Naragot Portfolio is a system that works completely unpredictable on a $4999 trading account. The robot doesn’t have huge success among Forex-related traders. Let’s take a closer look at it.

Naragot Portfolio: to trust or not to trust?

We’d like to say not to trust. The system consistently showed horrible trading results and it looks like the dev doesn’t know how to update the system.

Features

The presentation includes details about how the robot works and what features will help us with smooth and predictable trading.

- The advisor was designed to help traders with executing orders automatically on our terminals.

- So, we may do whatever we want.

- The price was decreased from $449 to $333 because of many negative testimonials.

- The next price can be up to $599.

- We can work with a trend strategy on our platform.

- It works with “principles of volatility breakout and breakouts of support/resistance levels.”

- It can be used on MT4 or MT5.

- The suggested broker is Darwinex.

- The robot is a low frequency trading solution.

- “The advisors are based on fundamental principles which work on many popular instruments.”

- It opens orders only during trends.

- “Unlike most sellers, I trade these strategies myself with my own significant funds.”

- We can trade on EURUSD, GBPUSD, XAUUSD, and USDJPY.

- It covers orders with SL and TP level placing.

- TP are bigger than SL levels.

- The advisor doesn’t use Grid, Martingale, and so on.

- The dev provided explanations about how it should be tested.

- “EET – Eastern European Time used by the majority of brokers. It allows dividing trading weeks into 5 24-hours candles. In this case, you should leave the setting at “0”. But if your broker uses any other time in the terminal, change this setting. For example, if your broker uses GMT time set “-3” or “-2” depending on DST.”

- Lot Sizes can be fixed or dynamic.

- The risk should be customized manually.

Price

The price decreased from $449 to $333. Anyway, the price is twice as high as it should be. We have no subscriptions provided. The demo copy of the robot is available for free.

Verified trading results

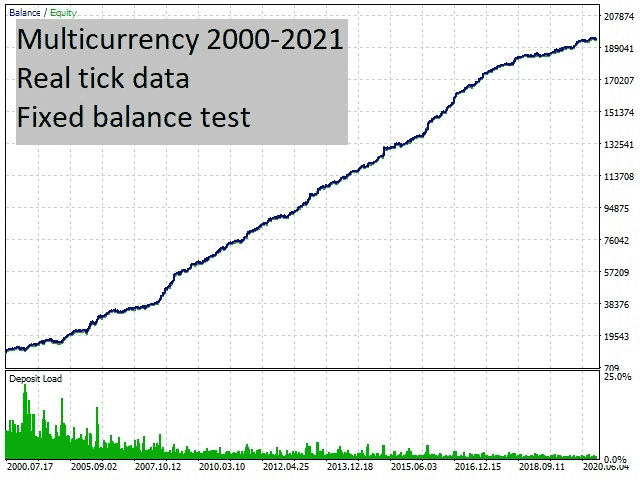

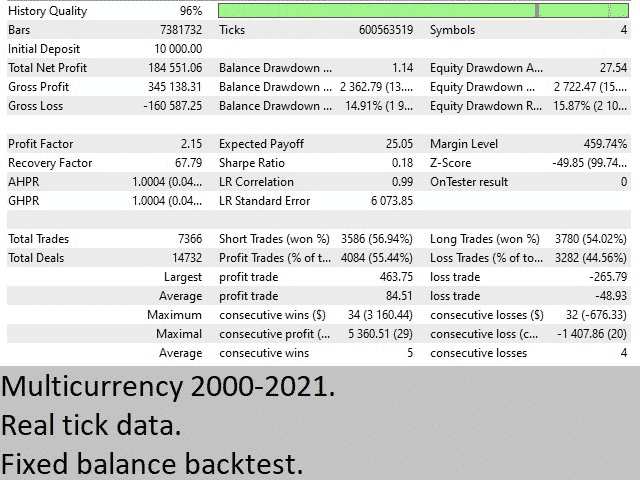

The data period was mentioned from 2000 to 2021. The test united four cross pairs. The history quality was 96%. An initial deposit was $10,000 that turned into $184,551 of the total net profit. The maximum drawdown was 14.91%. It’s an okay number. The profit factor was 2.15. The recovery factor was high and it was 67.79. The system executed 7366 orders. Accuracy was 56% for shorts and 54% for longs.

