When it comes to trading, achieving your profit target comes first. Your exits, not your entries, are what determine your net profit or loss. To be successful in trading, you need to be able to set a sensible profit target while still maintaining a risk/reward ratio that makes sense.

Profit targets are a critical aspect of every trading strategy. You must choose how much risk, in relation to reward, you are willing to take before setting a target.

Profit targets are the most crucial aspect of your plan, as they are the only position where you actually make money or lose money in the long run. An appropriate profit target for your trades is one that is both attainable and provides a reasonable risk/reward ratio.

Traders rely on the concept of support and resistance to analyze and understand price movement. On the basis of this theory, the price may have difficulty breaking above or below particular resistance or support points. This is a good way to estimate profit margins.

Using resistance

An ideal location for profit targets when trading long-term is key resistance zones. Taking profits at support zones is a good idea if you’re shorting a trade.

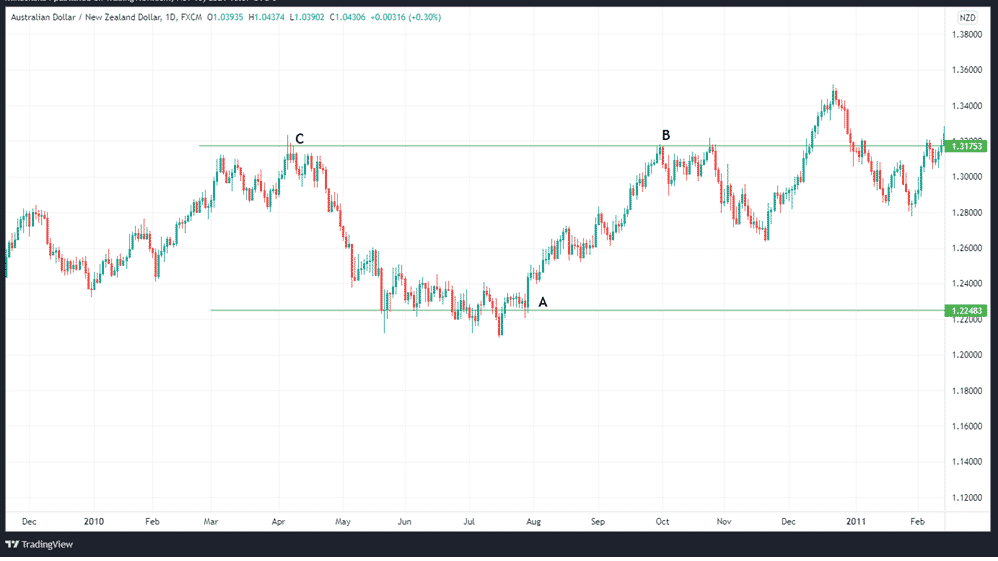

As illustrated in the chart below, resistance can be utilized to profit from a long position when prices are rising in your favor.

A. Shows a long entry before the uptrend begins.

C. Shows the location prior to the resistance

B. The profit target is determined by comparing the current resistance level to the previous one.

After the original entry into the market, as you can see from the chart, there is a favorable advance up to a level of resistance. When the price reaches this position, it may even begin to reverse.

Wherever the price approaches the level of resistance, you should prepare to cash out, that is, take profit.

Using support

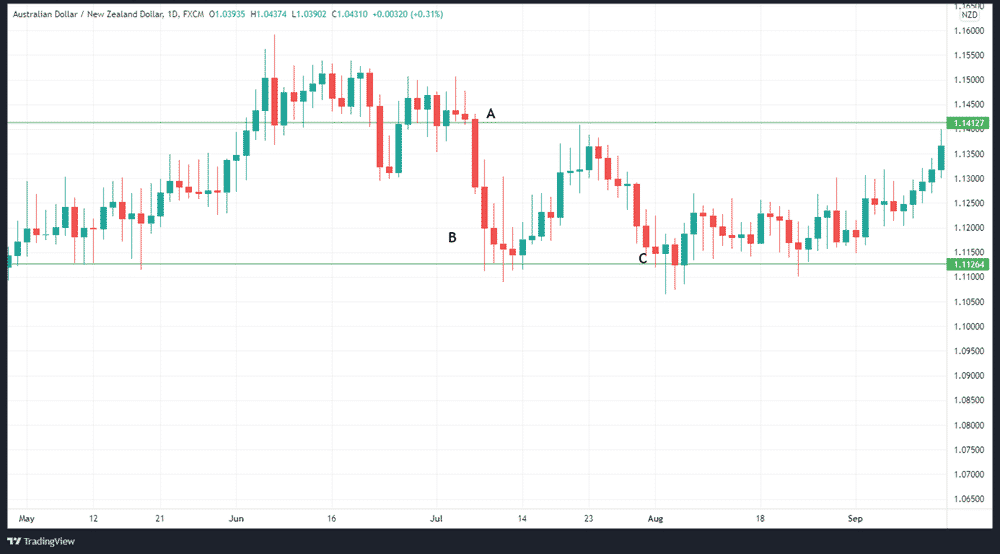

You can see how you can put support to good use when the market is trending down in your favor. The chart below shows how to go about it.

