There are numerous distinct formations that traders look for when it comes to technical trading setups. Some of them can be short-term occurrences that unfold over shorter intervals and provide possibilities for scalping. Others may be larger technical occurrences that occur on longer periods and provide possibilities for swing trading.

Nevertheless, some of the most popular and profitable technical trading setups occur across all time frames and are driven by the same order flow causes. Some can bring losses, but there are ways to avoid making losses. The short squeeze is one of the most common of these.

What is a short squeeze?

A short squeeze occurs when there is an excess of demand for a certain currency and a shortage of supply. The result is that prices keep on rising fast as a result of the excess demand. Traders with short positions attempt to cover (or close) their positions, which can only be done by purchasing. As more traders want to purchase, we often witness a prolonged rally as prices rise. All of the “shorts” are crushed in this way. We usually observe a reversal following a big sharp move.

Example

The GBPUSD is in a long-term downward trend. Some traders may believe that the pound is cheap at some moment, making it a favorable investment. As additional buyers join the market, traders holding short pound holdings feel it’s preferable to close out their positions rather than risk losing money. As a result, more traders are buying the pound, causing all short positions to be squeezed out of the market.

How do short squeezes manifest?

A short squeeze occurs when the price of a currency pair has been dropping for some time. The price drop draws an increasing number of short-sellers trying to benefit from the price drop. A significant amount of purchasing pressure enters the market at some time. It generally occurs as a result of one of two factors.

It might be unanticipated excellent news about one of the currencies in the currency pair, such as a large economic event that substantially exceeds market experts’ estimates. It’s also possible that technical traders start purchasing the currency pair because they detect signs that it’s oversold and hence ideal for an upward reversal.

Short sellers’ profits begin to erode, or worse, their lucrative positions begin to turn into losing ones when the fresh purchasing pressure in the market increases to the point that it begins to propel the currency’s price dramatically higher. They move to liquidate their short positions with the corresponding purchase order, fearful that the currency will continue to rise.

Previous short-sellers entering purchase orders to close out their positions adds fuel to the purchasing fire, drawing new buyers and driving the currency’s price further higher. Short sellers are progressively being forced out of their market positions as the currency price rises.

How can you identify an impending squeeze and avoid it?

Using trendlines and lines of resistance

When the market is in a downtrend, prices typically form increasingly lower lows. We can draw a trend line connecting the highs, and prices will not break above this trendline. In the event prices break above this trend line, it could be a signal of an impending short squeeze. However, it is not uncommon for prices to retest broken support. Thus, entering a trade based on this signal alone may very well prove detrimental.

Our chances of success improve if we additionally employ a breach of resistance. If the price fails to make a new bottom in a bearish trend and then breaks above a prior high, it’s a sure sign that the trend is ready to break. When accompanied by a trendline breakout, this can be a very powerful indication of a short squeeze.

How to avoid it

Don’t execute the trade if the price breaks the trendline but not the resistance level. This prevents us from being entangled in possibly unsuccessful trades that occur during choppy markets. And this will help us have a better chance of not having losses.

