Top Scalper is available at the MQL 5 marketplace. The robot scalps the market mainly at the end of the American session. The developer restricts themselves from providing good information about the system. Our article will cover all the aspects of the algorithm and give a verdict if it is profitable or not.

Top Scalper: to trust or not to trust?

The Top Scalper system only comes with backtesting results which are not sufficient to prove its performance. Backtesting does not respect real market liquidity and slippage, which can be crucial to the performance of scalpers. Therefore we can not say that the expert advisor is trustworthy to use.

Features

Top Scalper has the following features:

- Works on ECN brokers with low spreads

- It never waits to hit the stop loss and will close the position beforehand

- Can be set up easily within a few minutes. It has no set file as the best settings come as default

To get the robot up and running, you have to purchase the system at MQL 5 marketplace. After that, head over to the MetaTrader 4 platform and log in to the MQL 5 community. Head over to the experts’ tab and download the algorithm. Place it on EURCAD at the 15-minute chart and enable auto trading to begin.

The developer states the robot works at the end American trading session. It uses a virtual stop loss method which closes positions before it hits the actual exit point. It is essential to set the GMT of the broker within the inputs of the expert. The EA has built-in settings for calculating the position size according to the stop loss and the risk. Traders can also choose to go with the fixed lot size.

Price

The expert advisor can be bought for an asking price of $350. Traders can also rent it for $125 for three months. There is no money-back guarantee as per the rules of the MQL 5 marketplace.

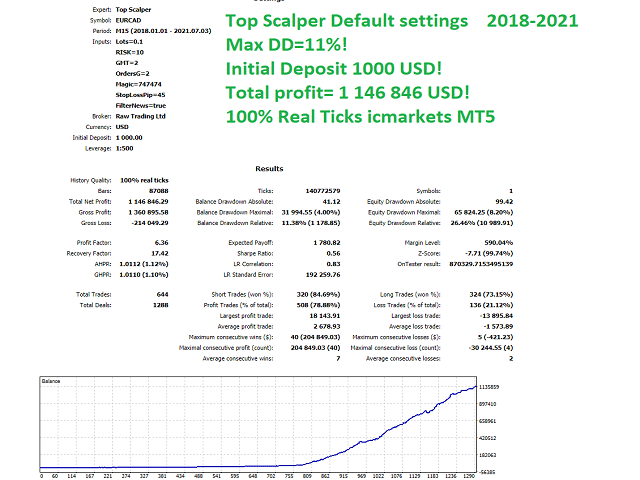

Trading results

The developer only provides backtesting results, and there are no live verified records. Backtesting results are available for EURCAD. The relative drawdown was around 26.46%. The winning rate was 78.88%, with a profit factor of about 6.36. All the tests were done on the 15 minutes chart with a starting balance of $1000. The robot tanked an average profit of $1146846 during this period. There were 644 trades in total, with 1288 deals. The best trade was $18143.91, while the worst one was -$13895.84.

High drawdown

The relative equity drawdown for the pair swas at 26.46%, which is a bit high. This means that the robot can lose more than a quarter of the initial capital during trading. And while these statistics are from the backtesting results, the actual drawdown on a live account will be high due to slippage and liquidity issues.

Vendor transparency

Valerii Gabitov is the author of the product who resided in Russia. He has a total rating of 4.1 for 47 reviews. The developer has nine products published on the MQL 5 marketplace and has a total of 13 subscribers for his services. He has one year of experience in the FX market. The vendor doesn’t provide any other information, such as programming, which raises some concerns over the authenticity of his products.