The EA Vega was released on MQL5 on January 14, 2021, by Wesley James. The current version is 1.1. The robot was updated on January 25, 2021. The expert advisor was completely free for a month. Now, it costs little money.

EA Vega: To Trust or Not to Trust?

The robot is too young to tell something for sure about its future performance and if it meets our expectations.

Features

We know enough about strategy and settings:

- The system is based on the break-out strategy.

- It runs an “Ichimoku Kinko Hyo indicator for spotting a future price momentum and determines areas between support and resistance levels.”

- The expert advisor “opens and closes trades based on the candlestick bar ranges and top and bottom prices.”

- It can work automatically for us.

- The system is designed to work with all pairs from the terminal.

- The most-traded break-out pairs are EUR/USD, GBP/USD, and USD/JPY.

- It can work on the M30 time frame.

- The robot covers deals by settings hard Stop Losses.

- The risk shouldn’t be higher than 5% to the account balance.

- The system was backtested with insane risk (25%) and insane drawdowns (80%).

- The robot can work with fixed Lot Sizes which we set.

- The vendor provides settings files for EUR/USD, GBP/USD, and USD/JPY.

- The robot doesn’t run risky strategies.

- We can use the system on the FIFO-regulated brokers.

- There’s a magic number to inform us where our deals are.

- The maximum Lot Size can’t be set higher than 100.

- The system has a low-trading frequency.

- If we’d like to wait, there’ll be an MT5 version of the expert advisor.

The robot was download free. Now, it costs $50 for a copy and $30 for a one-month rent. We can download it for free to check the system parameters.

Verified Trading Results

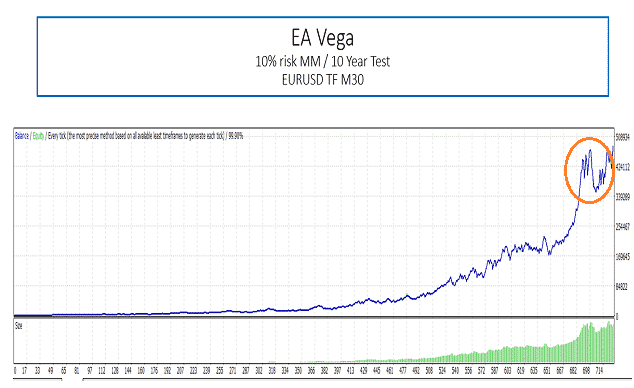

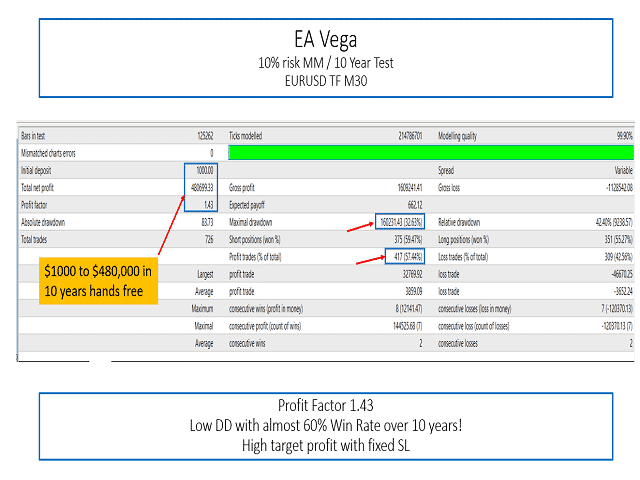

There are some horrible backtests. This one is a 10% risk EUR/USD on the M30 time frame based on the 10 years of trading data. The backtest’s modeling quality was 99.90%. An initial deposit was $1000. The Total Net Profit has amounted to $480k. The Profit Factor was 1.43. The maximum drawdown was 32.63%. The win-rate was only 57%.

