We’d like to talk about another FXAutomater’s product today – Volatility Factor 2.0

A robot has a 2.0 version and is advertised as “the most powerful EA on the Forex market.”

The robot has indicators that allow trading big market movements. Money-management tracks open deals to close them using a Trailing Stop Loss feature. Spread and slippage protections were designed to keep the deals in the best shapes.

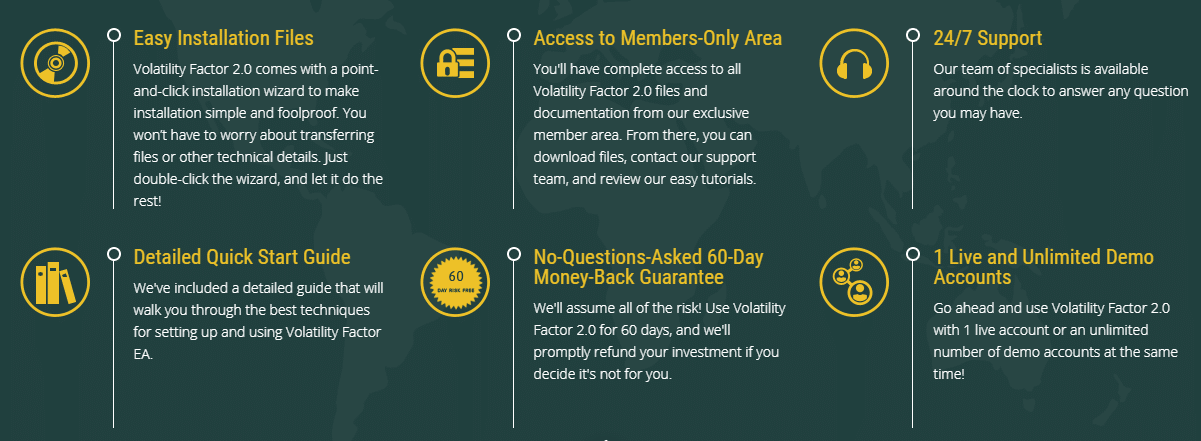

The devs systemized everything that will make our trading experience smooth and sound. There’s a simple installation, user guide, and other manuals, getting access to the members’ area, welcome and knowledgeable 24/7 support, one live and unlimited demo account package, and a 60-day money-back guarantee.

Volatility Factor 2.0: To Trust or Not to Trust?

The robot opens trades on the following symbols: GBP/USD, EUR/USD, USD/JPY, and USD/CHF. The system has received approval from NFA and FIFO. So, it’s allowed to be used in the US. This increases our trust a bit, but before we get sure that the EA is good to go, we have to check its trading results.

