Fundamental trading involves the use of all news or company-specific events to buy or sell an asset. As economic factors cause markets to move in the long term slowly, such types of traders usually keep their positions over the night and, therefore, fall in the category of swing or carry traders. For currencies, one may be looking at factors such as supply and demand, interest trades, GDP, politics, etc. In the stock market, the critical events are cash flow, return on assets, quarterly earnings, debt to equity ratio, and market cap.

Unlike fundamental, technical traders reside on price action patterns, indicators, past market data, and tools to make trading decisions. They use time frame analysis and confluence to increase the probability of the win/loss ratio. Scalpers and day traders are found readily scanning the charts for opportunities. Some investors may also combine technicals and fundamentals to predict the future movements of prices.

Key differences between fundamental and technicals

Following critical factors are there while trading with fundamentals or technical.

Trading approach

Traders who use fundamentals in their trading are considered long term investors. As stated before, usually swing or carry market players follow this style. In contrast, technical traders have a short term approach. You will mostly find them on short time frames like daily, H4, H1, or even M15.

Decisions

In fundamental analysis, decisions are made by looking at factors such as stock value, supply and demand zones, and more where you determine the price of an asset through an incoming statement on any one of these. Technical traders, on the other hand, focus on trends and stock price. Resistance and support are some of their favorites.

Data analysis

Fundamental traders gather all of their data from financial events and geopolitical statements. However, those who create on technical terms grab their information from the charts.

Goals

The main goal of fundamental traders is to scan the intrinsic value of the stock.

In contrast, technical traders are busy finding the correct entry and exit positions based on the asset’s current and past values.

Sight

Traders who trade on economic factors have their eyes glued on the past and future performance.

Technical market makers are mostly looking at the prior report of an instrument to determine the import key levels, support, and resistance points.

Backtesting

Nowadays, you can backtest your strategy based on both fundamentals and technicals. However, keeping a good record of all the economic factors that take part in an asset’s movement may not be as proficient during the procedure. In technical analysis, the overall process is simple as your simulator plays the candles in front of you.

What are the benefits of using only fundamentals?

Trading using fundamental factors have the following benefits for traders:

- Probability. Traders that trade using only fundamental analysis have a better chance at winning their trades.

- Time consumption. As such, trading is based on long-term decisions, you don’t need to sit on the trading desk all day long. Holding positions for months or even years does not require constant monitoring or management.

- Understanding of business. On a positive note, you can also better understand companies and businesses as you study them thoroughly.

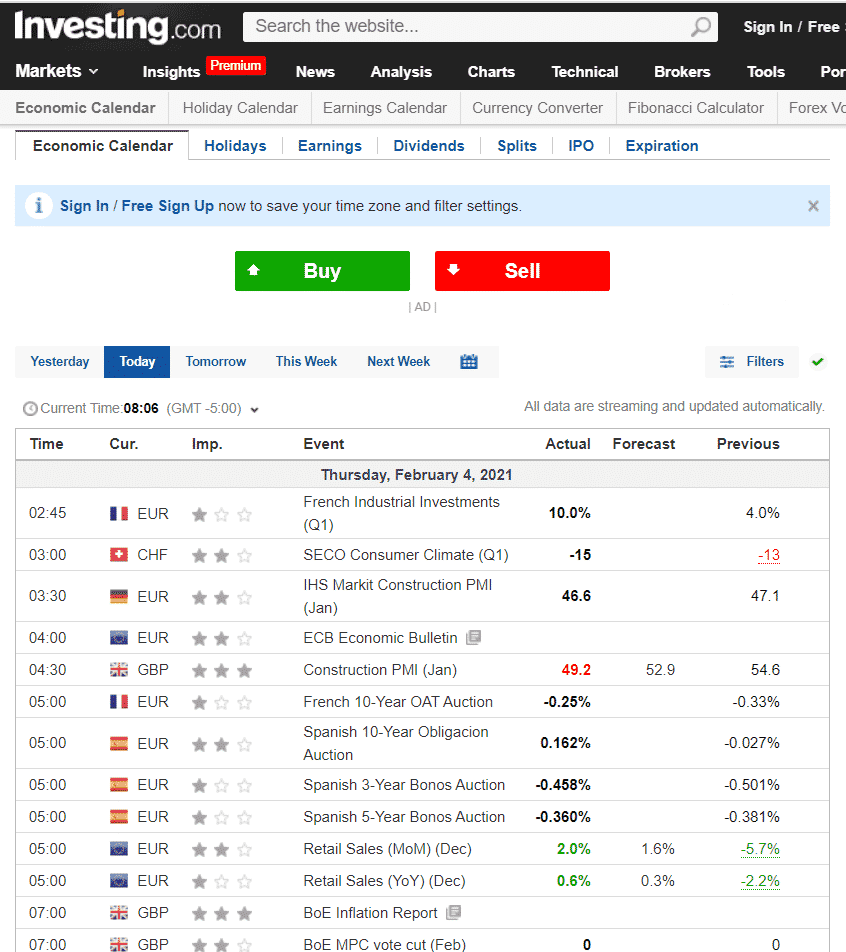

Image 1: A daily economic calendar is available on all notable financial websites. All the critical fundamental events and their associated importance are shown.

What are the benefits of using only technicals?

The technical analysis presents the following benefits for market players:

- Capital requirements. As these traders decide on short-term bank plans, they may not need higher equity. Scalpers can capitalize on short-term market movement and generate significant gains while combining small profits.

