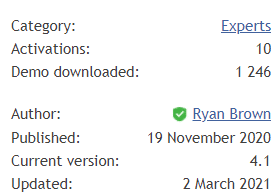

Ranger EA is a robot that was designed by Ryan Brown and published on MQL5 on November 19, 2020. The robot is updated consistently. So, the last update was released on March 2, 2021, to a 4.1 version.

Ranger EA: To Trust or Not to Trust?

There are risky strategies on the board. If you trust your real account to a Grid plus Martingale combo, it’s completely up to you.

Features

Let’s take a look at EA’s features:

- The system works automatically for us.

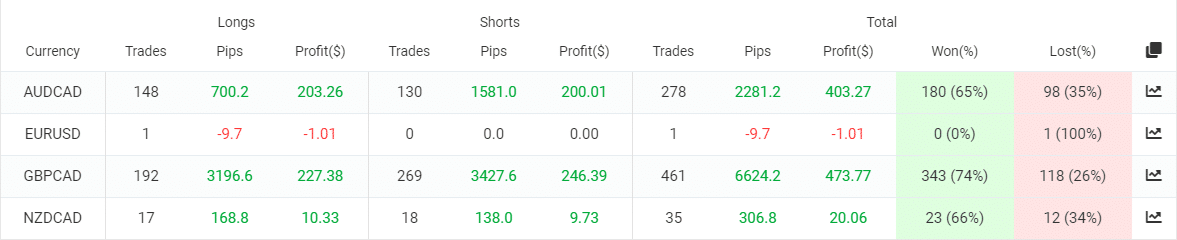

- Ranger EA works GBP/CAD and AUD/CAD.

- From trading results, we know that the system works with NZD/CAD too.

- The robot “performs a corrective trading technique to turn losing trades into winners.”

- The time frame for GBP/CAD should be M30.

- The time frame for AUD/CAD should be H1.

- The default settings are the best for the AUD/CAD symbol.

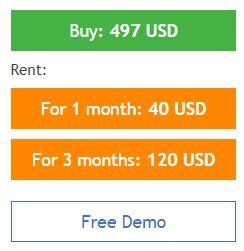

- It was backtested before being released.

- The developer has used 10-year tick data for checking how the system works.

- The higher risk, the more profits we can expect (up to 10% monthly).

- The default settings are good to become profitable.

- The robot trades with low frequency performing several deals weekly.

- The EA runs the account following FIFO rules.