Features

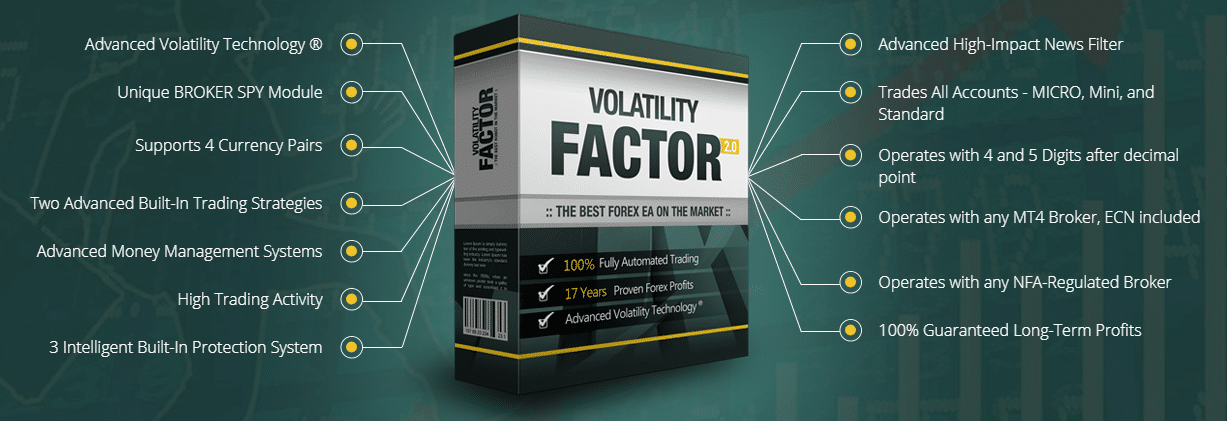

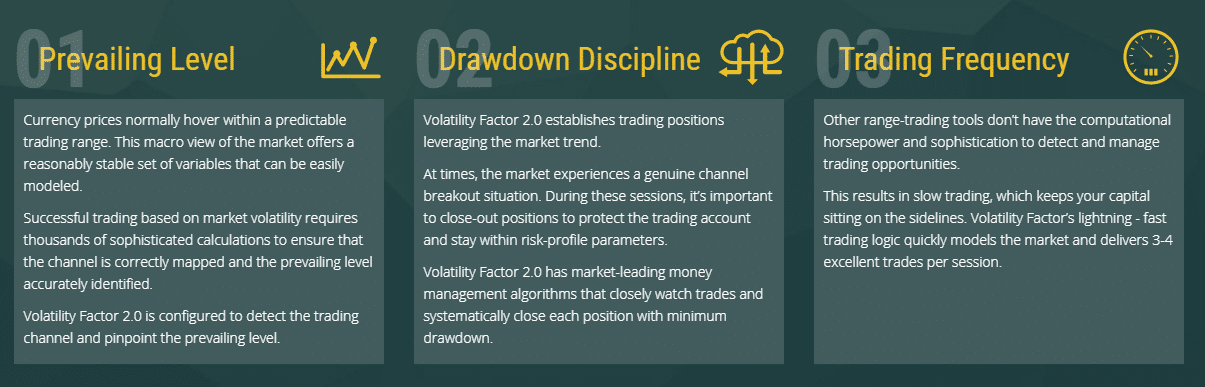

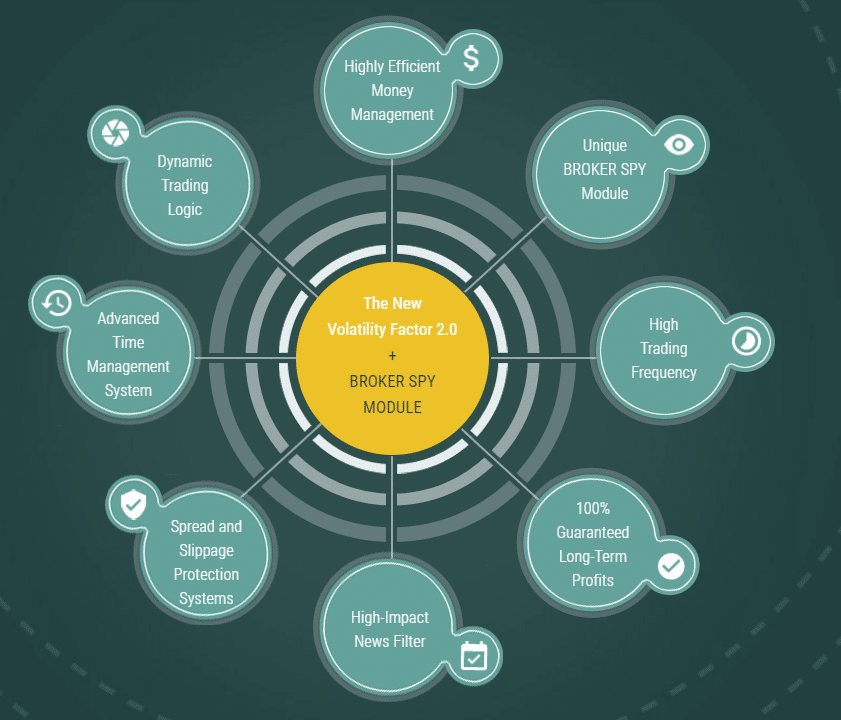

All features appear several times during a presentation, but this picture is the best way to mention all of them:

- The system was designed on advanced technologies that should increase its stability.

- A Broker Spy Module can cover us from unique activities from the broker side.

- The EA supports only four currency pairs: GBP/USD, EUR/USD, USD/JPY, and USD/CHF.

- The system was sewn two independent from each other trading strategies.

- Money management allows us to use Lot Size or calculate it for us automatically based on available margin and account balance.

- Volatility Factor is a high-frequency trading solution.

- The system is protected by a news filter that doesn’t open trade during High-impact News.

- We can trade on any type of accounts: Standard, Mini, and Micro.

