is Jerome Powell.

When the Federal Open Market Committee (FOMC) meets every six weeks, traders watch this event very closely. While the FOMC seldom changes rates or money supply, it does provide guidance for its future actions, which keeps on changing in nearly every meeting.

So, there is significant volatility in USDCHF around FOMC meetings. The calendar for these meetings is available on the Federal Reserve website. Every trader must keep track of these since any unexpected change in interest rates or liquidity could impact USDCHF.

Just like in the case of CHF, higher interest rates or lower liquidity in the US will result in more flows into the US dollar. This will lead to the USD strengthening against the CHF so that the USDCHF price would move higher.

Global risk sentiment

Despite CHF being a strong global currency, it is still seen as relatively riskier as compared to the US dollar.

The USD is globally recognized as the reserve currency, and hence it has a safe-haven status. In case of risk-off events, investors would sell whatever currency they are holding and flock to the USD. This was observed during both the 2008 financial crisis as well as the recent Covid-19 pandemic. During each of these events, CHF saw a sharp depreciation versus the USD.

This can be expected to materialize in future risk-off events as well. Hence, it is important to assess global risk sentiment as well in order to understand the movements in USDCHF.

USDCHF price movement history

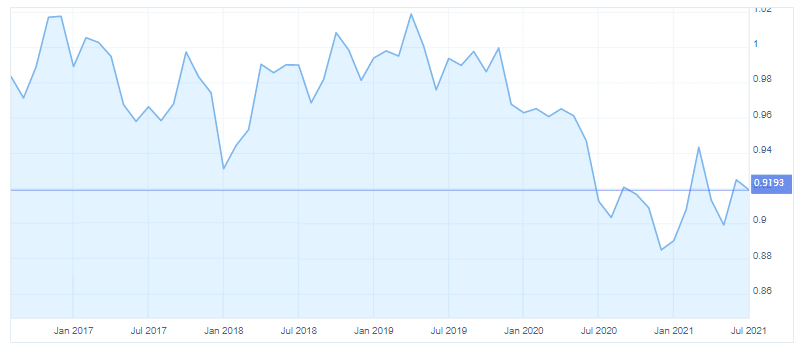

Over the past few years, USDCHF had traded in a 15 cent range. The 1.02 level served as a strong resistance for the currency pair as it failed to breach this level on multiple occasions. On the other hand, before the Covid-19 pandemic, the 0.96 level was a reliable support level. On breaching this support, USDCHF had briefly touched the 0.93 level but subsequently saw a swift recovery.

From the onset of the pandemic, the currency pair saw a rapid breakdown and went below the 0.89 level for the first time in nearly a decade. The price has seen some recovery since then and touched a YTD high of 0.943 in March, which was short-lived, as the price retreated quickly from there.

Conclusion

Overall, USDCHF is a rather stable currency. This is mainly due to Switzerland already having extremely low interest rates leaving little scope for a surprise. Although, as seen above, it has the potential for sudden sharp moves. So, traders actively participating in trading this currency should keep a constant track of global events, as well as the actions of the central banks.