The term penny crypto is one that was borrowed from the stock market, where the term penny stocks were used to refer to stocks valued at $5 or less. These stocks are often volatile, with some growth potential. Similarly, in crypto, there are several tokens retailing at less than a penny a pop. Such cryptos are preferred by long- and short-term traders alike due to their volatility and growth prospects.

About penny crypto

Generally, the term is used to describe cryptocurrencies valued at less than $1. There are four types of tokens that fall under this classification. The first is plentiful cryptos. These are coins that have a large supply, which causes their cost per unit to trend low. The second is newly minted crypto. As their name suggests, these are newly launched coins, which may not have amassed a large valuation yet due to their lack of popularity.

Another type of penny crypto is the fallen cryptos. These are coins that once had high valuations, but for one reason or another, their price crashed. This could be due to major hacking attacks, pump and dump schemes, or a variety of other reasons. The final type is stagnant cryptos. These are tokens that have been around for a long while but can’t seem to outgrow their low valuations.

Why do investors prefer penny crypto?

The majority of investors prefer large-cap, established cryptos such as Bitcoin and Ethereum, as these coins tend to enjoy high liquidity. However, more and more risk-tolerant investors are beginning to see the potential within these low-valued digital assets. Though they are a riskier investment, they tend to have bigger growth prospects. Case in point, XRP and Stellar Lumens were not so long ago unknown projects valued at fractions of a cent and are currently huge players in the industry.

Regardless of your reason for investing, this is a very profitable space if you play your cards right.

How to trade penny crypto

For short-term traders

As aforementioned, these crypto-assets are characterized by high volatility. This characteristic makes them suitable for scalping, day trading, and other short-term strategies. However, it is also a double-edged sword, as it places traders at great risk of loss. Therefore, such traders need to come up with foolproof strategies to manage this risk.

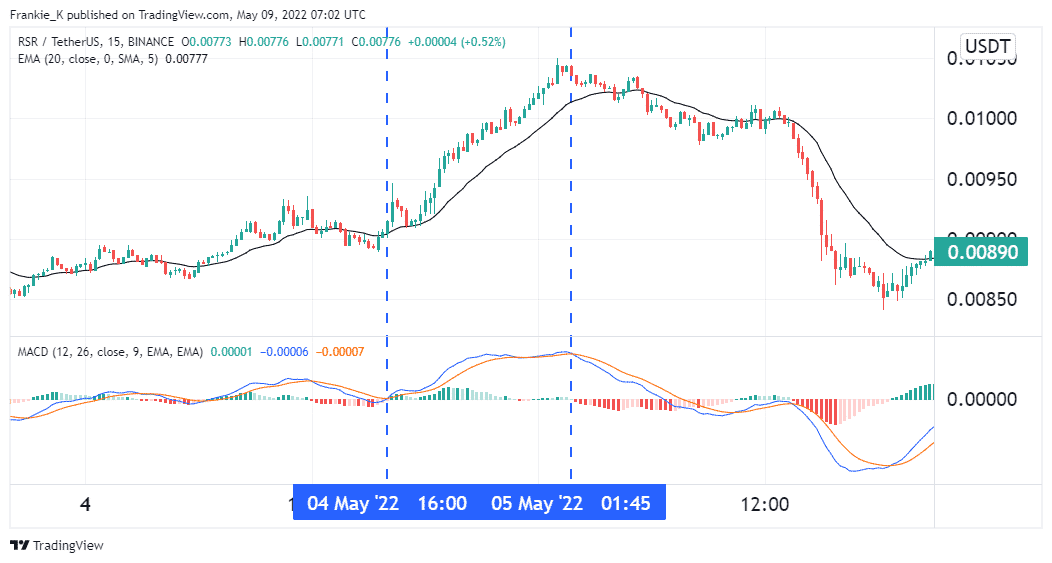

A suitable strategy involves using the Moving Average Convergence Divergence (MACD) and the Exponential Moving Average (EMA). Recommended settings are the default for the MACD and a 20-period setting for the EMA. The former will be tasked with producing entry and exit signals, while the latter provides signal conformation. An ideal timeframe is a 15-minute chart.