- The best option is to run an EA on the ECN account.

- We can use the services of NFA brokers.

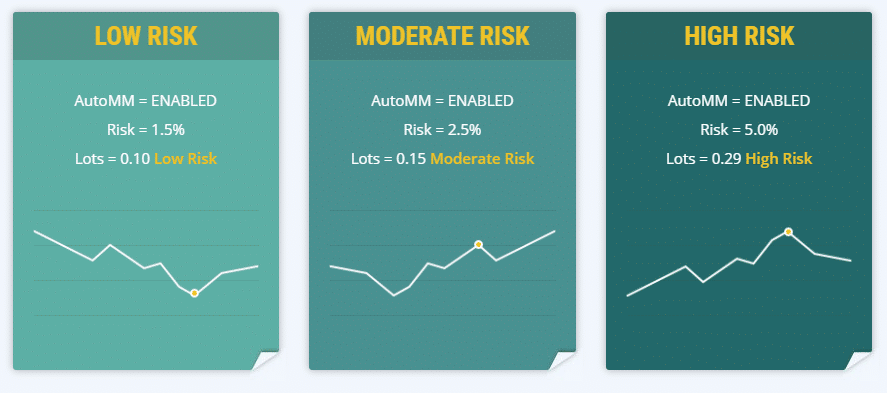

The Volatility Factor supports three levels of risk. Lor risks are 1.5% to the account balance or 0.10 Lot Size. The medium risks are 2.5% and 0.15 Lot Size. The highest risks that are supported by the EA are 5.0% and 0.29 Lot Size.

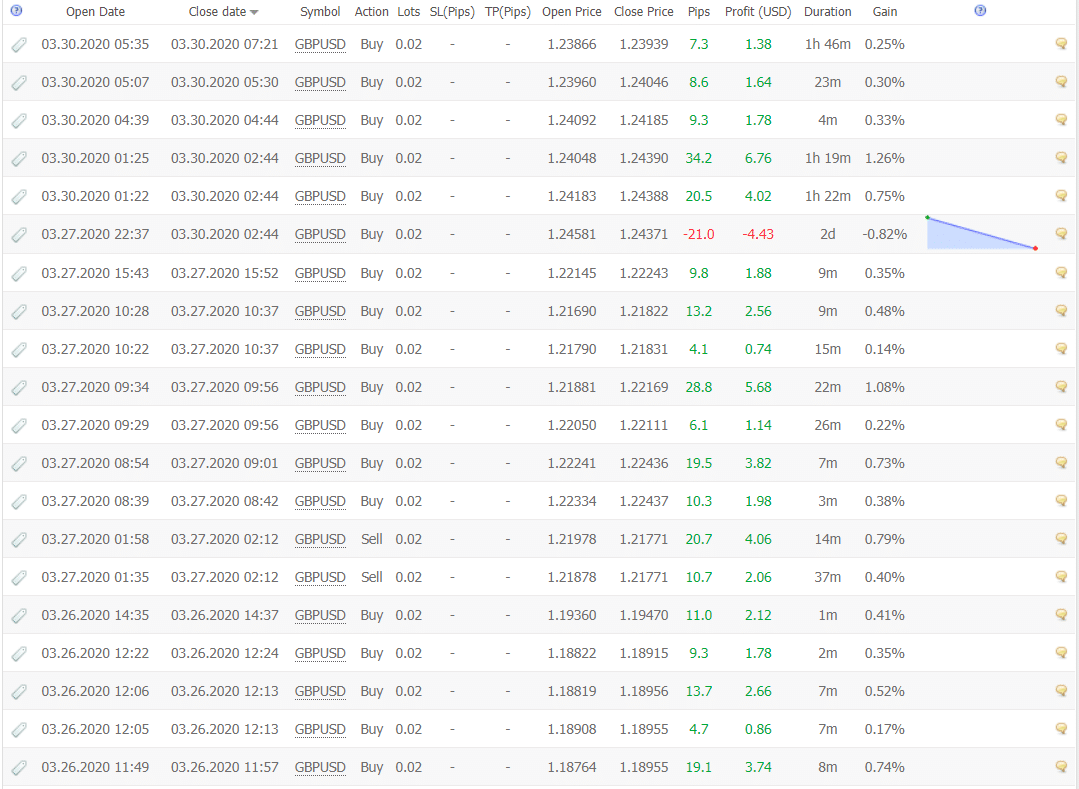

As we can see from the sheet, threading frequency is not that high and equals 3-4 trades daily. An average pips gain for a trade is 10-20 pips.

