The vendor introduces Grid Master Pro as the proficient version of its famous-BF Grid Master EA. The developers have incorporated new extra elements and systems in this latest version so as to enhance its profitability rate. More trading strategies have also been included to augment its performance. Grid Master Pro has been mainly created for the GBPUSD currency pair. Nonetheless, traders who desire to utilize other trading pairs are advised to do so cautiously and wisely.

Grid Master Pro: To trust or Not to Trust?

We have evaluated the Grid Master Pro EA and discovered that it cannot be trusted. This conclusion was made following our thorough analysis of the system’s performance in the past and in the current live market. Our examination revealed that the software applies a risky approach in trading. Both drawdowns in the backtest data and live trading results were relatively high which indicate that the account can easily incur losses.

Features

The vendor sells Grid Master Pro at $137. This plan features 1 real account and 3 demo accounts, 24/7 customer support and a 60-day money-back guarantee.

Grid Master Pro applies the grid trading strategy. The robot aims to take in profits on natural movements in the market by placing a series of buy stop orders and sell stop orders at various intervals of the set price.

However, the developers are quick to note that the grid based trading approaches are a contentious subject in the Forex community. They thus warn traders not to utilize it if they do not know the risks linked to this kind of strategy as they can make huge losses.

The vendor indicates that the system has a second feature that enables it to carry out scalping, when the price range is narrow. This feature also initiates a second line of drawdown to compensate trades lest the market price follows another unanticipated trend.

The robot features the following:

- Overbought-oversold trend-filter

- Advanced time management system

- Money management system

- Email and push notification system

- Advanced news filter

- Long only and short only option

- Friday exit system

- Second line of recovery option

- Volatility filter

- High spread, slippage and broker protection

- Trading logic

- Automated and manual trading

- Minimum deposit is $1,000 but the recommended capital is $3,000

- The recommended time frame is 15 minutes

- Uses the GBPUSD currency pair

- Compatible with both MT4 and MT5 trading platforms

- Detailed user guide

- Lifetime free updates

Trading Results

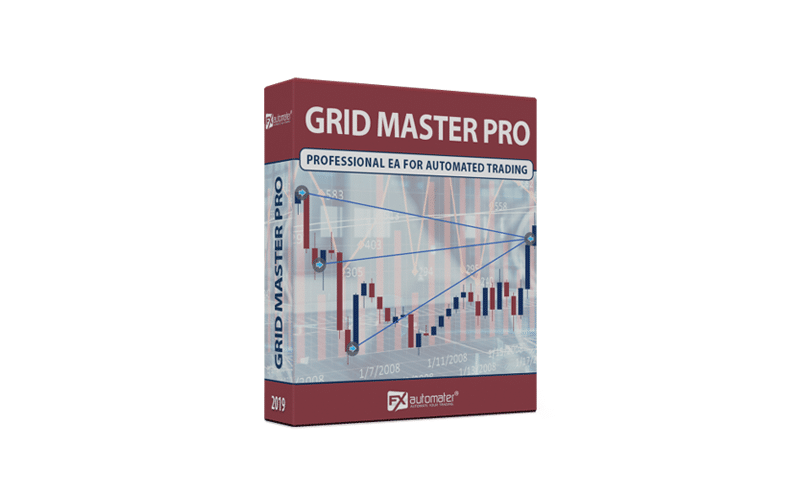

Below is a screenshot of Grid Master Pro EA’s backtest data:

The account traded with the GBPUSD currency pair on the 15-minute time frame. It operated for 10 years specifically between January 2009 and March 2019. During this period, the EA generated a profit of $355, 193.90 from an initial deposit of $5,000.

The robot carried out 4871 trades. Out of these, it achieved win-rates of 83.45% and 79.58% for longs and shorts respectively. The average loss trade (-$129.98) was slightly higher than the average profit trade ($120.61). The profit factor was 3.95. The drawdown which was 34.65% was huge. It highlights the high-risk approach the EA applies.

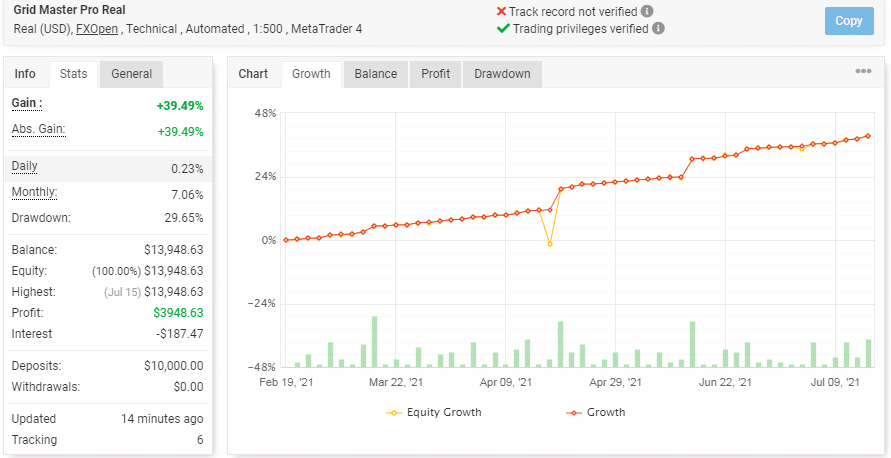

Grid Master Pro manages a real USD account on the FXOpen broker on MT4. The account was activated on Feb 19, 2021. By July 09, 2021, it had increased the account balance from $10,000 to $13, 948.63. As such, it made a profit of $3,948.63 which is equivalent to a 39.49% gain. The daily profit is 0.23% while the monthly profit is 7.06%. These figures are noticeably small.

