Growex is a signals provider company based in London Cape town. Ed and Val are two main managers who use automated algorithms and manual approach to handle the trades. Let us observe the service and see if the company is profitable enough for investors to follow.

Growex: to trust or not to trust?

Growex account managers use risky grid and martingale strategies which can blow up your portfolio if the market chooses to trend in one direction. The company does not follow its rules of risk management and drawdown, which is suspicious.

Features

The signals have the following features:

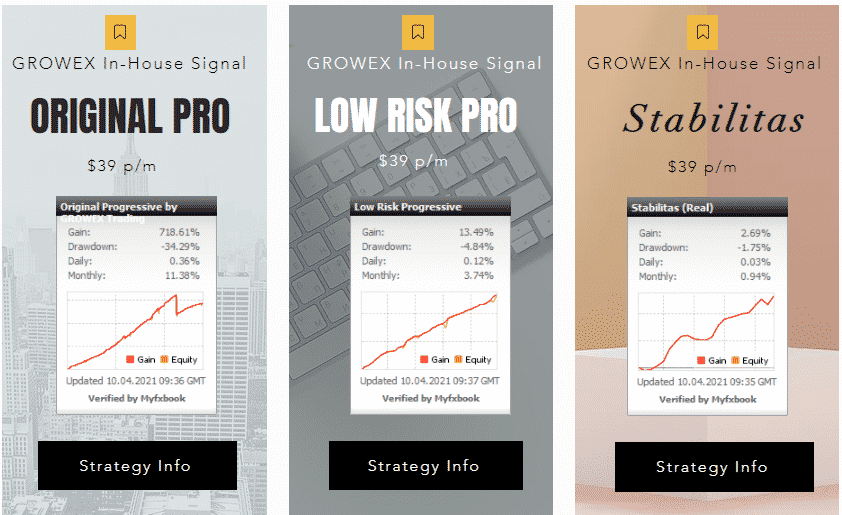

- It comes with multiple subscription packages that traders can follow.

- Traders can choose the amount of risk they are willing to take.

- They offer a free trial for traders to test them out.

- They host the accounts in dedicated servers to reduce latency.

- Support is available through telegram and live chat on the website.

To get the service up and running, you the following steps:

- Open a trading account with a reputable broker.

- Provide the account details to the company.

- They will install the designated platform and start copying the trades.

