Traders have become much more sophisticated when it comes to entries and exits in forex through the concepts of scaling. Ultimately, everyone seeks methods of decreasing risk and maximizing gains where possible.

It is one of the advantages of a highly leveraged market like currencies where traders can employ advanced money management tricks that wouldn’t be possible otherwise. So, what are the two kinds of scaling techniques, and what are the advantages and disadvantages of each? Let’s discover more.

What is scaling in?

Scaling in is the practice of adding multiple positions above an original order to maximize the overall profit on a trade. The typical scenario is a trader will first enter the market with a full size.

They would then observe how price behaves from their initial entry point. If the market showed promise of moving in their favor, the trader would add the same or similarly sized positions at predetermined points.

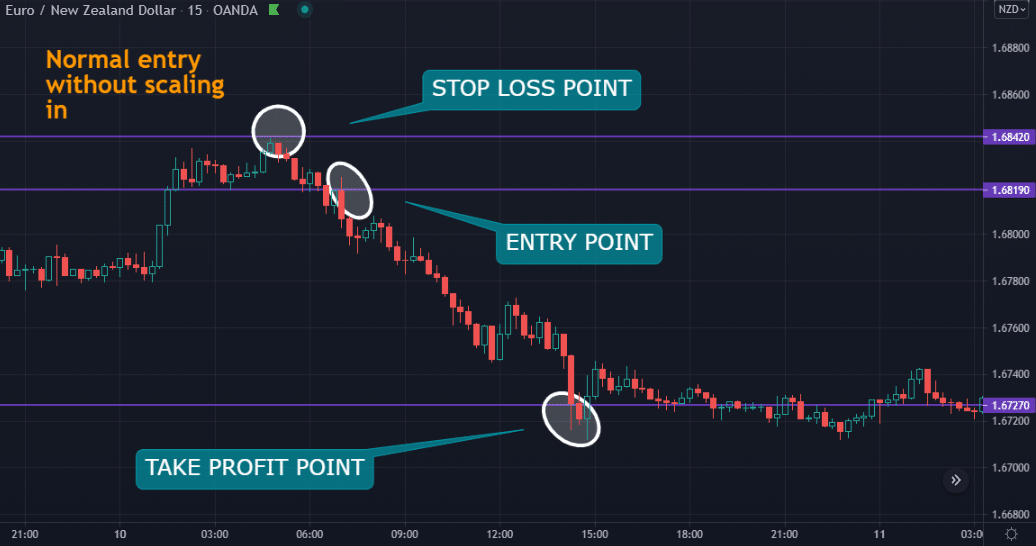

Let’s consider an example with the chart below of a standard order without scaling in.

Let’s assume a trader was trading a double top pattern on the EUR/NZD 15-minute chart and looking to go short. The entry is a 1.68190, stop loss at 1.68420 (23 pips), and take-profit at 1.67270 (92 pips from entry = 4 times the risk).

With a 0.62 lot size (representing a $100 stop loss), the potential gain in monetary terms is $400 (92 pips divided by 23 pips = 4).

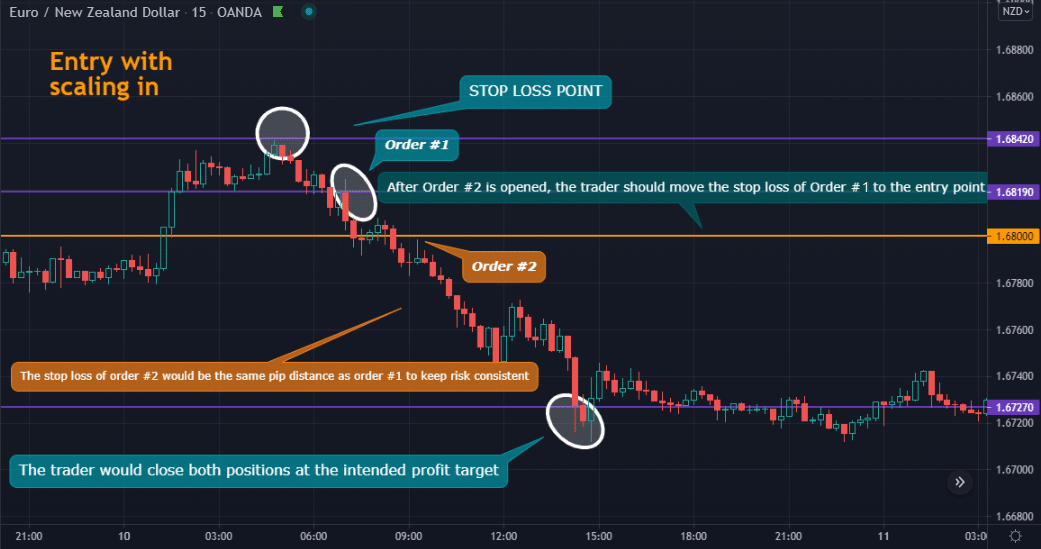

Now let’s look at scaling in. Here, a trader decides to enter the same 0.62 order at 1.6800 (marked as order #2 on the chart in orange). To manage the risk of having two positions open, they would need to move the stop loss of the first order to the breakeven or around their original entry to maintain consistent risk.

Moreover, they decide to place the stop loss of order #2 at 23 pips as they did with the first position. If the trader exited at the 1.67270 profit target (73 pips away from order #2), they would close the two positions.