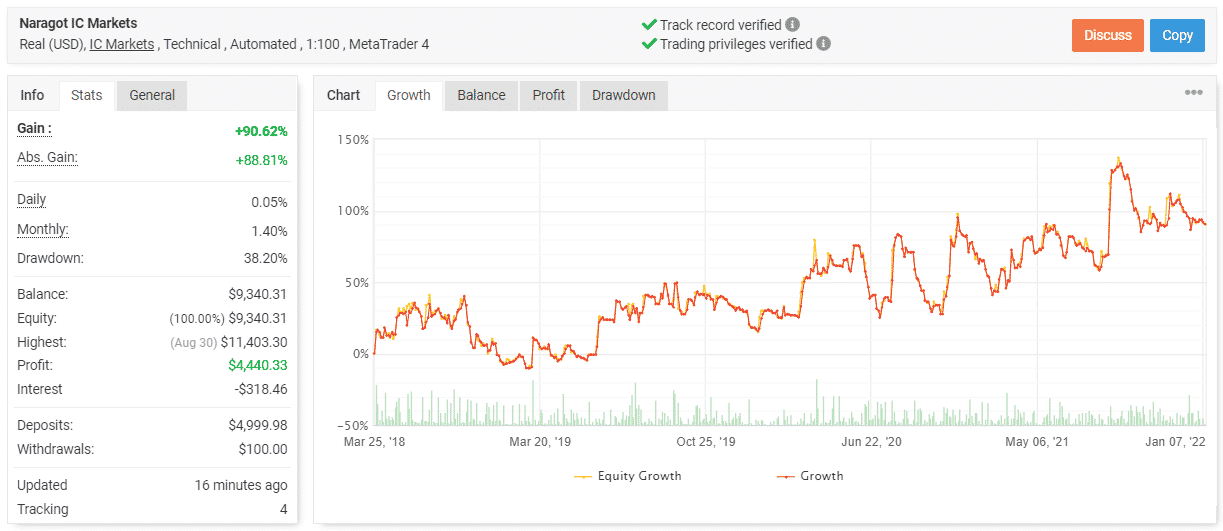

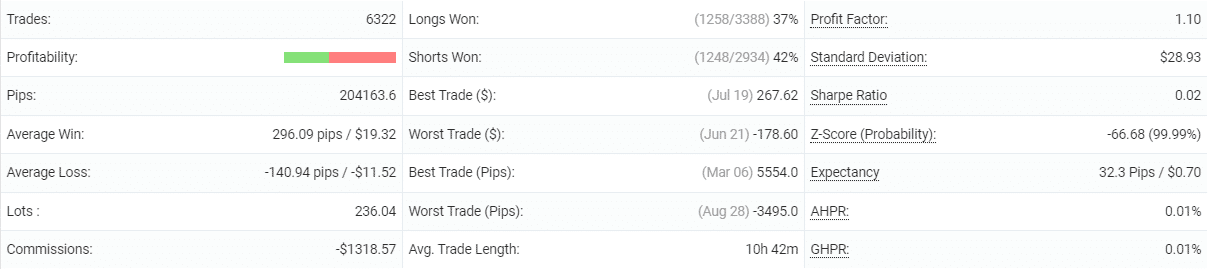

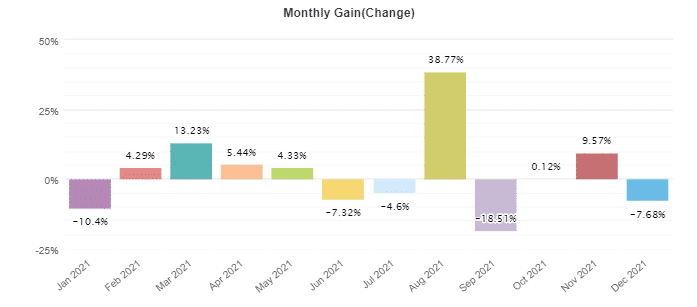

We have a system running a real account on IC Markets automatically with 1:100 leverage. The platform was common – MT4. The account has a verified track record. So, the data should be relevant. It was deployed on March 25, 2018, deposited at $4,999, and withdrawn at $100. Since then, the absolute gain has become 90.62%. An average monthly gain is 1.40%. The maximum drawdown is 38.20%.

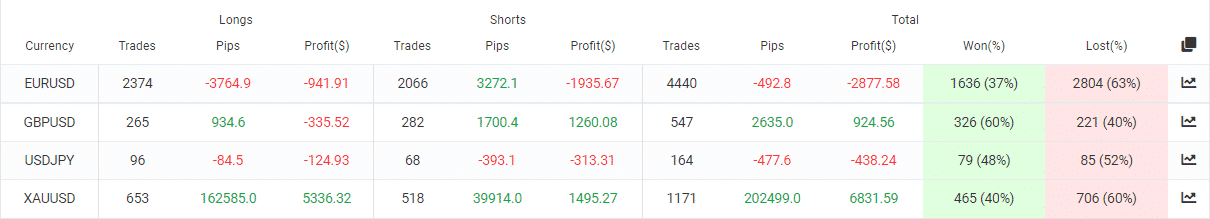

It traded 6,322 deals with 204,163 pips. An average win is 296.09 pips when an average loss is -140.94 pips. The accuracy for long trading positions is 37%, while for short trading positions it is 42%. An average trade length is 10 hours and 42 minutes. The profit factor is 1.10.