The first version of the robot has reached 62k pips when the second has got 107k+ pips and keeps growing.

Good 3rd-party verified Trading Results

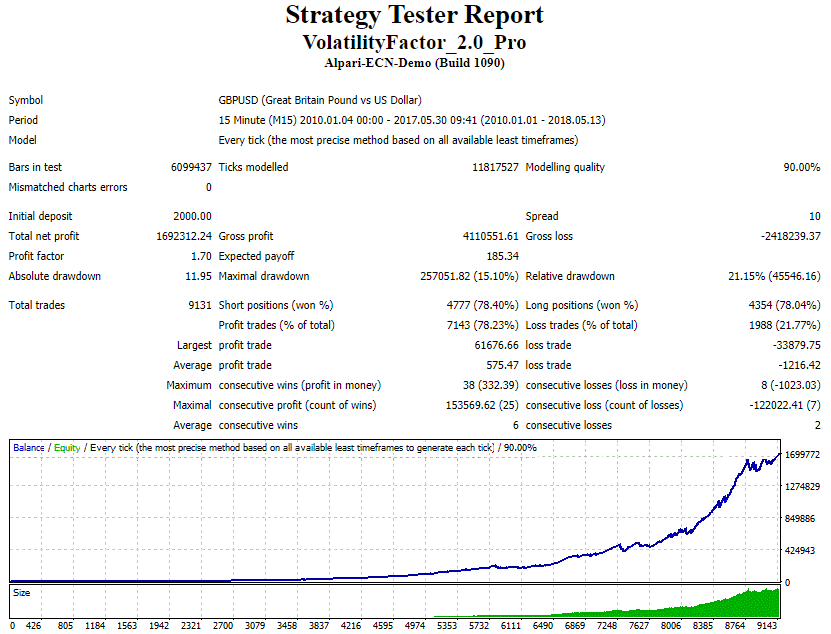

It’s a GBP/USD backtest on the M15 timeframe. A test was run for seven years. The modeling quality was 90%. An initial deposit of $2000 became $1,69M of the total net profit. The Profit Factor was 1.70. A maximum drawdown was little and amounted to (15.10%). The robot closed 9131 trades with a 78% win-rate. The average consecutive wins were 6; losses were 2.

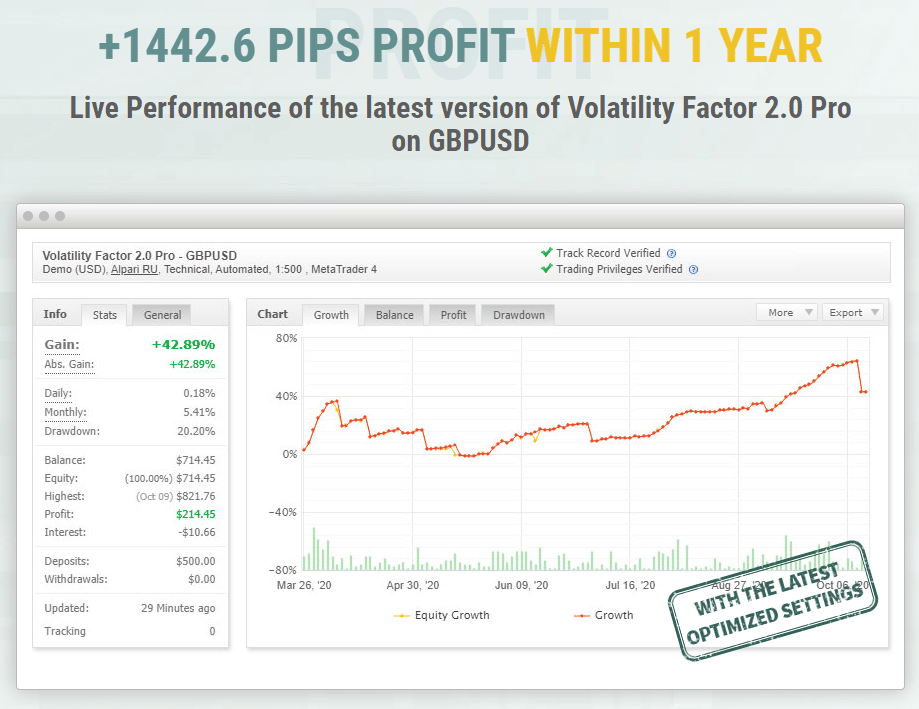

The presentation is featured by widgets with “The Latest Optimized Settings,” but according to the chart, these settings brought a huge loss.