Therefore, the total profit on the entire trade is $713.9, calculated as follows:

Order #1: $400

Order #2: $313.9 (a pip on EUR/NZD would be worth about $4.30 at this point, so $4.30 X 73 pips)

Things to consider with scaling in

A precarious way of scaling in is when traders add multiple orders close to their original entry, especially if they are all of the same sizes. This action can easily lead to a margin call.

The better option (albeit a little risky still) is a bit further away from the initial order at predetermined levels of entering and moving the stop of the first position to breakeven or another reasonable point.

What is scaling out?

Scaling out works in the opposite of scaling in for the most part. Here, traders will remove certain units of their original position to lock in partial profits while having the chance to gain more from the same trade.

The purpose is to protect profits. In any event, the market retraces back to a trader’s entry point. According to their trading plan, the trader will decide a sensible level to reduce their position by half or whichever ratio they prefer. Afterward, the trading platform will adjust this order to reflect the remainder of the decreased lot size.

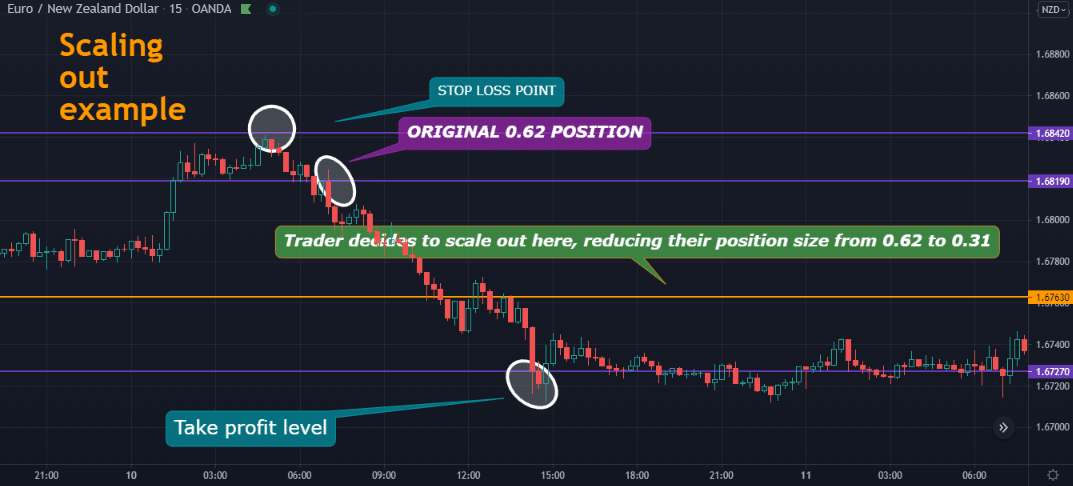

Let’s refer to the EUR/NZD example using the same parameters of a 0.62 sell order at 1.68190, stop loss at 1.68420 (23 pips), and take-profit at 1.67270 (92 pips from entry = 4 times the risk).

Here, the initial profit potential is $400. Let’s imagine the price moved 56 pips in the trader’s favor, leaving the trader with an open profit of $200 at 1.67630 (1.67630 is 56 pips away from the 1.68190 entry point). The trader may decide to lock in this gain but without entirely exiting the trade.

Hence, they could scale out by reducing their position from 0.62 to 0.31 lots, leaving them with a closed profit of $100. The remaining profit potential at this point is also $100 instead of $200. If the trader exited at their initial profit mark, the total gain on this trade is $200 instead of $400.

Alternatively, a trader could also decide to scale out at their profit target rather than at 1.67630 to leave the position open for the possibility of making more money.

Pros and cons of scaling in

When done sensibly and in favorable conditions, adding onto positions in an already profitable order can yield significantly more gains. Despite being a wonderful thing to do, it’s not the easiest to perform consistently.

Hence, scaling in is easily the riskiest technique for maximizing profits, particularly when traders add positions close to their original point. It is less dangerous when performed perhaps 20 pips or so from the entry point, though it takes experience and skill to know how to manage the trades.

The latter point is another disadvantage as one needs to move the stop loss of their earlier trade to a breakeven point. While this action is a protective measure, the market can still knock out the position, leaving the trader with no chance to gain from the trade.

A trader scaling into their positions will only want to use it when they’ve identified favorable conditions where the price is likely to move strongly in their favor with little retracements. Scaling in is almost like a superpower that should be used sparingly during certain times and with the best and most risk-conscious trade management strategy.

Pros and cons of scaling out

The point of scaling out is to lock in some profits to diminish the risk of uncertainty. As seen in the previous example, traders can scale out before their intended profit mark or after the trade moves one time the stop loss distance, twice the stop loss distance, etc.

On the downside, scaling out reduces the profit potential of a position drastically. Technically, scaling out can increase the number of gainful trades, but the average return per trade will lessen.

Like scaling in, this method needs a trader to decide the most logical points not to jeopardize their performance in the long run.

Final word

Scaling in is inherently riskier than scaling out, mainly when entries are performed very close to the initial order. Most traders who have blown their accounts did so by opening multiple positions.

Needless to say, despite being safer, scaling out has some negative consequences because it does diminish a trader’s profits. Hence, some traders do not employ these techniques for their positions and stick with one order having a fixed stop loss and profit target.

The key for anyone considering scaling methods is finding consistency and setting logical, strict rules around them.