BuySellSeriesEA is an FX robot that promises high performance with its fully automated trading. The vendor claims that the system uses accurate trade entries and exits without the need for human intervention. High monthly profits are assured by the developer for the FX EA which is supposed to have an easy setup with the guidance of the user manual and the support provided by the vendor.

BuySellSeriesEA: to trust or not to trust?

Our evaluation of this FX robot reveals a few important shortcomings that make us suspect it is not a trustworthy system. The high drawdown and hidden data in the trading results are a few instances of the risky approach and poor performance of this ATS. Let us first look at the features of this FX EA.

Features

As per the developer, this EA uses market volatility to generate monthly profits of more than 100% without losing your capital. Chukwudi Joshua Obiekwe is the developer of this EA. He does not provide much info on the features of the FX robot. A trend analyzing approach is used by this ATS with the help of news filters and candlestick patterns.

The minimum balance needed to use the system is $100. It works on the EURJPY and the GBPUSD pairs mainly but also works on other currency pairs, according to the developer. Any broker spread is compatible with the EA settings but the developer mentions that a low-spread broker provides a better advantage. Two risk settings namely a default setting and a defined setting are present from which you can choose a suitable setting. The one-hour timeframe is used by this EA.

Two price packages are present for this ATS. It costs $250 for the rental option and $800 for an outright purchase. The package includes the EA software, five real accounts, free updates, free support, and free demo accounts. There is no mention of a money-back assurance which is a sure sign that you cannot rely on the system.

Now that we have gone through the features of this FX EA, here are some of the major factors that influence the reliability of the system:

- High drawdown.

- Hidden data in real trading results.

- Vendor transparency.

Let us look at each of the above influencing factors in detail and how they affect the reliability of this FX EA.

High drawdown

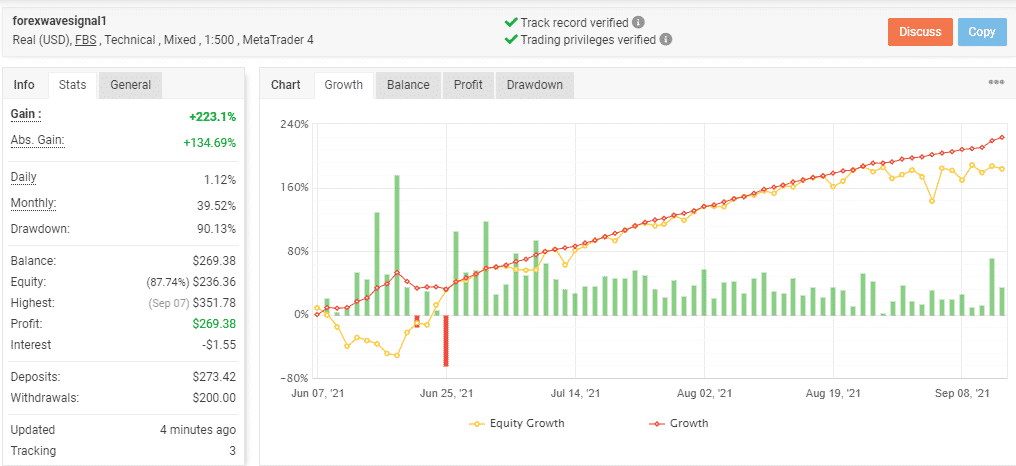

To start with, the developer does not provide backtests for this EA claiming that the algorithm it uses cannot be detected in backtests. The EA will be unable to use its algorithms in backtests resulting in over-optimization. A real live trading result verified by the Myfxbook site is shown on the official site.

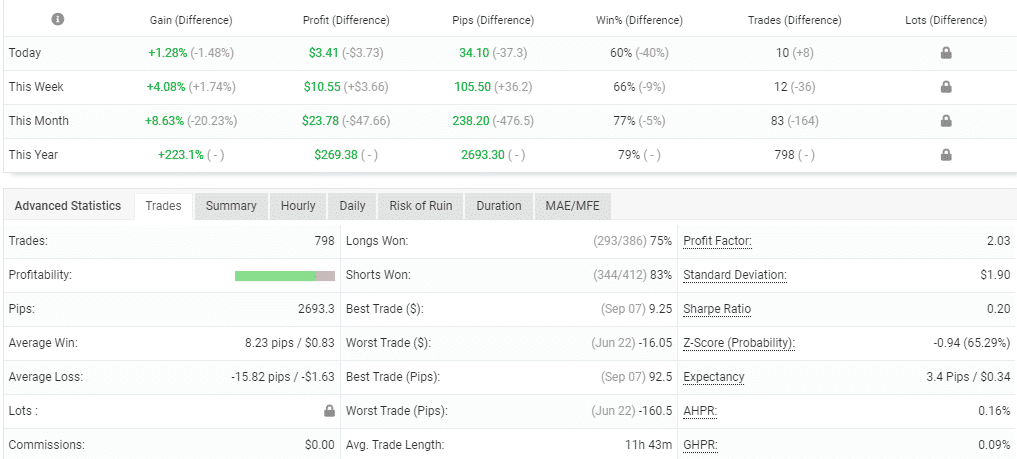

From the above screenshot, we can see that the real USD account using the FBS broker and mixed trading method on the MT4 platform reveals a total profit of 223.1%. The absolute profit is 134.69% which indicates a big discrepancy when compared to the total profit. This indicates a risk trading approach. The drawdown value is 90.13% which is too high and further confirms that the approach used is bad.

Hidden data in trading results

From the info of the real account trading, we can see the details of the lots are hidden in the trading period and the advanced statistics. The trading history also does not reveal the info on the lot size used. This hidden info raises a red flag. We suspect the approach and performance are not as claimed by the developer resulting in the hidden info.

Vendor transparency

The developer Chukwudi Joshua Obeikwe claims to be a professional FX trader with several years of experience. There is mention of a team of FX traders and programmers with a collective experience of more than 15 years of experience. We could not find further info on the founding history, the location address, phone number, etc. The lack of adequate vendor info and insufficient support methods make us suspect this is not a trustworthy EA.