Many people have started investing in cryptocurrencies because it has so much potential. If you’re a cryptocurrency investor, you’re probably going to make a lot of transactions in a year. It is challenging to keep track of these transactions and then calculate net profit and loss. You may use a crypto tax calculator to help you with your taxes. It automatically syncs between crypto exchanges and wallets, calculates your capital gains and losses, and generates final tax reports that you can use to file your taxes.

What do you consider when choosing a crypto tax calculator?

Bandwidth

This relates to the software’s data transfer capability. Ensure you look for a calculator that has the bandwidth to handle all of your cryptocurrency transaction imports.

Security

Inquire about the software provider’s security measures and whether your data is protected or guaranteed. Bare in mind that cybercriminals are interested in user data.

Price

While free platforms are beneficial, paying a little fee for better integrations, more bandwidth, and dependable support is well worth the money. Always check to see whether there is a fee per transaction or asset value, as well as if other factors can affect your overall software costs.

Customer service

You may learn more about their customer service by reading internet reviews. The team should be familiar with IRS and other tax regulatory agencies’ regulations and forms. You may also check if they’ve taken any steps with the IRS in regards to their services and the crypto area and if they’ve followed IRS requirements.

Reputation

Ensure you check the software provider’s repute. Learn about the company’s history and performance. Look for customer testimonials or reviews. This is critical because you will be held liable for any mistakes on your tax returns, even if they were processed by software.

Support from the country

Distinct countries have different taxation laws and tax structures. As a result, you should double-check that your tax calculator supports your country’s laws.

Integrations

Integrations are required for tax software and the top crypto platforms to communicate. This could take the shape of an API that handles requests between programs. CSV files are frequently used by cryptocurrency tax reporting software products to ease data transmission between programs.

Best crypto tax calculators

TokenTax

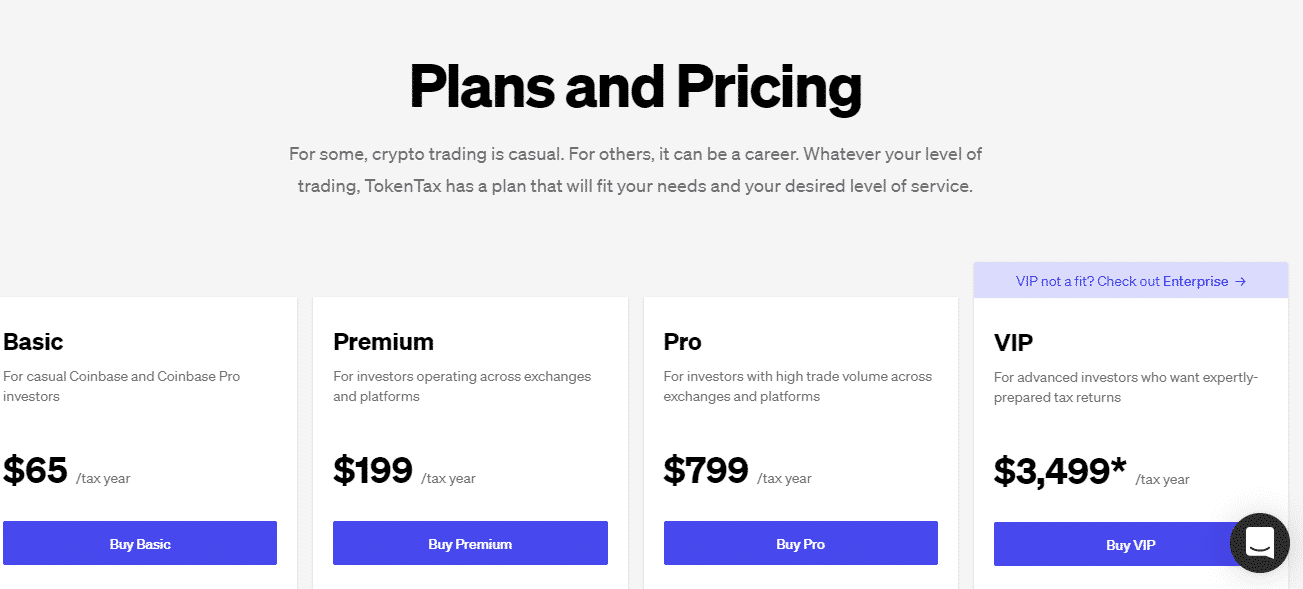

It supports FIFO, HIFO, and LIFO reporting methods. Only Coinbase and Coinbase Pro accounts are supported by their basic plan. You’d also be upgrading to one of their higher tiers to be able to use several exchanges.

