Although Forex trading promises you economic freedom, several merchants, especially the ones who have entered the market recently, struggle to make profits initially. Usually, traders formulate schemes of their own and then make their entry into the Forex market manually. Nonetheless, it is a tedious task to scan the computer screen for long periods, and as such, many traders tend to turn impatient and make rash decisions based on their feelings.

In order to avoid such bad decisions, most merchants use expert advisors or robots in order to start making favorable trades and get back to making profits. Here, we shall discuss in detail how automated Forex trading operates and what its benefits and drawbacks are.

What does Forex automated trading software do?

Automated Forex trading involves complex technology, but in spite of this fact, it uses technical indicators to carry out its operations. The same approach is followed while you are using software to trade in cryptocurrency, like Ethereum or Bitcoin.

The aforementioned programs let you set some conditions, which decide the point of exit and entry in the Forex market, additionally creating a set of regulations for managing money. After you program the system, it can monitor the specific market you are planning to trade in, placing trades in it as per your instructions.

You have the option to set prerequisites based on basic directives or extremely complicated algorithms. But, in order to successfully set up the latter, you need to have a sound comprehension of the coding language the EA or robot uses.

Nowadays, you can use a Forex robot or EA to conduct your dealings in all kinds of markets, counting Forex and share markets. You can access it easily using a computer and a stable network connection. Several traders, especially beginners, often do not know the minute details of the trading process or the Forex market.

Thus, it is hardly surprising that algorithmic trading systems are becoming increasingly favored.

Forex robot vs. EA

Although the basic concept is the same for both, Forex trading robots and EAs are not one and the same. Expert Advisors generate trading signals on their own and let you know about the various trading opportunities. A Forex robot is a different type of automated trading program that recognizes trends in the market and generates suitable trading signals.

Despite the similarity, a robot can actually place trades in your stead, an operation that is not possible through an EA. When you are trading through an EA, you need to carry out manual authorization. Thus, the major difference between the two is that the EA will only generate signals, whereas a robot will conduct trades without needing any manual intervention from your end.

Despite this, traders often use the two terms interchangeably, and by this, we mean that many EAs possess capabilities that stretch far beyond the generation of signals. The purpose of both is to nullify the illogical and impulsive decisions many traders are prone to making while conducting trades manually. Both of them follow preconfigured plans, sans human interference.

Forex automated trading working principle

You must be wondering how automated trading can be implemented to deal in the Forex market. In this case, let us look at MT4, which is one of the most favored trading platforms for Forex traders. Although the process might sound difficult, there are a few simple steps involved in it.

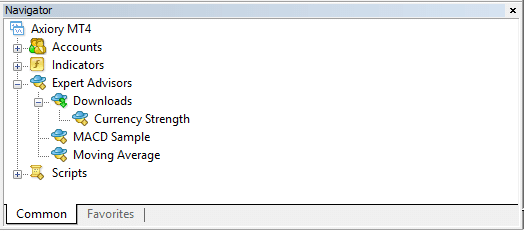

First of all, you need to open your MT4 platform and travel to the navigator section, which normally appears on the left. You can manually activate it by clicking on ‘view’ and then on ‘navigator.’ You should see a window like the one shown above.

Here, you can switch between several accounts, e.g., from your original trading account to your demo account for testing your strategy. You can also activate several technical indicators for the pairs you wish to trade. After you click on a particular indicator, it will get activated, and you can see it on the chart.

The third option is termed ‘expert advisors,’ and it divides itself into two main sections, the first of which contains the two expert advisors that are preinstalled. Here, you can see the Moving Average and MACD Sample as the two default EAs. The section called ‘downloads’ includes those EAs you have downloaded by yourself.

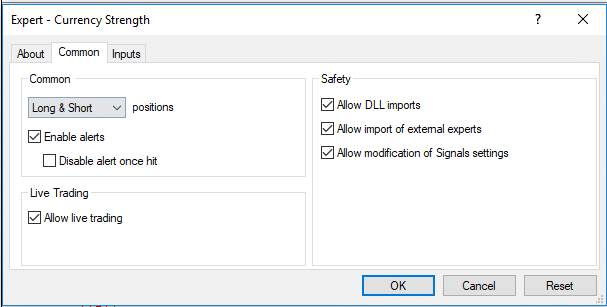

The bottom-most section is known as ‘scripts,’ and using this, you can alter the code for the EA or create a new one. If you wish to launch automated trading, you ought to drag one of the EAs onto the chart where you wish to trade. On doing this, you will see this menu:

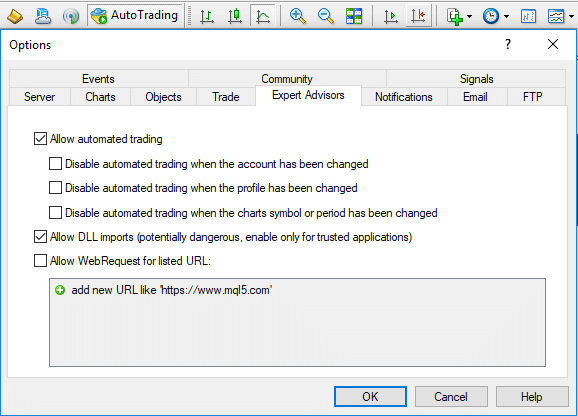

Here, you have the option to open short or long positions and activate alerts, so you always know when there is a trading signal. When you activate ‘allow live trading,’ as well as all the boxes lying under ‘Safety,’ you tell the EA to bring off automated trading. After this, you need to click on ‘tools’ and then ‘options,’ upon which you can see this menu:

You need to check and uncheck the boxes as shown in the image above and click on OK, followed by the AutoTrading button. Remember, you are required to activate algorithmic trading for each chart separately.

Advantages and disadvantages

The pros and cons of algorithmic trading are as follows:

Pros

- Emotional trading is minimized.

- Backtesting is possible.

- Trader discipline is maintained.

- Multiple accounts can be used.

Cons

- The system may suffer from technical failures.

- It requires monitoring.

Summing up

Thus, we got to know about the fundamentals of algorithmic trading and its operating principle. However, it lets you save a lot of time while trading. You should note that it is not flawless, and depending entirely on it might not be wise. You can use a hybrid scheme using both automated and manual trading methodologies for superior outcomes.