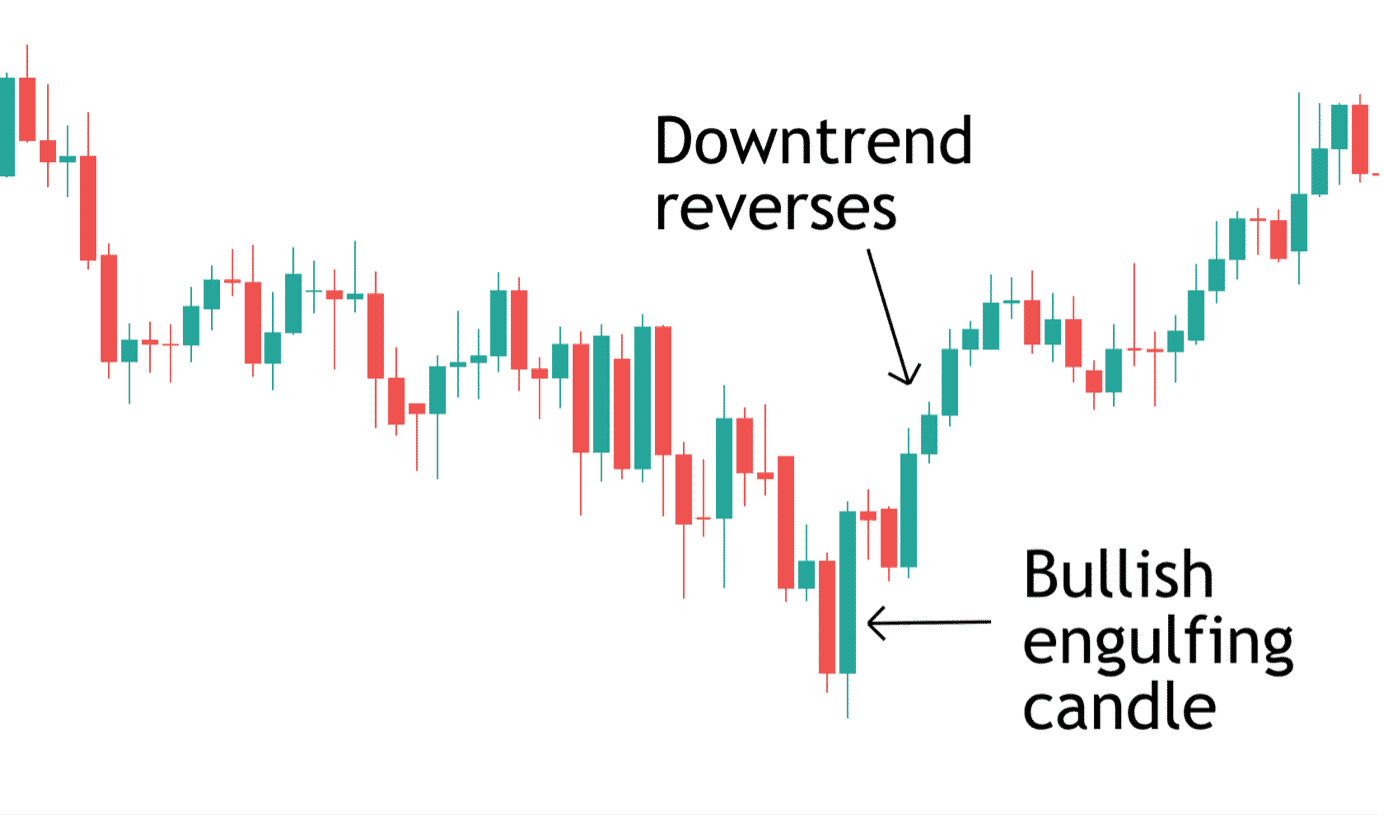

Using candlestick engulfing

Engulfing candles usually indicate a reversal of the market’s current trend. Two candles are used in this layout, with the latter candle consuming the full body of the candle preceding it. Depending on where it forms in reference to the existing trend, the engulfing candle can be bullish or bearish.

The bullish engulfing candle is one of the most frequent candlesticks that suggests a short squeeze is occurring. A bullish engulfing candle appears after a bearish candle and totally engulfs the preceding candle. This second candle (in its most effective form) is often much larger than the first (see the illustration above), indicating a significant change in emotion.

How to avoid it

Set a stop loss below the engulfing candle’s low.

Using Relative Strength Index

Most charting applications have an RSI indicator already inbuilt. If you plot the indicator, you can identify a short squeeze. RSI determines if the market is overbought or oversold. It also has a 0 to 100 scale. Readings of 30 or lower usually imply oversold market conditions and a greater likelihood of price strengthening. Overbought state and an increased risk of market weakness are indicated by readings of 70 or above.

How to use RSI to avoid short squeeze

Avoid trading when the RSI reading is above 70 or lower than 30.

Using stochastic oscillator

You can use a stochastic indicator to identify a short squeeze because it is used to tell oversold and overbought currency pairs. The indicator indicates that the instrument is overbought when the stochastic lines are over 80. When the stochastic lines fall below 20, the instrument is considered oversold.

How to use the stochastic indicator to avoid short squeeze

Avoid trading when the stochastic line is over 80 or below 20.

Conclusion

The squeeze might catch short-sellers off guard, requiring them to liquidate their positions by buying back the pair at a significant price. As a result, demand for the pair increases while supply decreases, driving prices upward. There are techniques to spot a short squeeze, and those same techniques may assist you in avoiding losses.