Technological advancement has propelled forex to become the biggest market with more than $5.3 trillion daily turnover. Unlike in the past when people had to assemble on trading floors or place orders via telephone or email, market orders are now executed millions of miles away in milliseconds. At the heart of the high-speed execution is straight-through processing (STP).

Understanding straight-through processing (STP)

STP is an automated process that ensures all transactions are carried out through electronic transfers. On this account, there is no or minimal manual intervention on both sides of the transaction. The system was made possible by the development of high-frequency and technical networking that has taken efficiency to another level.

Straight-through processing has found great use in the payments and securities trading business. Cryptocurrencies and financial technology providers have given rise to much faster types of STPs that are giving banking systems a run for their money.

In the modern world of the digital revolution powered by high-speed computers and superfast internet connections, all secondary market securities rely on electronic processing. While every transaction in the forex or stock market requires a trade settlement process, STP has proved to be a reliable framework.

STP in brokerage

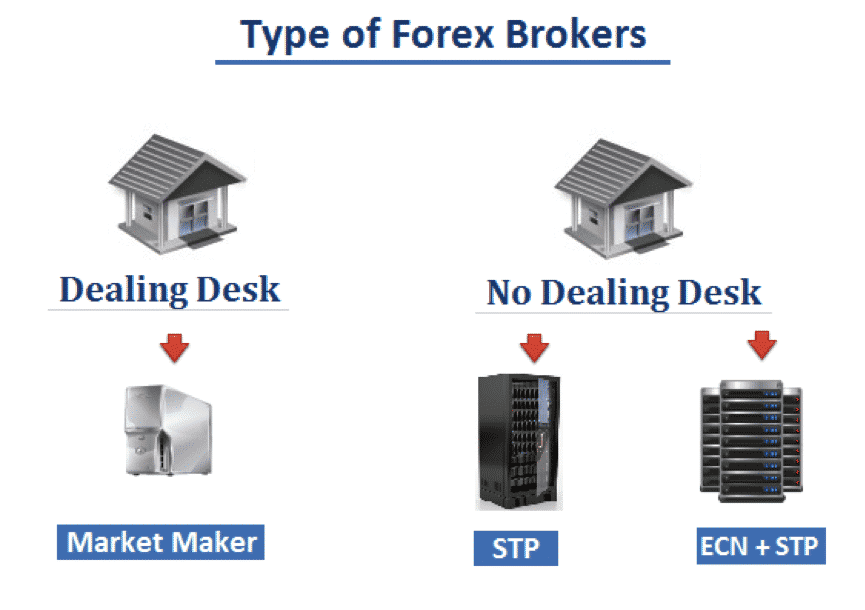

In the forex market, brokerage firms rely on STP to execute trades placed by clients on their platform. A broker is considered STP only if they do not process orders placed on trading platforms by clients through Dealing Desk. In this case, they do not operate as middlemen.

The absence of a dealing desk ensures full utilization of the STP process. Conversely, whenever a client enters a long or short position, it is routed through the broker servers and straight into liquidity providers. The liquidity providers are essentially banks.

The brokers don’t interfere with the trades, given the lack of a dealing desk. On bypassing forex brokers, orders are processed in a straight-through fashion that is devoid of any delays. Consequently, clients get their orders executed at preferred price points given the straight-through process.

How STP works in forex

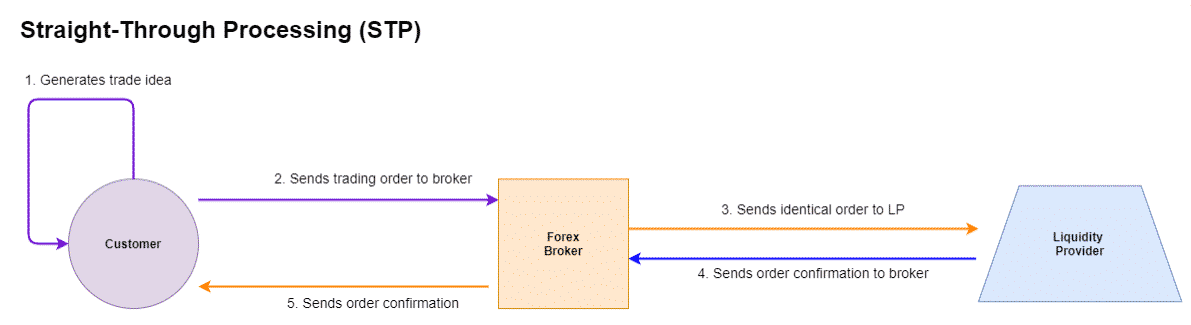

Every forex operation has a front and back end. The front end describes what traders and clients see whenever they wish to place trades. In this case, they are limited to seeing charts, order buttons, and account sizes on the trading platforms.

