In any economy, a currency is an essential medium of exchange for trading goods and services.

Foreign exchange, or forex, has expanded this concept to the international stage where all kinds of individuals and corporations globally can transact, do business, borrow, earn interest, store their wealth, and more.

Therefore, it’s befitting that we have many participants who trade forex for various reasons. This article will be an educational study into the numerous contributors and the power dynamics.

Retail traders vs. institutional traders

The primary distinction is that a retail trader is the average Joe trading their personal accounts. This group is characterized as heavy speculators trading purely to make a profit in the short term.

On the other hand, an institutional trader is part of an establishment like a bank, hedge fund, or corporation and doesn’t trade for themselves.

Moreover, they don’t necessarily engage in profit-driven trading depending on the purpose of their engagement in forex (as we’ll cover in the next section on market participants).

Retail traders have limits in the position size they can place, usually not above 100 lots (worth $10 million). Conversely, an institutional trader is far more dominant and regularly places orders worth several times higher, often hundreds of millions or more.

A question that’s often asked is whether institutional traders have the edge over retail traders. For the most part, the answer is yes. Despite retail traders dominating the bulk of spot forex (the most popular type of currency trading), institutions contribute the most to volume.

Moreover, institutional traders get lower spreads, have access to much better technology and resources, receive crucial information before it’s publicly released, etc.

The motivations for trading forex

It’s popularly referenced that several trillion daily are traded in the forex market. However, the uninformed trader may not recognize that only a portion of this volume consists of simple spot exchanging. Broadly speaking, the main divisions of forex are:

- Swaps

- Forwards/futures

- Spot

- Options (and other products)

Swaps, forwards/futures

This segment of forex is far less speculative and is primarily used for hedging purposes. Also, these instruments are generally reserved for institutional traders like banks and corporations.

However, futures and forwards have started becoming available at a retail level where traders speculate for profit.

- Swaps: A few types of swaps exist. However, the basic premise is taking a loan to borrow a foreign currency at a reduced cost while limiting exposure to exchange fluctuations. Participants look to secure cheaper debt and sometimes even earn interest.

- Forwards/futures: These are pretty similar, differing where they are traded. Regardless, their essential purpose is ‘locking in’ exchanges rates, specifically in cases where one party holds too much of a currency and needs to ‘offload’ it temporarily by accepting another.

Spot, options, and other products

Contrastingly, many of the instruments in this regard are used purely to profit in the short term. Spot forex is the most popular type of trading, being that it’s the most accessible and easiest to understand.

We find virtually participants engaging in spot forex because of the need to exchange currencies immediately. Options are also relatively prominent but are more suitable for more experienced traders.

List of market participants

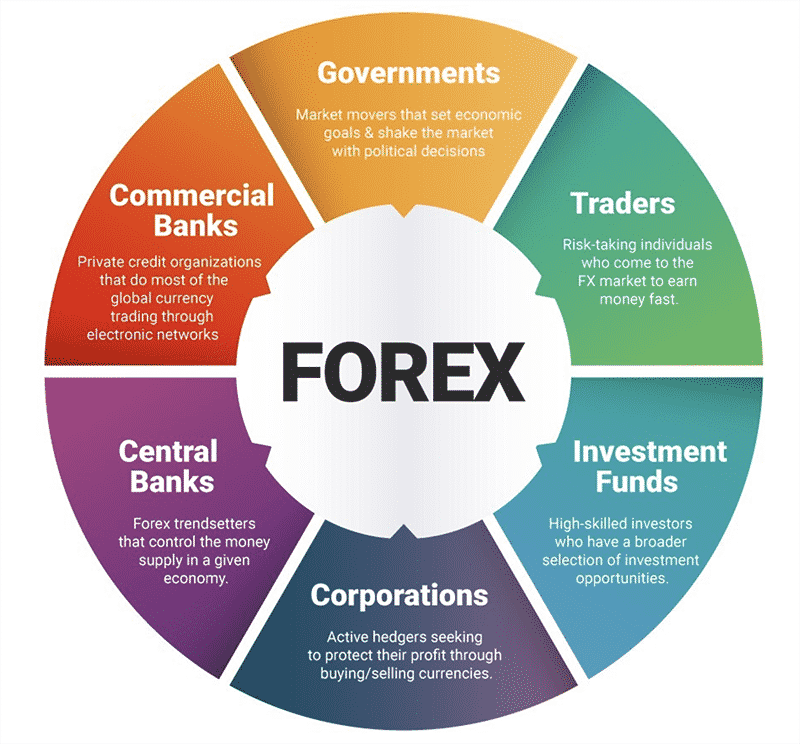

Let’s now look at the actual participants and some of the primary reasons they engage in foreign exchange. The image below shows the main groups trading currencies.

Except for the ‘Trader’ (retail), all other participants in forex are institutional.

- Commercial banks: These guys form the heart of all foreign exchange; no market would exist without them. This group is also known as the interbank market, simply referring to large commercial banks trading currencies amongst each other.

At their core, commercial banks provide liquidity for all forex dealers. Secondly, these organizations use foreign exchange to offer services to their clients. Such banks may also speculate for profit like retail traders in some cases.

According to a 2021 study by Euromoney, the top 10 banks by volume in this exclusive category include JP Morgan, UBS, Deutsche Bank, XTX Markets, Citi, Jump Trading, Goldman Sachs, Bank of America, State Street, and HSBC.

Predictably, commercial banks will primarily engage in spot trading.

- Central banks/governments: This class refers to the individuals responsible for monetary policies which are altered by interest rates.

Whether a central bank or government wants to increase or decrease inflation will determine how much money will be pumped into the economy.

Another motivator for them to trade forex is investing in other countries with better interest rates by buying large quantities of their currency. They may even intentionally weaken their domestic money to make exports more competitive.

This group will predominantly partake in spot, swaps, and forwards/futures.

- Corporations: This class of participants consists of massive multinational companies importing and exporting their goods between overseas countries. This means the need to convert foreign currencies will always be substantial.

Corporations are particularly noted for their participation in futures, which they use to ‘lock in’ exchange rates while awaiting a later-dated payment from another corporation.

Of course, this division is free to participate in other types of currency trading as well.

- Investment funds: This bracket of participants notably includes hedge funds but will also consist of other pool-funded organizations trading on behalf of pension funds, endowments, foundations, private investors, etc.

The main job of these guys is getting a return for their clients and hence will participate in spot or other types of forex as part of a diversified portfolio.

- Traders: Last but not certainly not least are retail traders, a segment of forex which has exploded in growth over the last two decades.

Virtually all the people here trade currencies for profit speculation and participate mainly in spot forex and other accessible products like options and futures.

Curtain thoughts

The point of this article is for us to appreciate why forex remains the largest financial market on the planet.

This instrument empowers virtually everyone, whether you’re trading from your bedroom, a central bank president deciding on the new interest rate, or a multinational car manufacturer waiting on a foreign payment from a parts distributor.

However, learning this information should be treated as general knowledge since it doesn’t give you much edge in better predicting price movements or developing more enhanced trading approaches.