To trade in the FX market, one has to study and analyze different indicators. This will help determine how prices change in the FX; hence traders can make important decisions like when to enter or when to leave the financial market as you can tell what money exchange will give substantial returns with some high level of confidence. Bond spread is one such indicator as it affects the position of a currency in the market hence its strength.

What is bond spread?

It refers to the contrast in interest rates among two bond yields.

Formula

Bond spread AB = Bond yield A – Bond yield B.

By keeping tabs on bond spreads and how rates of interest are expected to change, a trader is able to predict where currency pairs are headed and therefore be in a position to plan and invest in trades with the best possible returns.

Globally, all the financial markets are interrelated. This means that when one market is altered, it causes a change in other markets. A change in the equity market will affect movement in the FX market, and a change in the movement of currencies will affect the equity market.

The price of currencies affects the financial policies of nations across the world; hence this gives central banks across the globe a basis upon which they make financial policies decisions for their nations based on interest rates.

Types of spreads

Duration spread

This is a type of bond that indicates the difference in interest rates between two bonds with different maturities. Consider a two-year bond with a rate of interest of 4.5 percent in nation X, which has the lowest capital risk due to interest rate changes. A six-year nation X bond pays 6.1 percent interest, indicating a substantially larger capital risk. The yield gap between these two bonds is 1.6 percent, which is the difference in interest rates between the two bonds, with financial policies as the primary requirement.

Credit spread

This type of spread shows the counterparty credit risk (CCR) among two bonds. The CCR of the much lower interest rate bond is indirectly proportional to the spread. This means that as the spread increases, the CCR of the lower interest rate bond reduces as compared to that of the bond with a higher interest rate.

Coupon spread

This type of spread shows the discrepancy among two bonds with varying interest rate coupons. Consider this instance; the Government of the US has issued two bonds both of which are due in 2025; one bond has a 12% coupon (U.S 12/25) while the other one has a 9% coupon (U.S 9/25). Despite their similarity in maturity, these two bonds have a 3% disparity in payment every year until the full principal of say $100 is matured and has been repaid in full. A taxable trader would prefer the lesser coupon bond as they would rather have less money that is subject to tax.

Liquidity spread

This shows the variation in liquidities of two bonds trading with each other, i.e., the ease at which two bonds could be traded. For instance, a trader can buy zero-coupon bonds of say $100 with a similar maturity date in various forms, i.e.,

- a coupon, i.e., a stripped coupon payment from the bond

- a residual, i.e., the stripped principal payment from the bond

- an actual zero-coupon global bond issue.

With regards to liquidity, the global zero is traded at the least spread compared to the original bonds, as it has the highest liquidity. The residual is traded at a larger spread, as it has lesser liquidity. The coupon, on the other hand, is traded at the largest yield and spread as it has a smaller size (a coupon could be 2/3 of the original bond’s given rate of interest, for instance, $6 on a 9% interest rate) in the case of the above residual of $100.

How does bond spread affect currencies?

The value of a country’s currency is indirectly related to inflation, i.e., a weak currency would stimulate inflation, whereas a strong currency would prevent it. When a currency’s interest rate rises, the strength increases. Understanding this relationship is important since it is one of the most important elements that influence the strength of a currency. Interest rate differentials are used to estimate currency pair values based on how much traders worry about future exchange rates vs. current rates.

How do bond spread and exchange rate relate to each other?

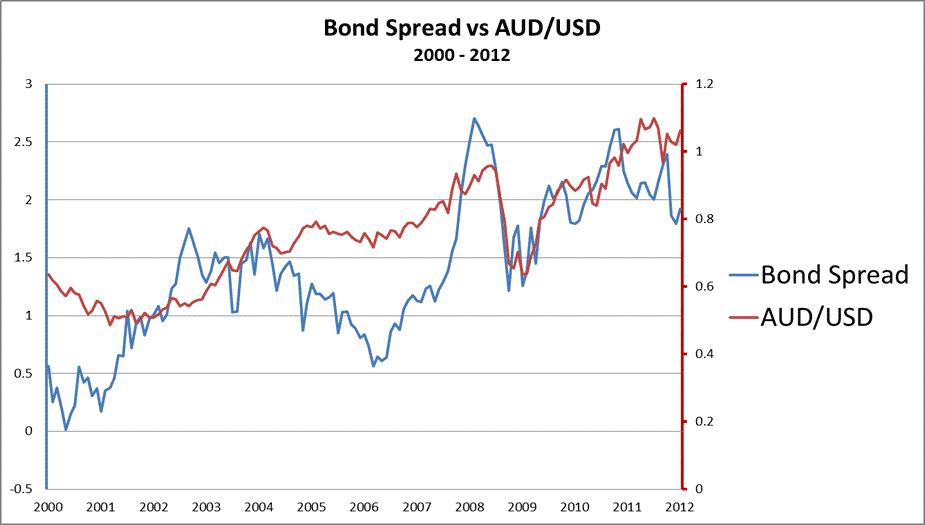

With the widening of the bond spread between the 2 countries, the currency of the country with the higher bond yield appreciates against the other currency of the country with the lower bond yield.

In the chart above, between 2002 and 2004, when the bond spread rose from 0.50% to 1.00%, AUDUSD rose almost 50% from 0.5000 to 0.7000. In 2007 also, when the bond spread rose from 1.00% to 2.50%, AUDUSD rose from 0.7000 to just above 0.9000.

When the bond spread increases, traders capitalize on the carry trade strategy. This is a strategy where traders borrow from a currency with a low interest rate and invest in a currency that provides a high return rate. As much as it is the most popular strategy, it can be risky as it is highly leveraged, and most of the time, it is overcrowded.

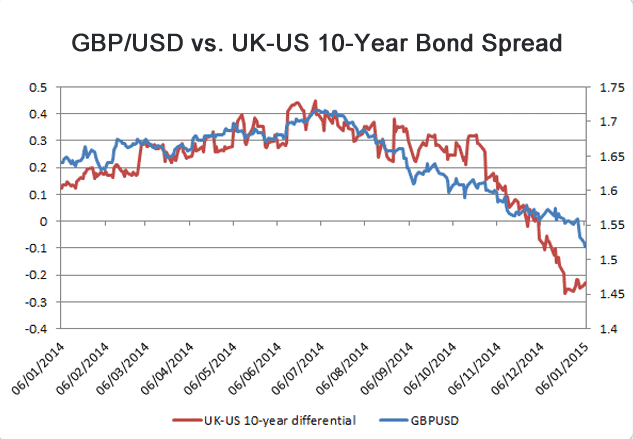

With a decrease in the bond spread between the US and UK bonds, the GBPUSD equally weakens.

Conclusion

Bond spread is an essential indicator in forex trading as it helps one determine where currency pairs are headed hence whether trading at a specific time would be profitable or not. Bond strength tells us the economic strength of a given country’s currency. Considering that all financial markets in the world are interconnected in a way, a change in one affects the position of the others, e.g., a change in commodity markets will influence how currencies are moving. There are several different types of spreads which include; term spread, liquidity spread, credit spread, among others.

The interest rate impacts the legal tender. When the interest rate surges, so do the value of that currency.