You can’t accomplish anything without first joining up for a subscription. The user interface is simple and easy to use. API keys can be used to connect a variety of exchanges.

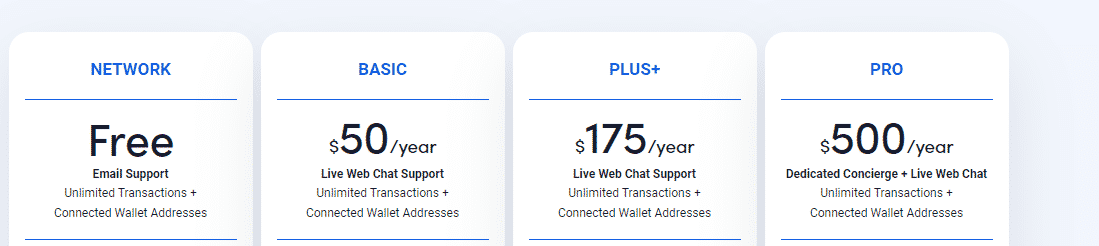

TokenTax also allows for manual entry or CSV upload of transaction data. You can choose from a variety of subscription options based on the number of transactions, exchange support, and a few other features.

Koinly

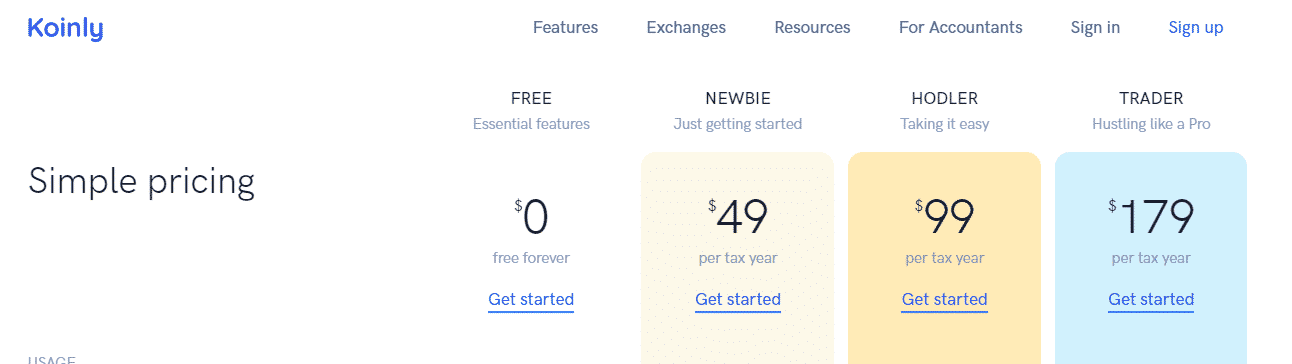

It specializes in super-fast tax calculation and reporting. You may complete your digital asset tax in about 20 minutes, according to the software. Koinly, which is available in over 20 countries, not only performs your taxes but also gives you simple recommendations on how to save money for the next financial year.

It offers a generous free subscription that allows for up to 10,000 transactions and a slew of other benefits. For tax accounting, it supports the standard FIFO, LIFO, average cost basis, and so on.

It can import data from 350+ exchanges, 50+ wallets, and 15 blockchains (API and CSV).