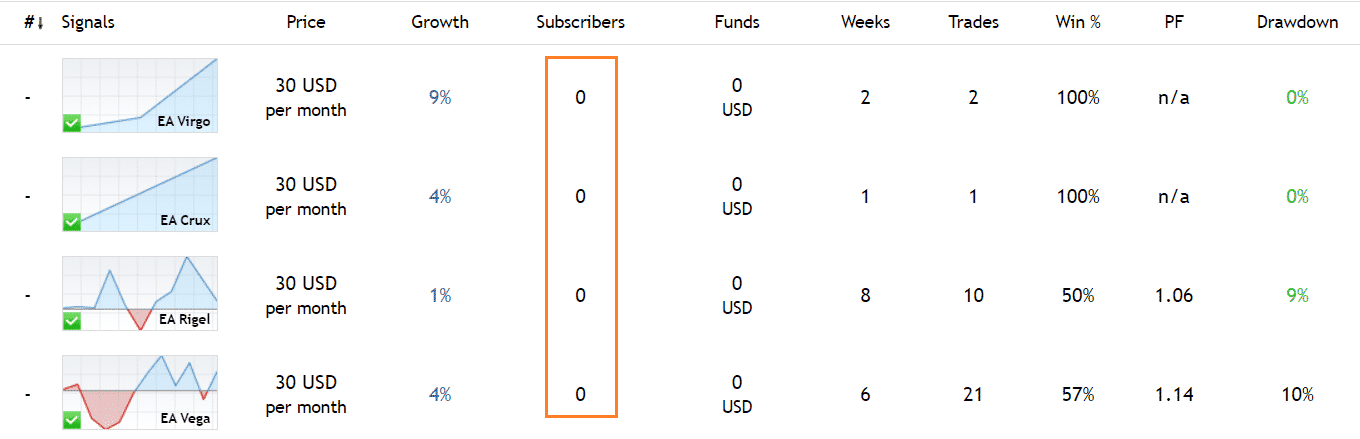

As we can see, no one interests in his signals, even for $30 monthly.