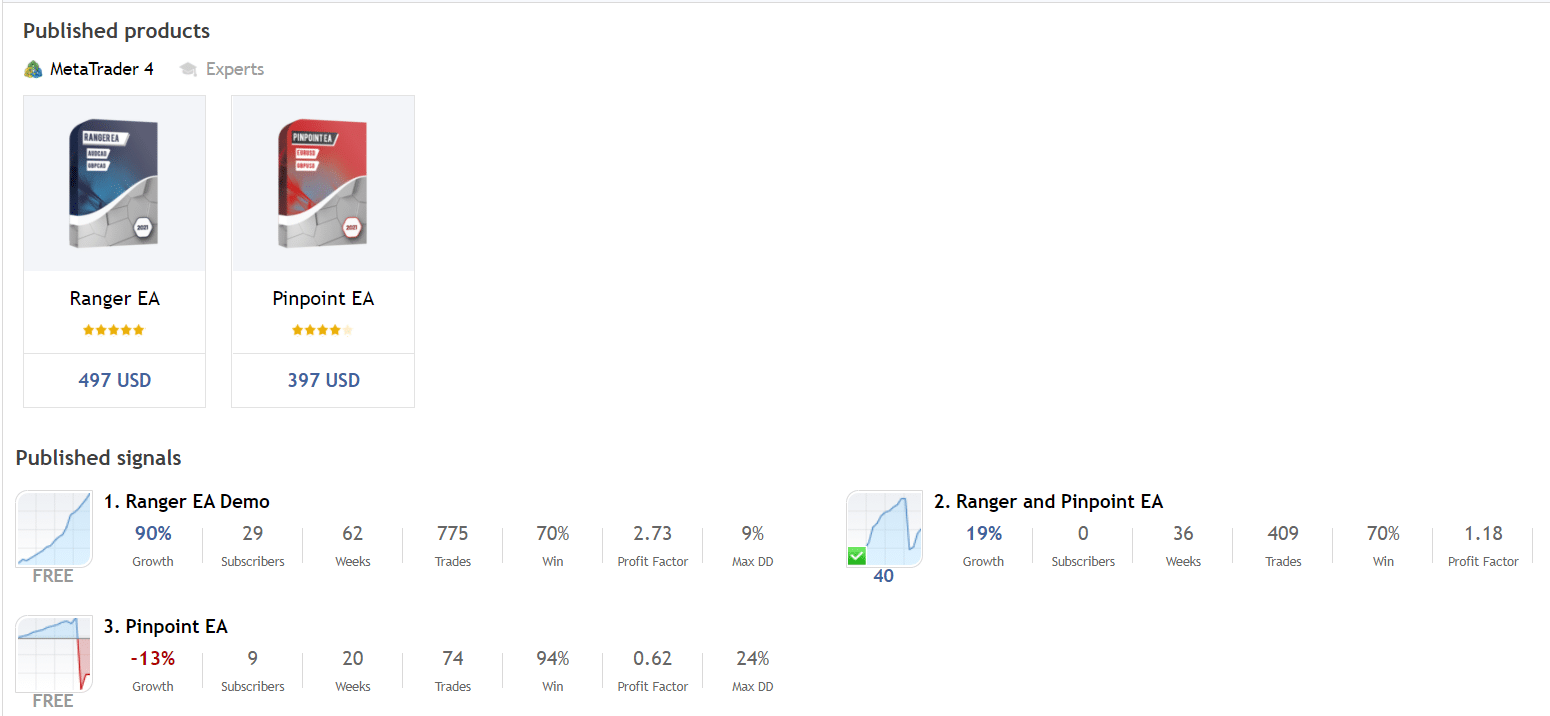

Ranger EA is sold for $497 for a copy of the product. There are two rent options: one-month and three-month subscriptions. The one-month subscription costs $40. The three-month subscription costs $120. The rental options are acceptable for many traders, excluding the main price. We can download the robot to check in on the terminal. There’s no refund policy provided.

Verified Trading Results

There’s a backtest of the AUD/CAD currency pair in the presentation. It’s based on 10-year tick data. The modeling quality was 99.90%. The absolute gain has become +104,015.01%. The period of data was from January 10, 2010, to August 17, 2020. An average monthly gain was +5.53%. The maximum drawdown was 55.85%.

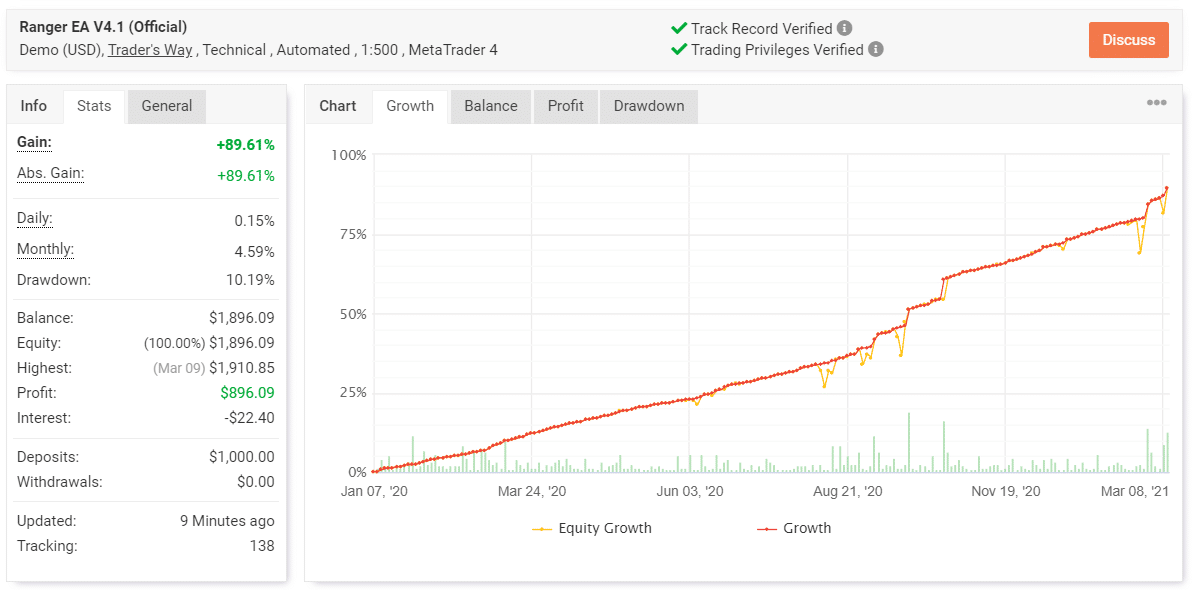

The robot trades on a demo USD account on a Trader’s Way broker automatically, analyzing data from technical indicators from the MT4 terminal. The leverage is set at 1:500. The account has a verified track record. It was created on January 07, 2020, and funded at $1000. Since then, the absolute gain has amounted to +89.61%. An average monthly gain is 4.59%. The maximum drawdown is quite high as for this profitability – 10.19%.