CryptoTrader.tax

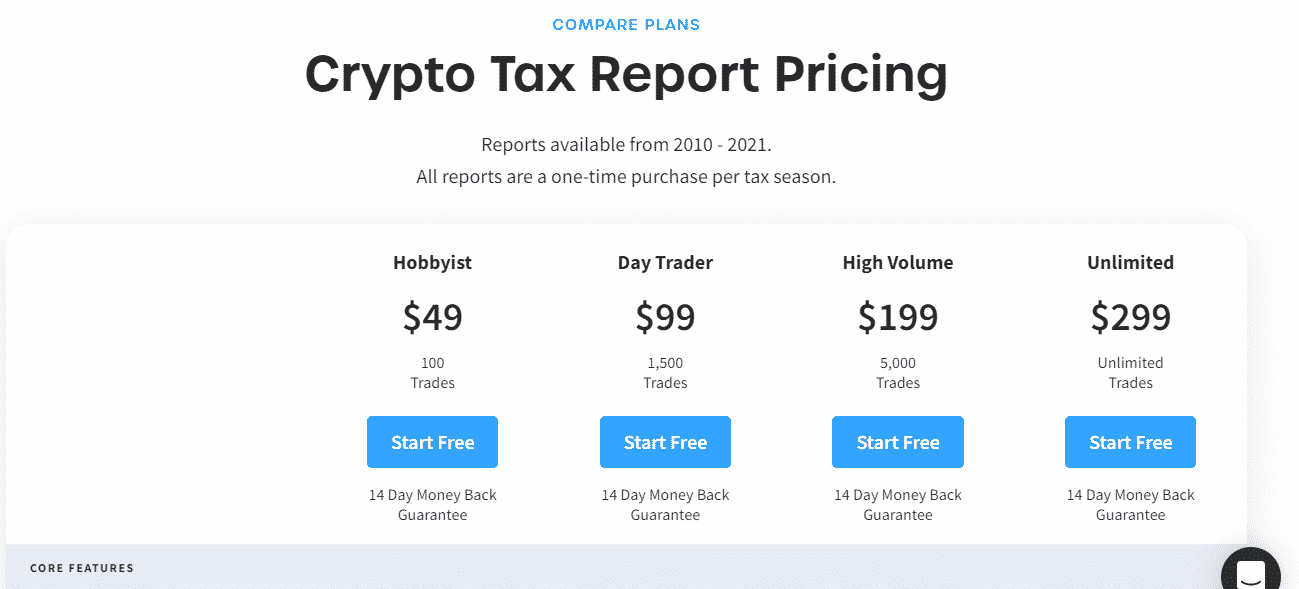

Tax was launched by the corporation, hence the name CryptoTrader.tax. It’s an excellent cryptocurrency tax calculator that will help you calculate all of your transactions and convert them into reports that you can send to the IRS.

It can report using the FIFO, HIFO, or LIFO protocols. It offers a simple user interface and plenty of tutorials to get you started. They work with a variety of platforms, including Binance, Coinbase, and Exodus. Free report preview and data import are available in this exchange.

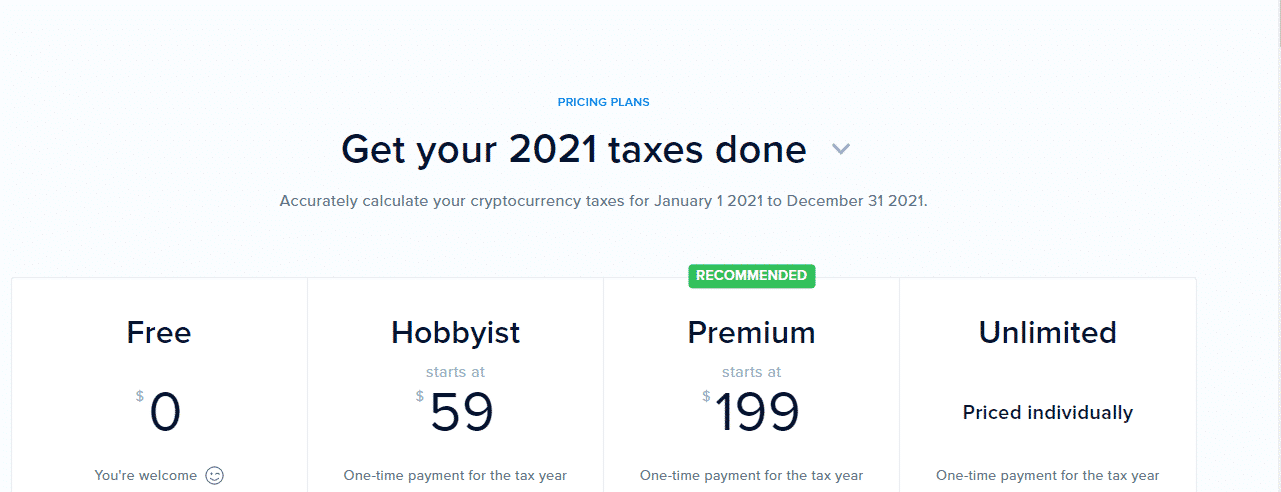

CoinTracker

CoinTracker is one of the best crypto tax software for beginners because it has a free tier. It is possible to use it for up to 25 transactions without having to pay anything. Furthermore, this software keeps track of your portfolio’s performance and assists you in managing it to maximize your profits.

They presently support over 300 different exchanges and over 8000 different coins. You can also use a CSV file or manually enter information to examine the tax implications right away. Additionally, it allows you to share the report with tax advisors.

