Gold has increased in popularity in recent years as forex traders seek solid investments that can hedge against inflation, market volatility, and other geopolitical factors affecting currency pricing. Traders can use gold to hedge against other investments or as a safe haven that provides consistency over time and is less susceptible to severe price volatility than many other currencies.

XAUUSD is one of several gold pairings offered by forex brokers today, making it easier than ever to incorporate gold into your forex trading strategy. Gold’s price stability over time makes it a useful asset during inflationary periods like the one we’re seeing right now.

What impacts the gold price?

The impact of geopolitics

Because gold is a popular safe-haven investment, it performs well during times of geopolitical crisis. During trade disputes, war times, disruptive national elections, and other key events, demand for gold rises as investors seek a reliable store of value, causing the price of gold to rise.

Demand and supply

Demand and supply, like with most precious items, have a key impact on gold price changes. If demand for the bullion is high, but supply stays low, the price will rise owing to scarcity. In contrast, if the supply of gold increases but demand stays low, prices will decline.

Inflation

Although not a guarantee, rising inflation tends to push gold prices higher, while lower inflation weighs on gold. Inflation is usually always an indicator of economic expansion and prosperity. When the economy is developing and expanding, the Federal Reserve is more likely to increase the money supply. Expanding the money supply dilutes the value of each existing monetary note in circulation, making it more expensive to purchase gold.

Economic data

Economic data such as manufacturing statistics and broader-based data such as GDP growth all influence the Federal Reserve’s monetary policy decisions, which can affect gold prices.

Though not guaranteed, a better US economy such as manufacturing expansion and GDP growth in excess of 2% tends to push gold prices lower. On the other hand, poorer job growth, rising unemployment, weakening manufacturing data, and substandard GDP growth can all lead to a dovish Fed scenario and higher gold prices.

How to trade XAU

Using Fib retracement levels

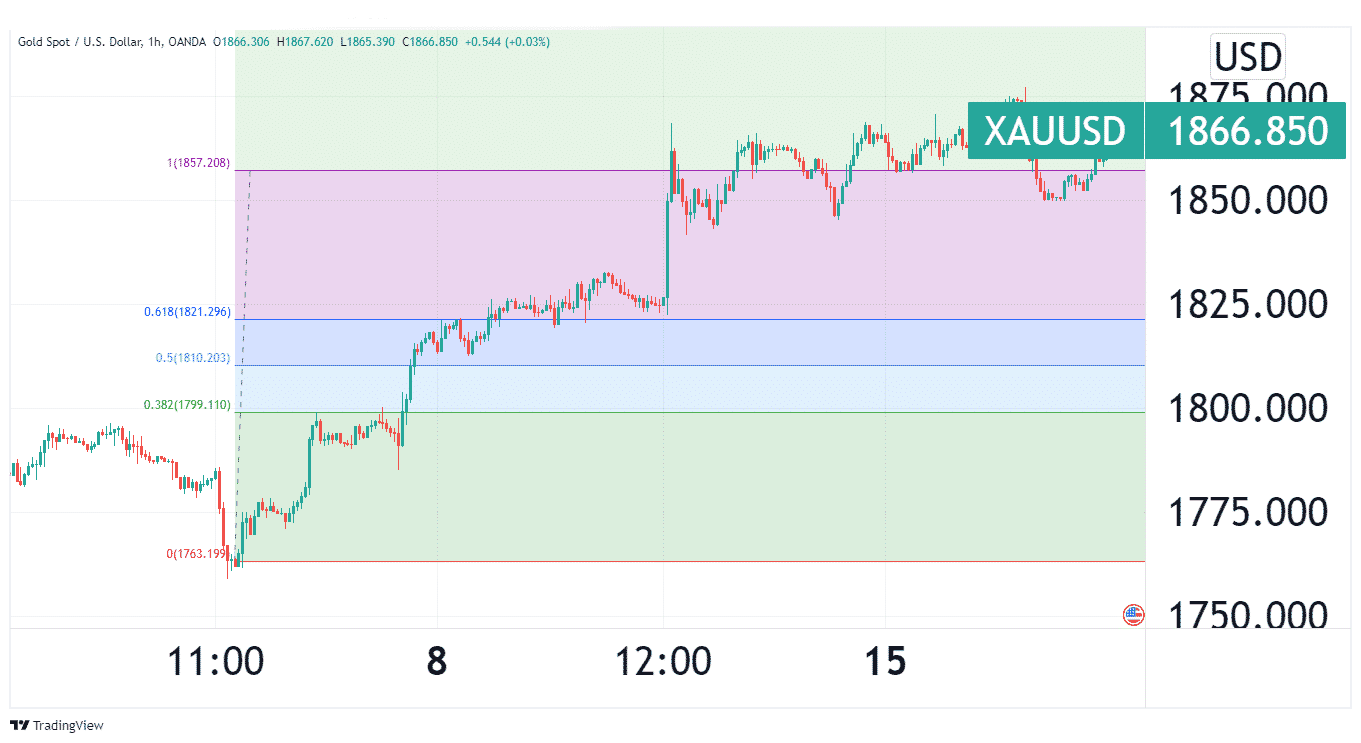

On a gold chart, the price does not move in a straight line up or down. Instead, it moves in a zigzag manner. The Fibonacci Retracement tool is used to determine where the zigzag will end. The levels of retreat are 38.2 percent, 50 percent, and 61.8 percent. These are the levels at which the gold market is expected to retrace.

We placed a buy order just between the levels 38.2 percent and 50.0 percent, with our stop loss just below the 61.8 percent pullback threshold because we know this is only a pullback based on our use of this indicator.

