Forex brokers, can’t live with them, can’t live without them. Despite not all brokerages receiving the most favorable reception, these firms are integral to the trading experience.

Foreign exchange is based on the interbank market, a global network of the largest financial institutions (like Citibank, HSBC, Bank of America, JP Morgan, etc.) trading currencies.

Your barrier to entering this exclusive ecosystem is high as an individual. Therefore, the average person needs a middleman to this access, which, in this case, is the broker.

The broker has advanced technological infrastructure sourcing liquidity from the numerous institutions in the interbank (market makers) to offer their clients the best available prices at any given time.

Of course, the broker can also be the actual market maker performing the same role. Regardless, running such an operation is no easy feat, meaning that these firms deserve compensation.

The question of how forex brokers make money may seem irrelevant, but it can help traders understand how to lower their trading costs and break some of the common myths around this topic.

The main revenue sources of the average forex broker

The most reputable brokers should technically only make money from two primary trading-related sources: spreads/commissions and swaps.

Other miscellaneous income sources may come from deposit/withdrawal, conversion, and inactivity fees (but these are usually not charged by most), along with other products they might sell directly to clients (data feeds, virtual private servers, etc.).

However, spreads/commissions and swaps are the most prominent, particularly the former.

Spreads/commissions and swaps

The spread is just the mark-up each broker applies to every executed position, the difference between the price they receive from the interbank and what is presented to the trader.

In other cases where the broker is the market maker (also known as a ‘dealing desk’), they could offer a lower spread with a fixed commission per trade, typically with a ‘zero spread’ account.

Regardless of the system, this business model is the most attractive for any broker considering the number of clients and their execution frequency. Even though spreads are pretty cheap for most markets, they add up quickly since most traders naturally trade often.

While not as significant as spreads, swaps or rollovers are another sustainable income source for brokers.

These apply due to the interest rate differentials between different currencies and can be positive (where the broker credits the trader) or negative (where the broker debits the client).

Generally, a firm will apply its own mark-up to the swaps provided by the interbank market. There is no universal method of this process, meaning that some brokers may charge a higher or lower swap for the same pair.

Rollover can be relatively high for exotic markets when debited, which is understandably more lucrative for the broker.

Do brokers actually make you ‘broker’?

This question continues to be one of the most debated in many forex trading communities. There are two ways of looking at the issue.

A and B-book, truth or myth?