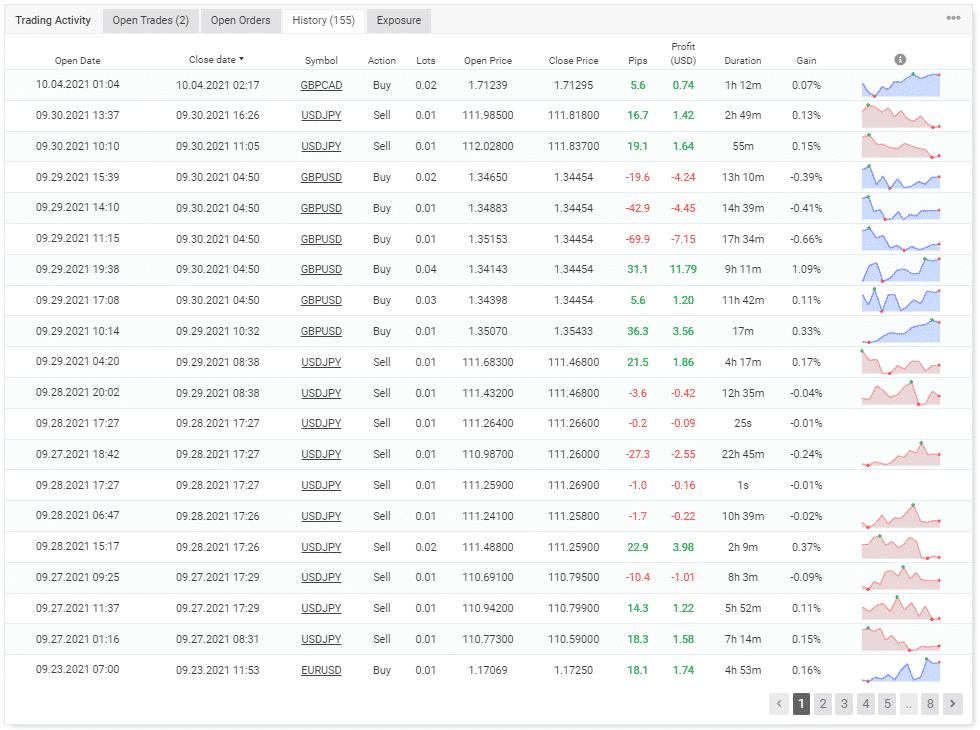

The providers are not transparent about their strategy on their website. On looking at the history on Myfxbook, we can see that they are using grid and martingale strategies in combination, which are quite risky to follow. They are trading on multiple currency pairs and hold the positions for an average of 8 hours and 6 minutes which conforms to a day trading methodology.

Price

The signals are available for an asking price of $39 a month. The cost is the same for all the packages.

Trading results

There are no backtesting records available that could have been provided as the company states that they use EAs for trading. We would like to see their performance on historical data to know what kind of drawdown we can expect in the future.

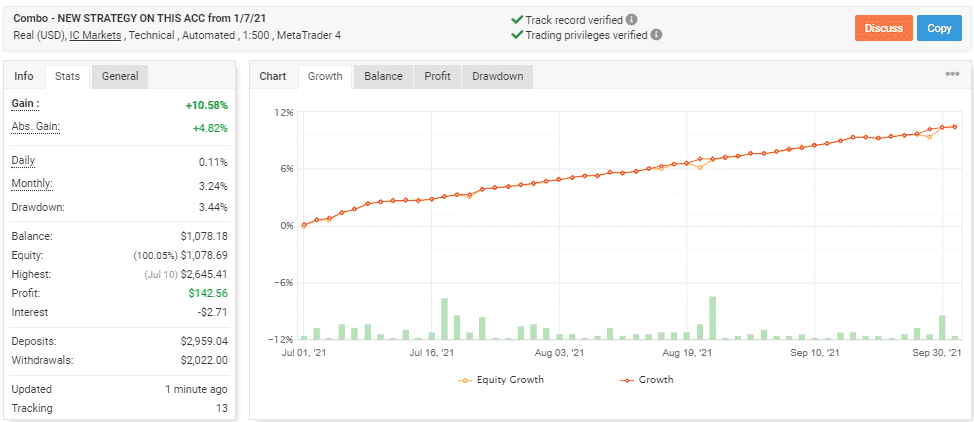

The dev shares the results of 2 live trading accounts on their website. We’ve decided to analyze one of them in detail called the combo plan.

Verified trading record shows performance from July 01, 2021, till the current date. The system has made an average monthly gain of 3.24% during the period, with a drawdown of 3.44%. The stated drawdown will likely increase in the future due to the implementation of grid and martingale.

The winning rate stood at 64%, with a profit factor of 2.61. The best trade was $19.59, while the worst was -$7.61. There were a total of 148 trades. The developer made $2959.04 in deposits and $2022 in withdrawals.

High drawdown

The current drawdown of the system is nominal, but the value will increase in the future when the market decides to trend in one direction.

Vendor transparency

Val and Ed are the two people behind the program. They present themselves as traders from the UK and Cape Town. They do not present a link to their portfolio and claim that they are highly experienced in the markets. Without any solid evidence, we can not believe their statements. Their WhatsApp no is given as +27 76 078 2659.

Customer reviews

There are only two reviews present at Forex Peace Army at which traders seem to be satisfied. The feedback can not be trusted as of now as they are little in number. An investor states that he has been following them on the demo account and is hopeful to make any profits.