What are the differences between variable and fixed spreads? This article will explore these concepts in more detail and how they affect forex traders.

The types of spreads we have include dairy, margarine, honey, yeast, and even meat. Jokes aside, these are certainly not the spreads forex traders concern themselves with unless you like to have a meal while analyzing the markets!

Ultimately, the spread in currency trading is the most constant charge every trader will face, regardless of their trading frequency, experience, or strategy.

We should note that while the spread doesn’t technically reflect an actual separate charge as commissions would, it has a bearing on how and when you enter the market and the markets you trade. In the world of currencies, brokers will offer two forms of spreads, floating or variable, and fixed.

Although forex has some of the lowest transaction costs out of all financial markets, it is beneficial to understand the distinctions between them, which this article will explore further.

Firstly, what is the spread in forex?

Before understanding the differences between variable and fixed, what is a spread? Let’s first recognize that one of the benefits of forex is you can often trade without any commissions on a per-order basis.

Of course, the question then becomes how brokers are compensated for their rigorous efforts of providing liquidity for us to buy and sell within milliseconds? The answer is charging spreads.

The technical definition of a spread is the difference between the bid and ask price. The bid is the highest price buyers in the market are willing to buy a particular pair; conversely, the ask is the lowest price sellers in the market ready to sell a particular pair.

At any given time before executing a position, your trading platform will always present both to you. The spread is essentially the broker’s built-in mark-up for sourcing a particular market from the numerous liquidity providers in forex.

If you place a sell order, you receive a price marginally lower due to the spread; if you place a buy order, you receive a price marginally higher due to the spread. So, how did we get to the point where we have floating and fixed spreads? Let’s explore this fact more in the next section.

Differences between variable and fixed spread

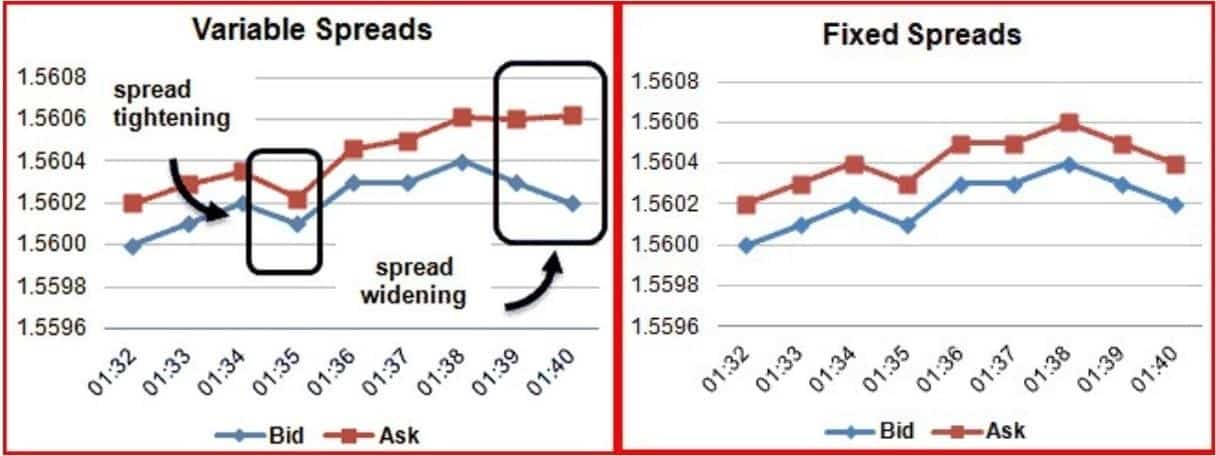

As the term suggests, fixed spreads remain relatively unchanged throughout the trading day, while floating or variable spreads vary according to different liquidity and volatility periods. Market conditions in forex are constantly in flux, and no two times are ever the same.

Like most market dynamics, when there is a lot of trading activity, transaction costs are lowered. On the flip side, when less buying and selling occurs, transaction costs can widen to compensate for the lack of activity.

Of course, this analogy is simplistic as we also need to consider volatility, though the basic idea is spreads are driven mainly by volume. It’s important to note how traders have fixed and variable options.

Primarily, a fixed spread is offered by what we refer to as a dealing desk or market maker broker. These institutions essentially create their own market, allowing them to set their own prices mimicking the real instrument as closely as possible.

On the other hand, variable spreads come from STP (Straight-Through Processing) brokers who pass your orders directly to the interbank market.

Although so-called dealing desk brokers continue to receive a lot of flak for this practice, there are numerous advantages of using these guys, provided they are appropriately regulated and reputable.

Truthfully, however, most brokers nowadays are never exclusively on one side of the fence and will regularly switch between STP and the dealing desk.

Why would you consider variable over fixed spread?

Variable spreads are generally sufficient if you don’t trade news events, exotic pairs, or scalp the markets. For instance, a 5-pip difference in the spread is inconsequential for the average swing trader since their profit targets are substantial and easily cover this cost.

Experts agree variable spreads are more transparent and reflective of the interbank market since the broker receives them from multiple liquidity providers rather than from a dealing desk. Moreover, your execution is usually a little bit faster for this reason.

Although floating spreads are constantly varying, they can be quite narrow most of the time, almost as much as fixed spreads.

Below is a summary of the pros and cons of variable spreads:

Pros:

- Faster trade execution

- More transparent pricing

- Spreads tend to be tighter most of the time

- No commissions

Cons:

- Not suitable for scalpers, new traders, and those trading exotic pairs

- Spreads can suddenly increase more widely during volatile periods

- Reqoutes are still possible

Why would you choose fixed spread over variable?

Fixed spreads undoubtedly offer some distinct advantages over their variable counterparts. Firstly, it’s vital to note that fixed spreads aren’t technically ‘fixed’ as the term may have you believe.

However, they are generally quite consistent throughout most of the trading day, only fluctuating here and there. Yet, they do not vary anywhere near the rate of variable spreads, meaning you can typically have more predictable trading costs because you are only charged a small commission per trade.

Fixed spreads are a must if you’re a scalper, trade high-impact news events, and also exotics since these are where spreads can be a lot higher than usual. Also, dealing desk brokers can offer special accounts like cent (where you trade nano lots) that you won’t typically find with primarily STP brokers.

While happening infrequently, the main downside is that fixed spreads can be prone to requote, especially if you have a large trading account. A requote occurs during a highly volatile market period where your broker cannot fulfill your executed order’s price in time, hence quoting you a new one.

Often, this price is worse than the initial one.

Below is a summary of the pros and cons of fixed spreads:

Pros:

- More calculable trading costs

- Lower capital requirements

- Necessary for high-frequency and news traders, those using robots and trading exotic pairs

Cons:

- Requotes are likelier the larger your trading account becomes

- Commissions are levied for every trade

- Slightly slower trade execution

Final word

Sadly, there are no ways of avoiding spreads altogether, but some do mitigate their impacts by constantly monitoring them and trading around specific periods of the day.

Overall, there are subtle yet crucial differences between the two spreads you encounter in forex—the decision on which to choose boils down to your trading style, strategy, and personal preference.