Currency trading is a global phenomenon that has given rise to one of the biggest markets with a daily turnover of more than $6 trillion. The high daily turnover is complimented with high liquidity, allowing people to place and close trades with ease.

Contrary to perception, the forex market is not the oldest. As early as a century ago, it was nonexistent even as the stock market existed in different forms. Its rise to prominence has been fuelled by technological advancement and changes in currency standards.

The trillion-dollar marketplace came into being as nations started printing their own money and reduced reliance on standards in the form of precious metals such as gold and silver. It started gaining prominence as soon as people found out that some currencies were more valuable than the standard, which was gold for the better part of the last century.

The printing of world currencies resulted in merchants opting to pay for goods and services using the lower valued fiats while requiring to be paid in high-value currencies.

Gold collapse

The collapse of gold as the global reserve currency might as well have paved the way for the trillion-dollar currency marketplace. For the better part of the last century, most currencies were pegged to standards such as gold and silver.

The demise of gold as a standard started to unravel as soon as nations refused to convert their currencies for the standards. Other countries responded and demanded an end to the standard as currency devaluations became the norm.

Enter Bretton Woods

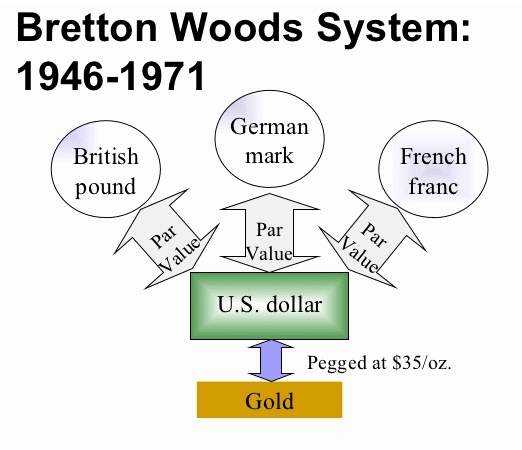

As WWII dust settled, allied nations came together and agreed to formalize exchange rates in an attempt to fix debasement effects. The result was the nation’s currencies being priced relative to the USD. In return, each US dollar was valued at $35 per ounce of gold.

As the United States strived to keep the greenback value close to the $35 peg against gold, its native currency slowly became the global reserve currency. Any nation with a surplus of another nation’s currency only had to exchange the surplus for the dollar or gold. The provision proved to be a brake on the nation’s inflation of their domestic money.

While the Bretton Wood peg did hold for some time, things started to crumble as some economies grew and others stagnated. As some nations reported inflationary policy to address rising debt, the effectiveness of the standard began to show cracks.

The last nail on the coffin for the Bretton Wood standard was when the US inflated the greenback status as the reserve currency.

The birth of Forex

As the US dollar got inflated, there were growing concerns that currencies were overvalued as well. Milton Friedman was the first to raise the red flag over the British pound value. Concerned that the pound was highly overvalued, Friedman sought to go short and profit from its value tanking.

His efforts to get banks to approve a short transaction on the pound failed miserably as no bank would agree to such a transaction unless there was a big interest from the market. Friedman’s efforts would, however, get the attention of Leo Melamed, who felt it was high time to float currencies in a market and allow people to place trades as they wish.

The US president Richard Nixon brought to an end the gold standard in the 1970s. The forex futures market was established in Chicago in 1972. The US allowing its currency to freely float in the market and value dictated by forces of supply and demand gave birth to forex trading as forex futures trading became the new norm.

The unveiling of forex futures meant traders and nations did not have to hold reserves in different currencies. Instead, one only had to trade currency futures without holding the actual currency.

Forex in the internet world

Internet development has been the main force behind the exponential growth of the currency futures trading phenomenon. The revolutionary technology has made it possible for people from all walks of life and all corners of the world to buy and sell their preferred currency futures without setting foot into a brokerage firm, let alone a trading floor.

Gone are the days when people had to flock to the trading floor, let alone call their brokers to buy or sell financial instruments. The internet has also transformed the market, making it operational 24 hours seven days a week.

The spread of the internet has only meant more people flocking into one marketplace to trade various currencies. Likewise, liquidity levels have inched higher significantly, a development that has made it easy for people to enter and close positions with ease at some of the lowest costs.

As forex is the most liquid marketplace, it responds rapidly to supply and demand signals. Additionally, the heightened levels of liquidity have averted some of the risks that companies looking to deal with various currencies would have experienced.

Trillions of dollars exchange hands daily in the currency market. Market players and institutions with huge financial aims have proved to be market movers. At one point, Billionaire investor George Soros did rattle the British pound by placing a short position and generating a whopping $1 billion on a single trade.

In addition to the internet, the forex market is highly decentralized. The lack of a central body to control operations in the sector, let alone currency rates, continues to attract millions of people to trade various currency pairs.

However, there are large bodies in the form of central banks that have a huge say in the market. The monetary policies passed by the Federal Reserve and the European Central Bank have proved to have a significant impact on currency exchange rates.

Additionally, the largest banks in the world led by JPMorgan, Citi, and Deutsche Bank have also proved to be market movers, given the big orders, they often place that often influence currency exchange rates.

Bottom line

Forex trading began in the 1970s as the gold standard collapsed and the US allowed its currency to float freely without any pegs. Widespread internet connection has only gone to spark currency trading complemented by several financial instruments that allow people to profit from currency price fluctuations.