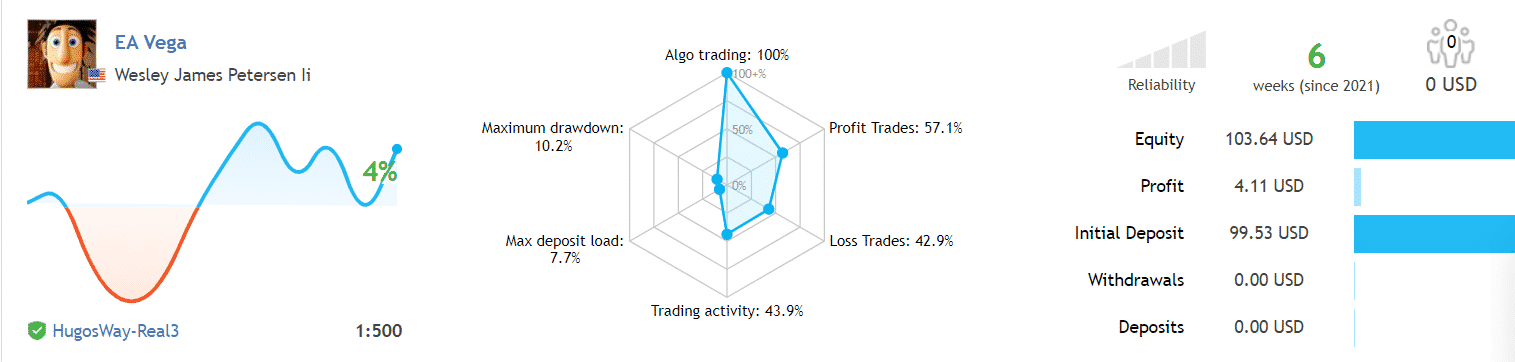

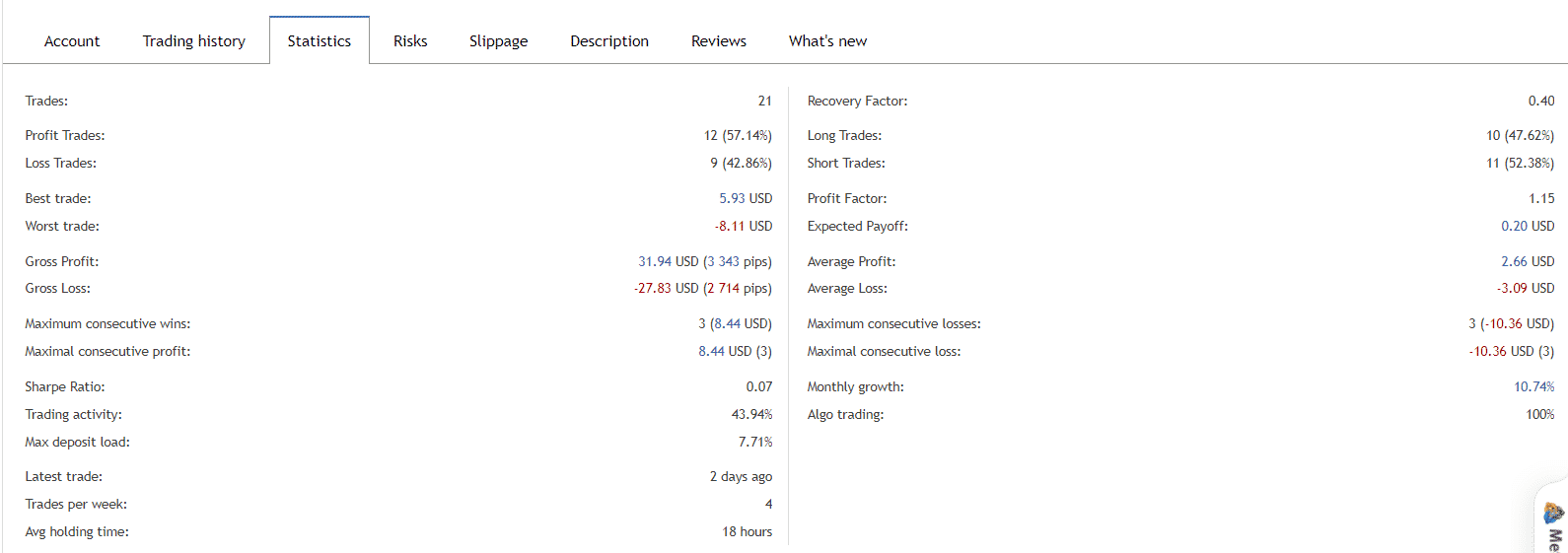

EA Vega works on a real USD account on a Hugo’s Way broker house. The account was created on January 18, 2021. The robot performs Algo Trading (100%). The initial deposit was $99.53. The absolute gain amounted to 4.13%. Trading activity is low – 43.9%. The maximum drawdown is 10.2%. The account has been running for six weeks.

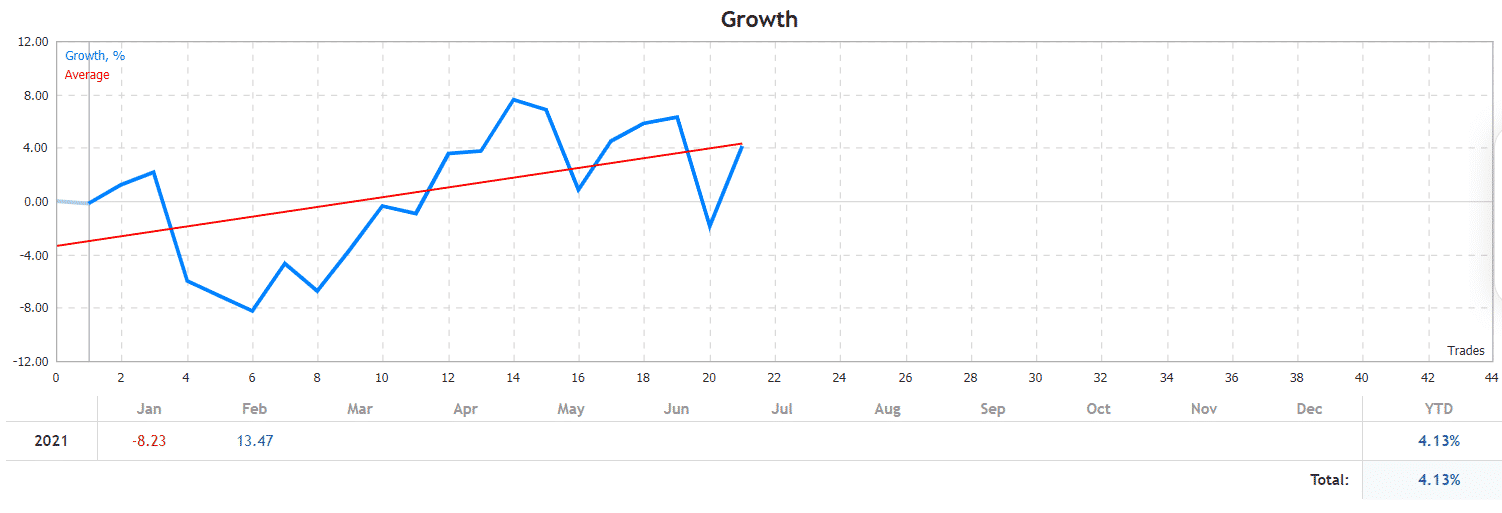

The growth chart looks scary to repeat this on the real account.

