To set targets as an investor or trader, you will need to consider your current financial condition and balance it with your desire to profit from trading. While at it, you must be conscious of the possible consequences of your conduct.

When it comes to accomplishing your profit targets, having a set of attainable goals will help. There is no need to assume greater risks if you are planning to invest a large amount of money and if losing a large percentage of it would have a significant financial impact on your current financial condition.

Taking profits in crypto trading

There is a lot to consider if you want to profit from crypto. Indeed, digital currency volatility is a double-edged sword.

Trading in the crypto market is all about knowing your boundaries and knowing when to buy or sell. Inexperienced traders could lose a lot of money if they don’t know what they’re doing. As a result, you’ll require a well-thought-out strategy. We’ll go through some of the best ways to figure out when to sell and how to set goals in the sections that follow.

Strategies for taking profit

Depending on your level of comfort with risk and long-term goals, you may or may not be able to benefit from cryptocurrency. There are, however, a few options worth examining. They are listed below.

Take small profits and reinvest

Depending on the size of your cryptocurrency holdings, you can sell 5% to 10% at a time to optimize your profits. You could sell a modest amount each week if the cryptocurrency has gained more than 30% since you bought it.

Because the crypto market is so volatile, it’s best to set your sell orders in small increments according to the current market conditions. If you sell everything at once, you run the risk of missing out on future gains, or you could regret failing to hang onto some of your holdings as a long-term investment.

Because your seed money is safe, you’re essentially insulating yourself from potential losses. In order to prevent future losses, some investors wait until their earnings reach the amount they put as their seed money before continuing to invest. In addition, you have the option of reinvesting for the subsequent bull run after first cashing out a portion of your profits.

Use Take Profit orders

There are two types of take profit orders: unleveraged spot trades and leveraged long and short positions. The profit price should be determined in terms of the total cost of the product. With stop-loss orders (S/L), most traders manage their open positions with take-profit orders (T/P).

For example, let’s say we bought bitcoin at $29,000, and we are hoping that it will rise in the coming week. We are targeting a 10% surge, but we are also aware that the price could head south, and we are willing to take a 5% loss. Therefore, we employ Stop Loss and Take Profit orders.

In this case, the T/P order is executed, and the position is closed again if the BTC rises to $31,900. Conversely, the stop-loss order is executed, and the position is closed for a loss if BTC falls below $27,550. Using these two points, you can work out the risk-to-reward ratio in the trade.

Because the trader doesn’t have to stress about manually executing a transaction or second-guessing oneself, the take-profit order is advantageous. Take-profit orders, on the other hand, are always executed at the greatest feasible price, regardless of the asset’s performance.

Use measured targets

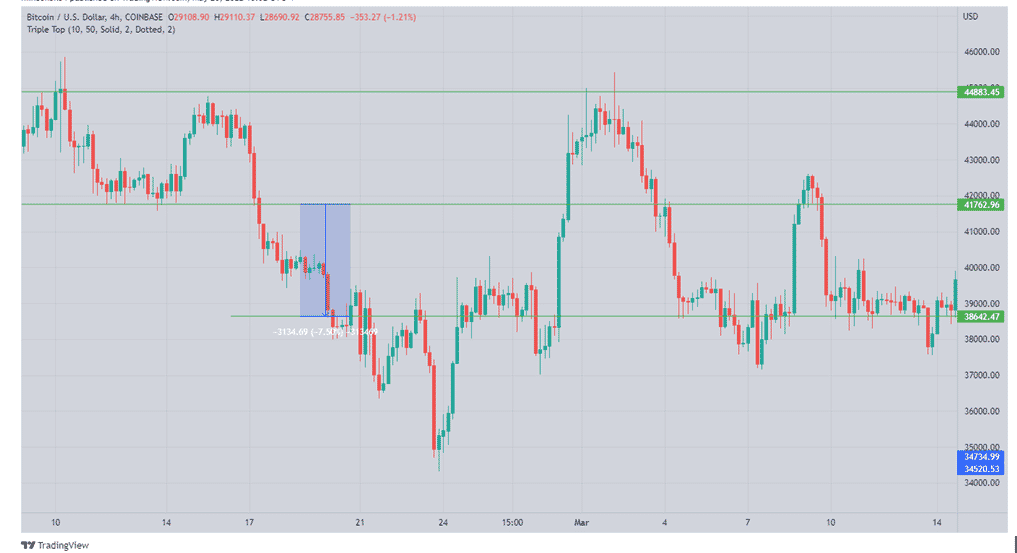

In the event of a triple top pattern, it is possible to predict how far the price will move once the pattern is broken. BTC’s intraday range, for example, might be between $41,762 and $44,883 as seen below. That’s a difference of about $3,121. If the price rises above $44,883 or falls below $41,762, another $3,131 move is likely.

We’ll use $3,121 as our yardstick in this instance to get the support at $38,642.

Trailing Stop-Limit order

With a trailing stop-loss order, you can profit when the price of an asset you bought starts to rise. As the price rises, this order will raise your stop-loss level. For instance, when placing a trailing stop order, you may wish to set it to 10% lower than its most recently traded price. Keep in mind that if the price rises, your stop loss order will also rise. It never deviates more than 10% from the highest price.

You may be able to benefit from the rise in the value of Bitcoin by using a trailing stop. And if the price starts to go down, you will lock in your profits before it gets too low.

The trailing stop-limit order is quite similar to the trailing stop-loss order, with the exception that it also includes a limit order. With this strategy, your broker will only sell the shares if the price falls below a predetermined limit price. In penny cryptos, trailing stop-limit orders can be very helpful because of the higher volatility. As a result, you should use this order to assist protect your gains in case these assets move significantly.

In summary

There are a variety of techniques to set a profit target. To make sure that your profit potential exceeds your risk, setting a profit target is an essential and effective strategy. At some time, every trade needs to be exited. To make a profit, you have to know when and where to exit a trade. Some of the most effective ways to go about it are using a profit target, a trailing stop-loss order, or a specified set of conditions.