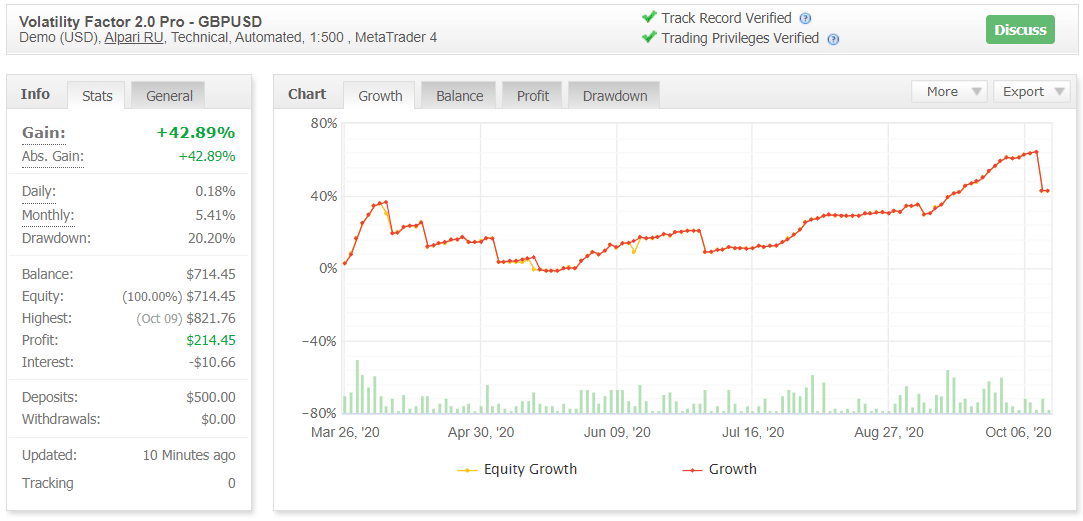

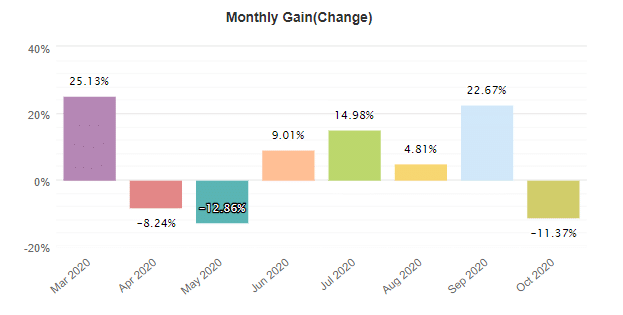

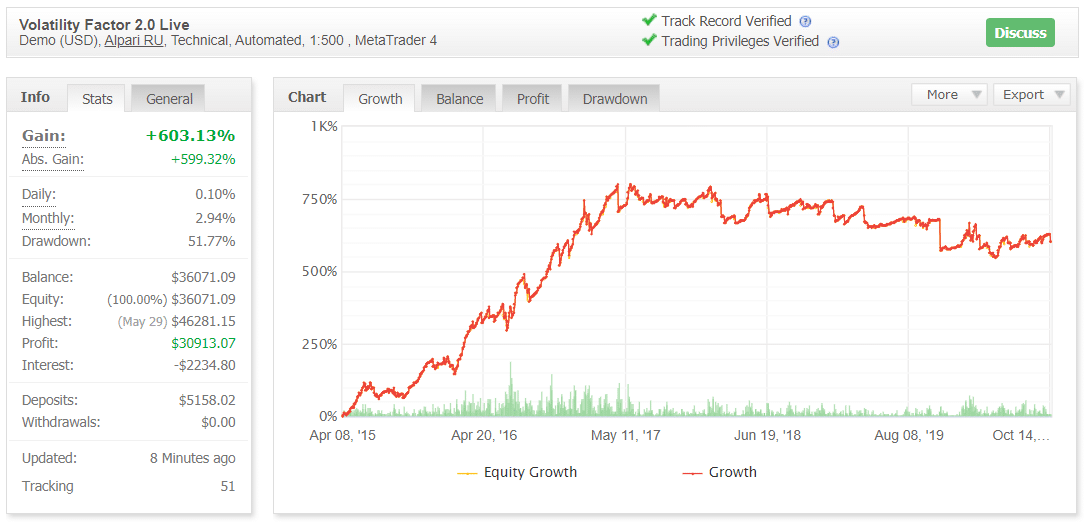

Volatility Factor works on a demo account through an Alpari RU broker with 1:500 leverage on the Meta Trader 4 platform. An account was created on March 26, 2020. For seven months, the total gain became +42.89%. A monthly gain is 5.41%, with 20.20% of the maximum drawdown.