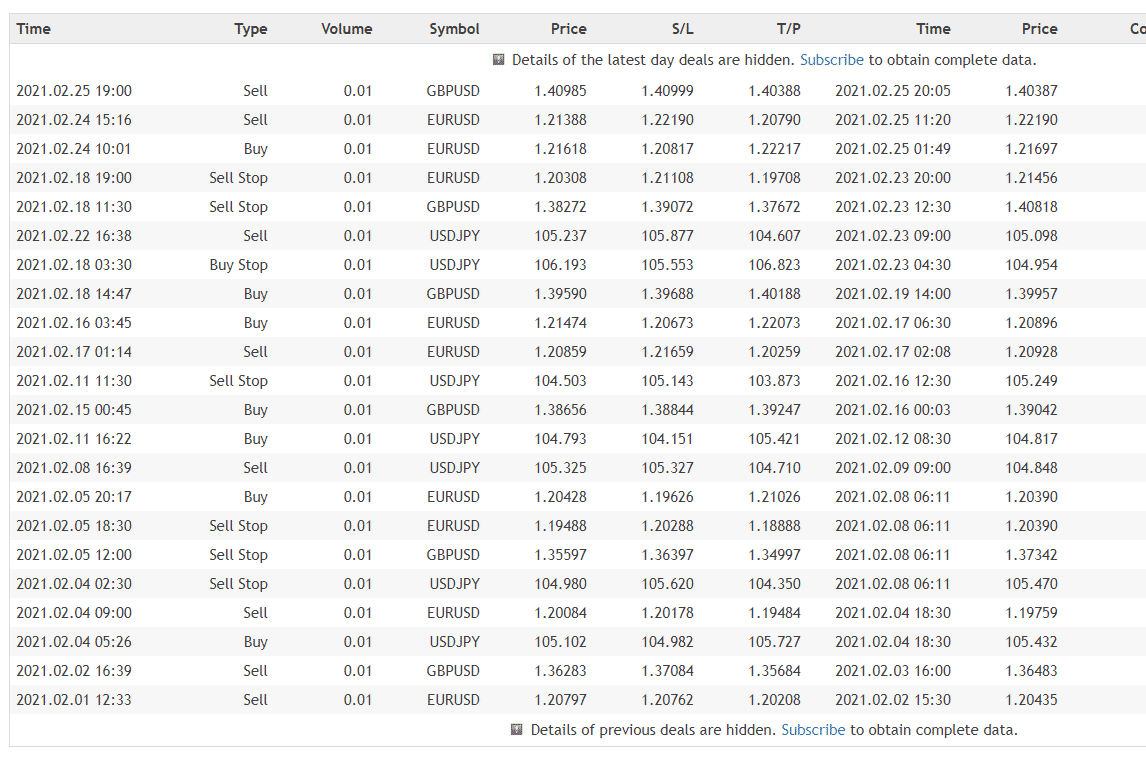

It seems like the system places pending orders to catch the market moves.

The EA has closed twenty-one deals. The win-rate is 57.14% (12/21 deals). The best trade is $5.93 when the worst one is -$8.11. The Gross Profit is $31.94 when the gross loss is -$27.83. The maximum win-streak is three deals. An average trade length is 18 hours. The profit factor is mediocre 1.15. An average profitable trade is $1.66 when an average loss trade is -$3.09.

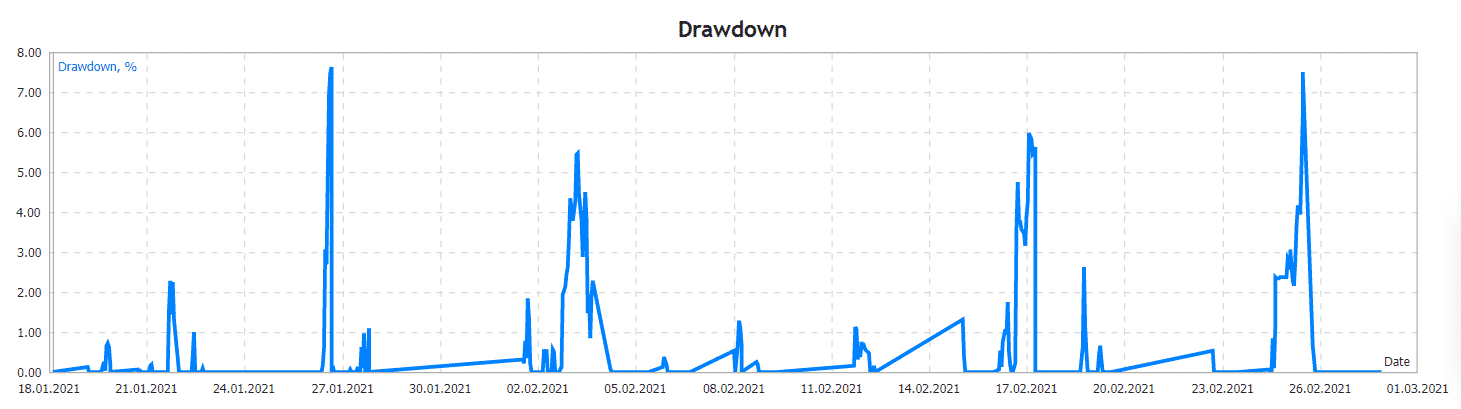

Acceptable Drawdowns

The drawdowns are middle-sized and not consistent.

Vendor Transparency

The vendor has a medium level of transparency because we don’t see how he looks, and we don’t have his social network profiles.

People feedback

There are many “reviews” without texts.

There are settings files provided for smooth and sound trading.

Other notes

The vendor’s profile has a 2325 rate with four signals and four products in the portfolio. There are only 37 friends. He noticed that he had over 35-year of trading experience.