TD Ameritrade is a popular online brokerage firm that offers a range of investment services to its clients. With its user-friendly platform and competitive pricing, TD Ameritrade has become a top choice among investors of all levels.

In this review, we’ll take a closer look at TD Ameritrade’s features, pros, and cons to help you decide if it’s the right brokerage for you.

Features

TD Ameritrade offers a wide range of features that make it a popular choice among investors. Some of the key features include:

- User-friendly platform: TD Ameritrade’s trading platform is easy to navigate and offers a range of tools and resources to help investors make informed decisions.

- Investment options: TD Ameritrade offers a range of investment options, including stocks, bonds, options, ETFs, and mutual funds.

- Education resources: TD Ameritrade provides a variety of educational resources to help investors improve their skills and knowledge, including webinars, articles, and interactive courses.

- Research tools: TD Ameritrade offers a range of research tools to help investors stay informed about market trends and individual stocks.

- Mobile app: TD Ameritrade’s mobile app allows investors to trade and manage their accounts on the go.

- Customer support: TD Ameritrade provides 24/7 customer support to assist investors with any questions or issues they may have.

Overall, TD Ameritrade offers a comprehensive set of features that cater to the needs of both novice and experienced investors.

Fees and Commissions

TD Ameritrade’s fee structure is competitive compared to other online stock brokers. The company charges $0 commissions on online equity, ETF, and options trades for U.S.-based customers. However, options trades carry a $0.65 per contract fee, and mutual funds transaction fees range from $49.99 to $75 per transaction, depending on the fund.

TD Ameritrade does not charge any account maintenance or inactivity fees, which is a plus for inactive traders. The broker also offers a variety of commission-free ETFs and no-transaction-fee mutual funds. This makes TD Ameritrade a great choice for investors who want to build a diversified portfolio without paying high fees.

In terms of other fees, TD Ameritrade charges $25 for outgoing wire transfers and $38 for foreign stock trades. Additionally, there is a $75 transfer-out fee if you choose to close your account and move it to another brokerage.

Overall, TD Ameritrade’s fee structure is transparent and reasonable, particularly for active traders who want to avoid high commission costs.