Bullish setup

When the MACD’s line crosses above its signal line, it points to a potential incoming rally. This signal is confirmed by the MACD histogram going into the positive zone and prices trending above the 20-period EMA. This is the signal to buy the coin.

The illustration above shows a bullish setup on an RSR price chart. The bullish MACD crossover manifested on 4th May, which coincided with prices breaking above the EMA. This was the signal to go long. The exit signal came on 5th May, when the bearish MACD crossover happened, and shortly after, prices broke below the EMA line.

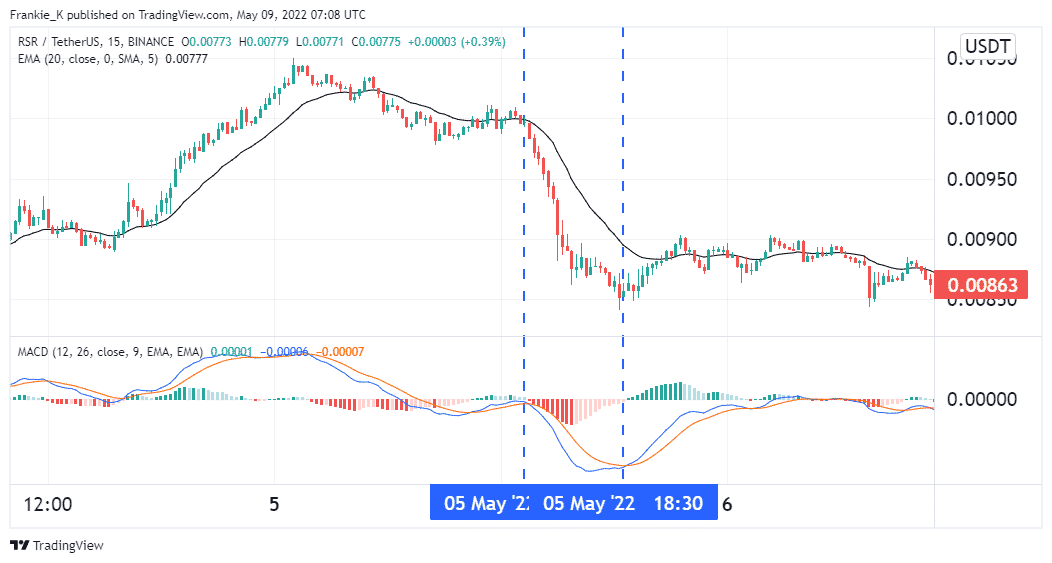

Bearish setup

It follows then that a bearish setup would be the complete opposite – the MACD line crossing below the signal, while prices break below the 20-period EMA. This would prompt traders to enter short trades for profit. This is illustrated in the figure below.

On the 5th of May, the MACD manifested a bearish cross, after which prices broke below the 20-EMA line. This was the signal to short RSR. The exit signal came a few hours later when the MACD staged a bullish cross. This was confirmed by prices breaking above the EMA line a few candles later.