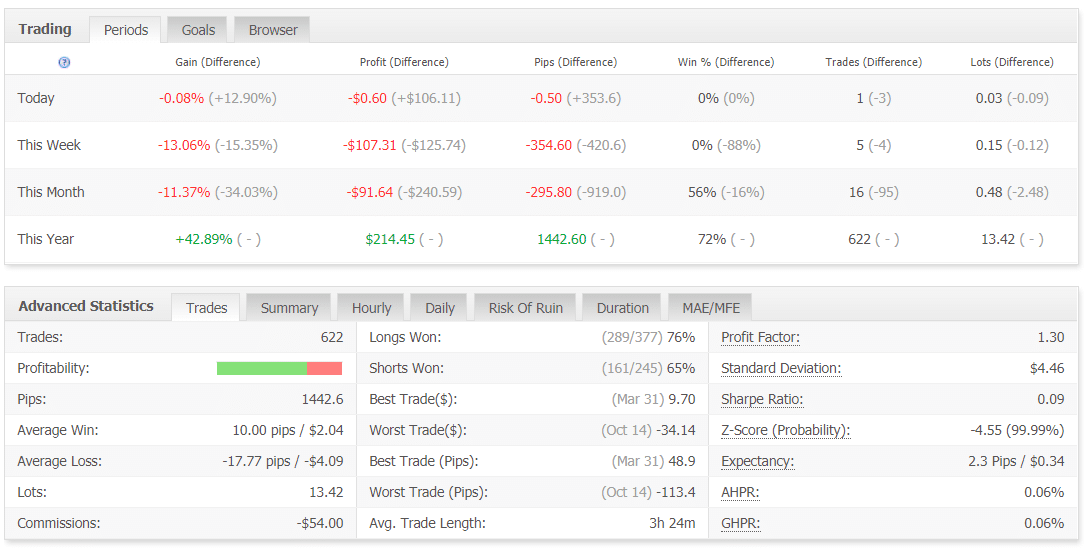

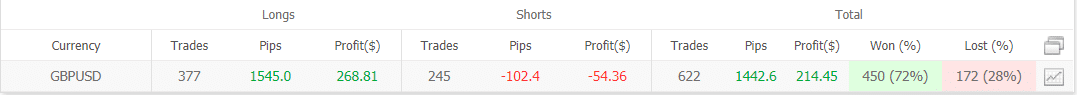

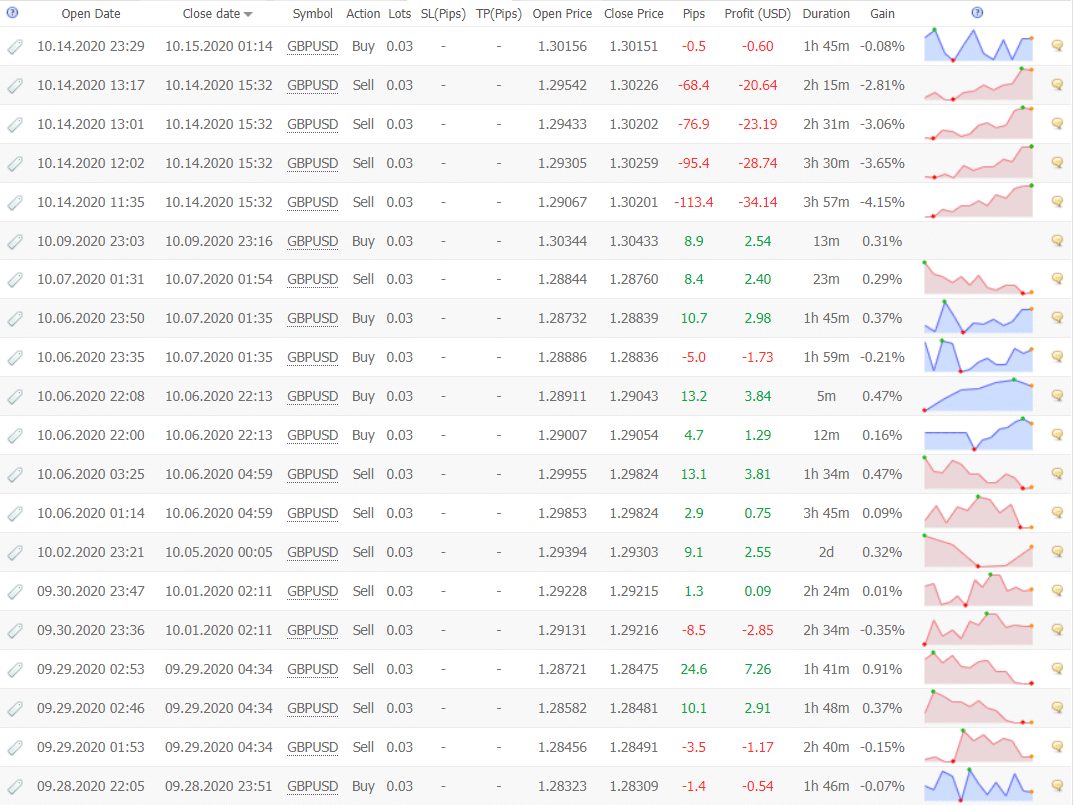

Last month’s trading results were horrible. Volatility Factor closed 622 deals with 1442 pips. An average win (10 pips) is almost twice less than an average loss (-17.77 pips). A win-rate for Longs and Shorts varies too. Longs’ one is 76%, Shorts’ is 