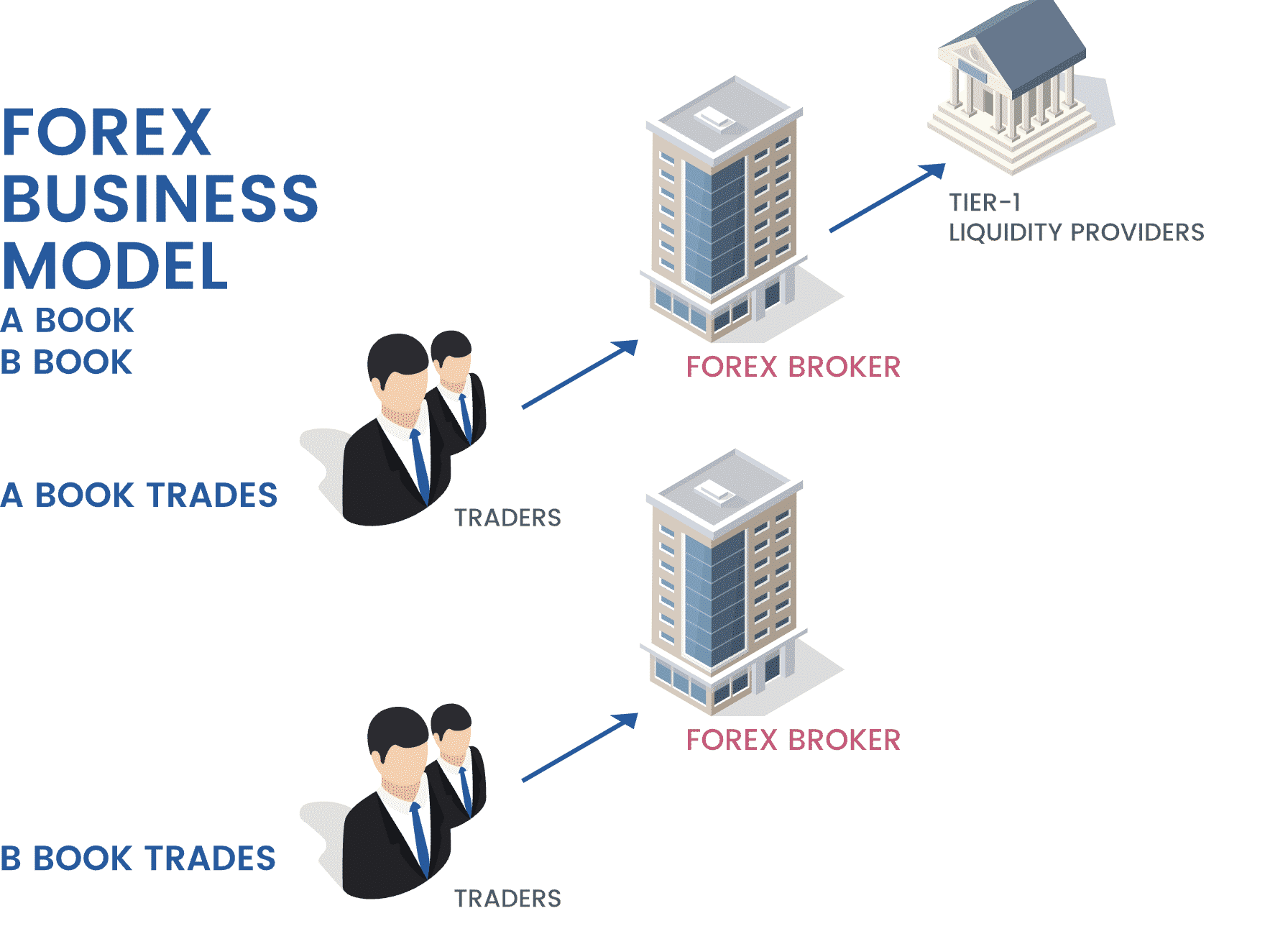

The first significant angle is mainly the concept of A and B-book brokers, as outlined in the illustration below.

A-book brokers (often referred to as STP/Straight Through Processing) are typically seen favorably due to the perception that these institutions route their clients’ orders ‘straight through’ to the interbank market.

Conversely, B-book brokers, also referred to as market makers or dealing desks, tend to be viewed less optimistically due to the notion of conflict of interest. This begs the question of whether these systems exist.

Truthfully, there is no concrete way for clients to know what goes on behind the scenes. The fundamental challenge is that forex is decentralized. Everyone receives the same price in an exchange-traded instrument like futures, but this doesn’t happen with currencies.

Therefore, a broker might not necessarily be routing your orders ‘straight through.’ So, in some cases, a broker is technically trading against their clients by being a counterparty.

The problem is most see this negatively, but for every buyer, there needs to be a seller (and vice versa). A dealing desk broker is more likely to implement manipulative tactics, but not if they are adequately regulated.

Therefore, the brokerage model is largely irrelevant. What matters more is receiving consistent execution with little or no slippage, low latency, and tight spreads. Furthermore, it’s a known premise that over 90% of traders lose money in the long run, which isn’t caused by clients using a certain type of broker.

The marketing problem

The second part of this question relates to marketing in the forex trading industry. Brokers use consistently-evolving campaigns and methods to attract new and existing clients to sign up to their service and trade frequently.

This also extends to other parties in the industry like affiliates, digital marketers, signal providers, and so-called mentors who are also incentivized to onboard as many traders as possible to rack up spreads and commissions.

Therefore, you shouldn’t be enticed; the responsibility of losing and winning in forex is largely up to the trader.

Lowering your trading costs

If you’re cost-conscious and look to improve your bottom line, here are a few things to consider.

- Moving towards a long-term trading strategy: One of the main ways to lower your trading costs is by being a swing trader. In this way, your execution rate is drastically lower, meaning you pay far less in swaps or commissions.

- Using a swap-free account: This option is mainly available for Islamic traders. However, some exceptions like Exness exist that provide a swap-free account for non-Islamic clients (although with terms and conditions).

Nonetheless, it might be worth considering if you hold your positions for many consecutive days.

- Fixed spread account: The spreads are lower and more predictable with this account, which is crucial, particularly if you regularly trade and during busy trading sessions.

Curtain thoughts

Irrespective of the model used, forex brokers will consistently profit whether their clients make or lose money. What’s more important as an individual is understanding your success depends only on you and very little on the broker you use.

Choosing an entity with a positive reputation is vital to having the most conducive trading experience.

However, you should look at methods of reducing your trading costs where possible and, more importantly, have a solidly tested game plan that can increase your bottom line over time.