EURUSD is the most traded pair with 4440 deals traded and -$2877 lost.

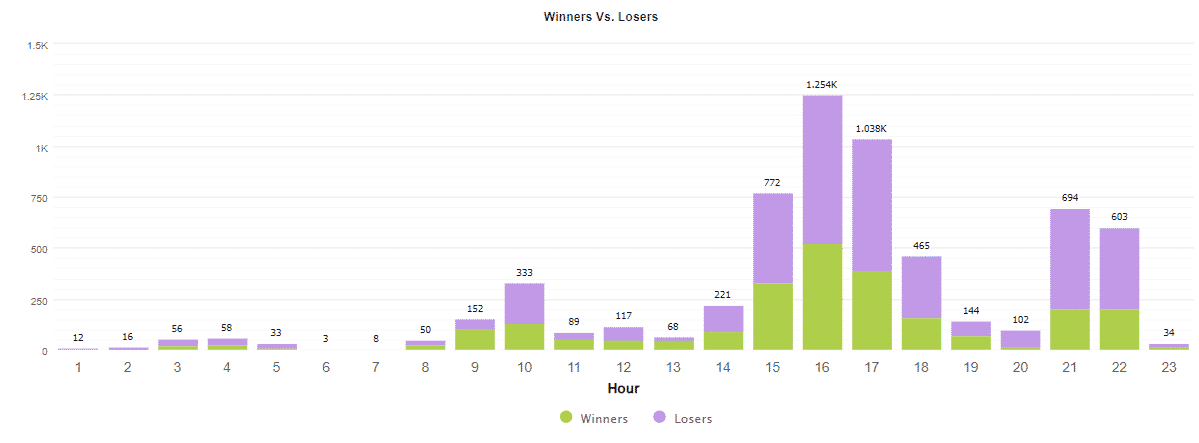

The advisor trades the opening and closing of the American session.

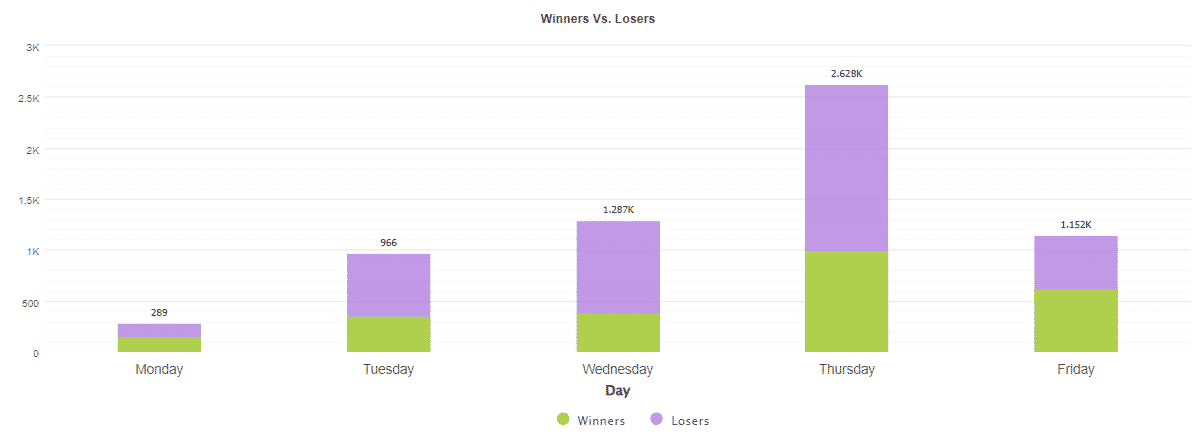

We may note that days excluding Thursday are traded little.

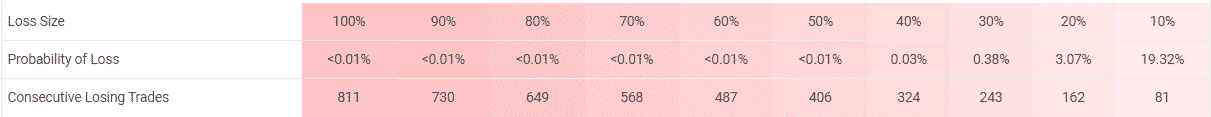

It works with moderate risks. There’s a 19.32% chance of losing 10% of the balance.