65%. An average trade length is over three hours. The EA trades with a mediocre Profit Factor (1.30).

The Shorts’ direction was a loss bringer. It’s weird because usually, Short Trades are more profitable.

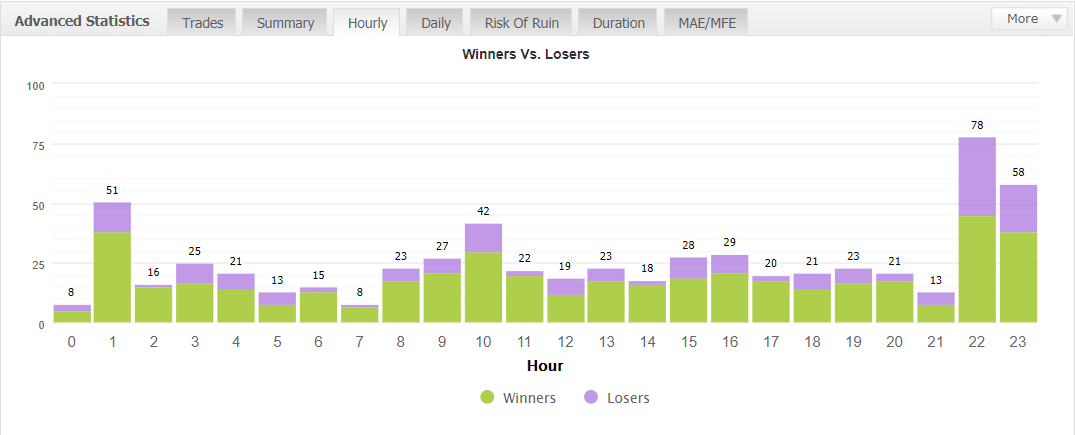

As we can see from the chart, a scalping pattern trades during an Asian market, the second one works for the rest of the day.