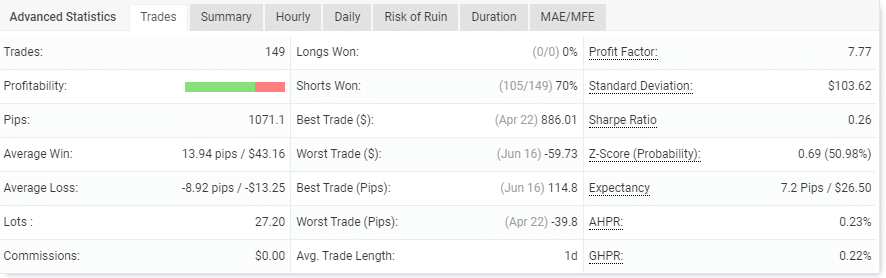

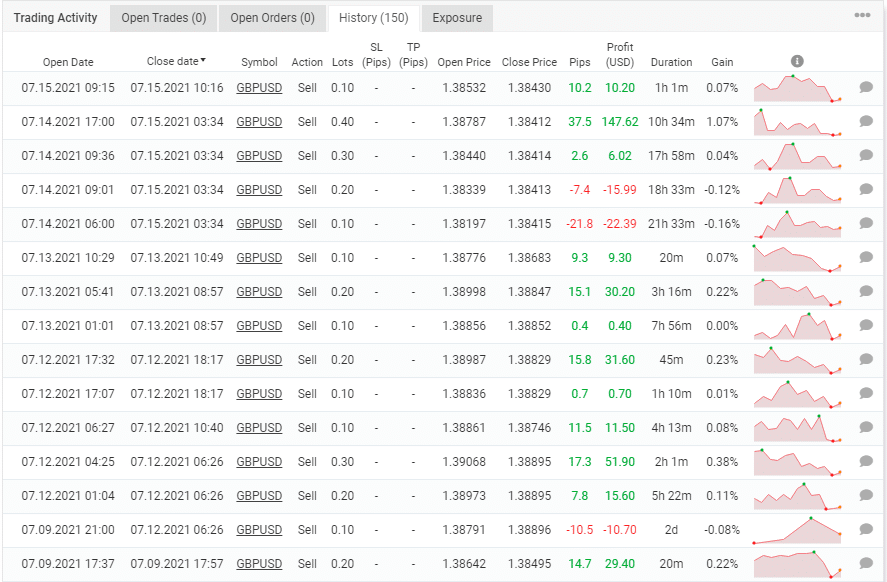

Evidently, the robot has performed 149 trades. The winning rate for short trading positions is 70% and zero for long ones. The system has made 1071.1 pips. The average win is 13.94 pips while the average loss is -8.92 pips. The profit factor is 7.77. The robot has traded with 27.20 lots. This figure is quite high and underlines the account’s tendency of applying risky tactics.

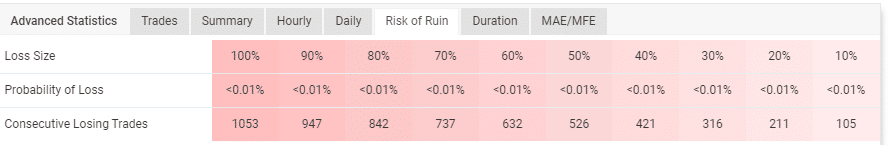

The account’s risk of ruin is low. The EA trades with low risks to the balance. If it loses 105 trades in a row, 10% of the account will be lost.

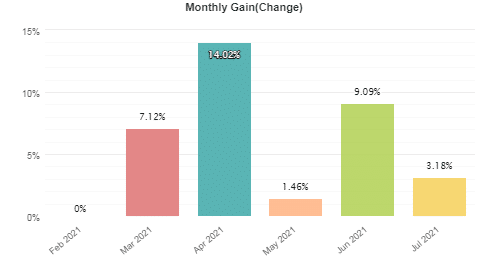

A look at the month-by-month performance shows that this EA provides inconsistent profits.

Clearly, the account trades with big lot sizes. The grid, scalping, and martingale strategies are also evident. The account buys or sells the currency pair with only a brief holding time so as to generate a series of quick profits. Also, when it makes losses, it tends to increase the lot sizes.

High Drawdown

The account run by Grid Master Pro has a high drawdown of 29.65%, which is quite dangerous. This illustrates that the EA is taking high risks in trading. A trader should be concerned by this because the account is being exposed to market punches as the robot seeks to generate profits. As a consequence, significant amounts of losses can be incurred.

Vendor Transparency

FXautomater is the developer behind this EA. FXautomater is a company that mainly specializes in creating fully automated Forex robots. The company indicates that it has a team of committed investors, active Forex traders and programmers with over 15 years experience in trading and 10 years in building EAs. Their other robots include, but are not limited to BF Scalper Pro, Smart Scalper Pro, and Gold Scalper Pro. The vendor has at least demonstrated some level of transparency in revealing the company it operates under, the team it works with, and its other products.

Customer Reviews

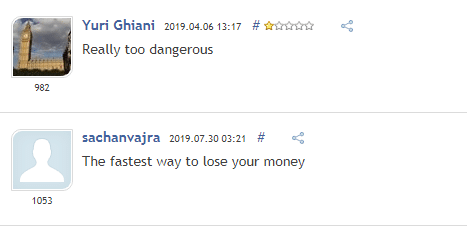

We found mixed user reviews for this EA especially on the MQL5 website. Most of the clients who were dissatisfied with this product stated that they found it risky and too dangerous, probably due to its high-risk approach.