We are not allowed to check closed orders.

December 2021 like many other months was lost.

High drawdowns

The system works with over 38% drawdowns. They are twice as high as they should be.

Vendor transparency

Alexander Mordashov from Russia has a 2264 rate on MQL5. The portfolio includes 10 products and one signal.

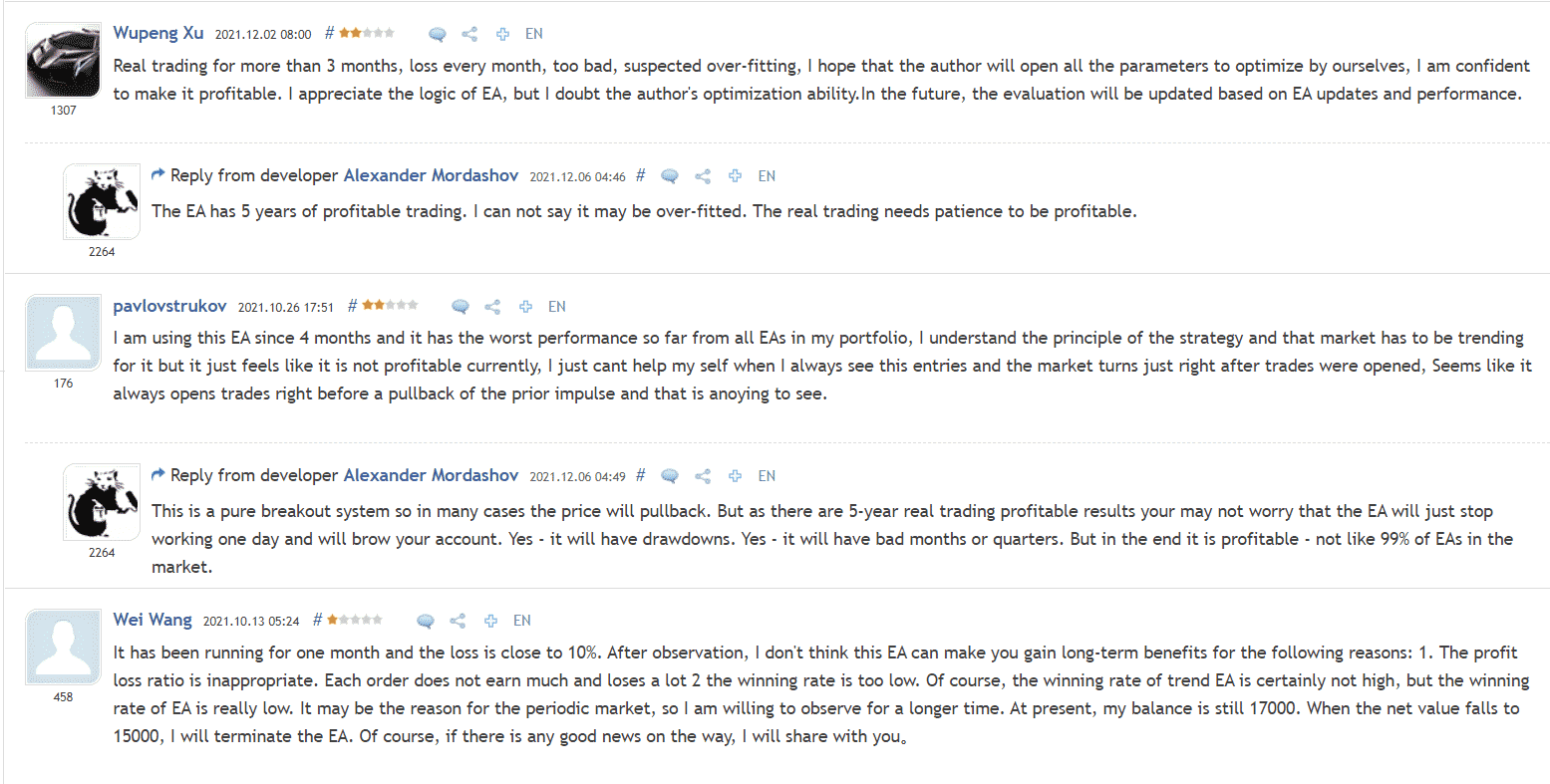

There are plenty of negative testimonials because the system doesn’t work properly.