TaxBit

TaxBit is compatible with more than 500 cryptocurrency exchanges, wallets, and DeFi platforms. Individual clients can use TaxBit’s free-forever service, which allows them to make limitless transactions. You can also combine a variety of relevant services so that everything is accessible from a single dashboard. Capital gains and losses can be realized prior to any transaction using TaxBit’s tax optimizer. Furthermore, its SOC 2 certification ensures complete data security.

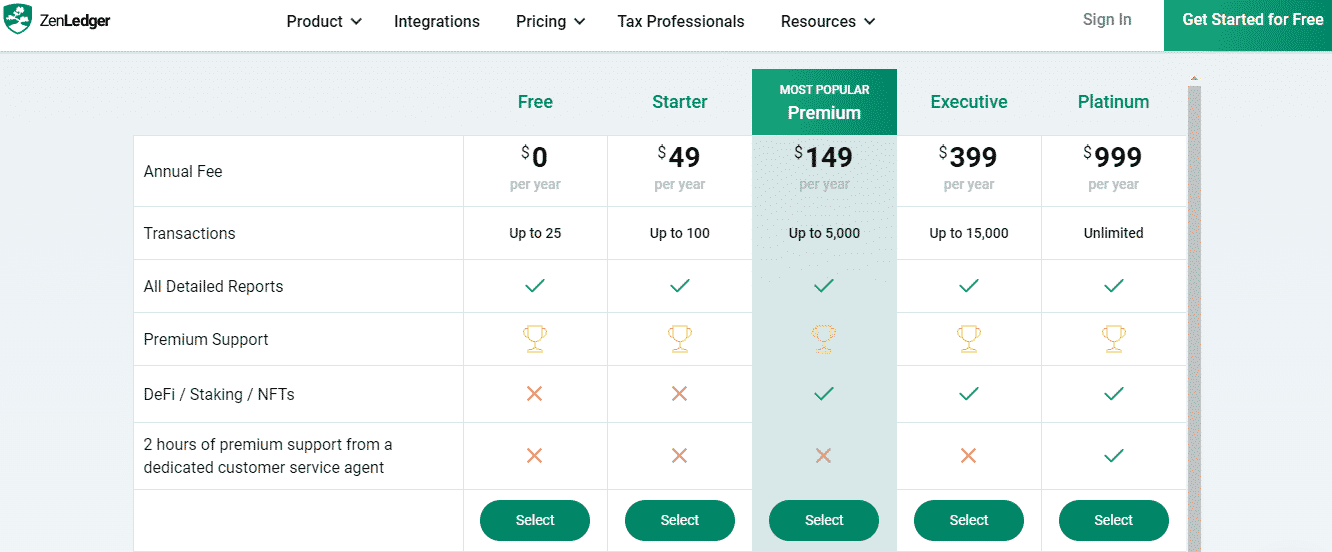

ZenLedger

It is known for being fast and user-friendly. It works with the HIFO, LIFO, and FIFO reporting methodologies. With ZenLedger, you can have a limitless number of exchange platforms. It also allows you to disclose a variety of crypto-related income, including as DeFi, NFTs, staking, contributions, mining, and so on. The outstanding customer support staff is a standout feature, while in-house professionals are available to assist you with any issue via chat, email, and phone calls seven days a week.