- Time frame. Technical traders can also utilize their craft in any timeframe they wish. They are not limited to short term trading and can include long-term swing and carry trading in their portfolio.

- Analysis. The overall time required to analyze our price action chart and get in the markets is low. You don’t have to spend much time looking at your screen for opportunities. Apply it to any market without much analysis.

- Repeated opportunities. In technical analysis, you will come across a lot of setups that repeat themselves again and again. However, with fundamentals, each economic report or a political statement may cause investors to react differently.

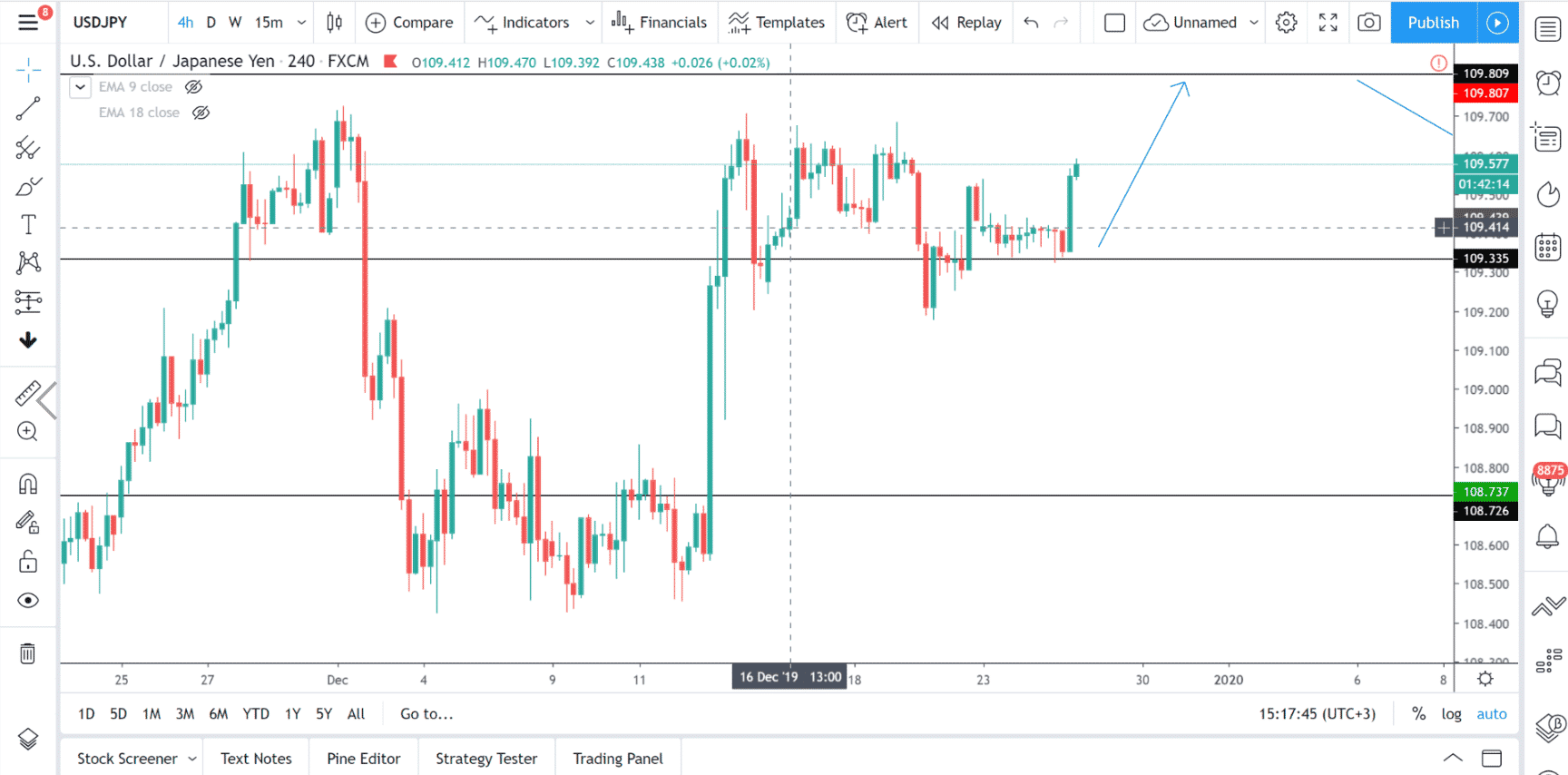

Image 2: A price action chart on 4H time frame shows key levels marked by a trader to analyze the market.

Using both technicals and fundamentals

Utilizing both technicals and fundamentals is a sure way to increase your profits in trading. You can take new positions or close your current ones by analyzing if the currency’s economic outlook matches the one from your charts. Use the proper news event to select a stock or currency to trade and then employ technical analysis to time your entry and exit.

One of the good examples of using both fundamentals and technicals is news trading. Traders capitalize on the volatility generated by five-star events. They assess the movement of 1 M, 5 M, 15 M, and 30 M candles that form just after the financial statement release.

Which type of analysis should you use in trading?

It may come down to your personal preference when choosing the type of trader you are. Trading fundamentals may require a lot of effort from your side, and you may need a guru to understand the volatility and reactions generated by news events. On the other hand, mastering technical analysis is their short term work. Both types of research indeed have their benefits and demerits. Keep in mind utilizing the two together will give you the best of both worlds.