In the XAUUSD chart above, if you had placed the buy order between 0.382% and 0.5% and the stop loss at 0.618%, you would have made a profit.

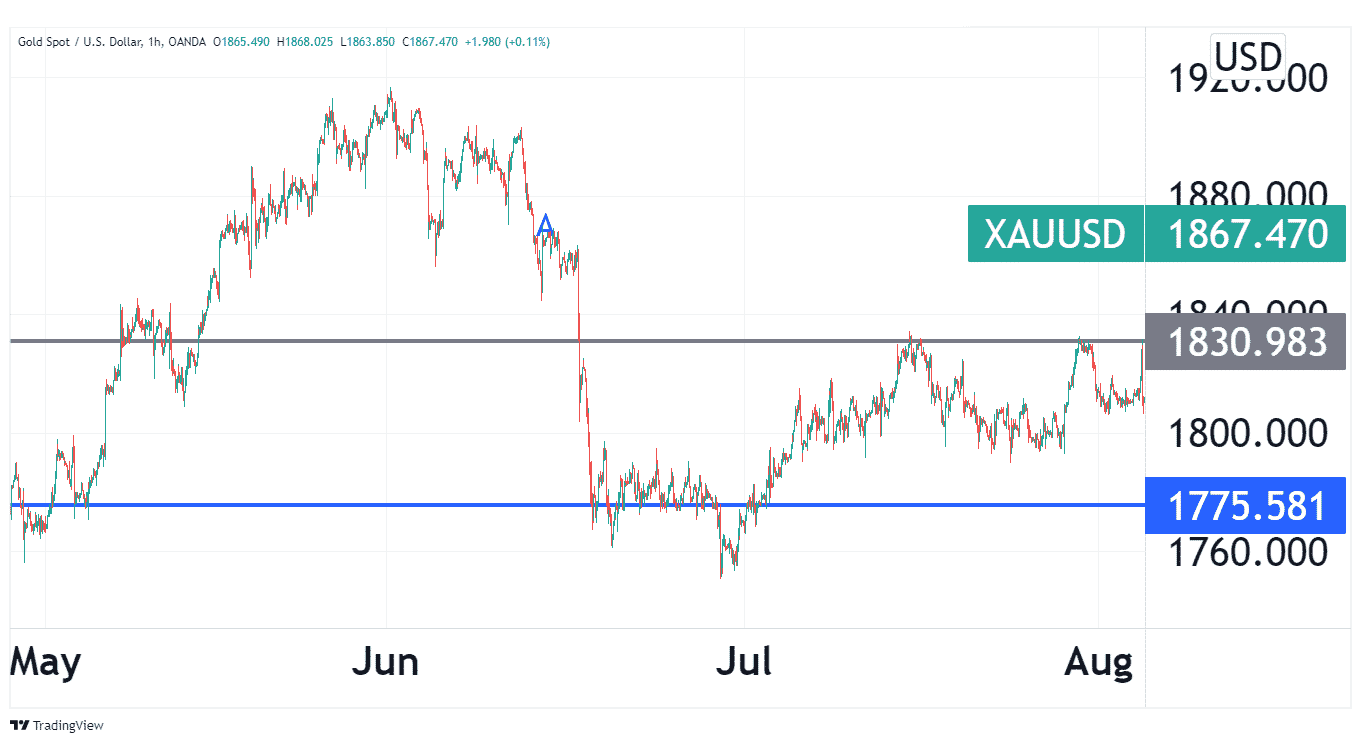

Use of support and resistance levels

Support and resistance are key tools that traders employ to read and interpret market activity. It is based on the idea that the price may struggle to break above or below specific resistance or support levels.

Support is a price level where a downtrend stops due to increased demand for an asset, whereas resistance is a price level where an uptrend reverses due to a sell-off. Support and resistance help forex traders understand where to enter and exit trades when trading gold.

In the XAUUSD chart above, the horizontal lines represent key support levels. If you spotted the bearish reversal at the point marked A and went short around 1830, when the market started consolidating, you can place the stop loss above the grey horizontal level and take profit at the blue horizontal line.

Monitoring central bank actions

When central banks anticipate currency instability, they typically purchase gold as a hedge. For example, China and Russia recently made news for big investments in gold, indicating their anxiety about the future value of the US dollar and the euro, among other major global currencies.

When central banks begin to acquire gold in substantial quantities, forex traders learn two things. Firstly, governments are acting on the assumption that major currency values will fall, which may encourage traders to shift a larger portion of their investments into less volatile funds. Secondly, greater central bank purchases usually result in an increase in the price of gold—at least in the near term. If gold prices begin to rise, it may be possible to make a quick profit.

Keep an eye on changes in gold production

There have been no significant changes in gold mining over the last few years. It’s not always tied to a drop in gold demand. Although gold is in high demand and overall mining production has increased over the last decade, today’s gold mining initiatives confront increasing costs due to the difficulties in accessing underground gold reserves in difficult-to-reach locations.

The most accessible gold reserves, at least those known today, have already been extracted and added to the global supply. However, limiting output does not indicate that gold is about to fall in price. In reality, a stable gold supply may place a squeeze on global demand, leading to higher prices, especially if central banks and other frequent buyers of gold begin to seek out this asset.

Conclusion

Gold trading has been embraced by many forex traders. It is important to know what impacts gold price before trading it. There are a number of ways FX traders use to trade oil, for example, use of Fib retracement levels, monitoring how often gold is mined, and trading in months with above-average returns.