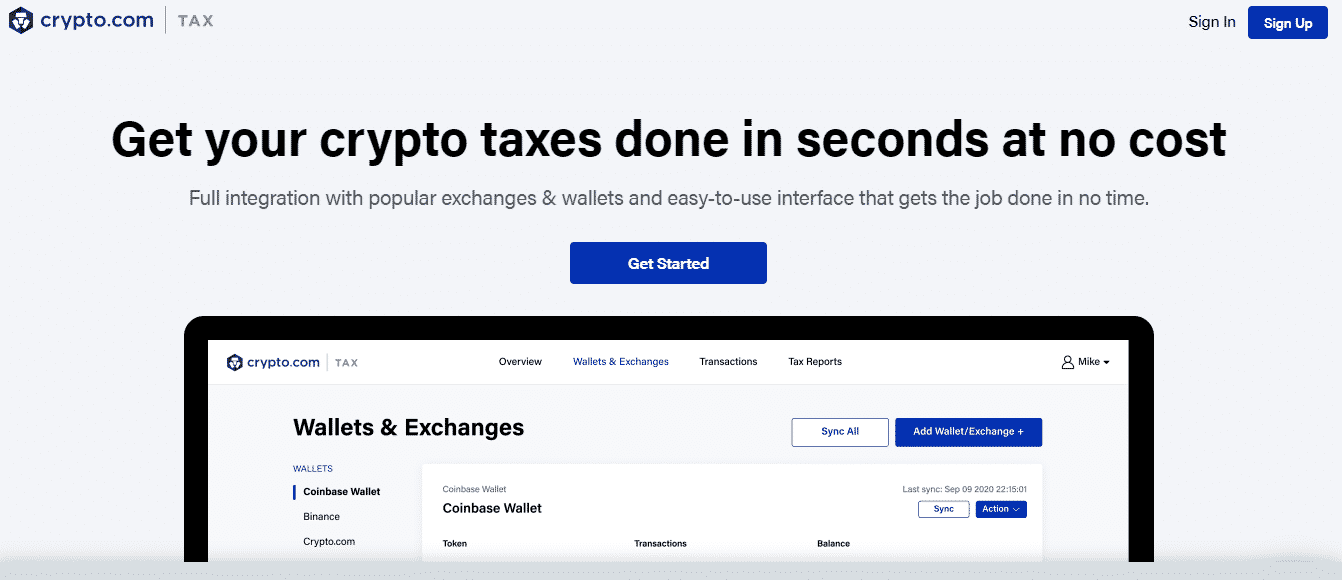

Crypto.com Tax

This is a free tax calculator. It performs calculations at no cost, no matter how many transactions you’ve had in the previous years. It has a simple, easy-to-use interface that gets the job done quickly. It is completely connected with popular exchanges and wallets. It is compatible with the Binance, Coinbase, and Crypto.com wallets. For prominent exchanges/wallets, it supports API (read-only access) and CSV import. You can still use our generic CSV format to acquire your tax computation results if you’re using different exchanges/wallets.

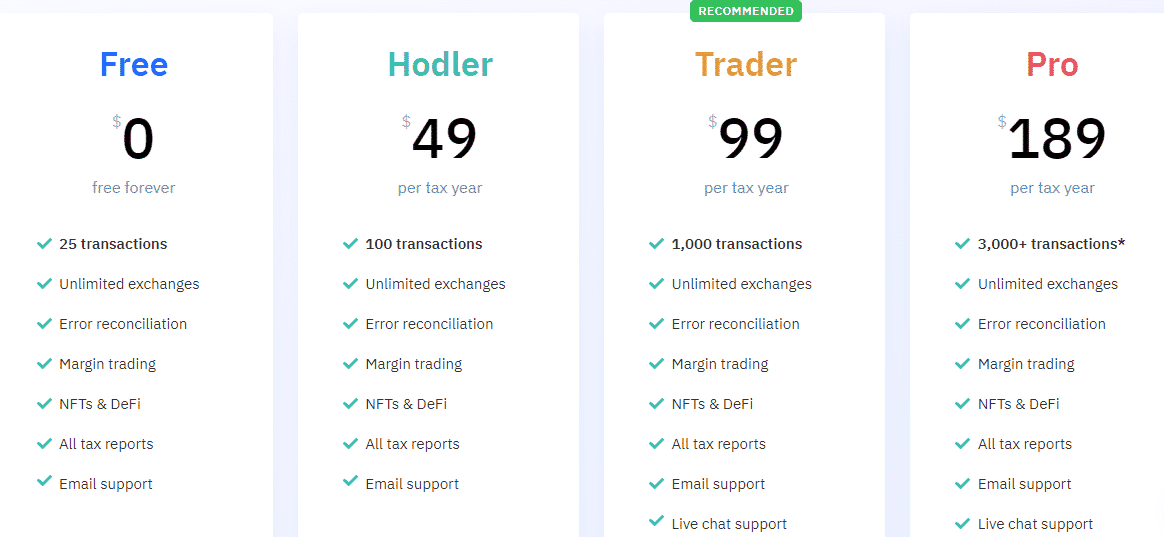

Coinpanda

Its free version has a lot of features and just a few that are only available with the premium subscription. Your crypto income will come from a variety of sources, including mining, staking, forks, airdrops, gifts, and donations.

This crypto tax computation software can be used by users with tax regimes that support FIFO, LIFO, ACB, Share Pool, and so on. Coinpanda accepts over 7000 different cryptocurrencies. To import data from a variety of exchange platforms, you can use the standard API sync and CSV methods.

Summary

You can use a cryptocurrency tax calculator to determine profit and loss from cryptocurrency trading, as well as capital gains and losses and cost deductions. Before settling on a particular calculator, make sure it fits certain criteria, such as bandwidth. There are a lot of crypto calculators out there, and we’ve covered the top eight in this article.