Trading Platform

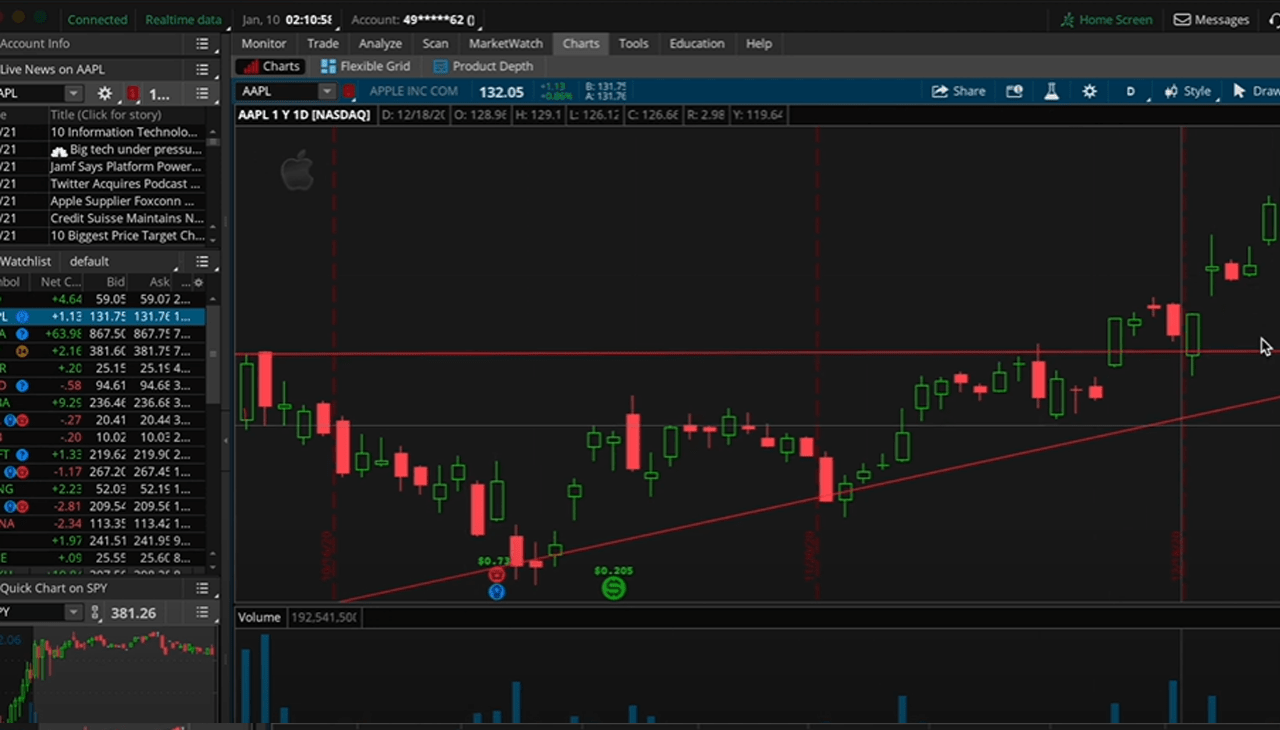

TD Ameritrade’s trading platform is called Thinkorswim, which is known for its advanced features and tools. The platform is available as a desktop application or as a web-based version, and it offers a customizable user interface that caters to different trading styles.

The Thinkorswim platform includes real-time data streaming, customizable charts, technical indicators, and advanced order types like conditional orders, trailing stops, and multi-leg options orders. It also provides access to news and research from various sources, including CNBC, Dow Jones, and Morningstar.

For mobile traders, TD Ameritrade offers the Thinkorswim mobile app, which is available for iOS and Android devices. The app provides access to all the same features and functionality as the desktop version, including the ability to trade on the go, view account balances, and receive real-time alerts.

One unique feature of Thinkorswim is paperMoney, a virtual trading simulator that allows users to test out trading strategies and practice trading without risking real money. This is particularly helpful for new traders who want to learn how to trade before committing to actual funds.

Overall, TD Ameritrade’s thinkorswim platform offers a robust set of tools and features for both novice and experienced traders, making it one of the best trading platforms in the industry.

Research and Education

TD Ameritrade offers a comprehensive set of research and educational resources for its customers. The company provides access to in-depth market analysis, news articles, and third-party reports from companies like Morningstar and S&P Global.

For active traders, TD Ameritrade offers a proprietary tool called Market Edge, which provides real-time technical analysis and trading signals for stocks and options. The tool also includes a daily stock ratings report that rates stocks based on technical and fundamental factors.

In addition to research, TD Ameritrade offers a variety of educational resources for traders of all skill levels. The company offers live online webinars, on-demand videos, and in-person workshops at its branch locations across the United States.

For beginner traders, TD Ameritrade offers a robust set of educational resources through its Investor Education section, including articles, videos, and courses on everything from trading basics to advanced strategies.

Overall, TD Ameritrade’s research and education offerings are top-notch in the industry, providing customers with a wealth of information and resources to make informed trading decisions.

Customer Service

TD Ameritrade offers excellent customer service to its customers, with a range of support channels available for assistance. The company provides 24/7 phone support, email support, and live chat support via its website.

TD Ameritrade also has a network of branch locations across the United States, where customers can receive in-person assistance from a financial consultant. The company’s website includes a branch locator tool, which makes it easy for customers to find the nearest location.

In addition to customer support, TD Ameritrade provides extensive educational resources and research materials to help customers make informed trading decisions.

Overall, TD Ameritrade’s customer service is responsive and helpful, with multiple support channels available for assistance. The company’s commitment to education and research also demonstrates its dedication to helping customers succeed in their trading endeavors.

Security

TD Ameritrade takes security seriously and has implemented several measures to protect its customers’ data and assets. The company uses 128-bit SSL encryption for all online transactions and requires two-factor authentication for logging into accounts.

TD Ameritrade also employs firewalls, intrusion detection systems, and encrypted data storage to safeguard customer information. In addition, the company has a dedicated team that monitors its systems 24/7 for any suspicious activity.

To protect customer assets, TD Ameritrade provides SIPC insurance on all brokerage accounts. SIPC insurance provides up to $500,000 in protection for securities and cash held in a brokerage account in the event of a broker-dealer liquidation or insolvency.

Overall, TD Ameritrade demonstrates a strong commitment to security, with multiple layers of protection in place to keep customer data and assets secure.