In the 21st century, many countries employ the strategy of having a floating exchange rate. They focus solely on achieving economic growth by improving the output potential of domestic markets and increasing GDP. The shifts in exchange rates are just a by-product. Others choose to follow the world’s largest economy by pegging their currency to the US dollars as a standard metric.

China, however, has been taking on a different approach. Although initially pegging the yuan to the US dollars, they have deviated from this path by further lowering their currency value. The pegging policy started in 1994 and lasted for more than a decade. The fixed exchange rate policy has recently caused controversy between China and the US, leading to an economic war. During Donald Trump’s presidency, the US has levied numerous tariffs on Chinese goods to combat this policy.

In this article, we will debunk the reasons China keeps a fixed exchange rate and how they manage it.

Currency theory

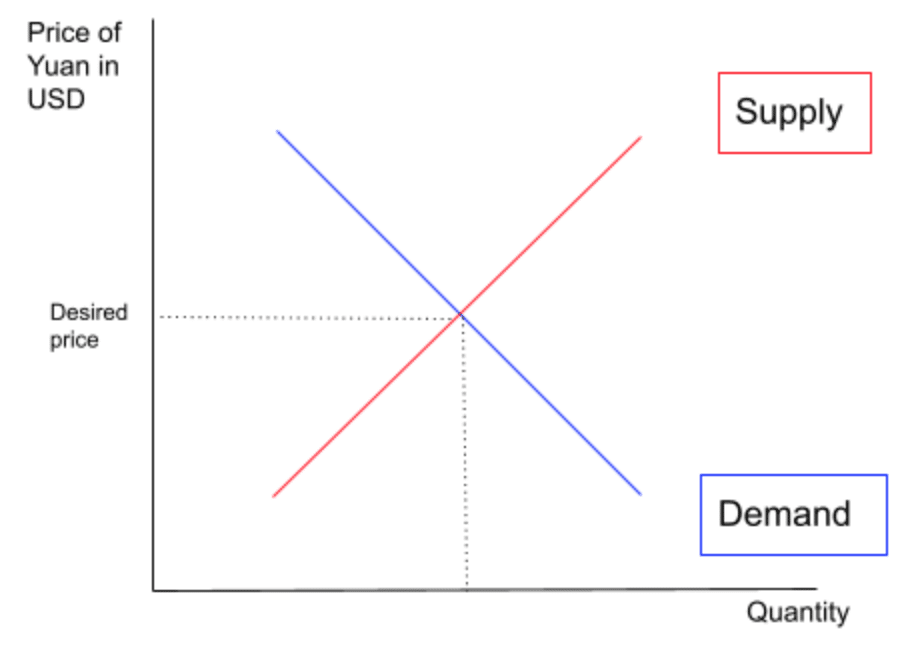

The exchange rate between currencies is based on the most basic of economic theory: demand and supply.

The diagram above represents the supply and demand of Chinese Yuan. By having a fixed exchange rate, China will alter the value of their yuan to mirror the ‘desired price’ on the forex market. They will have tools at their disposal to change the demand and supply of their currency to match the movement of the US dollars. As they want to keep it low, they will either decrease demand or increase the supply of the Chinese yuan.

The supply of the money is money that goes out of the country in the form of imports, transfer out of the country, or outward migration. On the contrary, the demand for money is the money that goes into the country, such as exports, inward transfers, or immigration.

It is important to note that, if someone wants to buy something from another country you are required to buy their currency to complete the transaction.

Why does China employ a fixed exchange rate

The primary reason for China’s fixed exchange rate is the competitive advantage it brings with its exports. A fixed exchange rate will make China’s exports relatively cheap in foreign countries. As it is more affordable, the demand will be higher. To accommodate this high demand, more jobs and investment opportunities will be available in China. By providing jobs, it builds a strong economy with low unemployment and high GDP.

There is also an element of sustainable growth. China’s GDP will increase as consumers spend more, firms invest more, and there are more exports without the government having to spend its budget on expansionary policies. Additionally, there will be a current account surplus which will be healthy for China’s balance of payments.

Another reason that may contribute to China’s decision is the competitive nature of the trades with the US. The US protects its domestic industries by levying a tariff on Chinese exports. A low exchange rate will offset this tariff as the exports will be relatively cheaper.

Potential costs of a fixed exchange rate

Despite the fixed exchange rate being a formula for success, China does have to contend with some problems that stem from its policy.

Firstly, there is a tendency to overinvest in exporting industries at the expense of domestic markets. It can lead to overspecialization and possibly high reliance on imported goods.

The trade-off for having cheap exports is expensive imports. This can drive up inflation as aggregate demand increases through the net export component.

High reliance on very expensive imports may sky-rocket living costs in China.

How does China keep a fixed exchange rate

As mentioned earlier, China’s low currency value is maintained by increasing the supply and decreasing the demand for the Chinese yuan.

The former is achieved through the use of foreign reserves. The Chinese government and central bank will sell the yuan into the market for another currency. This will increase both the supply of the Chinese yuan and China’s foreign reserves. We can see the effects of this through China’s staggering $3.3 trillion worth of foreign reserves, more than double second placed Japan at $1.3 trillion as of July 2021.

This can give China political and economical leverage over countries that owe them money. Also, having foreign reserves will give China a buffer in a case of emergency or if they decide to enforce an expansionary policy.

To decrease demand for the yuan, the government and central banks can decrease the interest rate. Foreign investors will not see benefits in savings in China because of the low interest rate. This is also an expansionary monetary policy, as Chinese people would also spend more which achieves China’s goal of having a strong and stable economy.

Conclusion

China’s fixed exchange rate has been a point of contention for many countries, especially the United States. Many believe this gives China an unfair competitive edge on exports. This advantage allows China’s economy to grow at a faster rate, and gives its citizens more prosperity.

However, this is not without its challenges. The fixed exchange rate causes China’s imports to be relatively expensive. Furthermore, to sustain this exchange rate, Chinese government does risk having a high amount of inflation due to the combination of expansionary monetary policy and high net exports.