The developers of Forex Pulse Detector imply that they created this robot with Forex traders in mind. Through this system, this client-base can hence obtain better results in the market. We demystify this claim in our review.

Forex Pulse Detector: to trust or not to trust?

Forex Pulse Detector cannot be trusted. We have identified many red flags that put its reliability into question. We particularly noted the following:

- It uses strategies that are both ineffective and risky.

- The vendor is not transparent.

- Customer feedback is suspicious.

Features

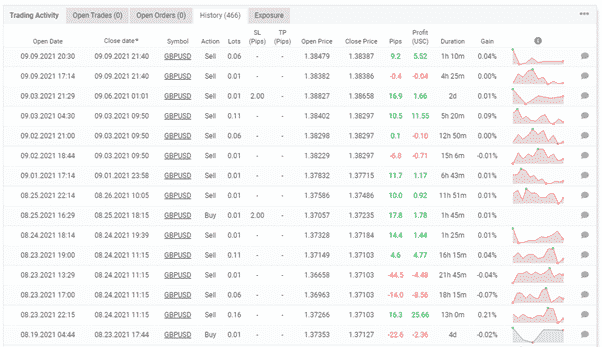

The developers say that their robot applies grid and scalping approaches. It works on short time frames that make it very active and able to gain pips quicker. But we also noted that, at times, the EA can go for several days without trading. This discovery can be confusing to traders who are trying to understand how it really works.

The main features of the system are:

- Supports GBPUSD and EURGBP pairs.

- Built in advanced loss recovery system.

- Works with all brokers and accounts.

- Hides SL and TP from the broker.

- High slippage protection.

- High spread protection.

- Money management.

- Broker protection.

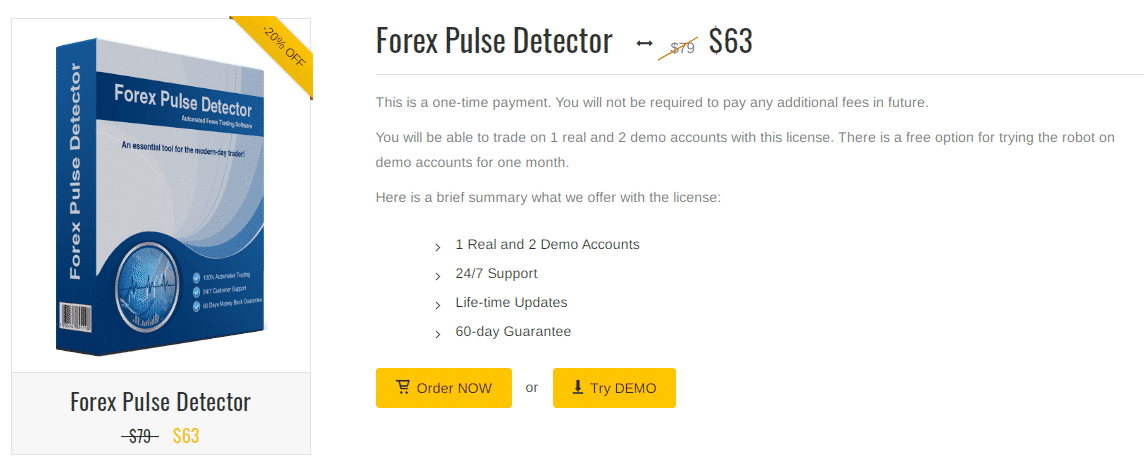

Forex Pulse Detector is being sold at $63 after the vendor dropped its price from $79. With this package, you get 1 real and 2 demo accounts, lifetime updates, 24/7 support and a 60-day guarantee.

Trading results

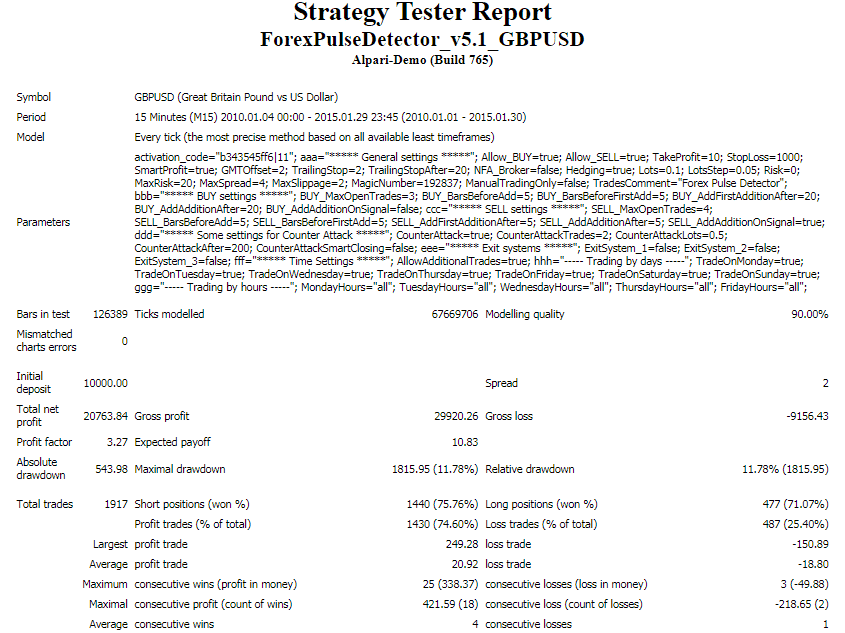

This report is proof that the EA went through a 5-year testing before going live. Thousands of trades (1917) were conducted as a result. The unremarkable performance of the short trades (75.76%) and long trades (71.07%) cannot be understated. The average profit trade was $20.92 when the average loss trade was -$18.80.

