FX futures are a type of contract that allows you to procure one currency for another at a fixed exchange rate on a specific future date. These are also referred to as currency futures. In other words, it involves two counterparties, with one committing to buy the underlying exchange rate and the other looking to sell the rate at a previously agreed-upon price in the future.

As the daily price changes, the differences are settled in cash until they expire. Pricing is transparent here, as each contract is negotiated on the best bid, best offer basis. The prices of futures can be affected by the institutional characteristics of this market, which include price limits, delivery options, and marking to market.

The Advantages – When You Choose To Trade Currency Futures

Arbitrage

Arbitrage is the process of buying and selling the same security simultaneously in different markets. This is profitable when one trades them as they can gain significantly from the price differentials of currency futures in different markets, such as on US-based exchanges and the London Exchange.

Reduced Administration

Hands-on administration is not required in handling this instrument. There is also no need for documentation to prove the existence of an order.

Speculation

Speculation refers to the act of investors looking at the movement of the underlying exchange rate and wants to increase their exposure. Those who are speculators do not have any interest in buying or selling the underlying currency. Their main aim is to profit from the short-term price movements with the belief that the currency rate will eventually change. Thus, they enable investors to speculate on short-term market movements.

Increased Access

These allow the opportunity to smaller corporate clients as well as individual traders to access favorable rates which would otherwise not be possible.

Gearing

Gearing is the act of using borrowing capital such as margin to increase the potential return of an investment. Trading currency futures allows the investor to pay a percentage of value instead of the full traded value.

Hedging

These can be used to hedge against forex risk. For instance, an importer can enter into a long currency future position to protect his positions against local currency depreciation. In this case, the importer gets exposed to a weakening exchange rate. The importer benefits if he has a payment quoted in foreign currency due to in a few months’ time.

Head to Head Comparison

According to many, the main difference is standardization. Currency futures are standardized and traded on a public exchange. These are designed to meet the specific requirements of either the purchaser or the seller. They are not traded on exchanges. The difference between the two when it comes to pricing however is negligible. Also, these are not limited by the existence of price limits and margin requirements. Both are however used for hedging against currency risk.

| Points of Difference | Currency Futures | Currency Forwards |

| Standardization | They are said to be standardized because they have a contracted amount and an expiration date. Also, they are traded only on centralized exchanges. One contract is 1000 units of the foreign underlying currency. | They are not restricted by value date or size and thus meet the needs of investors more accurately. |

| Liquidity | This market is very liquid, meaning that you can quit the market and walk away at any moment simply by selling your contract. You can easily choose to buy a contract and sell it a few days later without any additional costs associated with the exception of the exchange rate. | This market is not that liquid as transactions is done over the counter. Also since it involves a legally bounding contract between two entities, you cannot walk away without incurring extra charges. |

| Credit Risk | Futures exchanges are essentially guaranteeing traded futures contracts meaning that there is little to no credit risk. This means that the exchange has to default for buyers or sellers of contracts to not be paid. | Such contracts are between individual buyers and sellers. Thus, there is a significant default risk which you should take into account when valuing a forward contract. |

| Margin requirements | Investors may be required to pay certain margin requirements | In many cases, they don’t even require collateral and are exempt from margin requirements. This makes the investor free to allocate funds into various investments until the value date of the contract. |

The four main aspects that traders have to keep in mind while trading them are the underlying asset, the expiration date, the margin requirement, and the size of the contract. Since they trade on centralized exchanges, counterparty risk is vastly reduced when compared to currency forwards with maintenance margins of around 2% and initial margins of 4%.

Consider the Risks

- These are not as flexible as other instruments for accounting purposes. They trade in lots of preset amounts that are inflexible for accounting.

- They mainly trade on exchanges based in the U.S.

- Since they are a speculative product, they should be traded by professionals to get the full benefits.

- Some brokers pressure their clients to close positions before delivery

Final Thoughts

Currency futures are a widely accessible instrument as it attracts both speculators as well as firms with a genuine need for hedging. Always choose a broker that offers competitive brokerage fees and offer intraday graphs on currencies and live streaming prices and a range of currency options to choose from.

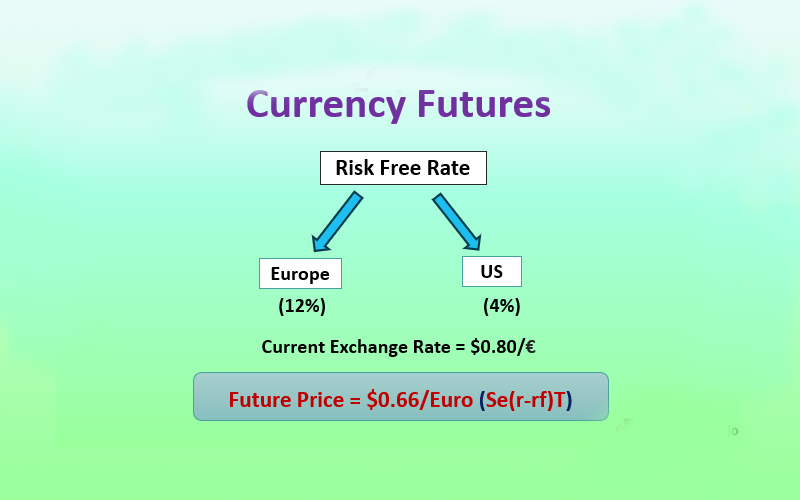

You can also use futures as a check for interest rate parity. If it does not hold, a trader may be able to implement a strategy of arbitrage to profit purely from the use of futures contracts and borrowed funds. Compared to forex forwards, it will be the fees and other factors such as accessibility that should guide your final decision.