The system has closed 775 deals with 9202.5 pips. An average win is 27.93 pips when an average loss is -26.40. The win-rate is 69% for Longs and 71% for Shorts positions. An average trade length is a day. The Profit Factor is 2.73.

The robot focuses on reading three currency pairs AUD/CAD, GBP/CAD, and NZD/CAD. The presentation said nothing about NZD/CAD. The most traded and profitable currency pair is GBP/CAD with 461 deals with $473.77.

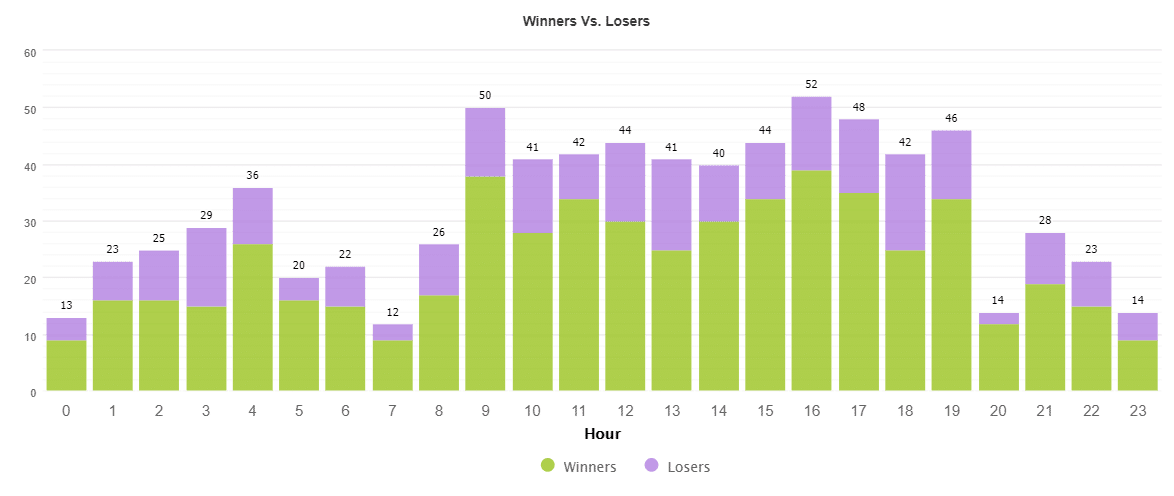

The robot focuses on trading mostly during the European trading session.

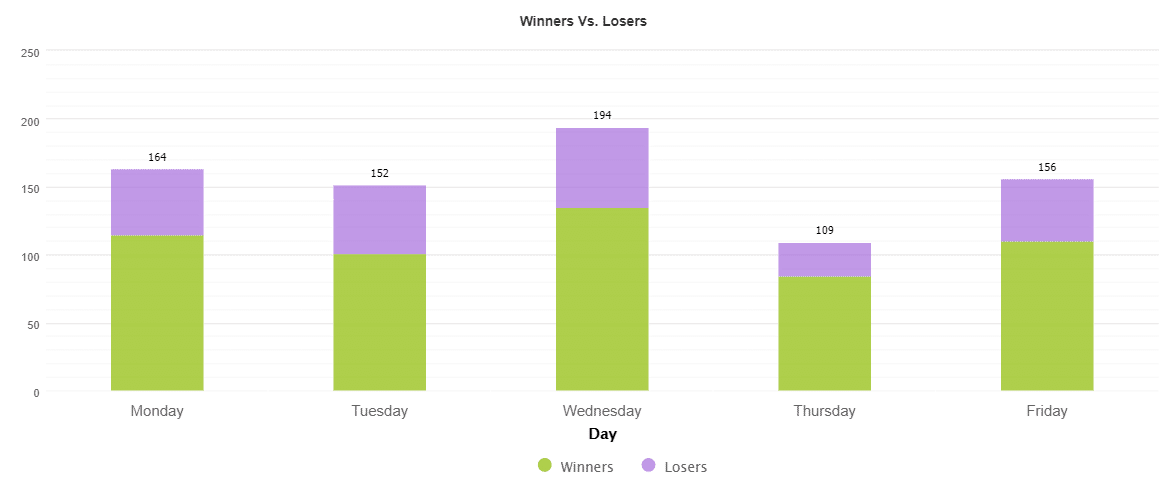

Thursday is the less traded day (109 deals) among others.