The following is a summary of the main points:

A. Shows a short entry position.

B. Shows the previous area of support.

C. The profit target is set at the level of support.

You can see from the chart above that the price drops to a level of support once a trade is entered into. The price is struggling and may even be headed for a reversal now To breach below that level of support.

Using double top pattern

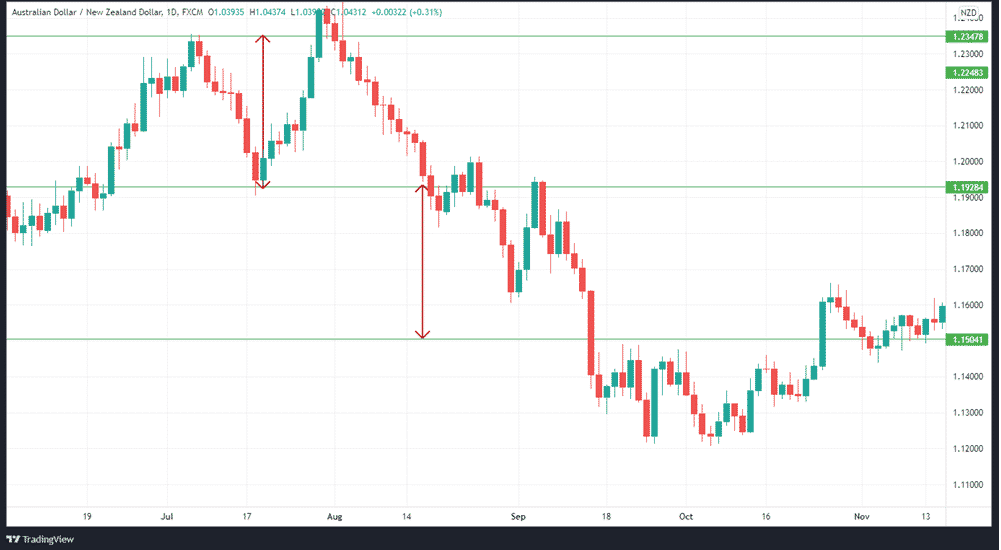

Long periods of upward movement often result in the formation of double top patterns. This occurs when the market fails to make a new high after a previous attempt.

As a rule of thumb, the profit target can be found simply by determining how far the high of the pattern is from its neckline and then projecting that distance towards the lower level.

The chart above demonstrates how to determine the profit target using the double top pattern on the AUDNZD pair.

Profiting from the wedge pattern

If you have a wedge pattern, you may calculate the profit objective by taking the pattern’s height and using it to project your profit target. To do this, you should project the measurement from every side of the wedge and use their first touch as the target. This figure can then be used to any future point in the market, going either way.

It’s critical to wait until the price breaks past support or resistance before taking an accurate reading.

Using measured moves

In the event of a chart pattern, it is possible to predict how far the price will move once the pattern is broken. For example, if an asset fluctuates between $70.50 and $71.50 during the course of an intraday trading session, that is a $1.00 range. It is reasonable to assume a $1.00 price movement if the price rises above $71.50 or drops below $70.50. For instance, you can set your target at $72.50.

Using risk

Using a predefined risk/reward ratio is one of the easiest ways to set a profit target. In such a case, you will set your stop loss depending on the position of your entry point. How much money you’ll be risking will depend on your stop loss. There are a number of factors that go into setting the profit target:

If you short an asset at $50.25 and set a stop loss at $52.25, your risk is $2.00. Using a 2:1 reward/risk, you should set your profit target at $46.25, which is $4.00 away from your entry price.

Suppose you are trading with a profit target of 5 pips for a pair that is trading at 1.3450. If it was a buy order, you should put your stop loss at 1.3440 and profit target at 1.3460, using a 2:1 reward/risk ratio.

Fixed targets ensure that you make more money on your winning trades than you lose on your losing trades. However, such an approach does not take into account the current market environment or the price action’s current trends. This results in a degree of randomness in the targets.

In summary

Profit targets are price levels on a chart at which you decide to take your profits. You should determine how much risk you are willing to accept for how much reward before making a profit target choice. There are a variety of approaches to set profit goals. Profit targets are used to estimate how far the price will go and ensure that your gain is greater than your risk.