The forex market is not centralized in any way. Consequently, traders can access different exchange rates and conditions depending on the platform they settle on. While there are different dealers, it is important to deal with one that offers uninterrupted access to liquidity providers for better pricing and low costs for optimum returns.

Understanding ECN Brokerage

Some brokers specialize in matching clients’ orders with what market makers are offering. Such dealers are known as ECN as they operate advanced trading systems that guarantees direct connections between market players and makers.

The ability to consolidate quotations from various liquidity providers allows ECN stockbrokers to offer much tighter bids and ask spreads. Consequently, players can incur some of the lowest costs. In addition, such dealers ensure swift interaction with liquidity sources.

By law, ECN dealers are not allowed to trade against their clients. They only make money by charging a commission on each order harmonized with liquidity sources and executed.

Consequently, ECN is a more efficient process that leverages advanced technology to ensure that orders entered by market participants are always matched at the best price available. By linking retail and large traders directly with liquidity providers, the process averts the need for intermediaries.

How it works

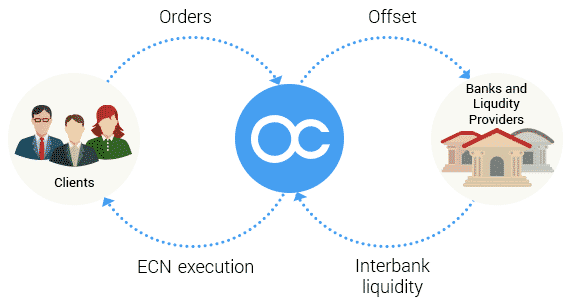

An ECN network is at the heart of how such brokers operate. The network acts as an electronic system whereby buyers and sellers come together to interact and enable the execution of orders. The network offers access to information regarding the various orders being entered by various market participants.

With this structure global banks enter buy and sell orders on the ECN server. Their quotes are then made available to clients for matching purposes. Once orders are entered, the ECN network matches the buy and sells orders with what is on offer on the liquidity provider base.

One’s match is found with the lowest ask and bid spreads an order is executed. Whenever specific order information is not available, the network provides prices that reflect the highest bid and lowest ask.

The ECN network stands out partly because of the high level of price feed transparency. The fact that all dealers have access to the same price feed ensures clients can never be duped. The structure averts the risk of price manipulation given the readily available information.

However, such a system is not immune to pitfalls. One of the biggest drawback of the network is the fees and commissions involved in dealing with it. Such costs can be much higher compared to other systems. The fact that such prices can be much higher can significantly affect one’s ability to generate optimum returns.

Choosing the best ECN broker

When choosing a broker, it is important to consider a number of things. First, it is crucial to see the kind of spreads they offer – fixed or variable. The best on this front are those that only offer floating or variable spreads

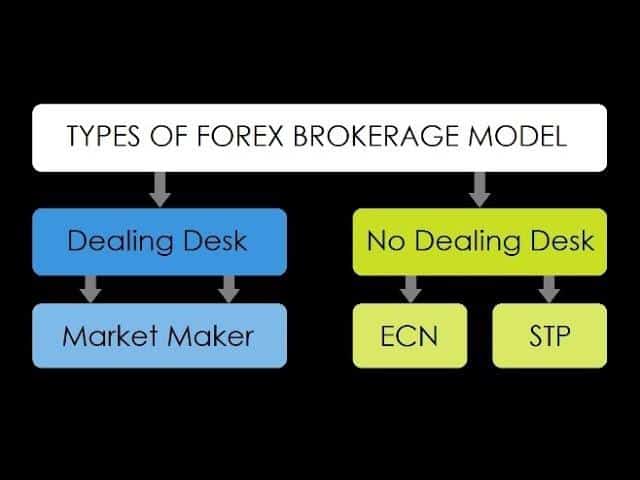

Secondly, you should check if one operates a dealing desk. A broker that is ECN compliant does not operate a dealing desk as it will always amount to a conflict of interest. Thirdly such a market should not be exposed to any form of negative slippage.

Advantages of ECN brokers

Such market makers stand out because they also allow people to trade outside normal trading hours. They do so by providing a framework through which those who cannot trade during normal hours can place trades when they are ready. In addition, they allow orders to be executed immediately, thus allowing clients to enjoy favorable price levels. Thinner spreads on offer also ensure low costs of trading.

Instant trade execution is another synergy on offer. The ECN network ensures efficient trade performance in that orders are matched as soon as they are placed within the shortest time possible. The fact that a client does not need to trade with the broker ensures real-time execution.

In addition to shielding customers from wider spreads charged by other brokers, they also tend to provide lower commissions and fees that significantly reduce the cost of trading. For clients that cherish their privacy, such brokers also provide a high level of anonymity.

ECN vs. Dealing Desk Brokers

ECN always stands out compared to dealing desk dealers as they provide a direct connection between buyers and sellers. In contrast, a desk executes trades by taking the opposite side of what a client has placed.

The fact that dealing desk brokers take the opposite side means they are essentially countering their clients. What this does is that it creates a conflict of interest which in most cases has been manipulated to the disadvantage of clients.

In addition, dealing desk agents can take much longer to pass orders to a liquidity provider leading to slow execution. The net effect is that orders get filled at less favorable price levels.

The downside to using ECN brokers

One of the biggest undoing in using ECN brokers is that one must be ready to contend with a fixed commission fee for every transaction. In addition, calculating stops and profit targets can be difficult because the price is constantly moving on the platform because of the variable spreads. The risk of slippage is also high.

Final thoughts

ECN brokers are some of the best for anyone looking to trade more efficiently and profitably. Better and favorable trading conditions are some of the benefits as such dealers ensure orders are matched with market makers’ offers. Increased transparency and no conflict of interest are some of the other benefits that guarantee a heightened trading experience.