Japan is the world’s 3rd largest economy and has the world’s 2nd largest forex reserves at $1.3 trillion. The Asian powerhouse was devastated by the end of the Second World War. However, its economy saw rapid growth thanks to the increase in global trade.

Japan made several strides on the technological front. Significant growth in its economy can be attributed to exports which still remain a critical component for the country. Automobiles and robotics are two of the largest sectors for Japanese exports.

Given the degree of impact that exports have on Japan’s economy, the exchange rate becomes the key to ensuring sustained growth. As a net exporter, Japan typically benefits from a weaker currency.

When JPY weakens against the USD, Japanese products become cheaper in nominal terms for a US consumer, and, consequently, its exports also see a boost. This is the reason why the USDJPY rate is very closely tracked by traders across asset classes.

USDJPY – the most important Asian currency pair

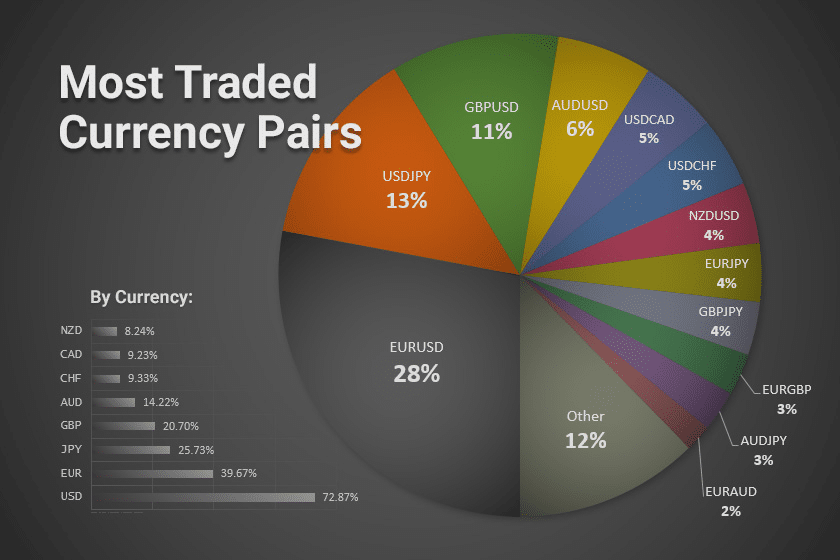

To understand the importance of USDJPY, let us have a quick look at a few statistics. JPY, on a standalone basis, was the 3rd most traded currency in the world, globally, and it accounted for 17% of the transactions globally.

Most traded currency pairs

The USDJPY currency pair is the 2nd most traded currency pair in the world and accounts for 13% of all the FX transactions happening each year. The USDJPY is sometimes also known as ‘Ninja’.

Negative yield – a unique attribute of JPY

Japan was among the world’s first developed nations to witness a long term economic slowdown. This was driven by low birth rates, which led to the country’s demographics being overweighted by the aged population. To counter this, the Japanese government and the Bank of Japan (Japan’s central bank) worked together to lower borrowing rates.

This policy also had its limitations in theory because no one had imagined negative interest rates until a decade ago. But in 2016, Japan sold a negative yield 10-year bond for the first time. This effectively means that the holder of the bond would be guaranteed to lose money at the end of 10 years!

While there was initial scepticism around negative yield bonds, over the years, these investments were well received and were also introduced in other regions like Europe.

However, for an FX trader, this has major implications. Interest rates and sovereign bond yield are major drivers of FX price movements. When the yields of a country go up, it attracts more investor flows, leading to the strengthening of this currency.

So, traders typically set up a trade where they borrow in a low yielding currency and buy the asset of a high yielding currency. To offset any risk for FX volatility, they hedge this trade by shorting the FX contract of that particular currency pair.

By introducing negative rates, Japan’s JPY clearly stood out as the currency with the lowest yield. This made JPY the most popular borrowing currency. As a result, whenever there is a significant difference between yields of two currencies, the USDJPY currency pair sees significant trading volume.

Impact of Bank of Japan’s actions

The BOJ (Bank of Japan) is perhaps the most active central bank in the entire world. It not only actively participates in the bond markets but has a major say in the country’s currencies and equities.

As discussed above, a weak JPY is positive for the Japanese economy and vice-versa. Hence, one of the major goals of the BOJ is to prevent any rapid strengthening of the JPY. Since the USDJPY is defined as the amount of yen to be paid for 1 US dollar, a strengthening of JPY translates to a fall in USDJPY. So, any trader looking to short USDJPY should tread with caution.

There are occasions when the short USDJPY looks attractive from the fundamental perspective or because of global sentiments. Traders tend to take aggressive positions in such cases and continue to add even as the price falls. But as the saying goes, ‘Don’t fight the central bank’.

We saw above that the BOJ sits on top of the world’s 2nd largest forex reserves of nearly $1.3 trillion. This gives it massive firepower to prevent any steep fall in the price. Hence if the price falls rapidly, the BOJ steps in and defends the fall. Traders might get caught in these trades if they are too aggressive or not mindful of BOJ’s actions.

JPY’s puzzling safe haven status

A safe haven asset is one that gains during a time of turmoil or deep market correction, for example, gold. In the FX world, the US dollar is widely regarded as a safe haven currency especially given its reserve currency status. However, quizzically, the Japanese yen has also behaved as a safe haven currency in several of the previous market turmoil.

This means that investors have flocked to the JPY whenever their view was that the markets may fall sharply or if there was increased market uncertainty. While JPY is indeed a safe currency, market participants are puzzled over why investors would flock to JPY over other major currencies such as USD, EUR and GBP.

One explanation is that since JPY is the primary borrowing currency, investors reverse these trades during stressed market conditions. As a result, JPY, which was borrowed, is paid back to unwind these trades resulting in large inflows into JPY. This results in the strengthening of the JPY. Essentially it might not be the safe haven status of JPY but rather the market microstructure that leads to bouts of strengthening in stressed market conditions.

For a USDJPY trader, this translates to a potential short trade should they expect deep market corrections in the near term.