Currency markets offer tremendous opportunities, given the high liquidity and elevated volatility that create an ideal trading environment. However, the market can be brutal, making it extremely difficult to build wealth and prosper while trying to squeeze profits in the highly competitive marketplace.

The Forex market can be overwhelming to the ordinary traders not used to processing huge troves of data and carrying out analysis to pursue lucrative trading opportunities. While a trading edge is crucial to carving a successful career, very few people ever succeed and become profitable in the marketplace.

Given the elevated competition in the market, forex signals providers prove to be game savers, rescuing millions of people not fond of or capable of carrying in-depth analysis of the forex marketplace in search of trading opportunities.

Gone are the days when people had to spend hours or even days analyzing the market.

Understanding forex signal providers?

A forex signal provider does the heavy lifting in analyzing the market in search of entry and exit points of various currency pairs. Such providers provide a way for beginners among other traders to leverage the knowledge of skilled traders while still maintaining control of their accounts.

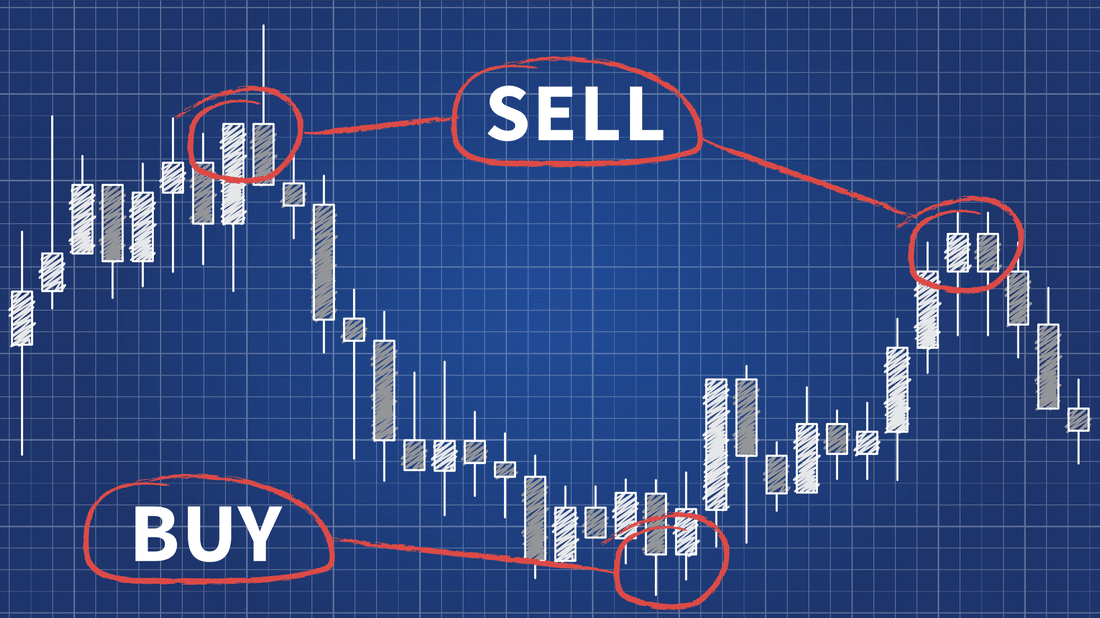

Such providers track the market studying various chart patterns and leveraging advanced technologies to analyze price action in search of opportunities. In the end, they provide entry and exit signals that people use to squeeze profits.

The trigger points offered to contain entry prices, stop-loss price, and take profit target. In the end, traders use the information to make trading decisions. In this case, one can enter and exit a position based on the information given. The signals are often relayed in real-time via mail SMs or a dedicated Mobile forex signal app.

There are two types of FX signals.

Manual forex signals

With manual forex signals, traders spend hours in front of computers searching for ideal entry points depending on how price behaved in the past. Likewise, they determine when to open a trade and when to close it. Decisions to execute trades are based on the trader’s interpretation of past price action.

Automated forex signals

In this case, the software analyzes the market, studying price action and chart patterns. The systems eliminate the human emotion aspect, therefore, generating trading opportunities that are ruled based.

As long as the signal generating program is accurate, the signals generated can be quite precise and likely to generate consistent profits in the long haul.

The best providers are known to offer

- Exact entry and exit price points for trades.

- Information indicating how signals are generated.

- A history of all transactions carried by signals offered and their success rate.

- Interact with members often.

Below are some of the things to look out for a while looking for an FX signal provider.

How reliable are they?

A reliable provider can make a big difference in protecting capital and generating significant profits or losing everything in the $6 trillion currency marketplace. While there are professional and transparent providers, there are also those in the game just to defraud people.

In addition to settling on a signal provider that offers a signal with a high win rate, it is also essential to settle on one with an average risk to reward. The risk exposure with each signal should be as small as possible as signals don’t work 100% of the time. A low-risk exposure ensures that in case of a market downturn, losses don’t accumulate exponentially.

Similarly, reliable providers are known for their consistent performance records. While they may not be profitable, every single day, they show consistent results that enhance the chances of generating significant profits.

Reliability also comes down to the technology that the signal provider uses. The technology should be such that it can send out notifications in real-time and in multiple ways.

Industry reputation

Reputation is another aspect to consider, as some providers are clearly better than others. By a simple Google search, you should get a reputable signal provider based on the reviews written by people who have used the service.

A reputable signal provider should boast of a mention in some of the biggest trade publications. Similarly, a respected provider will have a performance record detailing the published trades made and the success rate. This would be a perfect place to start getting insight into the average pip profit.

Win rate

It is common for signal providers to tout a win rate of up to 90%. Unknown to most people is that the win rate is designed to provide unsuspecting traders with a false sense of security. Never fall for this trap while selecting a provider.

Instead of focusing on the win rate, it is important to focus on the risk-adjusted return or risk vs. reward. In this case, analyze the number of risks that the signals offer in relation to the number of profits they provide. The higher the risk relative to profit, the higher the chance of losing money with the signal provider.

The best FX signal provider will only offer signals with a 1:3 risk to reward ratio. It becomes pretty easy to make consistent profits with such a setting, even with 50% to 40% win rates.

Drawdowns

No signal provider can guarantee profits 100% of the time. Losses are part of the game in the highly competitive business. It is important to note that even the best FX signal providers have losing periods where everything goes south, and signals struggle to generate the desired profits.

The sooner a trader realizes this, the better they will be at selecting a broker that strives to ensure losses are a small part of trading signals. Similarly, it is important not to cut off a signal period just because they have provided signals that have led to losses after a long winning streak.

Drawdowns will always be part of any trading activity; however, the drawdowns should be within reasonable levels.