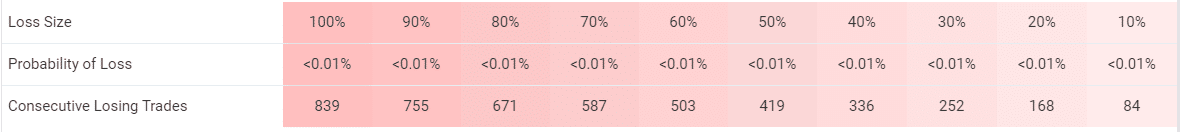

The system works with quite low risks to the account balance. For losing 10% of the account, the robot has to lose 84 deals.

As we can see, the system works with a dangerous Grid of seven orders and Martingale (x5).

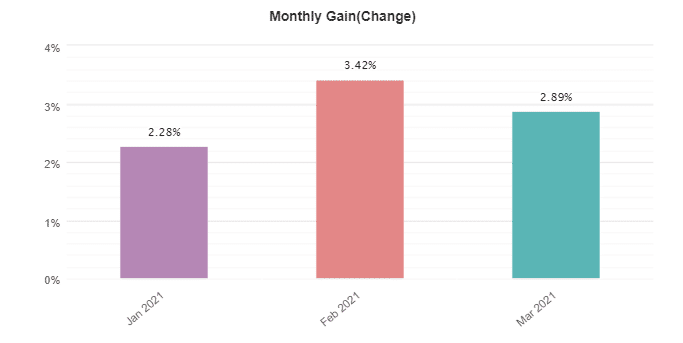

Ranger EA provides little profits every month.

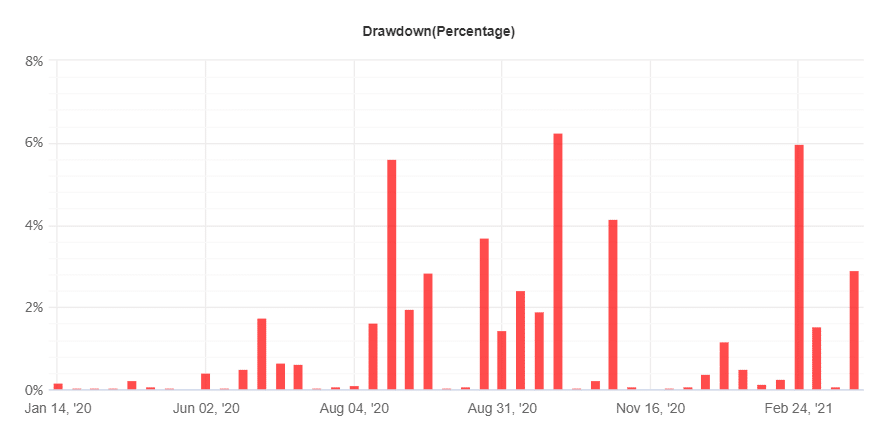

Acceptable Drawdowns

The robot works without deep drawdowns.

Vendor Transparency

The vendor has a high level of transparency. We know who he is. We have seen the robot’s backtest reports and 3rd-party verified trading results.

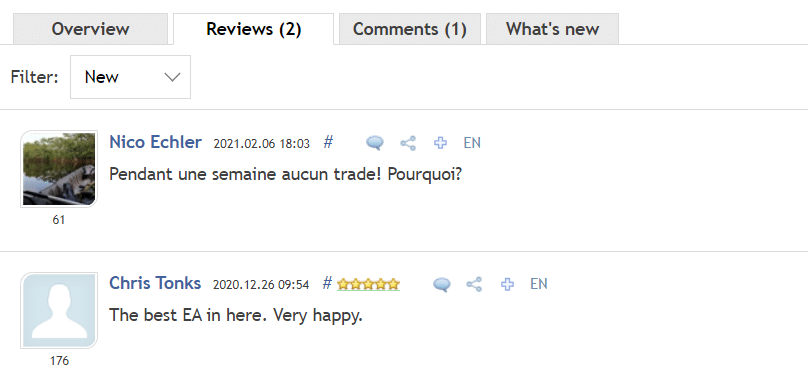

People feedback

The presentation includes only two comments from real clients.

Other notes

The developer has three signal accounts. As we can see, Pinpoint EA went down.