Index Scalper Pro is a new Forex robot that was published in December 2021. The system prefers to work with an ECN or Pro account and is well suited for both novice and veteran traders. To begin trading with it, you need to have a minimum deposit of $100 in your account. The vendor says that he will soon withdraw the tool from sale to restrict the number of users and prevent brokers from worsening the trading conditions.

Index Scalper Pro: to trust or not to trust?

Our assessment found that the robot was unprofitable when it traded on a demo account on Myfxbook for 5 months. It also produced poor win rates for both long and short positions and didn’t trade often.

Features

Index Scalper has the following features:

- It includes a stop loss and take profit.

- It doesn’t require a complicated setup and can be readily used on the recommended symbols; DE30, DAX30, DE30Cash GER30, DE40, DAX40, DE40Cash, and GER40.

- The EA works on a 1 hour timeframe.

- The recommended broker is IC Markets.

- It requires a VPN with minimal delay to the server of the broker, so it is advisable to use a VPN broker.

- The maximum spread is 10 or 100 points.

Index Scalper Pro is overpriced as the vendor wants traders to pay $1250 for it. Then, the EA should be generating higher returns that will help the user recover this cost. Otherwise, it may not be worth this money.

As the name indicates, this robot is a scalper. In other words, it focuses on obtaining small profits from small movements in prices. Furthermore, the system is created in line with the doctrine of the movement to the average price value. As per the vendor, this allows you to rapidly increase the balance in your account.

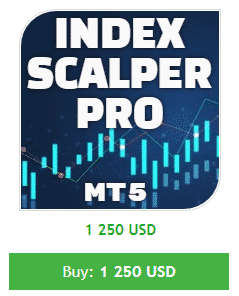

Backtest results

As per these results, the EA was able to complete 53945 trades during the backtesting period with a deposit of $1000. The resulting win rates for short (62%) and long (64%) positions were nothing to write home about. However, the total net profit ($49 960 888) amount realized was large. This indicates that each successful trade brought in a huge profit value. There was a profit factor of 2.34 and a relative drawdown of 2.86%. Obviously, the robot traded with minimal risks.