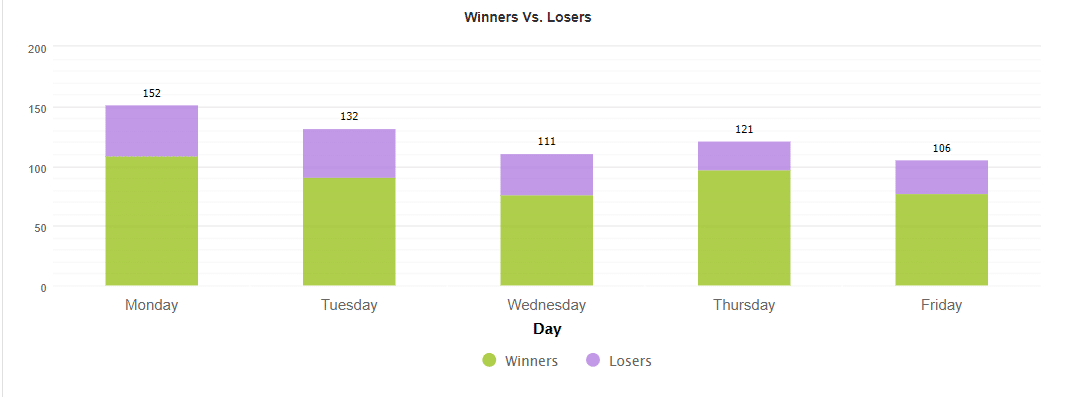

The weekly trading results look common.

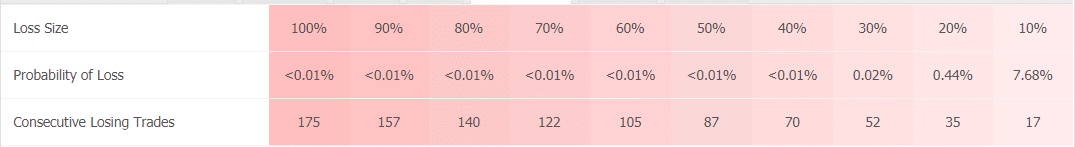

The account is run with medium risks.

The last trades were unsuccessful. From the number of lost pips, we can be sure that something is broken in the money-management system. You can’t be profitable when the average trade brings +7 pips, and some of the losses -100 ones.

It’s how the trading results looked at the beginning.

The annual chart shows that we can’t expect from the EA to be predictable.

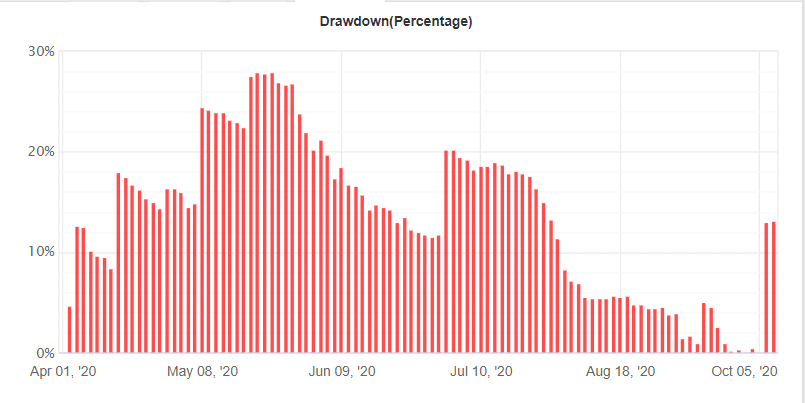

High Drawdown

The whole trading story, the EA trades with high and consistent drawdowns.

Vendor Transparency

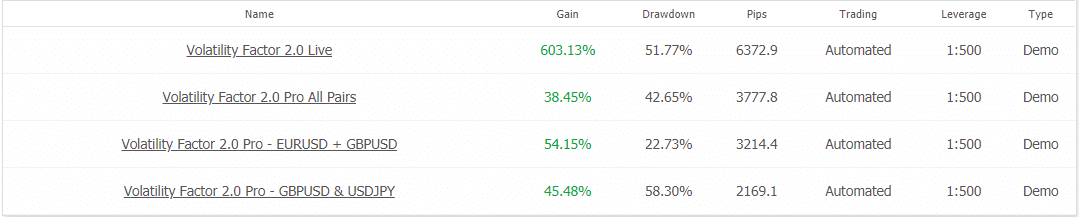

The vendor has many Volatility Factors’ accounts, but all of them are the demo ones.

It’s another one. We provide it to show that for the last three years since May 2020, the EA lost money.

Pricing

At the start of the presentation, we’ve seen their standard offer with a countdown.

Volatility Factor costs $187 with a $160 OFF for one real account license.

The vendor provides a 60-day money-back guarantee to cover if the robot doesn’t work well.