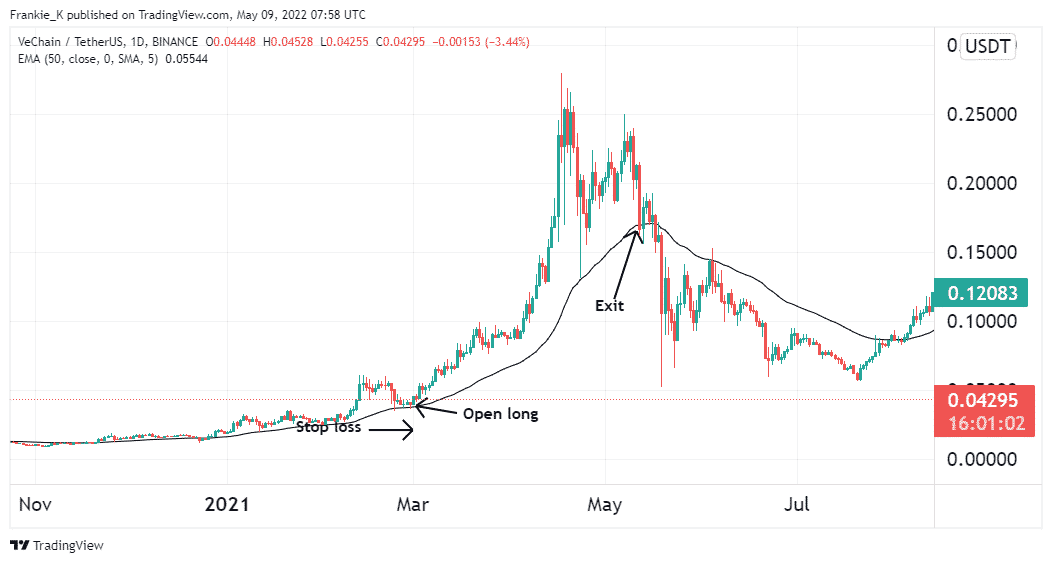

For long term traders

You can also buy and hold penny crypto for profits. To do this, we’ll utilize the 50-period EMA to help give us insights into the market momentum. The ideal timeframe is the daily chart.

Bullish setup

To time entries for a long trade, we’ll wait for prices to break above the 50-EMA. This shows that the coin has bullish momentum. We’ll then wait for prices to retrace to this EMA line and bounce back to continue on the uptrend. This will be our entry signal. This is illustrated in the image below.

In the chart above, the entry signal was marked by the price rebound after retesting the EMA support line. A suitable risk-to-reward ratio can be used to determine the exit. Alternatively, you could wait for prices to break below the EMA line, as shown above.

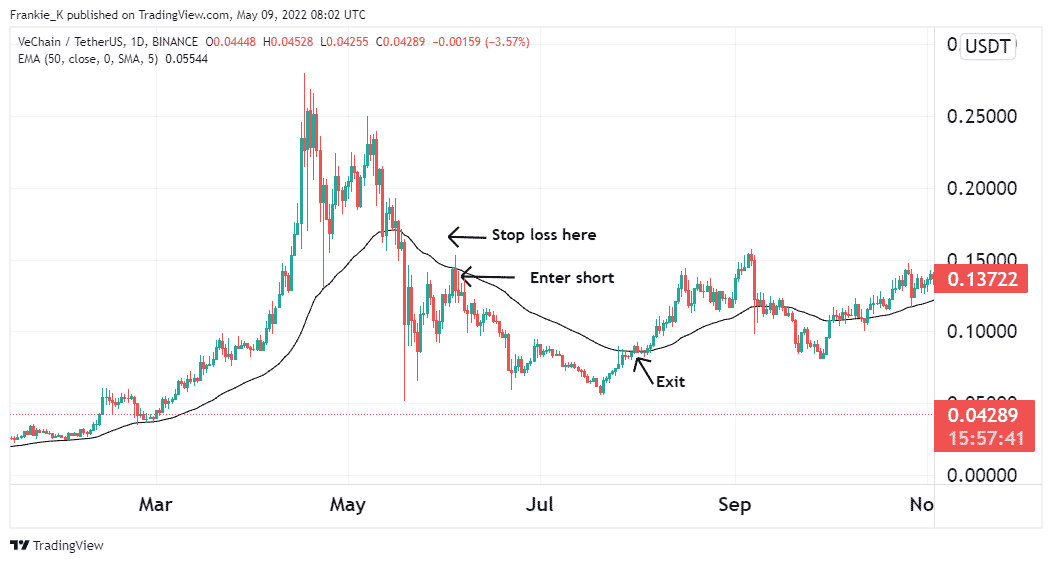

Bearish setup

For long-term traders, a bearish signal will be marked by prices breaking below the 50-EMA, then retracing to retest the EMA-line turned resistance. If the resistance holds, then one should place a short trade at that point. This is illustrated below.

Similarly, one can use a suitable risk-to-reward ratio to determine the exit. Alternatively, you could wait for prices to break above the MA resistance line, as shown above.

Conclusion

Penny crypto is slowly becoming a popular investment vehicle for crypto traders. This is because some of them have substantial growth prospects, which attracts long-term traders. Additionally, they tend to be highly volatile, which draws the attention of short-term traders looking to profit from the sudden price movements.