A total return of $20, 763.84 was realized from an investment of $10,000. The profit factor was 3.27 and the maximal drawdown was 11.78%.

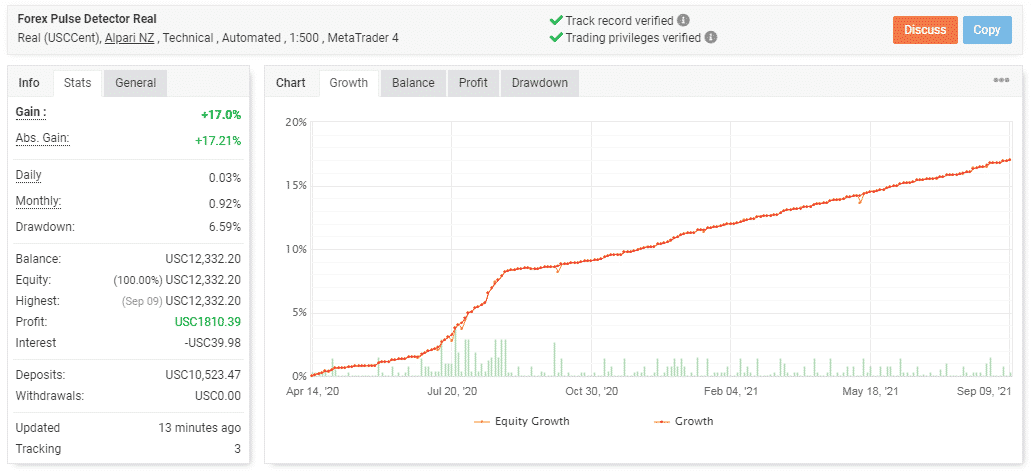

For an account that has been operating since April 14, 2020, a gain of 17% is unsatisfactory. The robot’s strategy is not profitable at all as shown by the low daily and monthly profits of 0.03% and 0.92% respectively. After the account was deposited at USC 10, 523.47, the profit generated is USC 1,810.39. So, the balance has not grown that much as it currently stands at USC 12,332.20.

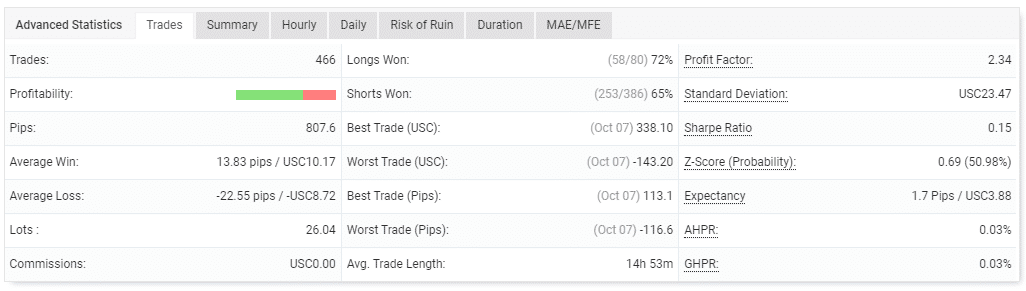

The bot has executed 466 trades with 26.04 lots. The average holding time for these deals is quite long, i.e., 14h 53m. The performance of the trades is not good as it has won 72% of the long trades and 65% of the short ones. The profit factor is 2.34.

The pips made are 807.6. The bot has been performing dismally as it mainly loses the trades it takes up. This is well illustrated by the average loss of -22.55 pips and the average win of 13.83 pips.

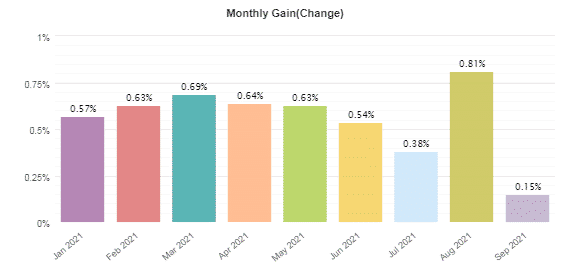

The results above highlight EA’s disturbing performance. Since January, it has not even managed to create a 1% profit.

The data above tells us that the grid approach is part of this system’s strategy. Even though the losses made are few, they are big compared to the wins. This is dangerous.

Low drawdown

The system has a low drawdown of 6.59%. However, this is no reason to celebrate yet. The grid approach is in play, and it will likely hold a losing position for a long time in the near future. This is when things will go south causing the drawdown to skyrocket.

Vendor transparency

The vendor has scored poorly in terms of being transparent. The closest they come to revealing their identity is stating that the team involved is composed of highly experienced developers and Forex traders. But there is no evidence to back up their said experience. Trying to contact them to find out more about their product would also be unproductive since no contact details or physical address are showcased.

Customer feedback

We only found one customer review on FPA and he praises the EA for having very good results. However, our assessment of the live trading performance has shown us otherwise.