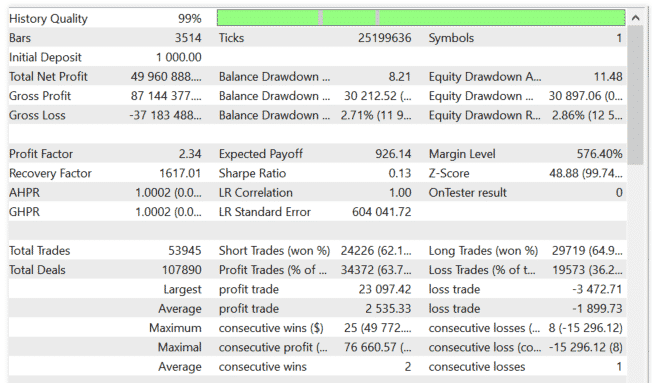

Trading results

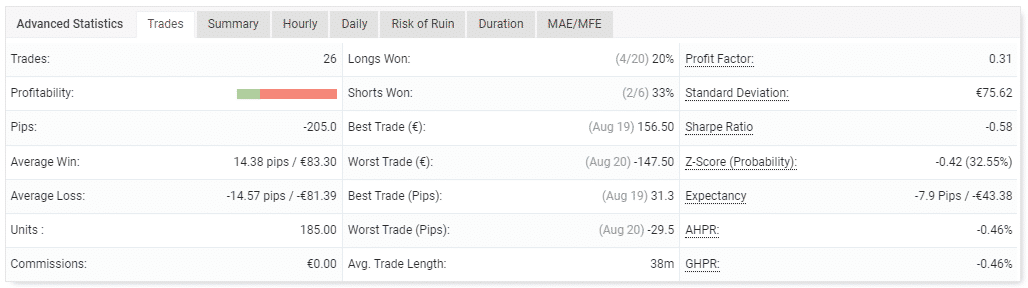

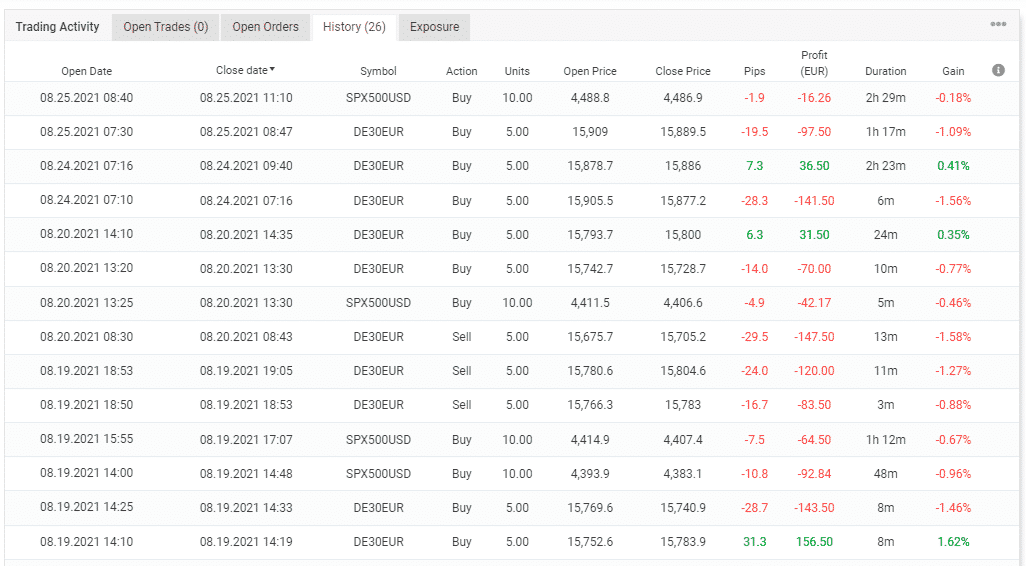

The vendor has provided us with a demo account that was hosted by the Oanda fxTrade brokerage. It was launched on August 18, 2021, and closed on January 20, 2022. From the results obtained, we can see that the EA failed to grow the account. Rather, it decreased its capital from €10000 to €8872.06 after making a loss of €1127.94. As a consequence, the account’s value decreased by 11.28%.

The profit factor (0.31) recorded from 26 trades carried out portrays Index Scalper as a loser robot. The poor win rates attained for long (20%) and short (33%) positions further prove that the system struggled to produce gainful results for the account. The average win was 14.38 pips, and the average loss was -14.57 pips.

The scalping strategy was used. A series of losses were experienced, especially between 19th August and 20th August 2021.

Low drawdown

Index Scalper Pro generated a drawdown of 11.28%, which was well within the acceptable levels. But if the owner had not deactivated the account on Myfxbook, the system’s high loss rate would have presented real problems. The drawdown level could have risen with time and threatened the viability of the account.

Vendor transparency

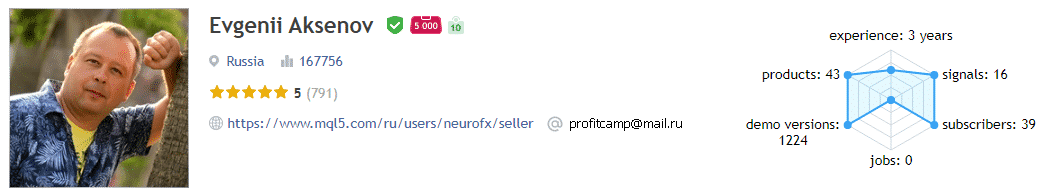

Index Scalper is owned by Evgenii Aksenov, a developer who has been creating trading systems for this market for 3 years now. So far, his portfolio includes 43 products, 1224 downloaded demo versions,16 signals, and 39 subscribers.

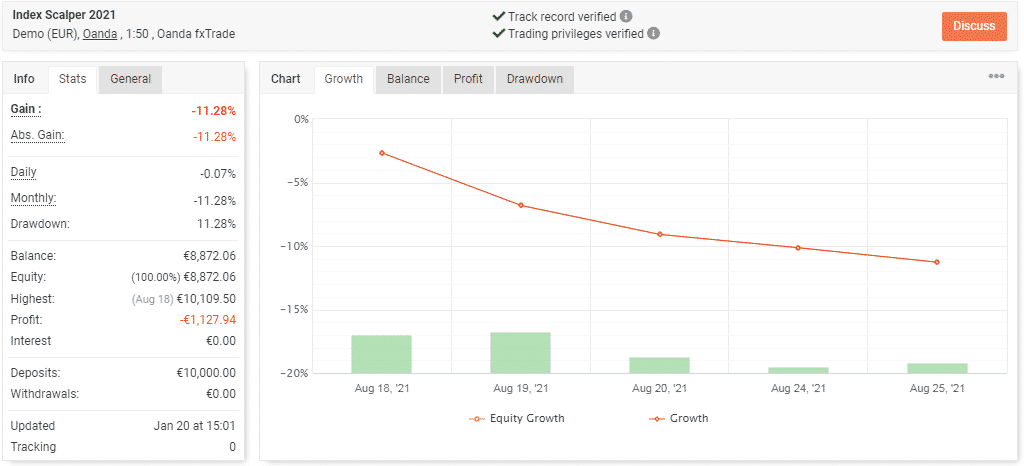

User reviews

The 2.8 customer rating on mql5 indicates that most traders using the EA are unsatisfied with it. We have posted a handful of reviews highlighting the users’ complaints. Apparently, Index Scalper only makes losses that can wipe out all the gains made, is costly, and makes only 2 or 3 trades weekly, etc.