Breakthrough Strategy is an expert advisor that works during the closing hour of Friday. The positions close during the initial trading hours of Monday. As per the developer, Konstantin Kulikov, the FX EA works on multiple currency pairs. The FX robot boasts of a live account for three years with a high-profit percentage. This ATS is compatible with the MT4 and MT5 platforms.

Breakthrough Strategy: to trust or not to trust?

On evaluating the various aspects of this FX EA, we found several downsides that tip the scales against this system. The high drawdown, big lot sizes, and absence of strategy information are key drawbacks that make us suspect this is not a trustworthy EA. Although the price is not expensive and the developer boasts of a live account for nearly three years, the downsides are too significant to ignore. Let us look at the features of this FX EA first.

Features

The developer does not provide much info about this ATS. From the minimal details provided the features of this MT4/MT5 tool include the use of a stop loss for every trade and no grid, hedging, or Martingale approaches which are considered high-risk strategies. This multicurrency EA works on the following currency pairs: UDCHF, AUDJPY, AUDNZD, CADCHF, EURCAD, EURCHF, EURGBP, EURJPY, EURNZD, EURUSD, GBPCAD, GBPJPY, GBPUSD, NZDJPY, NZDUSD, USDCAD, USDCHF, and USDJPY.

When used in live trading, the FX EA automatically determines the GMT offset parameter using the local time of your computer. With the parameters, you can synchronize the EA setting with the time of the MT5 server. The developer claims that it can work on any timeframe and takes necessary data from many timeframes automatically. You need not change the magic number for using the EA on different currency pairs as the MT5 tool identifies the trades simultaneously by the currency pair and magic number.

This FX EA opens 5 to 10 positions a week with each having a virtual SL that is hidden from the broker. Recommendations for this system include the use of a lot size of 0.01 for a deposit of $100 and the leverage of 1:500.

On evaluating the various features of this FX robot here are some of the factors that make us suspect this is an untrustworthy EA.

- No explanation of the strategy.

- Verified trading results that reveal poor performance and strategy.

- High drawdown and big lot size.

Here is a detailed analysis of each of the above downsides we identified in this expert advisor.

No explanation of the strategy

As we mentioned earlier, there is not much info on the feature, recommendations, strategy, and other details. When compared to other similar MT5 tools on the MQL5 site, we find the lack of info suspicious. The developer does not disclose the strategy he uses for this EA which raises a red flag. Other than mentioning how the system opens and closes its trade orders, there is no further info available. We could not find backtesting results also for this ATS.

Verified trading results that reveal poor performance and strategy

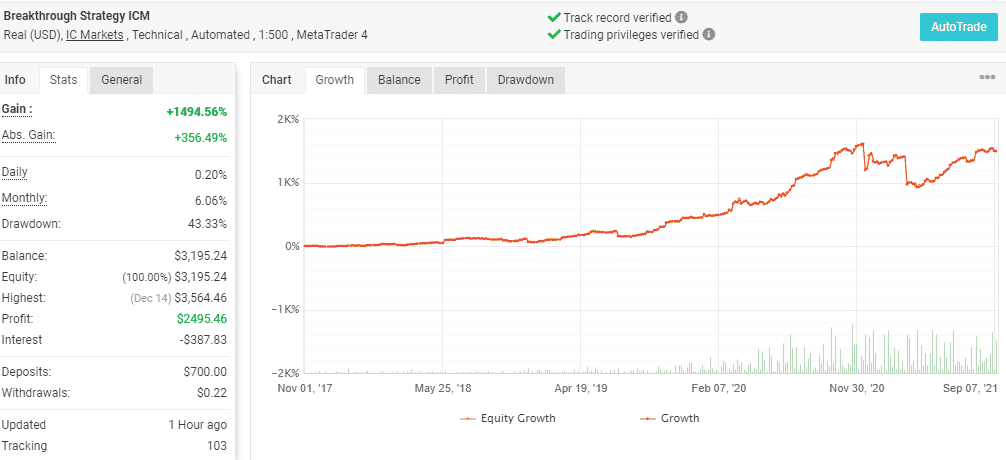

A real USD account live since November 2017 verified by the myfxbook site is present for this FX EA. The live account uses the IC Markets broker and an automated trading style on the MT4 platform using the leverage of 1:500.

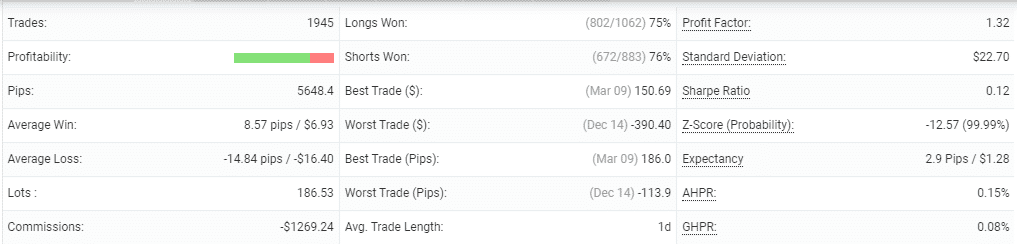

From the above screenshots, we can see the account has generated a total profit of 1494.56% and an absolute profit of 356.49%. The difference between the two values is huge indicating an ineffective or risky strategy. The account reveals a daily profit of 0.20% and a monthly profit of 6.06%. For a total of 1945 trades, the profitability is 76% and the profit factor value is 1.32. The low profitability and profit factor values also confirm our evaluation that the strategy is of high-risk.

High drawdown and big lot size

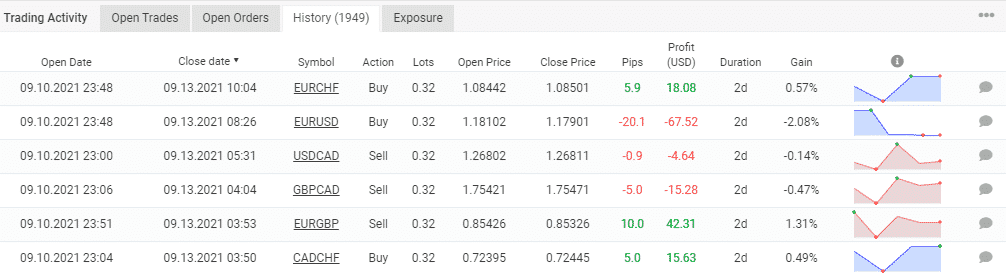

From the trading stats, we found the drawdown value is 43.33% which is very high. Such a high value shows that the approach used is dangerous and runs the risk of losing nearly half the capital. Most traders would not be comfortable with such a high drawdown. Further, the trading history reveals the lot size used for the trades is 0.32 which is very high. The high lot size also makes us suspicious of the efficacy of the money management method used.