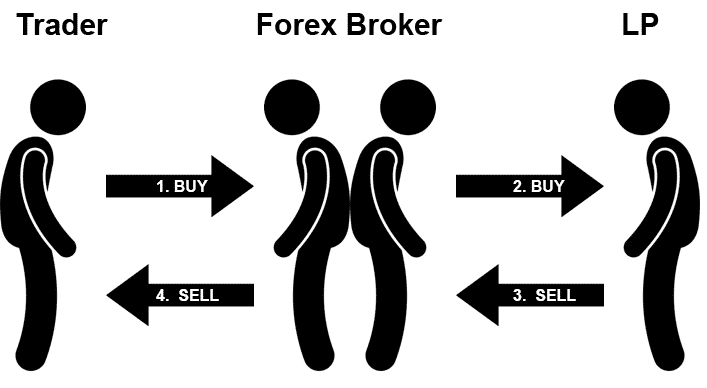

On the other end is the back end, whereby once a buy or sell order is placed, it is directed straight for execution. The data transfer from clients to the back end for execution takes a millisecond to and from. For any execution to occur, three parties are involved.

There is a trader who places a trade. In return, a counterparty assumes the opposite side of the trade. In the case of a buy position, there must be a seller willing to sell whatever the buyer is willing to buy.

Secondly, a broker must be willing to bring the two parties together to transact business. Thirdly, a liquidity provider must provide the desired pricing conditions for the participants to ensure all transactions are carried out.

There is no physical location in the forex market where all transactions are carried out. Instead, everything is carried out virtually and electronically. As part of the STP process, brokers are tasked with locating and matching orders with the counterparty within the shortest time possible.

The efficiency of an STP broker depends a great deal on the liquidity provider they settle on. A liquidity provider is essential and only deals directly with brokers instead of retail traders. In this case, the market makers come in and buy large volumes of trades on the buy or sell sides.

In return, they splint these positions and offer them to people who wish to buy and bid positions and those who want to sell

Instead of assuming the market maker position, forex STP brokers allow most of their traders to access the interbank market. Consequently, they gain access to a wide pool of liquidity providers offering securities at different prices. Traders must pay for the cost of these services often carried out on specialized platforms.

Examples

The best STP brokers are those that are regulated in various jurisdictions. Such brokers are overseen in various stages of their operations, thus can guarantee an ideal STP trading environment. Some of the best in the business include EToro, regulated by the Financial Conduct Authority, Cyprus Securities and Exchange Commission, among other agencies. FXTM is another top broker that offers fully-fledged STP accounts.

Benefits of STP Forex Brokers

STP Forex brokers are some of the best to deal with as they are not entangled in any conflict of interest for whatsoever reason. The fact that they do not act as counterparties to trades placed on their platforms ensures they don’t come up with ways to profit from operations on the network. Such brokers only make money by charging a commission to offer a platform whereby buyers and sellers interact.

The fact that liquidity providers make it easy for traders to execute trades at a preferred price point makes it easy for people to implement different strategies. In this case, one can engage in scalping by executing as many trades as possible within any given without facing the risk of being penalized with slippages and re-quotes

Such forex brokers also stand out partly because they enable deeper market access. Market players can enjoy pricing from several liquidity providers given direct access to the interbank market. The result is access to better pricing choices instead of being limited to a single liquidity provider.

Unlike with other brokers where trades can be executed at a different price point, with STP, what you see is what you get. The fact that orders are executed in milliseconds thanks to the straight-through processing is almost guaranteed to enjoy desired prices for various currency pairs.

Final thoughts

STP has enhanced the forex market by ensuring all the trading processes are carried out electronically without any manual intervention. Direct access to market makers ensures clients have access to a wide pool of pricing, therefore able to enjoy the best prices while trading. In return, trades are executed within the shortest time, therefore, averting the risk of slippage.